Ahead of the FOMC meeting, the tech giants lifted the SPY and QQQ to new record levels almost entirely on their own as the vast majority of the stocks slid sideways or south yesterday. At the same time, new records were made, the VIX rallied slightly, and the absolute breadth index continued to decline with the lack of momentum. Hedge fund manager Tudor Jones says go all-in on inflation trades if the Fed stays the course or expect a “taper tantrum,” should they make a course correction. We will find out Wednesday afternoon what their decision will be, so plan your risk accordingly.

While we slept, Asian markets traded mixed with the Nikkei surging up 0.96% while the Shanghai fell 0.91%. However, European markets this morning work for modest gains and new records cautiously waiting on the FOMC. With a significant economic data dump, futures in the U.S. trade mixed, and flat as the Fed beings its 2-day meeting. Will they or will they not react to inflation? Market direction may well be determined by the answer at 2 PM Eastern tomorrow.

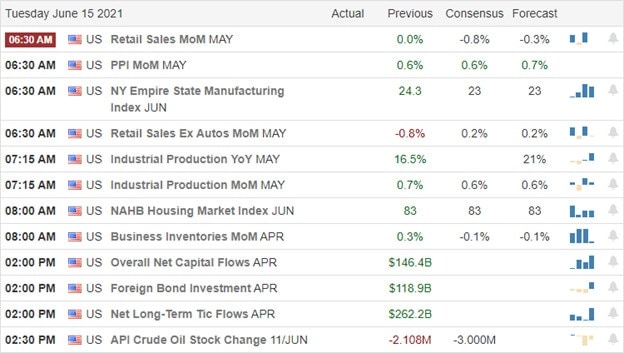

Economic Calendar

Earnings Calendar

On the Tuesday earnings calendar, we have 18 companies listed, but a large number of them are unconfirmed. Notable reports include HRB, ORCL, & LZB.

News and Technicals’

New closing records in the QQQ and SPY supported almost entirely by the tech giants, with the rest of the market largely sliping sideways or south. According to Jamie Dimon, JPMorgan is hoarding cash rather than buying Treasuries or other investments due to the possibility of higher inflation that’s here to say. He is one of the first investment banks to break ranks with the idea that the spike in inflation is transitory. Hedge fun manage Paul Tudor Jones suggested to “go all-in on inflation trades” if the Fed stays the course and ignores the spike in inflation. Tudor says the market will experience a “Taper Tantrum if they do make a course correction.” Interestingly trade doesn’t seem to share the same inflation concerns, with the 10-year treasury notes falling to 1.484 this morning and the 30-year dipping to 2.176%. Could it be complacency has raised its ugly head?

Today begins the 2-day FOMC meeting and a substantial economic calendar data dump that could inspire and bring in some early price volatility. As the QQQ and SPY set new records, the T2122 indicator slid south, and the absolute breadth index declined, with just a select few tech stocks doing the heavy lifting. That said, the SPY and QQQ index charts hold fast to bullish trends. IWM remains below overhead resistance while the DIA looks tired and the most at risk if the bears find some inspiration. As we wait on the FOMC decision, choppy price action would not be a surprise. However, with PPI, Retail Sales, Industrial Production, Housing, and Manufacturing numbers just around the corner, prepare for some early session volatility. Who knows, with so much data, the bulls or bears could find some inspiration to end this chop ahead of the Fed.

Trade Wisely,

Doug

Comments are closed.