After a bearish start to the day, the bulls worked to begin a relief rally that lacked momentum as investors moved cautiously in this final trading week of September. The rising bond yields contributed to the uncertainty with the 10-year bonds topping a sixteen-year high. Today we face more possible market-morning economic reports and a few more notable earnings to inspire the bulls or bears. Expect the challenging price action to continue and watch and be prepared for some big point whips or reversals and pent-up waiting for an opportunity.

Asian markets closed their Tuesday session red across the board as real estate woes continue with inflation data on the horizon. European markets also trade cautiously bearish this morning with German manufacturing continuing to decline under the economic pressures. U.S. futures point to a bearish open ahead of earnings and economic data possibly reversing yesterday’s tepid bullishness.

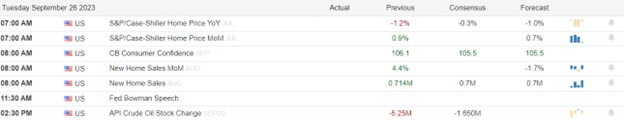

Economic Calendar

Earnings Calendar

Notable reports for Tuesday include AIR, CTAS, COST, FERG, MLKN, SNX, PRGS, & UNFI.

News & Technicals’

The global economy is facing a serious threat from the escalating tensions in Eastern Europe. The war in Ukraine, which started in 2014, has not only caused human suffering and political instability but also strained the relationships between the economic superpowers, such as the US, China, Russia, and the EU. The conflict has also increased the risk of sanctions, trade wars, cyberattacks, and military confrontations. Jamie Dimon, the CEO of JPMorgan Chase, suggested that Eastern Europe was the epicenter of risk, and compared the situation to the aftermath of World War II. He said that the world had not faced such a complex and uncertain scenario before, and warned that it could trigger inflation, deficits, and recessions

Ukraine is facing a challenging situation as it tries to maintain its international support in its conflict with Russia. The war, which has been going on since 2014, has caused thousands of deaths, millions of displacements, and widespread damage. Ukraine relies on its allies, especially the US and the EU, for political, economic, and military assistance. However, some recent diplomatic gaffes, such as the leaked phone call between President Zelensky and President Biden, have raised doubts about the strength of their partnership. Moreover, public opinion in both Europe and the US has shown a decline in support for Ukraine’s cause, especially when it comes to providing more funding and weapons. Some analysts fear that Russia could take advantage of this situation and try to undermine Ukraine’s alliances and increase its aggression.

The artificial intelligence (AI) chip market is heating up as more startups compete with established players like Nvidia and Arm. One of them is Kneron, a U.S.-based semiconductor company that specializes in edge AI solutions. Edge AI refers to the processing of AI tasks on devices such as smartphones, cameras, and robots, rather than on cloud servers. Kneron announced on Tuesday that it raised an additional $49 million in its funding round, bringing its total funding to over $100 million. The round was led by Taiwanese giant Foxconn, the world’s largest electronics contract manufacturer and a key supplier of Apple’s iPhones. Other investors included Alltek, a communications tech company, and several venture capital firms. Kneron said it will use the funds to accelerate the commercialization of its AI chips, which are designed to enable low-power and high-performance edge AI applications across various industries.

After the DIA tested and held its 200-day moving average the bulls worked to provide a little relief rally on Monday but lacked momentum with inflation data looming later this week. The ongoing increase in U.S. Treasury yields, which have reached their highest level for the year, surpassing 4.5% for the 10-year bond added to Monday’s uncertainty. The U.S. dollar, which tends to appreciate when investors seek safety, has also risen sharply. The DXY dollar index is above 105, its highest level for the year, creating some headwinds for global companies and markets. Today we have a few more notable earnings reports that could provide some inspiration for the bulls or bears and may also give us a glimpse into the 4th quarter as well as hints to the strength of the consumer. Investors will have to also deal with Case Shiller, FHFA House Prices, Consumer Confidence, New Home Sales, a 2-year bond auction as well as more Fed member pontifications. Plan carefully as Asian and European bearishness tries to reverse yesterday’s relief all at once at the open.

Trade Wisely,

Doug

Comments are closed.