As harsh as the selling might have felt during the morning session but thus far the bulls defended index 50-day average supports. A very good sign but with so many big earnings reports rolling our this week we should expect more volatility over the next couple of weeks with both bullish and bearish surprises.

Earnings season normally produces significant overnight market gaps adding complexity to your trading decisions. New US/China trade tensions and newly imposed sanctions on Venezuela also adding stumbling blocks effecting price action volatility. Keep in mind the tech bellwether AAPL reports after the bell today opening the door for a Wednesday market gap. Clearly, there is a lot to consider as we plan our risk in the day ahead. Be careful not to over-commit and stay focused on price action.

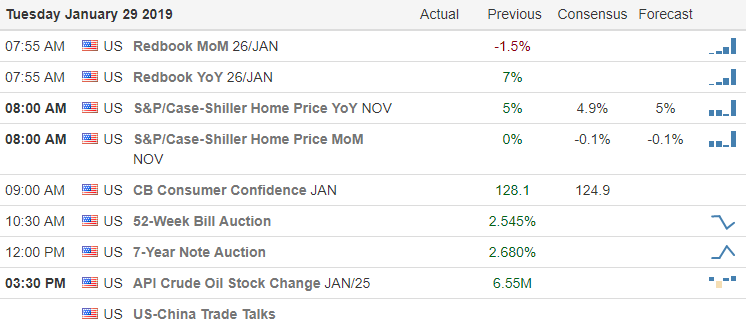

On the Calendar

On the Earnings Calendar, we have 112 companies reporting today. There are more notable reports today than I can list here but keep in AAPL, AMD and EBAY report after the bell today.

Action Plan

After a steep decline during the morning session, the bulls went to work showing a willingness to defend the 50-day average support of the indexes. A good sign but the real test will be after the market bellwether AAPL reports after the bell this afternoon. Currently, futures are suggesting a modest decline this morning, but with so many earnings reports before the bell, I would expect something very different by the open.

New tensions this morning as US and Russia impose sanctions on Venezuela and new tensions on the US/ China trade negotiations as the US files criminal charges on the china mobile device maker Huawei. Keep in mind that the FOMC meeting begins today which will culminate with their rate decision Wednesday afternoon. AAPL’s earnings report will set the stage for a flurry of big tech reports this week. Unfortunately, most of them will report aftermarket close which sets the stage for significant market gaps the next morning. Consider the gap risk as your plan ahead and expect considerable price action volatility.

Trade Wisely,

Doug

Comments are closed.