Although bank earnings continue to disappoint and warn of rising default risks, the bulls kicked off a needed relief rally on Friday. Speculation and willingness to dive headlong into earnings risk remain surprisingly high, considering the economic conditions. So, with high emotion, expect overnight gaps, intraday whipsaws, and stocks that miss the lowered expectations to be severely punished. Watch earnings dates before buying, respect overhead resistance levels, and fear-of-missing-out trade decisions.

Asian markets rallied overnight in reaction to the U.S. bounce, even as oil prices rose 2%. European markets are also in a bullish mood this morning, seeing green across the board. Ahead of more big bank earnings, U.S. futures look to extend Friday’s rally pointing to a gap up open before the data. Expect challenging price action and keep an eye on overhead resistance levels for the possibility of a pop and drop.

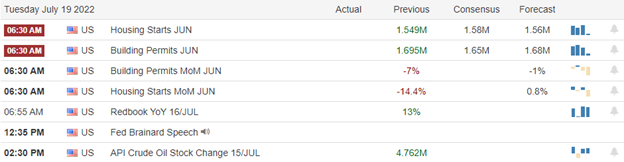

Economic Calendar

Earnings Calendar

This week we pick up the pace of 3rd quarter earnings. Notable reports include BAC, SCHW, GS, IBM, PLD, & SYF.

News & Technicals’

Celsius is down to $167 million “in cash on hand,” which they say will provide “ample liquidity” to support operations during the restructuring process. However, according to its bankruptcy filing, Celsius owes its users around $4.7 billion, and there’s an approximate $1.2 billion hole in its balance sheet. Restaurants and diners alike are feeling the pinch from the industry’s labor shortage. According to the National Restaurant Association, the industry is still down 750,000 jobs — roughly 6.1% of its workforce — from pre-pandemic levels as of May. In the first quarter, customers mentioned short staffing three times more often in their Yelp reviews than in the year-ago period, according to the restaurant review site. The battle to become the U.K. Conservative Party’s next leader — and the country’s next prime minister — heated up over the weekend. The five candidates vying for the top job looked more like enemies than colleagues as they went head-to-head in a televised debate on Sunday. They clashed over taxes, Brexit, and trans rights in the latest leadership debate, questioning each other’s office records and political and ideological perspectives. Earnings could be a main driver of stocks in the week ahead, after a roller-coaster ride on changing sentiment about how much the Federal Reserve will raise interest rates. Hot inflation data initially sparked speculation the Fed could raise interest rates by a full percentage point. By the end of the week, strong data and comments from Fed officials quashed those expectations. In the week ahead, investors are looking to housing data and expect earnings from a broad swath of companies to steer stocks. Treasury yields rose in early Monday trading, with the 10-year climbing to 2.96% and the 30-year pricing at 3.12%. Unfortunately, the 2-year continues to point toward a recession at 3.15%, inverted over the five, ten, and thirty-year bonds.

Despite the disappointing bank earnings, the speculation that lowered earnings estimates will deliver better than expected results kicked off a needed relief rally. The good news is that the relief was overdue, and we have a little break from the heavily bearish economic reports this week. The bad news in this all-or-nothing market is the T2122 indicator is quickly reaching the short-term overbought condition with a GDP report and FOMC rate increase just a week away. As earnings reports ramp up, expect overnight reversals and intraday whipsaws to challenge even the most experienced traders. With speculation remaining so high, keep in mind that companies that miss expectations will likely get severely punished, so plan carefully! I believe we will see many disappointing results, so keep an eye on technical and overhead resistance levels for the location for bear attacks.

Trade Wisely,

Doug

Comments are closed.