With bond rates softening, the bulls seem ready to come back to work this morning. The big premarket pump-up could fire off a bit of a short squeeze with those that held short positions over the weekend. However, with significant overhead price resistance levels and the NASDAQ needed to recover its 50-day average, I would not expect the bears to give up as quickly as they have in the recent past. Keep a close eye on those bond yields and stay focused as we approach price resistance levels in the index charts.

Asian markets surged higher overnight, led by the NIKKEI closing up nearly 2.5%. European markets are also decidedly bullish this morning, taking Qs from declining treasury yields. U.S. futures point to a substantial gap up open ahead of earnings, economic reports that may prove market-moving. Expect significant price volatility at the open as the bulls and bears battle for control.

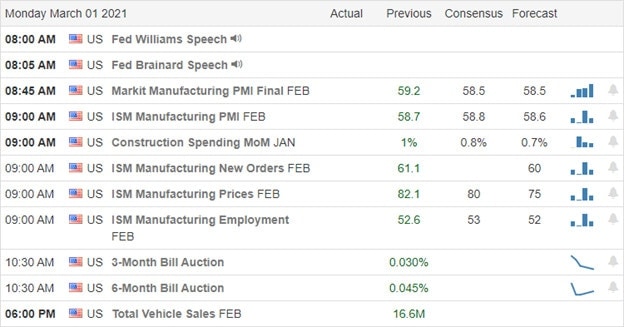

Economic Calendar

Earnings Calendar

To kick off the first trading day of March, we have more than 100 companies fessing up to quarterly reports. Notable reports include DDD, AI, CWEN, CLOV, XRAY, EVTC, HGV, IPAR, LMND, NIO, NVAX, NRG, PRGO, APTS, SGMS, SWCH, TGNA, UNIT, WKHS, & ZM.

News and Technicals’

Fear of rising bond rates created significant price volatility last week, waking up some aggressive bears. This morning bond rates are retreating, and bulls are stampeding back with U.S. Futures suggesting a strongly bullish open. The U.S. House passed the 1.9 Trillion stimulus bill and extended unemployment benefits by five months, paying an extra $400 in benefits per week. The new one does the J&J vaccine gained emergency approval this weekend, and shipments have already started. GM announced the all-electric Bolt hatchback and crossover vehicles will price under $34,000 as the race for the EV market share heats up.

With the bulls rushing into the futures this morning, expect a somewhat volatile open. I suspect there will be an attempt to trigger a short squeeze, particularly in the DIA catching a large number of bears holding short positions over the weekend. Bond yields have softened, but the question is, will it be enough to back off the bears as we approach overhead resistance levels. Having both held their respective 50-day averages as support, the SPY and DIA are the best positioned to recover. However, the QQQ has the challenge of recovering its 50-day average, downtrend, and substantial overhead price resistance. Facing a big round of earnings with PMI, ISM, and Construction Spending numbers to digest the first day of March could be a wild one.

Trade Wisely,

Doug

Comments are closed.