Yesterday’s insipid price action and declining volume suggested the market needed a rest after the hard bullish partying earlier this week. With the futures currently suggesting an overnight gap down at the open today, we are reminded that bears still exist. Now the question to be answered, do the bears have teeth, or will the dip crowd have the energy to defend trends and price supports as we slide into the weekend? Recent evidence and hope for another 1.9 trillion stimulus seem to give the bulls the upper hand.

Asian markets closed in the red across the board, with the HIS leading the way, dropping 1.60%. European markets retreat as well this morning as the virus spread and economic data damper recovery enthusiasm. Ahead of earnings and several possible market-morning economic reports, U.S. futures point to a gap down open within bullish index trends. Prepare for an extra dose of volatility as we head into the weekend.

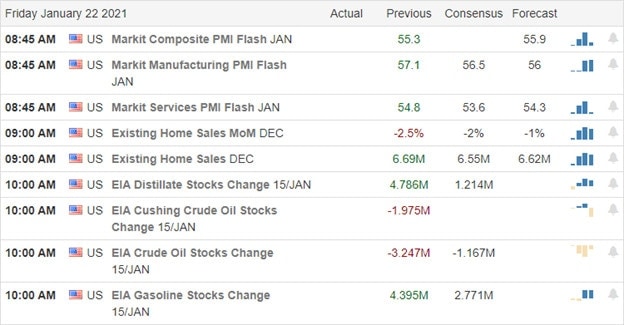

Economic Calendar

Earnings Calendar

On the Friday earnings calendar, we have 22 companies fessing up to quarterly results. Notable reports include ALLY, HBAN, KSU, RF, & SLB.

News & Technicals’

While mostly bullish, the market’s price action seemed a bit insipid while still squeaking out new records in the SPY and QQQ. The energy and financial sectors experienced a notable weakness, while the big tech growth names garnered most the bullish attention. Whitehouse adviser Dr. Fauci says new data shows vaccines appear to be less effective against some newly identified strains. President Biden plans to sign more executive orders today but has reportedly come under pressure to scale back his 1.9 Trillion stimulus package. INTC stock surged just minutes before the close yesterday when an infographic related to the coming earnings report was leaked. The stock sold off after the bell and the release of the earnings. The company says it’s investigating the situation. Have I mentioned, I’m not too fond of earnings and the price manipulation it creates.

Technically speaking, trends remain bullish all-be-it quite stretched with volume declining even as new record highs occurred. However, this morning futures point to a gap down open, reminding us that bears still exist. We have a lighter day on the earnings calendar but several possible market-moving economic reports to keep us busy. As long as overall trends and support hold in this morning’s pullback, this is healthy market price action. However, it might be a bit painful from this elevated position for those overtrading. Plan your risk carefully as we head into the weekend.

Trade Wisely,

Doug

Comments are closed.