High emotion continues to govern the market price action this morning with yet another large news-driven morning gap. China and the US have agreed to hold ministerial-level talks one month from now with deputy-level talk not expected until mid-September. While it is very good news that we will return to the negotiations table, a lot can happen during that month of waiting as the uncertainty swirls around the market. I guess what I’m saying is that the All-Clear is a long way off so expect volatility to continue and carefully plan your risk as we navigate through this new-driven minefield.

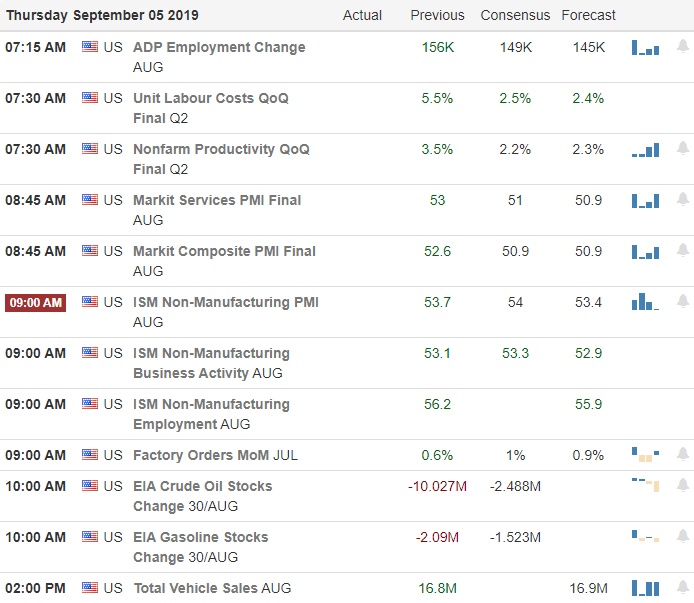

Overnight Asian markets Asina markets closed mixed but mostly higher as traders closely monitored the developments in Hong Kong. Currently, European markets have mixed results but mostly modestly higher, reacting to UK developments and China-US news. US Futures are very happy this morning ahead of a big day of economic reports and earnings. The Dow points to gap up of nearly 250 points as it waits for the data dump.

On the Calendar

The Thursday Earnings Calendar is the biggest day of reports this week with more than 40 companies reporting. Notable reports include LULU, ZM, CIEN, DOCU, GIII, LE, MDLA, FIZZ, SIG, and ZUMZ.

Action Plan

US and China have agreed to hold ministerial-level trade talks in early next month with the deputy-level meetings not taking place until mid-September. British Prime Minister Boris Johnson has now failed in his attempt to force a no-deal Brexit by the end of October stabilizing the Sterling and kicking the can further down the road. US Futures are bullish on this news ahead of busy morning on the Economic Calendar as well our biggest day of the week for earnings reports.

So once again the market is expected to significantly gap this morning, but at least it’s in the same direction as yesterday’s gap up and chop price action. Honestly, I have a hard time understanding agreeing to talk about trade one month from now warrants a gap of more than 200 points. However, I also have to say that I’m not all that surprised considering how erratic and emotional the price action has been over the last month. The question now is, can it hold as the uncertainty swirls around us for another month.

Trade Wisely,

Doug

Comments are closed.