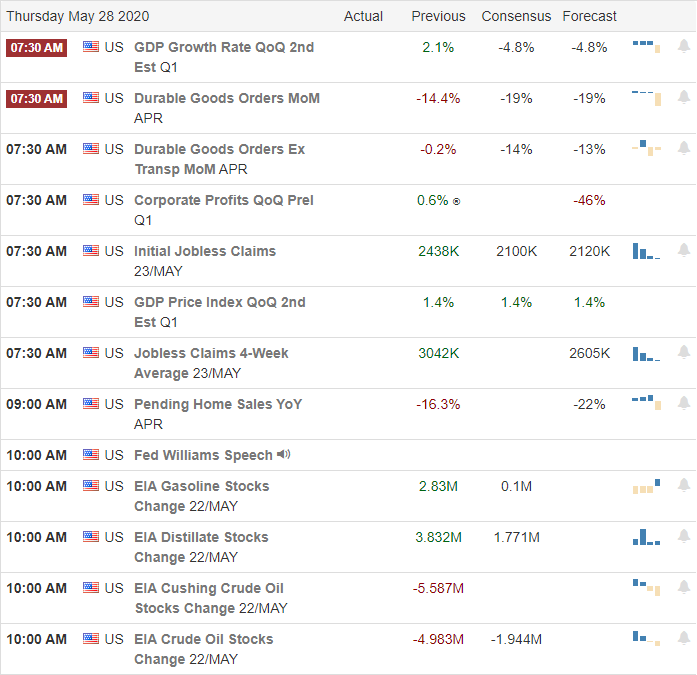

The bulls surge at the end of the day with the financial and retail sectors sharply gaining ground as wall street hopes grow as business across the country begins to reopen. Sadly the Beige Book report cited a different story with business leaders pessimistic about recovery and workers reluctant to return to their jobs. Before the open today, we have a big data dump, including jobless claims with consensus suggesting more than two million joined the historic number of unemployed.

Asian markets closed mixed with Hong Kong moving lower after China pass new security measures cracking down on the country. European markets see green across the board as the monitor escalating tensions between the US and China. US Futures point to another bullish gap up open ahead of a busy day of earnings and economic data. An extra dose of price volatility is likely this morning as we react to data.

Economic Calendar

Earnings Calendar

On the Thursday earnings calendar, we have 87 companies reporting quarterly results. Notable reports include DG, COST, ULTA, ANF, BURL, CM, CSIQ, DLTR, MOMO, NIO, JWN, OLLI, CRM, SAFM, SHOO, TD, & VMW.

Technically Speaking

For the 3rd day this week, the bulls charged forward on hopes of the country reopening its economy. Interestingly, the Fed Beige Book said economic activity declined across the country, falling sharply in most regions. It also cited that workers are reluctant to go back to their jobs due to safety concerns, child care, and the very generous unemployment benefits provided by the government. The report also stated that business leaders were pessimistic about the potential pace of the recovery. Tensions between the US and China are growing. Last night Chana approved the new security measures for Hong Kong, although many countries have come out against the law as limiting free speech. The US House yesterday sent a bill to the president’s desk to sanction China for human rights violations. Hong Kong may lose its special status with the US, which could have ramifications for investors in the coming weeks. Today we have big data dump on the economic calendar with Durable Goods, GDP, Jobless Claims, Home Sales & Petroleum Status. Consensus suggests that more than 2-million Americans applied for unemployment last week even as the business tries to reopen across the country. Boeing announced layoffs for nearly 7000 employees yesterday, and American Airlines plans a 30% reduction of management and administrative staff as the industry continues to struggle.

The Financial and Retail sectors had a very good day yesterday, pushing the indexes higher will in a late-day surge of buying. The Dow has rallied more than 1000 points in just two trading days, and the SP-500 closed above its 200-day average for the first time since early March. US Futures once again indicate a bullish open the suggesting a Dow gap up of more than 100 points ahead a big day of economic data. I would not be surprised to see an extra dose of price volatility ahead of the market open. The T2122 indicator continues to warn of an extreme overextended condition in the indexes. Still, the bulls seem to be in a relentless buying mood no matter what the numbers suggest about the economy. Hang on tight anything is possible and be prepared for the possibility of profit-taking that could begin at any time.

Trade Wisely,

Doug

Comments are closed.