Bulls Look To Make Move At Open

On Tuesday the large-cap indices opened flat while the QQQ gapped down half of a percent. From that point, all three indices chopped sideways (with a slightly bullish trend in the large-caps) all the way into 3:30 pm. The DIA continues to hold its retest of the 50sma from above and the SPY is holding on in its retest of a support level. However, the QQQ continues to get the worst of the beating in the current downtrend. This action is giving us indecisive, white-bodied, Spinning Top type candles in all three major indices. And these moves came on below-average volume.

On the day, nine of the ten sectors are in the green with Healthcare (+1.50%) and Energy (+1.47%) leading the way higher while the Consumer Cyclical (-0.54%) sector fared worst. Meanwhile, the SPY was up 0.14%, the DIA was up 0.31%, and the QQQ was down 0.08%. At the same time, the VXX is down 0.75% to 14.54 and T2122 has climbed but remains in oversold territory at 14.54. 10-year bond yields surged up to 3.695% and Oil (WTI) was up 1.10% to $76.02 per barrel. So, overall, it was an indecisive grind of a day in the bearish trend, which at least gave a little over-extension relief in the large-cap indices.

In economic news, November Building Permits came in lower than expected at 1.342 million (compared to the forecasted 1.485 million and the October reading of 1.512 million). So, this amounted to an 11.2% decline month-on-month. Meanwhile, November Housing Starts came in stronger than expected at 1.427 million (versus the forecast of 1.400 million and October’s reading of 1.434 million). Finally, after hours, the API Weekly Crude Oil Stock Report showed a larger-than-expected drawdown of -3.069 million barrels (compared to the forecasted drawdown of 0.167 million barrels and last week’s large inventory build of +7.819 million barrels).

SNAP Case Study | Actual Trade

In bad actor company news, WFC agreed to a record $3.7 billion settlement with the US Consumer Financial Protection Bureau. This included a $1.7 billion fine and more than $2 billion in compensation for victims. This settlement was related to abuses tied to mortgages, auto loans, wrongly charged overdraft fees, and the unauthorized opening of checking accounts. For its part, WFC released a statement saying many of the required actions had already been done and the company’s Q4 earnings will reflect expenses for the civil penalty and customer remediation efforts. The company has now been labeled as a “repeat offender” by the CFPB and remains under a consent decree from the Federal Reserve over other offenses such as creating fake accounts to get around Fed capitalization rules. The settlement also does not offer immunity to any WFC employees that violated laws or the company from individual lawsuits related to losses and harm caused.

In stock news, the US Postal Service announced Tuesday that it intends to purchase at least 66,000 electric vehicles between now and 2028. Of those, 45,000 – 60,000 will come from OSK. In other transportation news, BA won the backing of SU Senator Cantwell (Chair of Senate Commerce Comm.) for a waiver from the FAA certification of meeting safety standards for 737 MAX planes. (Because a BA waiver from a deadline to meet safety standards is just what the world needs.) Elsewhere, AMZN has reached a settlement with the EU over three different antitrust investigations. AMZN avoided any fines in the three cases.

In miscellaneous news, TRP submitted a plan for the reopening of the Keystone oil pipeline to US regulators on Tuesday. The cleanup of the pipeline’s third major spill in five years will take months but, with approval, TRP hopes to have the pipeline back online soon. Meanwhile, the Equipment Leasing and Finance Assn. (ELFA) reported that US companies borrowed 9% more to finance equipment investments in November than they had a year earlier. The group said, “Labor markets are stable, inflation woes appear to be abating, consumers are spending, and businesses continue to expand and grow: a recipe for stable growth by providers of equipment financing.” In political news, Ukrainian President Zelenskiy will address the US Congress in person today (in his first trip abroad since the Russian invasion of his country).

After the close, NKE and WOR reported beats on both the revenue and earnings lines. However, FDX missed on revenue while beating on earnings (even though the beat is actually a 34.2% negative earnings growth). FDX also lowered its forward guidance and announced an additional $1 billion in cost-cutting measures. So far this morning, RAD has reported beats on both the top and bottom lines. (CTAS, CCL, and TTC all report closer to the opening bell.)

Overnight, Asian markets were mixed with Australia (+1.29%) leading the gainers as India (-1.01%) paced the losses. Most of the region produced modest moves in an even split of directions. Meanwhile, in Europe, the region’s exchanges lean heavily to the upside with only Portugal (-0.05%) showing any red. The FTSE (+0.87%), DAX (+0.71%), and CAC (+1.03%) are leading the region higher. However, the gains are widespread and consistent in early afternoon trade. As of 7:30 am, US Futures are pointing to a green start to the day. The DIA implies a +0.64% open, the SPY is implying a +0.40% open, and the QQQ implies a +0.18% open at this hour. 10-year bond yields are down a bit to 3.681% and Oil (WTI) is up 2% to $77.76/barrel in early trading.

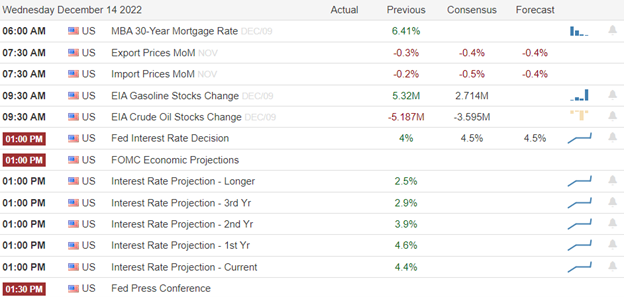

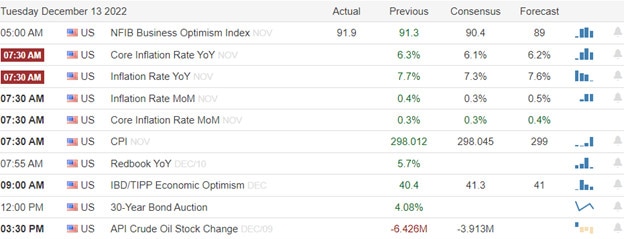

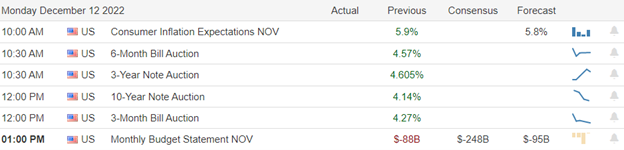

The major economic news events scheduled for Wed. include Q3 Current Accounts (8:30 am), Conf. Board Consumer Confidence and November Existing Home Sales (both at 10 am), and EIA Weekly Crude Oil Inventories (10:30 am). Major earnings reports scheduled for before the open include Wednesday, CCL, RAD, and TTC. Then, after the close, MU and MLKN report.

In economic news later this week, on Thursday, we get Q3 GDP, Q3 GDP Price Index, and Weekly Initial Jobless Claims. Finally, on Friday, Nov. Durable Goods, Nov. PCE Price Index, Nov. Personal Spending, Michigan Consumer Sentiment, and Nov. New Home Sales are reported.

Meanwhile, in earnings later this week, on Thursday, we hear from KMX and PAYX. Finally, on Friday, there are no reports scheduled.

In late-breaking news, mortgage demand surged 6% last week as interest rates fell to their lowest level since September. New home purchase loan applications decreased 0.1% week-on-week, but this is to be expected in what is a normally very slow week for the housing market. The national average rate for a 30-year fixed-rate conforming loan fell to 6.34% (down from 6.42%) over the week. This caused a 6.1% increase in the demand for refinance loan applications.

With that background, it looks like all three major indices want to make a move back up toward their T-line (8ema) this morning. However, only the DIA looks like it put in a real bottom to the recent strong bearish move while the other two simply look like volatility testing the downtrend line at least for now. Keep in mind that the SPY has its 50sma close overhead as potential resistance and the DIA has a price-action resistance level not far above. So, don’t assume any bullish moves will go untested. Nonetheless, we remain extended to the downside and some relief was in order. (Just be aware that this relief can come in the form of a bullish move or sideways rest.) Be cautious and keep in mind that the week is winding down with a half-day Friday and then the market is closed Monday. That means it may be time to start hedging, flattening, or taking profits…and you will not be the only trader thinking that way. My point is, don’t go chasing too many new positions unless you can get your move very quickly or you are willing to ride the trade through a long weekend and likely dead week to follow.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the man in the green bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is absolutely no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby. It’s a job. The money is real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

Swing Trade Ideas for your consideration and watchlist: No trade ideas today. You can find Rick’s review of tickers on his YouTube Channel here. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service