The bears overwhelmed the market worried about political infighting over a high court appointment, a possible government shutdown, a delayed or no 2nd stimulus package, an upcoming election, and rising coronavirus concerns. Even though the bulls fought back, leaving behind some hopeful candle patterns that a relief rally may soon begin, the market downtrend and substantial resistance levels above provide concern that the overall downtrend may not be over just yet.

Asian markets chopped in an uncertain session with rising pandemic concerns. European markets have found a bit more bullishness this morning, getting a modest relief rally after yesterday’s rout. US Futures at the time of writing this report suggest a mixed but relatively flat open with tech doing its best to lead a relief. Expect price volatility to remain high with the market sensitive to the news cycle.

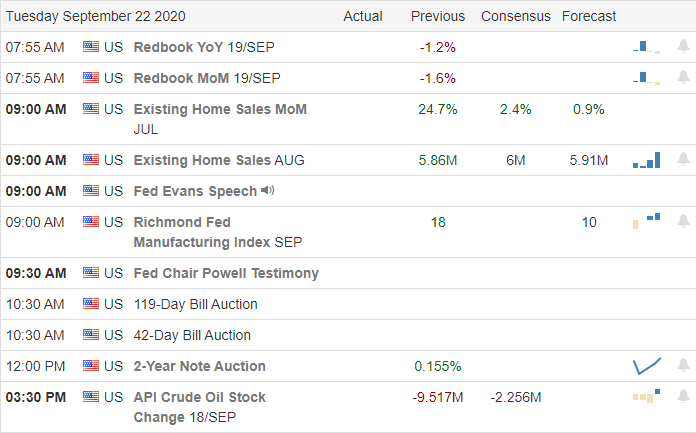

Economic Calendar

Earnings Calendar

On the Tuesday earnings calendar, we have 12 companies reporting quarterly results. Notable reports include NKE, AZO, KBH, SCS, & SFIX.

News and Technicals’

Worries about political infighting over a high court appointment, a possible government shutdown, a delayed or no 2nd stimulus package, an upcoming election, and rising coronavirus concerns had the bears working hard yesterday. The first 4-day string of selling since February has created technical damage and damaged to trader confidence in the path ahead. According to the T2122 indicator, the indexes are in a short-term oversold condition suggesting a relief rally may begin soon but having broken down below the 50-day averages and price support, the resistance above could stop any bullish attempt. Should we see a failure at or near the 5-day average, we can’t rule out the possibility of a 200-day average test in the weeks ahead. We should also consider the chance that we have seen the highs for the year, and the market could settle into a volatile sideways consolidation.

Technically speaking, the rally off of yesterday lows left behind hopeful candle patterns that a relief rally could soon begin. However, with the DIA, SPY, QQQ all below substantial resistance levels, a one day bounce while in a downtrend is nowhere near an all-clear signal to buy the dip. With so much uncertainty ahead, expect extreme sensitivity to the news cycle, overnight reversals, intraday head-fakes, and whipsaws, making price action very challenging to navigate. The silver lining in all of this is that stocks are on sale, and eventually, there will be some bargains when this is over.

Trade Wisely,

Doug

Comments are closed.