The majority of price action over the last week of trading occurred in the overnight gap, and it appears that it will continue this morning as the market reacts to a hopeful vaccine beginning a Phase 1 clinical trial. The Covid-19 death toll here in the US is likely to top 100,000 today, and health officials continue to warn of fall resurgence. Be careful chasing such a huge gap and remember tensions continue to grow between the US and China.

Asian markets closed the day higher across the board on vaccine hopes, and European markets are bullish this morning with travel stock surging over 5%. Ahead of earnings and several economic reports, the price resistance that has held the indexes down for more than a month looks to break with the overnight futures gap. The question remains, will there be follow-through buying at the open?

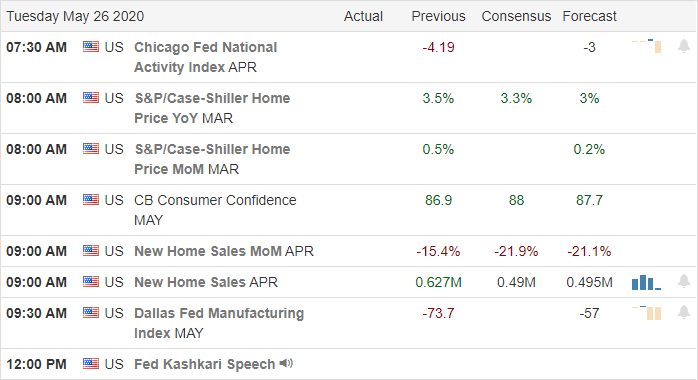

Economic Calendar

Earnings Calendar

As we begin a short trading week, the Tuesday earnings calendar has 69 companies reporting results today. Notable reports include BNS, BAH, HEI. HIBB, OOMA, STNE, & VSAT.

Technically Speaking

The overall market closed little changed on Friday with very light volume as we moved into the long weekend. There was, however, some slight selling pressure as China issues new crackdown rules on Hong Kong restricting freedoms. Not surprisingly, tensions between the US and China continue to grow a may present more of a market threat than the coronavirus in the long-term. This morning US Futures are leaping higher on hopes of a vaccine from Novavax that is beginning a Phase 1 Trial with plans to begin Phase 2 as early as July depending on results. Today the US is likely to reach a grim milestone with Covid-19 related deaths topping 100,000. As the country tries getting back to normal health officials, warn of a possible resurgence of the virus this fall.

The big push in the overnight futures will finally breach the resistance that has held the indexes. Amazingly the biggest part of price movement over the last week of trading has occurred in the overnight session with little to no price action during the typical retail session. If you have ever needed proof that its institutions that move the market, take note of the 500 point gap this morning with rental unable to participate. As always, be careful, chasing a vast opening gap. Moves such as this easily create the fear of missing out, but let us make sure we see some follow-through buying remembering the possibility of a pop and drop if profit-takers take advantage of the price surge. Although earnings season is winding down, there are still notable reports to be aware of this week as well as a busy economic calendar.

Trade Wisely,

Doug

Comments are closed.