On Sunday the Wall Street Journal triggered a buy the rumor rally when they reported that the US and China are “in the final stage of completing a trade deal.” The story offered nothing as to an actual completion date of the agreement and had little to no details about what’s included. Nonetheless, markets around the world have reacted bullishly to the hope that some kind of agreement is forthcoming hopefully sooner than later.

We have more than 500 companies reporting earnings this week and busy economic calendar as we move toward the Friday Employment Situation report. The index trends are still up but we still have those pesky price resistance levels above that continue to demand respect. As we saw on Friday a gap into price resistance can prove dangerous and costly if you chase into it with a fear of missing out. Wait for proof in the price action after the gap that buyers are stepping in supporting the gap to avoid those nasty pop and drop patterns.

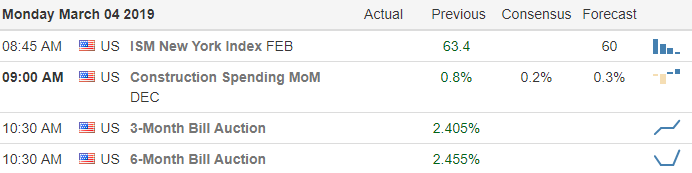

On the Calendar

On the Earnings Calendar we have 64 companies stepping up to report earnings results today.

Action Plan

Friday’s gap up open into resistance found sellers and through our the morning gave back the entire gain and at one point was looking pretty grim. Fortunately the bulls went back to work in the afternoon recovering about half of the initial morning gap. This morning futures are once again signaling a gap up open with Asian and European markets also bullish overnight. On Sunday the Wall Street Journal reported that the US and China are “in the final stage of completing a trade deal.” It cited that Beijing was offering some lower tariffs on U.S. Products and markets responded bullishly around the world.

Unfortunately the story said nothing about the timeline to completion and little to no detail as to the contents in the agreement. A true to form buy the rumor market pop! Nonetheless, the trend is still up and thus far key resistance levels are still holding and must be respected. We have another big week of earnings reports and several significant economic reports culminating on Friday with the big Employment Situation number on Friday morning. As always, avoid chasing the morning gap waiting instead for proof in the price action that buyers are going to set in supporting the gap.

Trade Wisely,

Doug

Comments are closed.