Earnings reports, the government shutdown in its 25th day and a Brexit vote could make for a challenging day. So far the bulls have done a very good job of defending price supports, but the bears have also been working hard keeping the index range bound in a rather tight consolidation. That consolidation could easily become the launching platform to attack the 50-averages, which for Dow is nearly 400 points higher. Or, it could also become the “border wall” that the bears defend.

Today we could see a rise in volatility this afternoon depending on the result of the Brexit vote because of the currency ramifications. We will have to remain flexible, stay focused on price action and avoid over-committing to a directional bias as the events of the day roll out. Fast price action and whipsaws are possible after the Brexit vote so stay on your toes, as it may prove to be a challenging day.

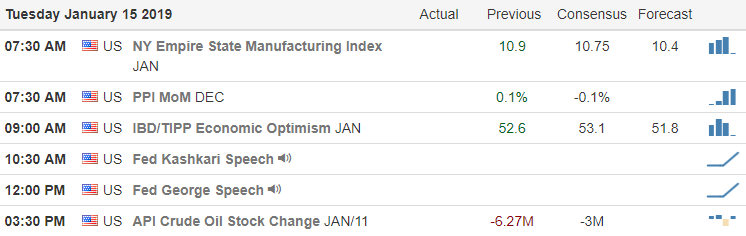

On the Calendar

On the Earnings Calendar, we have 18 companies reporting. Notable reports JPM, UNH, WFC, INFO & DAL before the market open. After the bell UAL reports.

Action Plan

Earnings results and political uncertainty will keep traders on their toes today. First, we have several notable earnings before the bell that could provide a little volatility before the open. Then this afternoon we could see some substantial volatility as a result of the Brexit vote this afternoon. At this time the vote is expected to fail, and some say it could be an epic failure that could wildly move currency markets. As we begin the 25th day of the shutdown TSA workers all across the country are calling in sick in protest. Air travel could become very difficult and create unintended economic impacts as the shutdown drags on.

The good news is that the bulls thus far seem largely unaffected by the turmoil rejecting yesterday’s gap down and defending price supports. Currently, the futures are suggesting a gap up to an upper range of the current consolidation, but that could easily improve or worsen as earnings results roll out. T2122 pulled back yesterday but remains stretched suggesting more pullback or consolidation is possible. I would not rule out a bullish push to test the daily 50 averages nor can we rule out the possible pullback so stay flexible and focused on price action for clues. With the Brexit vote possibly kicking in an extra dose of volatility it could be challenging day to navigate.

Trade Wisely,

Doug

Comments are closed.