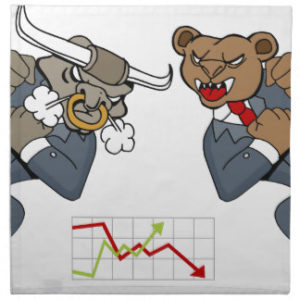

Bulls and Bears in a dead heat at resistance.

At the open yesterday, it appeared that the Bears were taking control, but Bulls fought back with equal vigor. As a result, the day ended with the Bull and Bears locked in a virtual dead heat. All the major indexes, however, remained under resistance and short-term downtrends remain in tact. A stalemate just below resistance is not the place to be actively adding risk. Always remember anything is possible and don’t assume you can predict the outcome. If you do decide to trade, I suggest keeping positions smaller than normal until you see the Bulls gaining the upper hand. Also, have a plan to protect current profits and cut losses quickly if the Bears gain the upper hand.

At the open yesterday, it appeared that the Bears were taking control, but Bulls fought back with equal vigor. As a result, the day ended with the Bull and Bears locked in a virtual dead heat. All the major indexes, however, remained under resistance and short-term downtrends remain in tact. A stalemate just below resistance is not the place to be actively adding risk. Always remember anything is possible and don’t assume you can predict the outcome. If you do decide to trade, I suggest keeping positions smaller than normal until you see the Bulls gaining the upper hand. Also, have a plan to protect current profits and cut losses quickly if the Bears gain the upper hand.

On the Calendar

We kick off the Thursday Economic Calendar with the Weekly Jobless Claims number at 8:30 AM Eastern. Normally we would have seen an increase in Jobless numbers this time of year due to the annual auto retooling. However, this year claims have held steady at historic low levels. Forecasters are expecting to see an increase this week to 237K vs. 232K on the last reading. At 10:00 AM we get a reading from Existing Home Sales which are expected to rise to 5.565 million annualized rate vs. the 5.520 in the last report. After that, we have a few reports that are very unlikely to influence the market and a bunch of bill/note announcements.

On the Earnings Calendar, we have nearly 80 companies expected to report today. Retailers play a prominent role today with reports from ANF, BURL, DLTR, FLWS, and SHLD all reporting before the bell. It’s been a rough quarter for retail so let’s hope we can begin to see that trend change today.

Action Plan

After the morning gap down the Bull attempted a rally but near resistance levels, they seemed equally matched by the Bears. Sideways choppy price action most of the day was the result. Resistance levels continue to hold as does the newly developed technical downtrend. Currently, futures are pointing to a slightly higher open, but as of now, it appears to be less than yesterdays highs. Perhaps today’s economic and earnings data will provide some directional inspiration after the open.

Currently, I am holding some nice gains in several positions and yesterday during the daily live session I picked up a few DIA and SPY puts. Please understand I am not trying to predict the market is about to fall with the put purchase. I am merely adding a little hedge to lower my long exposure to the market. As we approach the weekend, I will have a focus on taking some profits. With the overall market testing resistance, I will also be very focused on price action. I want to be prepared to act if the Bulls break through resistance or if the Bears gain the edge on this battle ground.

[button_2 color=”green” align=”center” href=”https://youtu.be/I_BBPBWDQ-8″]Morning Market Prep Video[/button_2]

Trade Wisely,

Doug

Relief rally, not a game changer yet.

Yesterday it was nice to have such a strong bullish move and relieve some of the bearish pressure. Unfortunately, the relief rally was not a game changer. The indexes closed the day below resistance levels and continued to remain under the current downtrends. The Bulls still have a lot of work to do if they are to regain control and I suspect the Bears still have some fight in them.

Yesterday it was nice to have such a strong bullish move and relieve some of the bearish pressure. Unfortunately, the relief rally was not a game changer. The indexes closed the day below resistance levels and continued to remain under the current downtrends. The Bulls still have a lot of work to do if they are to regain control and I suspect the Bears still have some fight in them.

A mistake I used to make was to focus too closely on the hard right edge of the chart. Yesterdays, bullish move would have me tossing caution to the wind, and I would buy stocks with both hands severely over trading the market condition. If the market turned, I would suffer big losses damage not only my account but also crush my confidence as a trader. My suggestion, if you do trade, consider smaller than normal positions to control the risk. Also be mentally prepared to exit trades quickly should the market begin to turn against you. Be willing to take small gains and cut off losses quickly if you suddenly find yourself on the wrong side of the battlefield.

On the Calendar

The hump day Economic Calendar kicks off at 9:45 AM with the PMI Composite Flash report. The consensus is expecting a moderate but constructive growth with services continuing to outpace manufacturing. At 10:00 AM we get the latest reading on New Home Sales which forecasters are expecting to remain flat at the July 610K print. 10:30 AM the very important EIA Petroleum Status Report. The last reading showed a decline in inventories, but crude continues to struggle under selling pressure. There is no forecast for this number, so all we can do is wait and hope it will continue to decline and supporting prices.

The Earnings Calendar has just over 50 companies reporting 3rd quarter results. There are several details in the list today with LOW being the most notable and heavily watched. LOW will report before the bell.

Action Plan

Yesterday all the major indexes caught a relief rally that was quite strong and leaving behind an open gap. The DIA, SPY and QQQ’s, all left behind a candle pattern loosely interpreted as a Morning Star. As good as that would seem the indexes are still not out of danger. First, this pattern requires follow-through. Price action to be valid. Secondly, all the indexes closed below. Short-term down trends as well price resistance. The questions now, will the Bulls have the moxie to push through the resistance? I suspect the Bears will have something to say about that mounting a defense. It should be an interesting battle.

Currently, the futures are pointing to a lower open which is not a surprise after such a big move. There are a lot of good charts flashing buy signals after yesterdays move. While I am long the market, I want to remain very cautious. For me, that means I want to be careful to not over trade during this market condition. I will normally begin with smaller than normal positions to reduce my risk. I will also be prepared to take any profits much faster should the overall market show clues of failure. If the Bears happen to regain control, a very quick sell off is possible, so plan accordingly and remain focused on the price action after the open.

Trade Wisely,

Doug

Can the Bulls repair the technical damage?

While many traders are focused on the what will happen today, I am honestly more concerned with the overall technical damage in the charts. Today we may bounce, but the big questions are will the Bulls have the energy to repair the price damage. If we do rally, I will be keenly focused on the on the price action as we approach resistance levels. In my heart of hearts, I want the Bulls to remain in control and buy the dip, but I won’t risk my money on hope or guesses. I will need to see proof, and that may take a little time to develop. Twenty-seven years experience has taught me that there is no need to rush. If I can control my emotions, wait and watch, I get better trades, and my win/loss ratio can continue to average around 70%. You don’t have to trade every day to be a successful full-time trader!

While many traders are focused on the what will happen today, I am honestly more concerned with the overall technical damage in the charts. Today we may bounce, but the big questions are will the Bulls have the energy to repair the price damage. If we do rally, I will be keenly focused on the on the price action as we approach resistance levels. In my heart of hearts, I want the Bulls to remain in control and buy the dip, but I won’t risk my money on hope or guesses. I will need to see proof, and that may take a little time to develop. Twenty-seven years experience has taught me that there is no need to rush. If I can control my emotions, wait and watch, I get better trades, and my win/loss ratio can continue to average around 70%. You don’t have to trade every day to be a successful full-time trader!

On the Calendar

Tuesdays Economic Calander is another very light one. At 9:00 Am Eastern is the FHFA House Price Index followed by the Richmond Fed Manufacturing Index at 10:00. Both are really not-consequential reports having little chance of moving the market. Rounding out the calendar day is a 4-week bond auction.

Over 60 companies grace the Earnings Calendar today with their quarterly results. INTU, MOMO, and TOL, CRM and AABA may be extra notable for some of the members. Make sure you are checking the reporting date of all companies that affect your portfolio.

Action Plan

As I was out playing with telescopes and photographing the eclipse yesterday, I was not following along intraday as normal. Although the DIA failed the 50-day average during the day making a new low the Bull managed to stage enough of a rally to recover price and close above this important support level. The SPY, QQQ’s and the IWM all staged a late day rallies but remain under key moving averages. I suspect the market will bounce and the current futures are pointing to a slight gap up. However, other than the DIA the indexes are in a precarious position. Any rally back toward resistance levels could produce failure patterns continuing the current downtrends.

As you all know, I try to avoid prediction of any kind. I simply want to follow price when evidence of direction supported by actual buyers or sellers. As a result, I will likely give the market 20 to 30 minutes to digest the morning rush before making any trading decisions today. Of course, the top order of business is to manage current positions protecting profits and trading capital.

[button_2 color=”green” align=”center” href=”https://youtu.be/zYmTDGJdBeM”]Morning Market Prep Video[/button_2]

Trade Wisely,

Doug

The Bears have their nose in the door.

With the follow through selling on Friday, it would appear the Bears have their nose in the door and smell a tasty opportunity. The Bulls will have their work cut out for them with the significant technical damage that has now occurred in three of the major indexes. A short-term oversold condition exists, and a bullish bounce is likely to begin soon. However, I would not assume the down trend is over. Any bounce or rally back to resistance could set up more selling. If you do decide to trade, keep that in mind as you plan the position. Technical damage such as this not likely to be repaired quickly. There is no rush. Wait for a defensible entry with solid evidence that the bulls are regaining control before risking your hard-earned money!

With the follow through selling on Friday, it would appear the Bears have their nose in the door and smell a tasty opportunity. The Bulls will have their work cut out for them with the significant technical damage that has now occurred in three of the major indexes. A short-term oversold condition exists, and a bullish bounce is likely to begin soon. However, I would not assume the down trend is over. Any bounce or rally back to resistance could set up more selling. If you do decide to trade, keep that in mind as you plan the position. Technical damage such as this not likely to be repaired quickly. There is no rush. Wait for a defensible entry with solid evidence that the bulls are regaining control before risking your hard-earned money!

On the Calendar

It looks as if the Economic Calendar has decided to take most of the day off to watch the eclipse. At 8:30 AM Eastern there is a single report from Chicago Fed National Activity Index. As a general rule, this report will not move the market. Other than that we have a bill announcement and a couple of bill auctions wrapping up the day.

On the Earnings Calendar, we have just over 50 companies reporting earnings today. Scanning through the list, I don’t see any that would be market moving reports. However, it is always wise to make sure are checking your current holdings and those you are considering to trade. It only takes a couple of minutes but could save you thousands in trading capital.

Action Plan

Friday was a tough day for the traders that jumped in on Thursday trying to buy the dip. While the DIA managed to hold on to the 50-Day SMA, the SPY and the QQQ’s both closed below. Technically the QQQ’s are in better shape than the SPY having managed to close just above the low on the 10th. The SPY is now technically in a downtrend and a candidate for a Blue Ice Failure pattern after a brief rally. The IWM is by far the weakest of the indexes closing well below the 200-day average, however, holding onto a major price support built over the last ten months of trading.

I was quite content with my decision to stand aside on Friday. As I will be gone shortly after the open to meet with a group of astronomical scientists to study the eclipse, I will not be trading today either. Although the futures were negative all night long, they are now suggesting a flat open. Personally, I believe that the indexes are currently over sold in the very short-term. A bounce or relief rally could begin at any time, but please don’t interpret that as an invitation to buy the dip blindly. There is a lot of technical damage in the SPY, QQQ, and IWM. Any bounce or rally may serve to attract more Bears so be very careful. Also, keep in mind much of the US will be out observing the eclipse today. I would not be surprised if the volume was light and the price action was choppy most of the day.

[button_2 color=”green” align=”center” href=”https://youtu.be/Semq3_wtAF4″]Morning Market Prep Video[/button_2]

Trade Wisely,

Doug

The Bears create technical damage.

Sad ly the price action concerns that I mentioned yesterday came to fruition as the Bears won the battle at resistance. This time there was significant technical damage was created the in the index charts. It may turn out to be nothing more than another round of market jitters but to ignore it is unwise. The mantra for the last few years has been “Buy the Dip.” However technical damage such as this normally takes at least several weeks to resolve. We can now expect more volatility and challenging price action going forward. Plan accordingly.

ly the price action concerns that I mentioned yesterday came to fruition as the Bears won the battle at resistance. This time there was significant technical damage was created the in the index charts. It may turn out to be nothing more than another round of market jitters but to ignore it is unwise. The mantra for the last few years has been “Buy the Dip.” However technical damage such as this normally takes at least several weeks to resolve. We can now expect more volatility and challenging price action going forward. Plan accordingly.

On the Calendar

We have a very light Economic Calendar this Friday. At 10:00 AM Eastern we get the latest reading on Consumer Sentiment. Although Consumer Confidence has been running near 20-year highs, Consumer Sentiment has been drifting lower. The consensus is expecting a slight rebound to 94.0 vs. the last reading at 93.4. Shortly after at 10:15 AM we have a Fed Speaker to round out the week.

On the Earnings Calendar we just over ten companies reporting today. One of the biggest today will come from DE that reports before the bell. Retailers EL and FL are also slated to report before the open today. Although earnings season is winding down, it’s very important to make checking earnings report dates on the companies you hold and are thinking of buying. Failing to do so can quickly damage an account.

Action Plan

Raising my caution level based on the price action served me well yesterday as the Bears won the first battle at resistance. Yesterday the DIA broke and closed below the strong uptrend that it has enjoyed for several months. Tremendous technical damage in the SPY was created yesterday breaking down below the prior low and closing well below the 50-day average. The QQQ’s also suffered damage but managed to hold above the last low and the overall up trend closing at the 50-day average. The poor IWM not only made a new low in its current downtrend but also sliced right through the 200-day average as if it was not even there.

With so much technical damage ahead of the weekend I will most likely stand aside today. As you know, I always try to trade with the overall trend. There are now sufficient clues that the up trend may falter, so I will begin putting together a watch-list of down trending stocks. If you happen to be a long only trader, it is now time to curtail your trading activity. Repairing technical damage will normally require several weeks of trading during which time volatility will likely be elevated making it very challenging even for the most experienced traders. Please protect your accounts and realize you don’t have to trade every day to be a profitable trader.

[button_2 color=”green” align=”center” href=”https://youtu.be/5epadPTFvrQ”]Morning Market Prep Video[/button_2]

Trade Wisely,

Doug

The Bull/Bear battleground.

The Bulls have been impressive rallying back up to test market highs however they seemed to lose considerable energy near the close. With the futures looking lower this morning the Bears are showing their teeth and willingness to fight. With definitive support and resistance levels on the DIA, SPY, and QQQ’s the Bull/Bear battleground as been established. I suggest staying very focused on price action. Trend and momentum currently favor the Bulls, but last week we saw how quickly that edge could fade away. I am raising my caution levels and will restrict my market activity. No matter which team wins this battle I will be ready to ride their coat tails when price action clues of the winner begin to emerge.

The Bulls have been impressive rallying back up to test market highs however they seemed to lose considerable energy near the close. With the futures looking lower this morning the Bears are showing their teeth and willingness to fight. With definitive support and resistance levels on the DIA, SPY, and QQQ’s the Bull/Bear battleground as been established. I suggest staying very focused on price action. Trend and momentum currently favor the Bulls, but last week we saw how quickly that edge could fade away. I am raising my caution levels and will restrict my market activity. No matter which team wins this battle I will be ready to ride their coat tails when price action clues of the winner begin to emerge.

On the Calendar

The Economic Calendar for Thursday begins with the weekly Jobless Claims at 8:30 AM Eastern. Labor continues to hold very strong this year, and forecasters see that continuing with a 240K print today. Also at 8:30 AM is the Philly Fed Business Survey. The July report only showed marginal strength at 19.5 vs. the 17.0 consensus for today. At 9:30 AM we get a reading on Industrial Production which is expected to rise 0.3% with capacity utilization edging up to 76.7%. Other than that we have Fed speakers at 1:00 and 1:45 PM and few non-market-moving reports mixed in for good measure.

There are just over 50 companies reporting earning today, so please stay on your toes checking your holding and those you are considering for new trades. A couple to make a note of are the reports from BABA and WMT which both happen before the bell today.

Action Plan

Before the FOMC Minutes, the market was finally seeing some follow-through buying after the morning futures pump. However, after the report, weakness showed up in the indexes selling off to near the opening prints. The DIA, SPY, and QQQ’s all remained under resistance leaving behind indecisive candle patterns once again opening the door for reversal. Currently, futures are pointing to a slightly lower open that require our attention. If it turns out to only be a rest near the highs, perfect, but if the Bears go to work here then trouble could be just around the corner.

Over all the trend continues to be up but I think it’s wise to raise your caution level as we dance around the market highs. Reversals can happen very quickly near market highs, and although 3 of 4 major indexes are holding up well, IWM is down-trending raising some questions. As a result, I will likely curtail my trading activity slightly and will be prepared to take profits ahead of the weekend.

[button_2 color=”green” align=”center” href=”https://youtu.be/jG0wwbpUUQM”]Morning Market Prep Video[/button_2]

Trade Wisely,

Doug

Morning gaps but no follow-through action.

So far this week the pros have pumped up the premarket in the futures gapping the market higher. There is nothing wrong with that as long as we see some follow-through buying after the open. However, the last two days have only seen chop after the open making it frustrating and challenging for most traders. I have been warning each day to avoid chasing the gap and getting caught up in morning drama.

So far this week the pros have pumped up the premarket in the futures gapping the market higher. There is nothing wrong with that as long as we see some follow-through buying after the open. However, the last two days have only seen chop after the open making it frustrating and challenging for most traders. I have been warning each day to avoid chasing the gap and getting caught up in morning drama.

With the futures pointing to another gap up today, I will risk sounding like a broken record and repeat the same words of caution. Keep in mind FOMC Minutes come out this afternoon. It would not be a surprise if the market waits for choppy price action before the report. After the minutes are released expect an extra dose of volatility with quick whipsaw action.

On the Calendar

We have three potential market moving reports on the Economic Calendar today. At 8:30 AM Eastern it kicks off with Housing Starts which were weak in both April and May but bounced back in May. Forecasters expect to see another increase today to 1.225 million annualized rate. At 10:30 AM we get the EIA Petroleum Status Report. Last reading broke a downtrend in oil supplies with a surprise build squashing the recovery that had begun in the sector. Let’s cross our fingers and hope for a decline in supplies today helping to support the overall market. The always anticipated FOMC Minutes will come out at 2:00 PM. Normally the market would see light volume and choppy price action ahead of the number, but there is nothing normal about the current market.

On the Earnings Calendar, we have over 40 companies reporting today. Retailers happen to be in focus with TGT reporting before the open today.

Action Plan

Our all or nothing market continues to gap higher at the open, but so far this week, there has been little to no follow through the rest of the day. There is movement in some individual stocks but to have a little luck and be very quick to gain much benefit. Currently, the futures are pointing to yet another gap up, but as now a breakout to new price levels has not occurred. If you find yourself frustrated, you are not alone! With out question, current price action has been very challenging with little to no edge for retail traders.

With another professional gap this morning I am once again forced to wait for clues that real buyers are willing to support current prices of the overall market. The gaps on both Monday and Tuesday were met with chop the rest of the day. Perhaps today will be different but with the FOMC minutes coming out this afternoon could once again create the conditions for more chop after the gap. The trend is up so if I do trade it will be long.

[button_2 color=”green” align=”center” href=”https://youtu.be/cfbSgw60Dc4″]Morning Market Prep Video[/button_2]

Trade Wisely,

Doug

Will resistance hold or break?

Yesterday’s bullish move looks as if it will be followed by another gap up bring the both SPY, QQQ’s right back to last weeks resistance. The question is, will resistance hold, stopping the Bulls advance or will it break? To say the least, this kind of price action is tough to trade, and what makes it worse it’s dripping with emotion and drama. There is an old saying that, Fortune favors the bold. For some that’s true, but history rarely writes catchy sayings for those that lost their heads during their bold attempts. Keep in mind it’s not necessary to trade every day to be successful. Choose your battles wisely.

Yesterday’s bullish move looks as if it will be followed by another gap up bring the both SPY, QQQ’s right back to last weeks resistance. The question is, will resistance hold, stopping the Bulls advance or will it break? To say the least, this kind of price action is tough to trade, and what makes it worse it’s dripping with emotion and drama. There is an old saying that, Fortune favors the bold. For some that’s true, but history rarely writes catchy sayings for those that lost their heads during their bold attempts. Keep in mind it’s not necessary to trade every day to be successful. Choose your battles wisely.

On the Calendar

We begin Tuesday with the biggest report of the day on the Economic Calendar at 8:30 AM Eastern. Retail Sales number have disappointed all year but today consensus expectations for today are looking for a 0.3% vs. the 0.2% decline last reading. Also at 8:30 we will hear from the Empire State Mfg. Survey and Import/Export Prices. Consensus for the manufacturing number is to remain steady at 9.8. Import/Export prices are expected to increase by 0.1% vs. the 2% decline last month. At 10:00 AM both Business Inventories and Housing Market Index release results. Forecasters are calling for 0.4% gain in June for Business Inventories and a 65 reading in the Housing Index. The Treasury International Capital number rounds out the day at 4:00 PM.

On the Earning Calendar, there are more than 30 companies reporting today. Retail numbers will be the theme most of this week. Home Depot reported very early this morning beating both the top and bottom line as same store sales increased, but as of now, investors seem unimpressed.

Action Plan

The Bulls made a strong showing yesterday gapping the market higher and managing to hold it above the gap all day. Currently, it would seem the Bulls would like a repeat performance with the Dow futures suggesting another gap up of nearly 50 points. That brings the SPY and the QQQ’s right back up into the congestion zone they were having trouble with as the Dow pushed higher just a week ago. If you’re confused as to what to do, you’re not alone. Price action such of this is very difficult to trade. Traders that step in boldly might get richly rewarded however they may just as easily punished for chasing into price resistance. Tough decisions to be sure.

Over all trends continue to be up so to follow my rules and trade with the direction of the market I will be looking for long trades. However, I will not rush in after another gap. I will wait and watch and enter only if the timing is right and the price action confirms.

[button_2 color=”green” align=”center” href=”https://youtu.be/J5GupuuqpSA”]Morning Market Prep Video[/button_2]

Trade Wisely,

Doug

Big gaps, high emotion – A dangerous combo.

The sell off last week spiked the VIX more than 65% suggesting elevated volatility and challenging price action ahead. A Monday morning professional gap up of nearly 100 points only increases trader emotions. For years I made the mistake of getting caught up in the drama of this kind of price action. I would chase it down and chase up thinking I was missing a big opportunity to make money. After years of poor results, I finally wised up and realized that often less is more.

The sell off last week spiked the VIX more than 65% suggesting elevated volatility and challenging price action ahead. A Monday morning professional gap up of nearly 100 points only increases trader emotions. For years I made the mistake of getting caught up in the drama of this kind of price action. I would chase it down and chase up thinking I was missing a big opportunity to make money. After years of poor results, I finally wised up and realized that often less is more.

What I mean by that is commonly traders get caught up in the idea if the market is open then they have to be trading. That is just not true! The best traders in the world watch and wait much like a sniper patiently for one shot. I found that if I could avoid the drama, watch, wait and plan I traded less but made a lot more money. My win/loss ratio went way up, and my trading account started to grow rather than the endless Yo-Yoing I had been experiencing. When the markets become volatile, it is easy to over trade and get caught up in the drama. Not every day is a good day to trade if you want to maintain your edge. Always remember sometimes less is more!

On the Calendar

The Economic Calendar decided to extend the weekend by largely taking Monday off. Other than a bill announcement and a couple of bill auctions there is nothing on the calendar today.

Today is the last big earnings day for this quarter with about 220 companies reporting results. Earnings have been a major source of inspiration for the bulls this quarter. I will be interesting to see how the market responds as that energy supply begins to burn out.

Action Plan

As anticipated, the Korean worries prevented the Bulls from mounting a rally on Friday. The good news is that the Bears were also unsure about the weekend and most of them seemed to join the Bulls in taking the day off. Only the QQQ managed to end the day with a respectable defense of the 50-day moving average while the SPY closed below the 50 for the 2nd day in a row. With the threat to the weekend now past the Dow Futures are currently pointing to a huge gap up open of nearly 100 points.

Although the gap up this morning is not that surprising, it’s also something that I don’t want to chase. Keeping in mind the overall price pattern the morning gap up will still be under significant price resistance on the SPY, QQQ, and IWM. Always keep in mind that a gap up the perfect setup for a pop and drop or whipsaw price action. I refuse to chase, so I will be standing aside for 20 to 30 minutes allowing the price action develop. If the Bulls step in supporting the gap with actual buying then and only then will I consider new long positions. Until that time I will carefully manage the positions that I held over the weekend that hopefully will benefit from the bullish open today.

[button_2 color=”green” align=”center” href=”https://youtu.be/76ZRvlXN1X8″]Morning Market Prep Video[/button_2]

Trade Wisely,

Doug

Will Korean tensions keep the Bulls away?

With such strong sell off it would not be unreasonable to think a bounce is in the cards for today. I would agree however the Korean tensions could make it difficult for the Bulls to buy this dip. I can tell you that see no good reason to add risk going into this weekend and I suspect many will have the same inclination. That’s not saying we can’t or won’t experience a relief rally. I’m only suggesting the possibility exists that it may be a lackluster bounce or that it may not occur all. Trying to predict a bottom is just a futile and dangerous as it is trying to predict the top. Wait for proof in price and then react unemotionally with a well thought out plan.

With such strong sell off it would not be unreasonable to think a bounce is in the cards for today. I would agree however the Korean tensions could make it difficult for the Bulls to buy this dip. I can tell you that see no good reason to add risk going into this weekend and I suspect many will have the same inclination. That’s not saying we can’t or won’t experience a relief rally. I’m only suggesting the possibility exists that it may be a lackluster bounce or that it may not occur all. Trying to predict a bottom is just a futile and dangerous as it is trying to predict the top. Wait for proof in price and then react unemotionally with a well thought out plan.

On the Calendar

The Consumer Price Index tops the Economic Calendar today coming out before the market opens at 8:30 AM eastern time. The consensus is only expecting a gain of only 0.2% with the yearly rate slipping to 1.8 from 1.9 on the last reading. Declines in cell phone services and fundamental prices including housing are the culprits pointed to as the reason growth in this number remains weak. At 9:40 AM and 11:30 AM we have Fed Speakers rounding out the day.

The Earnings Calendar will not begin to lighten up dramatic with just under 70 companies expected to report their results today. At the close yesterday, NVDA topped estimates, but the stock sold off sharply and is indicating a 7% gap down this morning. That will not be helpful to an already weakened QQQs as we head into the weekend.

Action Plan

The follow-through sell-off yesterday created some significant psychological damage in the indexes. The SPY, QQQ’s and IWM have also suffered significant technical damage cutting through the 50-day moving average. Even more damaging is that the SPY broke the uptrend that began in early 2016. The IWM being the weakest of the indexes fell all the way to the 200-day moving average and is currently indicating it will gap below it at the open today.

Adding insult to injury, the futures are again suggesting a small gap down at the open. Normally after a sharp selloff such as this, it is reasonable to expect a bounce in price. However, as we head into the weekend the tensions growing in North Korea, traders may prefer to avoid the risk. I for one will not be looking for new positions today as I view the weekend risk simply too high for my taste. Having already trimmed my portfolio ahead of this sell off I will sleep well this weekend. The market will be open Monday, and there will be plenty of opportunities made available. Of course, I will be closely monitoring the positions I continue to hold and plan to carry through the weekend.

[button_2 color=”green” align=”center” href=”https://youtu.be/cJQK2aEKN6w”]Morning Market Prep Video[/button_2]

Trade Wisely,

Doug

At the open yesterday, it appeared that the Bears were taking control, but Bulls fought back with equal vigor. As a result, the day ended with the Bull and Bears locked in a virtual dead heat. All the major indexes, however, remained under resistance and short-term downtrends remain in tact. A stalemate just below resistance is not the place to be actively adding risk. Always remember anything is possible and don’t assume you can predict the outcome. If you do decide to trade, I suggest keeping positions smaller than normal until you see the Bulls gaining the upper hand. Also, have a plan to protect current profits and cut losses quickly if the Bears gain the upper hand.

At the open yesterday, it appeared that the Bears were taking control, but Bulls fought back with equal vigor. As a result, the day ended with the Bull and Bears locked in a virtual dead heat. All the major indexes, however, remained under resistance and short-term downtrends remain in tact. A stalemate just below resistance is not the place to be actively adding risk. Always remember anything is possible and don’t assume you can predict the outcome. If you do decide to trade, I suggest keeping positions smaller than normal until you see the Bulls gaining the upper hand. Also, have a plan to protect current profits and cut losses quickly if the Bears gain the upper hand.