Global Growth concerns once again raise its ugly head after European data disappoints just one day after a broad-based market rally. I must admit I was hoping for a little follow through to the upside this morning but the futures are currently pointing to a gap down open across all indexes. Overall it has been a great week of gains in the QQQ & SPY and some profit-taking as we head into the weekend should not be that surprising.

Although yesterdays strong rally may have felt as if the all-clear sounded, however, a quick look at the index charts shows us that price resistance above is still at work. The DIA and IWM are particularly problematic with the lower high still in force even after such a bullish move Thursday. Keep that in mind as you plan your risk heading into the weekend.

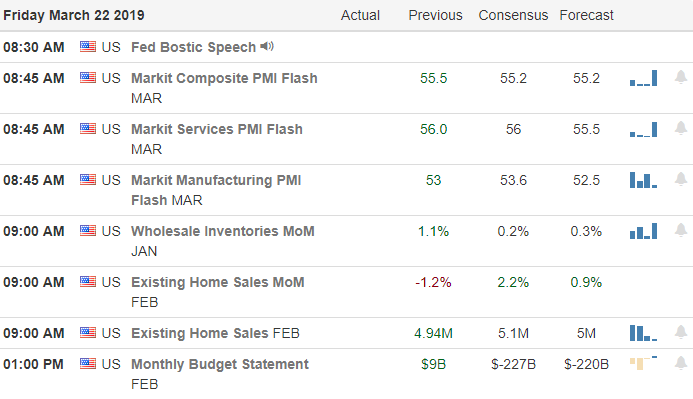

On the Calendar

We have a light day on the Earnings Calendar with less than 40 companies reporting. Notable earnings DXLG, HIBB, JKS & TIF.

Action Plan

After such a big rally on Thursday that was very broad-based I was hoping for a little more upside this morning. However, the market has different plans after some disappointing European data once again raises concerns of a global economic slowdown. Asian markets managed an ever so slightly bullish close across the board but this morning European markets are all seeing red.

US Futures that have been out of sync of late have linked back up and currently indicate a lower open today. The recently problematic Existing Home Sales out at 10 AM Eastern could belay some slow down concerns if the number comes in showing an increase as the consensus is expecting. Of course if it misses the exact opposite may be true adding to the slow down concerns this morning. All and all it has been a fantastic week of gains and there is nothing wrong with a little profit-taking as we head into the weekend.

Trade Wisely,

Doug

Comments are closed.