The first trading day of the second quarter the bulls put on a display of power charging through price resistance and breaking the last weeks chop zone. Unfortunately, the bulls stopped just short of the next price resistance hurdle in all four of the major indexes. It would be completely rational to think the momentum of yesterday bullishness would be enough to carry the index’s over this price barrier. However, it’s also quite rational to think a little pause to take a breath or even some profit-taking might be in order.

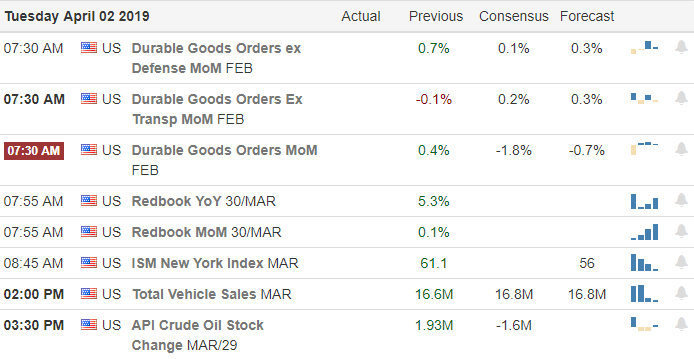

With the DIA and SPY finally making a new high we technically in a much better position, assuming the bulls can hold this newly attained elevation. The QQQ stopped short of a new high yesterday closing at price resistance while the IWM continues to languish in a downtrend. Futures are currently flat this morning but keep an eye on the Durable Good Orders report at 8:30 AM Eastern as it could set the tone for the day.

On the Calendar

We have a significant decline in earnings reports today with just over 20 companies. Notable earnings include GME, PLAY, NG & WBA.

Action Plan

After huge bullish one day rally where the Dow gained a whopping 329 points the futures indicate a more subdued open this morning. As a matter of fact, US Futures trading in the red all night and have only begun to see positive prints in the pre-market pump. Asian markets finish their trading day mixed but mostly higher overnight. European markets are bullish across the board this morning after reporting stronger than expected factory activity overshadowing another failed Brexit vote. Unless they can come to an agreement in the coming days the 5th largest economy will leave the bloc on April 12 with no deal.

Although yesterday was a great day for the market finally breaking a week-long chop zone the indexes charts find themselves with yet another price resistance hurdle just above. Perhaps the sheer momentum of yesterday’s bullishness is enough to propel the indexes over the hurdle but we shouldn’t expect the bear to give up easily. After such a big one day move it would not be at all surprising to see a little profit-taking to test overnight futures lows or pause the action to take a breath. The Durable Goods Orders at 8:30 AM could set the tone for the day but the consensus estimate is expecting a decline in this potential market-moving number.

Trade Wisely,

Doug

Comments are closed.