A Tough Week

It’s been a tough week of price action, with economic reports continuing to show deteriorating economic conditions. However, since the bears have thus far been unable to make new index lows, there may be hope of a relief rally if today’s economic data cannot inspire the bears. The T2122 indicator suggests a short-term oversold condition, so fingers crossed the PMI, ISM, and Construction spending numbers can show us a light at the end of the tunnel! Keep in mind we are heading into a 3-day weekend, so plan your risk carefully.

While we slept, Asian markets closed Friday, trading with losses across the board, with the Nikkei leading the way. European markets trade mixed and near the flat line after ECB warns of rate hikes on the way after their inflation rate hit a record high of 8.6%. Though U.S. futures have recovered from overnight lows, they continue to point to a bearish open as we wait on manufacturing and construction data with an uncertain 3-day weekend ahead.

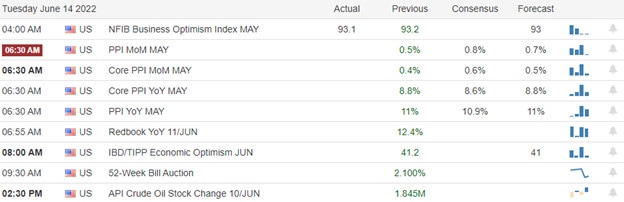

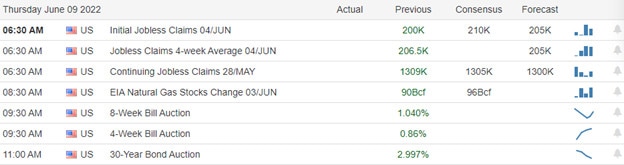

Economic Calendar

Earnings Calendar

To kick off third-quarter trading, we have no confirmed earnings reports.

News & Technicals’

European inflation hits a new record high of 8.6%, and the ECB is preparing for a rate hiking cycle. Speaking earlier this week, ECB President Christine Lagarde struck a hawkish tone. As a result, there are growing questions about the future of monetary policy in the eurozone amid fears of a recession in the coming months. Philip Lane, the bank’s chief economist, said the ECB needs to remain vigilant. Chief Product Officer Chris Cox warned employees at Facebook-parent Meta that lean times are ahead. To make up for last year’s Apple privacy update, which decreased the company’s ability to target ads, Meta will invest in Instagram Reels, its TikTok competitor, as well as shopping and messaging features. Kohl’s has called off talks to sell its business to The Vitamin Shoppe owner Franchise Group; sources tell CNBC. This decision from Kohl’s comes as its stock price slumps and its sales decline. Franchise Group had been lowering its bid for Kohl’s to closer to $50 per share from about $60. Earlier this year, Kohl’s rejected a buyout offer from Starboard-backed Acacia Research priced at $64 a share. Its stock closed Thursday at $35.69. Micron Technology, a major vendor of memory chips for PCs and smartphones, said on Thursday that it now expects smartphone sales to be meaningfully lower than expected for the rest of 2022. The company said consumer demand is slowing because of China’s lockdowns, the Russia-Ukraine war, and rising inflation. Treasury yields fell in early Friday trading, with the 10-year slipping to 2.97% and the 30-year dipping to 3.16%.

It’s been a tough week for the market and the worst first half of the year since 1970. With Europe’s inflation rate hitting 8.6%, beginning a rate hiking cycle, and the uncertainty of 3rd quarter earnings just around the corner, the challenging times are likely to continue in the weeks ahead. However, there may be hope that a relief rally could soon begin. As of now, the bears have been unable to make a new market low, and the T2122 indicator remains in a short-term overbought condition. Trader anticipation of earnings season may also inspire some short bursts of buy-side speculation. That said, geopolitical tensions and the decorating economic data are likely to make price action challenging, with gaps and overnight reversal possible as we wait on the banks to report.

Trade Wisely,

Doug