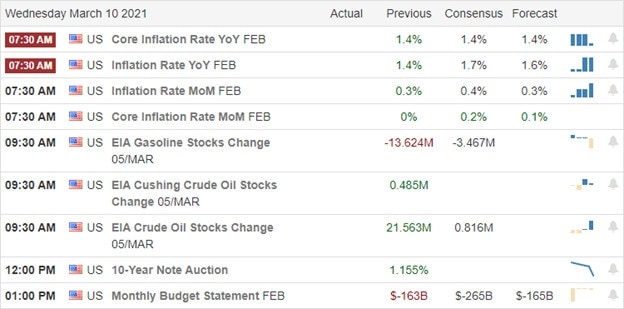

The bulls went back to work in the NASDAQ yesterday, lifting the index 3.69%, with the Dow briefly touching a new record high. However, the bulls still have a lot of ground to recover, with the QQQ, SPY, and IWM still challenged by overhead resistance. I think the big question the market has to grapple with is the bullishness of another 1.9 Trillion in stimulus and the possible bearishness that could create in interest rates and inflation. The success of the 10-year bond auction at 1 PM eastern today could be telling.

Asian markets closed mixed after a choppy session that saw selling into the close of the day. European markets seesaw this morning with modest gains and losses as the rally momentum seems to have faded. Ahead of earnings and a reading on the CPI, U.S. futures trade mixed in the premarket as inflation worries linger.

Economic Calendar

Earnings Calendar

On the Wednesday earnings calendar, we have just short of 100 companies fessing up to quarterly results. Notable reports include AMC, ASAN, BLDP, BBW, CPB, CLDR, EXPR, FOSL, FNV, LC, NGMS, SUMO, tup, UNFI, & VRA.

News & Technicals’

The bulls went back to work on Tuesday, pushing the Dow to a new high, but afternoon selling closed short of a record high close. The SPY and QQQ rallied sharply, testing resistance levels of price and downtrend, with big tech leading the gains. The U.S. House plans to pass the Senate revised stimulus bill today, and the President says he will sign it as soon as it hits his desk, adding 1.9 trillion in deficit spending. At 1:00 PM Eastern today, there will be a bond auction of the 10-year Treasuries. The last 10-year auction triggered a sharp rise in rates raising significant concerns of inflation. I may be wise to keep an eye on today’s auction if it energizes the bears for another attack. Representative Suzan DelBene is reintroducing a bill aimed at creating a national standard for digital privacy rights allowing states to build on the protections of the federal standard.

A look at the index charts, and it’s pretty easy to see the DIA is leading the way in printing a new record high before the profit-taking heading into the close. IWM is also in good condition though still challenged by some overhead resistance. Both the SPY and QQQ rallied sharply but still must address the downtrend as well as price resistance levels above. Keep in mind that that the QQQ remains the weakest of the indexes needing to recover more than 10 points to challenge its 50-day average as resistance. Before the bell, we will get the latest reading on CPI, and later today, it may be wise to keep an eye on the 10-year bond auction.

Trade Wisely,

Doug

Comments are closed.