In a morning statement, the President pledged to more than double the commitment of the Paris accord, saying he will reduce greenhouse gas by at least 50% in just nine years. This bold stamen comes just before he hosts today’s climate summit with world leaders. What began as a relief rally turning into a full-fledged reversal as traders rush back into stocks. Big point moves like this make a dangerous trading environment. Plan your risk carefully, follow your rules, and remember sharp reversals can go both directions, so avoid chasing with the fear of missing out.

Asian markets traded mixed but mostly higher overnight as the Nikkei rebounded 2.38%. European markets rally this morning with modest bullishness as they wait on an ECB decision. After a booming reversal and ahead of jobless numbers, the U.S. futures seem to be taking a wait-and-see approach, currently pointing to modestly lower open. Fasten your seatbelt because anything is possible in this emotionally charged market.

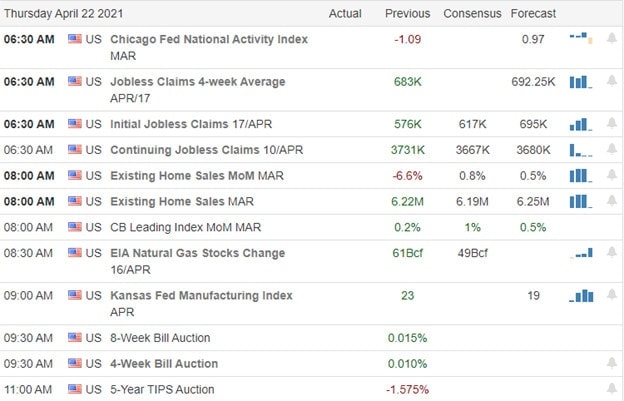

Economic Calendar

Earnings Calendar

We have the biggest day of earnings reports this quarter, with nearly 100 companies listed on the calendar. Notable reports include INTC, ALK, AAL, LUV, AEP, ARI, T, BIIB, BJRI, BX, SAM, CLF, DHI, DOW, FE, FCX, GPC, HBAN, MKTX, MAT, NUE, ODFL, ORI, PNR, POOL, STX, SKK, SNAP, SNA, TSCO, TPH, UNP, VLO, VRSN, & WWE.

News & Technicals’

The President is hosting a climate summit today, but before it begins, pledges to reduce greenhouse gas emissions by at least 50% by 2030. His target is more than double the commitment under the 2015 Paris climate agreement. Treasury yields are declining slightly this morning ahead of today’s Jobless numbers dipping to 1.552%. The forecast is for 603,000 new jobless claims last week. India reports a single-day jump in pandemic infections, with more than 314,000 cases confirmed in 24 hours. That number surpassed the world’s previous highest daily record. Hospitals are said to be overwhelmed and turning away patients due to a shortage of beds, including critically ill patients.

Markets zoomed during yesterday’s rally as this emotional all-or-nothing market condition whips. We’re either rushing to buy anything moving or running for the doors with substantial risk due to the significant point moves. With a big day of data ahead, we should expect more of the same today. Though yesterday was a very bullish day, keep in mind we still have resistance highs to deal with, and that index chart remains in a very extended condition. Stay with the bullish trend but guard yourself against getting caught up with the fear of missing out, chasing into already very extended stocks. When running fast, a market stumble can create very painful reversals. Stay focused and avoid overtrading.

Trade Wisely,

Doug

Comments are closed.