All eyes are on the FOMC decision & forecast. Will they, won’t they, how much or how little will they do to stimulate the economy? Certainly the market has rallied significantly with the hope of rate cuts. Will the Fed do enough to support such strong anticipation or will they disappoint the market? It’s a tough call as US economic data continues to show strength and the market is nearing a test of all-time highs. What they do will not be nearly as important to traders than how the market reacts to the news. Pop some popcorn the show is about to begin.

Asian markets closed higher overnight as they reacted to the positive US/China trade developments. Negotiations will resume and leaders will meet at the G20 attempting to find a compromise to the current trade war. European markets as well as the US Futures are rather subdued this morning as the world waits for the FOMC decision on interest rates and their future forecast. It would be normal to expect light and choppy price action as the market waits but at 2 PM Eastern anything is possible as the market reacts. Plan your risk carefully.

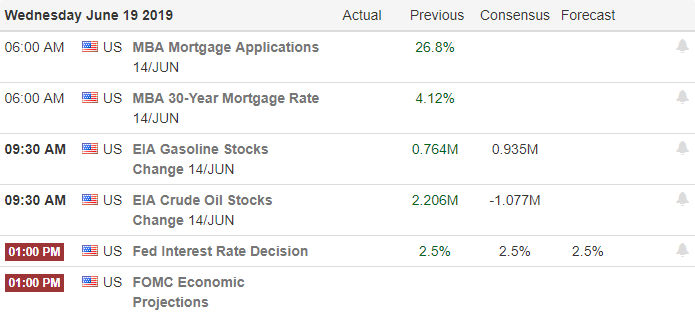

On the Calendar

On the hump day Earnings Calendar we have only 11 companies reporting quarterly earnings. Notable reports include ORCL, SCS & WGO.

Action Plan

After yesterday’s 350 point Dow rally and facing the FOMC rate decision one wonders if there will be anything to do until after 2 PM Eastern today. Of course the wording in the FOMC statement will be very important but I believe the market will be most interested in the forecast and the possibility of not just one rate cut this year. Expect choppy price action as the market waits for the decision and then anything is possible as the market digests the statement, forecast and press conference.

An apparent successful phone conversation with the President and Chinese Leader raised hopes a forthcoming trade deal after confirmation they will meet at the G20 to discuss trade. Although many are saying the offs of a deal at the G20 is very slim the market seems to be very hopeful a compromise is possible. Never say never but I wonder if a US/China deal occurs will the FOMC see a need to lower rates? Only time will tell.

Trade Wisely,

Doug

Comments are closed.