Much Data and Debt Ceiling Bill Moves On

Wednesday started off with a Bearish gap (down 0.45% in the SPY, down 0.30% in the DIA, and down 0.48% in the QQQ). The two large-cap index ETFs continued lower for the first hour, reaching the lows of the day at about 10:30 am before grinding sideways until about 1 pm. At that point, the bulls led a rally back up to the opening level by 2 pm and then another sideways chop into the close. Meanwhile, QQQ rallied the first 30 minutes of the day, fading the opening gap before the Bears stepped back in at 10 am. The tech-heavy NASDAQ reached the lows of the day at about 11:30 am and then also ground sideways until 1 pm before rallying back to the opening level at about 1:35 pm. From there, we saw a much wavier sideways action all the way into the close. This action gave us gap-down Doji candles in all three major indices. The QQQ is still well above its T-line (8ema), while the SPY retested its T-line (from above) and held on the day. The DIA retested its own T-line from below and remained below that level..

On the day, seven of the 10 sectors were in the red with Energy (-1.78%) way out in front pulling the rest of the market lower while Utilities (+0.72%) and Healthcare (+0.67%) held up better than the other sectors. At the same time, SPY lost 0.68%, QQQ lost 0.57%, and DIA lost 0.30%. VXX fell 0.78% on the day to end at 34.46 and T2122 fell just into the oversold territory at 17.77. 10-year bond yields fell again to 3.645% while Oil (WTI) plummeted another 2% to end the day at $68.02 per barrel. So, Wednesday was a bearish day as markets seemed to fear that the House won’t get the Debt Ceiling bill passed and that might give MAGA Senators the ability to stall the deal in the Senate past the deadline causing a debt default. However, as the day progressed, House Democrats helped Speaker McCarthy get the bill to a floor vote last night. So, traders were left unsure and that gave us an indecisive day on the Bearish side of neutral. This all happened on average volume across the three major indices.

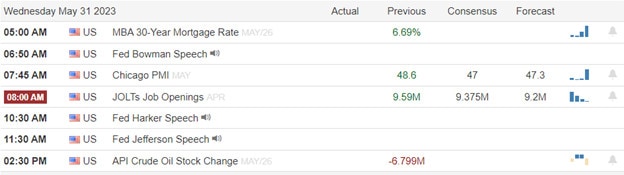

In major economic news Wednesday, the May Chicago PMI came in well below what was expected at 40.4 (compared to a forecast of 47.0 and the April reading of 48.6). This was the worst reading in six months and indicates there is a contraction in the Manufacturing sector in the Chicago region. Later, the April JOLTs Job Openings number was higher than anticipated at 10.103 million (versus a forecast of 9.775 million and a March value of 9.745 million). The new openings came mostly in Retail, Healthcare, Transportation, and Warehousing. After the close, the API Weekly Crude Oil Stock Report showed a significant unexpected inventory build of 5.202-million-barrels (compared to a forecast of a drawdown of 1.220-million-barrels and a vast swing from the previous week’s 6.799-million-barrel drawdown).

SNAP Case Study | Actual Trade

In Fed speak, early Wednesday Cleveland Fed President Mester (hawk, not a voter) told the Financial Times that (in her estimation) the FOMC does not have a “compelling reason” to pause on its interest rate hikes at the upcoming June Meeting. A bit later, Fed Governor Bowman (hawk and voter) told a Boston audience that she thinks the rebounding residential housing market could impact how the Fed acts next in the inflation fight. She said the Fed has been waiting on falling rents to have an impact on headline inflation numbers, but real estate prices have been rising. However, she said that now home prices have been “leveling out recently, which has implications for our fight to lower inflation.” (She did not explain how or when it might impact decisions.) On the other side, Philly Fed President Harker (borderline dove and voter) said he is in the pause camp. He told an event Wednesday afternoon, “I think we can take a bit of a skip for a meeting,” … “I am definitely in the camp of thinking about skipping any increase at this (coming) meeting.” Finally, Fed Governor Jefferson (hawk and voter) said, “A decision to hold our policy rate constant at a coming meeting should not be interpreted to mean that we have reached the peak rate for this cycle,” which has been taken as hawk approval of a pause.

In stock news, INTC’s CFO relieved some market fear over sales as he told an investor conference that he sees Q2 Revenue tracking at the upper end of previous guidance. (The fear came from the fact INTC has no AI products and is not participating in the recent AI-chip craze.) Later, WMT announced shareholders had sided with the CEO and defeated all nine investor-proposed proposals (including revealing China risk exposure, conducting an independent safety review, and disclosing company political contributions). Elsewhere, TSLA has begun shipping its cars to customers with only a 50% charge (and also giving the customer TSLA Supercharging credits) as a safety measure. At the same time, the CEO of F said that his company’s cost to produce electric vehicles may not drop to match its cost to produce gasoline vehicles until 2030. (Analysts had been projecting cost parity by 2025.) At the close, DOW announced it is cutting its Q2 revenue forecast while citing slower macroeconomic growth (specifically noting weaker Chinese demand) and weaker market prices. After the close, Reuters reported more than 100 AMZN corporate employees walked off the job in protest of the company’s “return to office” and climate policy changes on Wednesday afternoon. (This work stoppage only happened in Seattle, but more than 1,900 AMZN employees globally have pledged to protest over those issues.) Also in after-hours news, LCID announced it has raised $3 billion through a new equity offering (the majority bought by the Saudi Sovereign Wealth Fund). Finally, the Biden Administration has agreed to let GE build jet engines for Indian military aircraft. (The agreement will be announced during President Biden’s June 22 visit to India.)

In stock legal and regulatory news, CHWY won a US Appeals Court case, invalidating the company’s 2019 $13,000 fine related to workplace safety after the death of an employee. The ruling said, “The retail industry as a whole lacked notice of the engineering reconfiguration requirements that OSHA now alleges are mandatory”. Later, AMZN agreed to pay the FTC $25 million to settle allegations it has violated children’s privacy rights by having the Alexa voice assistant constantly monitoring conversations. In a separate case, the AMZN agreed to pay the FTC $5.8 million for violating privacy by having its Ring Doorbell system include cameras that were placed in the bedrooms and bathrooms of female customers in 2017 (again, constantly recording and sending data to the company). Meanwhile, META threatened to remove all “news” content from the view of users in the state of CA. This came in reaction to a CA state bill that would require online platforms to pay news publishers a usage fee for republishing their news stories (the same issue that has been faced in Australia, Canada, and Europe). Elsewhere, BA said it is taking a “considerable amount of time” to get FAA approval of the company’s 737 MAX 7 and 10 planes. The company spokesman went on to say they “hope” the 737 MAX 7 will still be certified by the end of this year and 737 MAX 10 certification is projected still to be sometime in 2024. (LUV has already pushed back plans to have the 737 MAX 7 in service into 2024 after initially having it scheduled to be in service this summer.) After the close, the NHTSA announced that F has recalled 142,000 2015-2019 Lincoln SUVs over fire risk. At the same time, a new trial over JNJ talc asbestos claims began in CA. This overrides the company’s attempt to settle claims and avoid liability via the “Texas Two-Step Bankruptcy” of a subsidiary.

In debt ceiling news, the Congressional Budget Office (nonpartisan) announced late Tuesday that the new work requirements the GOP had said would save money, would actually cost money because the agreement exempted veterans and the homeless. This complicated things on the GOP side, reducing what they can claim when talking to their supporters. Later, 52 House Democrats crossed the aisle to vote with the majority of GOP members in a procedural vote which allowed a final floor vote. Then last night, after hours of tedious posturing speeches, the House did pass the bill 314-117 with the support of 165 Democrats and 149 Republicans (bipartisan support). After this vote was finalized, late last night Senate Majority Schumer stood in a virtually empty Senate chamber to place the bill on the calendar for today. Senate leaders of both parties hope to see the bill passed within 48 hours. However, the Senate rules make it easy for a single Senator to grind the process to a halt. And, at least two Senators (Lee and Rand) have publicly said they want to see the bill stopped. So, the solution seems to be progressing. However, it’s not quite a done deal yet.

After the close, CRM, JWN, CHWY, PVH, NTAP, PSTG, VEEV, CRWD, and OKTA all reported beats on both the revenue and earnings lines. Meanwhile, NGL and VSCO both missed on both the top and bottom lines. CRM, VEEV, and OKTA all raised their forward guidance while VSCO lowered its guidance.

Overnight, Asian markets were mixed. New Zealand (+0.87%) and Japan (+0.84%) were by far the largest gainers. Meanwhile, Thailand (-0.79%) was by far the biggest loser on the day. In Europe, the bourses are green across the board at midday. The DAX (+1.11%), CAC (+0.67%), and FTSE (+0.39%) are leading the region higher in early afternoon trade. In the US, as of 7:30 am, Futures are pointing toward a start to the day just on the green side of flat. The DIA implies a +0.03% open, the SPY is implying a +0.24% open, and the QQQ implies a +0.20% open at this hour. At the same time, 10-year bond yields have risen to 3.664% and Oil (WTI) is down another seven-tenths of a percent to $67.63 per barrel in early trading.t.

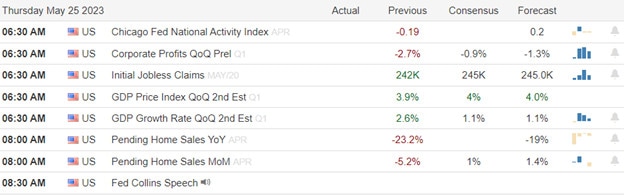

The major economic news events scheduled for Thursday include ADP May Nonfarm Employment Change (8:15 am), Weekly Initial Jobless Claims, Q1 Nonfarm Productivity, and Q1 Unit Labor Costs (all three at 8:30 am), May Manufacturing PMI (9:45 am), ISM May Mfg. PMI (10 am), EIA Crude Oil Inventories (11 am), Fed Balance Sheet, and Bank Balances with the Fed (both at 4:30 pm). We also get a Fed speaker (Harker at 1 pm). The major earnings reports scheduled for the day are limited to BILI, DOOO, CAL, DG, HRL, M, and SPTN before the open. Then after the close, AVGO, COO, DELL, FIVE, and LULU report.

In economic news later this week, on Friday, we get May Avg. Hourly Earnings, May Nonfarm Payrolls, May Private Nonfarm Payrolls, May Participation Rate, and May Unemployment Rate. In terms of earnings reports later this week, there are no major reports scheduled for Friday.

In miscellaneous news, DB released a study Wednesday saying a wave of bank loan defaults is imminent in the US and Europe. The study expects the peak of defaults to be in Q4 of 2024 and cites the “fastest monetary tightening cycle in 15 years” as the primary cause. With that said, the study said default risks are higher in the US than in Europe and it estimates an 11.3% peak default rate for loans in the US. In a related story, the FDIC said Wednesday that it has added four lenders to its confidential list of “problem banks,” increasing the number on the list to 43. Elsewhere, after all the Fed speak on Wednesday, traders dramatically shifted the probabilities (based on Fed Fund Futures) of a rate hike at the upcoming June 14 Meeting. The Fedwatch Tool tells us this morning 72% of traders expect no rate change with 28% still expecting another quarter-point hike.

So far this morning, M, DOOO, and BILI all reported beats on both the revenue and earnings lines. Meanwhile, HRL, SPTN, and CAL all reported misses on revenue but beat on the earnings lines. Unfortunately, DG missed on both the top and bottom lines. So far, there have been no changes made to guidance. In terms of surprises, M gave us the only significant shock with a 22% upside surprise on earnings (even though that number also represented a 48% earnings decline).

With that background, it looks like the market is still undecided this morning, giving us a premarket candle inside Wednesday’s candle at this point. The DIA seems to want to retest its T-line from below while the QQQ may be thinking about working on a J-hook pattern. For its part, the SPY is just treading water this morning. Perhaps traders are waiting on all the data to come later this morning. The QQQ is a little closer to its T-line than it has been but remains the most extended of the three major index ETFs. Meanwhile, the T2122 indicator is now just inside the oversold territory. Just remember, the economic data is likely to revive talk about whether the Fed will hike rates again in two weeks and news out of the Senate (related to stalling the Debt Ceiling bill) may throw a wet blanket on the Bulls. So, be cautious and ready for volatility.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the man in the green bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is absolutely no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby. It’s a job. The money is real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Enthusiasm Faded

Monday began inspired by a compromise in Congress but the early enthusiasm faded as the path passage looks to have a challenging and uncertain outcome. However, a late-day rally led once again by the very extended tech giants left indexes little changed by the close. Today we have several Fed speakers, Chicago PMI, JOLTS, the Beige Book, and several notable earnings reports to inspire the bulls or bears. Unfortunately, it will be the news about the progress or lack thereof that’s likely to determine the deminer of the market as we wait.

Asian markets traded sharply lower overnight as China’s factory activity numbers disappointed and new signs of real estate defaults reemerge shaking the confidence of recovery. European markets also trade red across the board as they monitor the political wrangling in Congress. U.S. futures though off of their overnight lows continue to point to a bearish open ahead of earnings and economic data with plenty of Fed speak tossed in for good measure.

Economic Calendar

Earnings Calendar

Notable reports for Wednesday include AAP, AI, CPRI, CHWY, CONN, CRWD, CRM, DCI, FRO, GME, NTAP, JWN, OKTA, PSTG, TCOM, and VSCO.

News & Technicals’

The U.S. Congress moved closer to averting a historic default on Monday as a bipartisan bill to raise the debt ceiling cleared a crucial hurdle in the House of Representatives. The bill, which would suspend the debt limit until December 2022, passed the House Rules Committee with the support of Rep. Tom Massie, a key Republican swing vote who had previously opposed raising the debt ceiling. The bill now heads to the full House for a final vote, where it is expected to pass with mostly Democratic votes. The Senate had already approved the bill last week with 50 Democrats and 14 Republicans voting in favor. The compromise bill came after weeks of tense negotiations and brinkmanship between the two parties over how to address the debt ceiling, which is the legal limit on how much the federal government can borrow to pay its bills. If Congress fails to raise or suspend the debt ceiling by Monday, the U.S. Treasury would run out of cash and be unable to pay its obligations, triggering a default that could have catastrophic consequences for the global economy.

The CEO of JPMorgan Chase & Co, Jamie Dimon, urged the leaders of the U.S. and China to talk more and solve their problems on Wednesday. He said this during his first trip to China since he said sorry for making a joke about China’s ruling party in 2021. Dimon said the U.S. and China are the biggest economies in the world and they have some issues about trade and security that can be fixed. He said they should not cut off their ties but try to make them safer. Dimon’s bank wants to grow more in China and it was the first foreign bank to own all of its securities business there. The U.S. and China have not been getting along well for a long time and they have been arguing about many things. Last week, some officials from both sides met and talked about trade. On Tuesday, the U.S. said a Chinese plane was too aggressive when it flew near a U.S. plane over the sea.

After a positive start, enthusiasm faded learning that the debt deal had a difficult road to passage whipsawing prices and keeping uncertainty high. The S&P 500 finished flat on Tuesday following news that a tentative agreement on the debt limit has been reached in Washington. Global equities were generally mixed on the day, as were commodities with gold moving higher and oil lower. Interest rates were down with the 10-year Treasury yield back near 3.7%. The technology sector was once again the decisive leader with a handful of tech giants doing most of the work. Today Fed member talk increases with Chicago PMI, JOLTS figures, and the Beige Book this afternoon. Traders will also have some notable earnings to inspire the bulls and bears as we wait on demagoguery and political gamesmanship driving market emotions to end.

Trade Wisely,

Doug

Tentative Debt Agreement

The President came to a tentative debit agreement over the long weekend providing some bullish premarket inspiration. However, tentative is the keyword here as the R’s and D’s in the congressional bodies try to pass the 2-year deal by Wednesday. I wouldn’t be surprised if we experience some substantial whipsaws as they let the rhetoric fly adding uncertainty to the process. After Friday’s rally on the disappointing Core PCE numbers we face a big week of Jobs data, a declining number of earnings events, and the question of can big tech giants continue to rally on all the AI without a correction.

Asian markets traded mostly higher overnight as they wait on the key U.S. debt vote later this week. European markets appear a bit more tentative as they wait for Congress trading mixed this morning. However, U.S. futures continue to power higher this morning driven mostly by the tech giants continuing to shrug off Friday’s rising inflation data. Watch for possible a whipsaw after the morning gap.

Economic Calendar

Earnings Calendar

Notable reports for Tuesday include AMBA, BOX, CGC, HPE, HPQ, & SPWH.

News & Technicals’

Stocks are set to rise on Tuesday after a deal to raise the debt ceiling for two years was reached by Biden and McCarthy. The deal needs Congress’s approval by Wednesday to avoid a default by June 5. Investors are relieved by the deal amid inflation and banking woes.

North Korea has confirmed its plan to launch a military spy satellite in June, which it claims is needed to monitor the U.S. and its allies’ military activities in the region. The announcement has raised alarm among neighboring countries, especially Japan, which has ordered its forces to shoot down the satellite or any debris if they enter its territory. The launch is seen as a provocation by North Korea, which has been testing missiles and nuclear weapons since 2022 in defiance of U.N. sanctions. The launch also coincides with the 70th anniversary of the U.S.-South Korea alliance, which has been conducting joint military exercises near the border with North Korea. The launch news has boosted the shares of South Korean defense companies, such as Firstec, Victek, and Korea Aerospace Industries, which rose by 3.8%, 3.3%, and 0.6% respectively on.

The war between Russia and Ukraine escalated on Tuesday as Moscow reported a drone attack on its capital that damaged several buildings and injured two people. The Russian Defense Ministry accused Kyiv of being behind the attack, which it said involved eight drones that were all shot down by air defenses. Ukraine has not commented on the allegation. The drone attack came after Kyiv suffered three Russian bombardments in 24 hours, killing one woman and wounding 13 others. The Ukrainian authorities said the attacks were carried out by missiles and drones launched by Russia.

As we begin a holiday-shortened week the bulls are inspired due to the tentative debt agreement between the President and Speaker. Now comes the task of passing the 2-year deal by Wednesday so I would not rule out some substantial whipsaws as the rhetoric flies between the R’s and D’s along the way. With the number of earnings declining markets will have a lot of jobs data to react to this week as traders grapple with the next FOMC rate decision coming up on June 14th after the disappointing Core PCE last Friday. Can giant tech continue to rise on AI hopes without a correction? We will soon find out, so buckle up for another wild week.

Trade Wisely,

Doug

Debt Deal And CB Consumer Sentiment

Markets opened modestly higher on Friday (gapping up 0.17% in the SPY, up 0.30% in the QQQ, and up just 0.12% in the DIA). However, this open just fueled the Bulls to rally strongly until 11 am in all three major indices. At that point, the two large-cap index ETFs ground sideways (with a very slight bullish trend in the SPY and a slight Bearish trend in the DIA) for the rest of the day. At the same time, QQQ trended modestly higher from 11 am to 3:15 pm, before taking profit the last 45 minutes of the day. This action gave us gap-up large white-bodied candles with smaller upper wicks in all three major index ETFs. The DIA also printed a Morning Star signal (while just failing to close above its T-line (8ema) after a retest. SPY did cross back above its T-line and QQQ is now very extended above its T-line.

On the day, all 10 sectors were in the green with Technology (+2.56%) way out front leading the market higher, and Energy (+0.06%) and Healthcare (+0.10%) lagging way behind the other sectors. At the same time, the SPY gained 1.30%, DIA gained 0.94%, and QQQ gained 2.56%. VXX dropped 3.83% on the day to end at 35.65 and T2122 climbed back up into the mid-range at 50.84. 10-year bond yields fell slightly to 3.81% while Oil (WTI) gained 1.32% to end the day at $72.78 per barrel. So, Friday was the Tech Bulls’ Day again, with TSLA (+4.72%), AMD (+5.55%), and AMZN (+4.44%) pulling the rest of the QQQ and SPY upward on the promise of AI-based chip sales after a blowout report from MRVL. Fear of a US Debt Default fell off as all day the reports said a deal was very close. This all happened on greater-than-average volume in the QQQ and DIA and slightly below-average volume in the SPY.

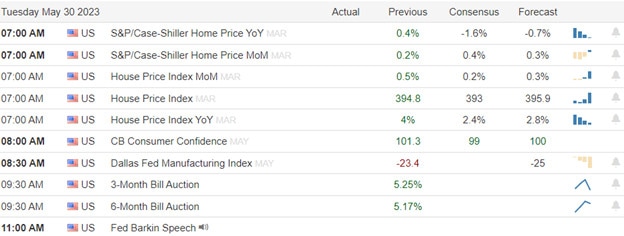

In major economic news Friday, April Durable Goods Orders came in much stronger than expected at +1.1% (compared to a forecast of -1.0% but still much weaker than the March reading of +3.3%). At the same time, the April PCE Price Index also came in stronger than expected on the annual rate at + 4.4% year-on-year (versus a forecast of +3.9% and a March value of +4.2%). On the month-on-month metric, April PCE Price Index came in right on target at +0.4% (against a forecast of +0.4% but still stronger than the March +0.1% reading). Meanwhile, the April Personal Spending month-on-month came in very hot at +0.8% (versus the forecast of +0.4% and much higher than the March reading of +0.1%). On the business side, Preliminary April Retail Inventories showed a decline of 0.1% (compared to the March 0.1% increase). Later in the morning, Michigan Consumer Sentiment came in higher than anticipated at 59.2 (versus a forecast of 57.9 but still less than the April value of 63.5). These measures show a stronger consumer than economists have been expecting with a slightly better outlook for the future.

SNAP Case Study | Actual Trade

In stock news, the IPO of ATMU, Atmus Filtration Technologies (a spinoff of CMI), opened at $21.67 and closed at $22.40 after pricing at $19.50/share on Thursday night. CMI raised $275 million from the IPO and retains 83% control of the company. Meanwhile, Mexican President Lopez Obrador said Friday that his government may buy up 50% of the stock in Banamex (the C Mexican subsidiary, which C announced Wednesday it would spin off via IPO). He told the press Mexico has $3 billion for this purchase and if his stock valuation is anywhere near correct it means C will take a major hit on the unit (which it purchased for $12.5 billion in the early 2000s). On Saturday, MSFT announced it will discontinue some of its hardware products like ergonomic keyboards. Elsewhere, in a potential blow to major importers (AMZN, DOLE, TGT, WMT, FDP, LOW, HD, etc.) the Panama Canal has ordered ships to lighten their loads and also increased transit fees due to a severe drought lowering the level of lakes used to flood docks over the course of the canal.

In stock legal and regulatory news, a US judge approved $50 million settlement of a class-action lawsuit against AAPL over defective MacBook keyboards. Elsewhere, MSFT laid out the grounds of its appeal against the British Competition and Markets Authority’s veto of the company’s acquisition of ATVI. MSFT said its appeal is based on “fundamental errors” in the CMA’s assessment of the company’s cloud gaming services. At the same time, six major European insurers have quit the Net-Zero Insurance Alliance (aimed at forestalling climate change by committing to reduce greenhouse gases) in the 36 hours prior to the Friday close. The insurers all cited US Republican political attacks (on behalf of fossil fuel industries) as the GOP has prioritized the financial health of those industries over climate. Bank of England Governor (and co-chair of the COP26 project) Carney decried the losses and warned the political attacks are now interfering with the Insurance industry’s ability to price climate risk, harming their investors, policyholders, and the local governments that will suffer climate impacts. Meanwhile, ETRN’s long-delayed Mountain Valley natural gas pipeline (in WV and VA) was dealt another legal blow Friday. The US District Court in DC ruled that the US Federal Energy Regulatory Commission had “inadequately explained its decision not to prepare a supplemental environmental impact statement” (that would address the) “unexpectedly severe erosion and sedimentation along the pipeline’s right-of-way.” Later, PFE and MRNA were sued by ALNY over patent infringement related to the two company’s COVID-19 vaccines. The ALNY suit seeks unspecified damages, but PFE made $37.8 billion and MRNA made $18.4 billion from the sale of the vaccines in question. Finally, a San Francisco Federal jury awarded SONO $32.5 million in its suit against GOOGL over patent infringement related to wireless audio devices.

In debt ceiling news, on Friday, Treasury Sec. Yellen announced that numbers were refined and it has now been determined that June 5 would be the actual date of default (as opposed to “as soon as June 1”). However, by Saturday afternoon, the two sides had reached an agreement. The deal increases the debt ceiling enough to avoid a similar situation for two years. It raises defense spending by a whopping 11% over 2023 even kicking in an additional (unexpected) 3% while keeping non-defense spending roughly flat in 2024 (versus ’23 levels) and then increasing it by 1% in 2025. The deal phases in some work requirements for SNAP (food stamps) but then ends those same work requirements in 2030. It also rescinds about $30 billion in unspent COVID-19 aid (not to include veterans’ medical care or $5 billion for creating the next generation of vaccines and treatments). The agreement also calls for a “lead environmental agency” to develop new comprehensive environmental reviews intended to appease the oil and gas industry by theoretically speeding up project approvals.

Nobody wins or loses a negotiation. However, based on reactions, it appears the MAGA faction of Republicans believes they lost. There is enough there for them to claim credit (such as reducing IRS staffing). However, the lack of reality in what they promised “they” would do and the fact that outrage is their political style likely means they were always going to be “the loser” of any deal. On the other side, many of the most Progressive Democrats may well feel similarly (related to work requirements on SNAP and the loss of funding to increase IRS enforcement on the top one percent). However, at least as of now, that group has expressed their concerns in a less bombastic way. For the markets, it is expected that we do see those extremists (maybe both sides, but the GOP side is the one to watch) threaten to kill or at least delay a vote on the deal until there is a default. Concerningly for us traders, I have heard commentators imply that the President and Speaker are counting on market turmoil to apply pressure to the extremists and get the bill turned into law. That may mean the war of words is not over…or may ramp up this week. Votes are scheduled to begin on Wednesday in the House.

Overnight, Asian markets were mixed and split evenly in number. South Korea (+1.04%) was by far the biggest gainer while Malaysia (-0.57%) lost the most. All of the other exchanges fell in the middle on modest moves. Meanwhile, in Europe, we see a similar story taking shape at midday. The DAX (+0.56%), CAC (-0.36%), and FTSE (-0.50%) lead a mixed region with on massive moves underway in early afternoon trade. In the US, as of 7:30 am, Futures are pointing to a green start to the morning. The DIA implies a +0.14% open, the SPY is implying a +0.55% open, and the QQQ implies a +1.13% open at this hour. At the same time, 10-year bond yields are down sharply to 3.719% and Oil (WTI) is off 1.13% to $71.85 per barrel in early trading.

The major economic news events scheduled for Tuesday are limited to Conference Board Consumer Confidence (10 am). The major earnings reports scheduled for the day are limited to ESLT and SKY before the open. Then after the close, HPE, HPQ, YY, AND UHAL report.

In economic news later this week, on Wednesday, we get Chicago PMI, April JOLTs Job Openings, Fed Beige Book, API Weekly Crude Oil Stocks Report and two Fed speakers (Bowman and Harker). Then Thursday, ADP May Nonfarm Employment Change, Weekly Initial Jobless Claims, Q1 Productivity, Q1 Unit Labor Costs, May Manufacturing PMI, ISM May Mfg. PMI, EIA Crude Oil Inventories, Fed Balance Sheet, Bank Balances with the Fed, and a Fed speaker (Harker) are reported. Finally, on Friday, we get May Avg. Hourly Earnings, May Nonfarm Payrolls, May Private Nonfarm Payrolls, May Participation Rate, and May Unemployment Rate.

In terms of earnings reports later this week, on Wednesday, AAP, CAE, CPRI, CD, DCI, HOV, CHWY, CRWD, NTAP, NGL, JWN, OKTA, PSTG, PVH, CRM, and VEEV report. Then Thursday, we hear from BILI, DOOO, CAL, DG, HRL, M, SPTN, AVGO, COO, DELL, FIVE, and LULU. Finally, on Friday, there are no major reports scheduled.

So far this morning, ESLT beat on revenue while missing on earnings. On the other side, SKY missed on revenue while beating on earnings. (TNP reports at 8:20 am.)

With that background, it looks like the Bulls are frisky again this morning in the QQQ and SPY. The tech-heavy NASDAQ will be gapping to levels not seen in 14 months with prices now near the overnight highs similar to how they were in premarket Friday. The SPY is gapping as well but has backed off early highs. Still, an open where it sits now will take the main index ETF back to levels not visited since August of last year. However, the stodgy mega-caps remain just in the red and are at their premarket lows. If we open at this level, DIA will be just under its T-line and not giving the follow-through to the Friday Morning Star that the Bulls would have been hoping to get. QQQ is very extended from its T-line while SPY may also be just a bit stretched (both to the upside). Still, the T2122 indicator sits right in the mid-range, telling us we have some room to run. Just remember, the Debt Ceiling may be agreed upon by leaders but there are plenty of people who may decide it is a better political move to throw a wrench in the works (coincidentally getting a lot of headlines in the process) than it would be to get the bill approved and move on to other business. This is particularly true since the deadline has been shown to not hit until June fifth. So, beware of volatility and news risk.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the man in the green bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is absolutely no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby. It’s a job. The money is real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Debt Deal Close With Holiday Ahead

On Thursday, the major indices diverged greatly at the open. The SPY gapped up 0.92%, QQQ gapped up a massive 2.29%, but the DIA opened flat (down 0.02%). SPY immediately faded half of its gap higher and then went through wild fluctuations until noon. At that point, a volatile rally took over for the rest of the day but ended on a down wave the last 15 minutes. Meanwhile, QQQ followed up its gap higher by fading a third of the gain in the first hour before rallying strongly back above the open by 11 am. From there, it rode waves slightly bullishly to the highs of the day at 2 pm. QQQ then had a significant selloff and recovery before taking profits for the last 15 minutes of the day. However, after its flat open, DIA sold off, ground sideways, and sold off again, reaching the lows of the day at about noon. From that point, the mega-cap index ETF rode a wavy rally back to break even before taking profits on those last 15 minutes. This action left us with three indecisive Doji candles (a gap-up Dojis in the QQQ and SPY as well as a flat Doji in the DIA.

On the day, eight of the 10 sectors were in the red with Technology (+2.45%) way out front leading the market higher and Energy (-2.04%) and Communication Services (-1.92%) lagging far behind the other sectors. At the same time, the SPY gained 0.86%, DIA lost 0.08%, and QQQ gained 2.43%. VXX fell 2.34% on the day to end at 37.07 and T2122 climbed but remains in the oversold territory at 14.52. 10-year bond yields spiked up to 3.819% while Oil (WTI) plummeted 3.31% to end the day at $71.88 per barrel. So, Thursday was the Tech Bulls’ Day, with NVDA (+24.37%) and AMD (+11.16%) pulling the rest of the QQQ and SPY upward on the promise of AI-based chip sales after the NVDA report. However, fear of a US Debt Default pulled downward against that exuberance, weighing most heavily on the stodgy, mega-cap DIA. It is worth noting that QQQ had above-average volume, DIA had average volume, and SPY had just below-average volume for the session.

In major economic news Wednesday, Q1 GDP was revised upward to +1.3% (versus a forecast of +1.1% and the Q4 reading of +2.6%). However, the Q1 GDP Price Index also was revised up slightly to +4.1% (compared to an expected +4.0% and the Q4 value of +3.9%). At the same time, Initial Weekly Jobless Claims came in far below the expected number at 229k (versus the forecast of 250k but still more than the prior week’s 225k). Later, April Pending Home Sales were reported at dead flat +/-0.0% (as compared to a forecast of +0.5% but much better than the March reading of -5.2%). After the close, Bank Reverse Balances with the Fed were reported at $3.251 trillion (down $29 billion from last week’s $3.280 trillion value).

SNAP Case Study | Actual Trade

In stock news, Nippon Steel continued its talks with the Management of TECK about taking a stake in the coking coal miner, despite the GLNCY bid (opposed by TECK mgmt.) to buy TECK. At the same time, CMI has decided to brave debt ceiling risks to price an IPO for its filtration unit. This new IPO will begin trading Friday. Meanwhile, ILMN saw the Chair of its board voted out as activist investor Icahn (Chair of IEP) led an investor revolt. However, two of Icahn’s board nominees failed to be elected and the CEO also retained his seat. Elsewhere, the CEO of F (Farley) told an MS investor conference “I think we see the Chinese as the main competitor, not GM or Toyota” … “The Chinese are going to be the powerhouse.” Interestingly, on the same day, F struck a deal with TSLA to allow F electric vehicle owners access to the TSLA supercharger network as of early 2024. On a day when AI reigned in the market, MSFT President Smith told a Washington DC audience that deep fakes are the biggest AI concern. “We’re going have to address the issues around deep fakes. We’re going to have to address in particular what we worry about most foreign cyber influence operations, the kinds of activities that are already taking place by the Russian government, the Chinese, the Iranians,” he said. He went on to call on President Biden to use an Executive Order to force federal agencies that use or deal with AI in any way to adopt and comply with a framework developed by the US NIST in 2020. Smith also called for the creation of a new federal agency dedicated to regulating AI.

In stock legal and regulatory news, in the afternoon, German authorities announced that they received serious indications of possible data protection violations by TSLA. They cited 100gb of confidential TSLA customer and former/current employee data (including names, social security numbers, salaries, bank details, addresses, email, phone numbers, etc.) leaked to German newspaper Handelsblatt. TSLA European HQ has been notified of the investigation and the matter has also been reported to the EU over GDPR violations. Elsewhere, the US State Dept. followed up on MSFT’s report Wednesday by Thursday announcing that Chinese hackers had targeted both US and Western countries’ governments and public infrastructures. The report went on to say that FTNT products had been compromised and were being used by the Chinese “Volt Typhoon” group of attacks. Later, a US district judge refused to dismiss a case, ruling that BAC must face allegations that it failed its responsibility by permitting unauthorized transactions on CA unemployment and disability benefit cards. (BAC paid $225 million to settle cases brought by two US agencies over very similar matters in 2022.) After the close, the New York City Banking Commission voted to freeze NYC deposits in COF and KEY after the two banks failed to file plans to eliminate discrimination from their operations.

In debt ceiling news, mid-morning Thursday, Representative Hern (head of GOP caucus) told Reuters the he believed it likely a debt-ceiling deal would be done by Friday afternoon. He said “I think it’s some of the finer points they are working on right now,” … “You are likely to see a deal by tomorrow afternoon.” (That makes sense as Speaker McCarthy has promised his conservative faction three days to read the deal. So, a Friday afternoon deal gives them the normal 3-day weekend off to “read” the deal with a vote on Tuesday.) By mid-day, Reuters sources inside the negotiations said the two sides were just $70 billion apart and they were edging close to a deal. However, the source also said what is likely to emerge is just a “slimmed-down version” of an agreement rather than the hundreds of pages of detail the full bill will require. A second source in the room told Reuters that top-line numbers will be hammered out allowing both sides to declare victory while the fine details of what actually gets cut and what gets funded at what level) will all be worked out in future appropriations bills. If that is true, it begs the question of why the hell the Congress (GOP) took us through this entire song and dance. If there is no budget now, will be no budget after the deal (because this is not about a budget it’s about permissible debt), and the plan all along has been for Congress to actually budget by releasing appropriations at a line-item, fine-detail level…then this whole debt ceiling fiasco was just a publicity stunt for conservative lawmakers. They could have done the same thing without all of the drama.

After the close, ULTA, MRVL, WDAY, RH, LGF.A, and DECK all reported beats on both the revenue and earnings lines. Meanwhile, COST, GPS, and ADSK all missed on revenue while beating on earnings. It is worth noting that DECK lowered its forward guidance. The surprises included a 200% upside earnings shock from LGF.A, a 106% upside earnings surprise from GPS, and a 33% upside earnings shock from DECK.

Overnight, Asian markets leaned to the green side, but the biggest mover was toward the red. Hong Kong (-1.93%) and New Zealand (-1.09%) showed the only appreciable losses on the day. Meanwhile, Taiwan (+1.31%) and India (+0.97%) led the more numerous green exchanges higher to end the week. In Europe, the bourses are mostly green on modest moves at midday. Greece (+1.45%) is the exception to the rule with the CAC (+0.22%), DAX (+0.10%), and FTSE (+0.20%) leading the region higher in early afternoon trade. In the US, as of 7:30 am, Futures point toward a modest green start to the day. The DIA implies a +0.15% open, the SPY is implying a +0.19% open, and the QQQ implies a +0.36% open at this hour. At the same time, 10-year bond yields are retreating to 3.789% and Oil (WTI) is up nine-tenths of a percent to $72.49/barrel in early trading.

The major economic news events scheduled for Friday include April Durable Goods Orders, April Goods Trade Balance, April PCE Price Index, April Personal Spending, and April Retail Inventories (all at 8:30 am), and Michigan Consumer Sentiment (10 am). The major earnings reports scheduled for the day are limited to BIG, BAH, and HIBB before the opening bell. There are no reports scheduled for after the close.

So far this morning, KT, PDD, and BAH reported beats on both the revenue and earnings lines. However, BIG and HIBB both missed on the top and bottom lines. It is worth noting that HIBB has lowered its forward guidance. Notable surprises include an 82% downside earnings shock from BIG and a 76% upside earnings surprise from PDD (which also delivered 187% earnings growth for the quarter).

In miscellaneous news, after-hours Thursday, CNBC reported that JPM is developing a “ChatGPT-like” AI named “IndexGPT” to give investment advice to its customers. The US Supreme Court dealt a blow to the EPA’s ability to regulate pollution by ruling in favor of a couple who had sued to fight the designation of their lakefront property as Wetlands. The ruling put new rules (written by the conservative majority) on the Clean Water Act which Bloomberg says will make it harder to stop pollution done on private property. Finally, META has offered to “limit use of other businesses’ advertising data” for its own Facebook Marketplace offerings in a proposed concession to the British Competition and Markets Authority (anti-trust watchdog). Using the product/price offerings, advertising, and sales (order click) data from other companies that use META as an advertising platform had always been a primary strategy of the company. While doing it less to UK businesses is a step in the right direction, this is not final and was not a META commitment to any other country.

With that background, it looks like the Bulls are frisky again this morning with price now at the highs of the overnight trading in the SPY, QQQ, and DIA. SPY appears to be crossing back above its T-line (if premarket price holds) while QQQ is pulling away from its own 8ema to highs not seen in more than 13 months. Of course, DIA has the most work to do and must break its downtrend and deal with a resistance level immediately if the bulls are going to take it higher. Extension is not a problem in SPY obviously. DIA is also good in that department if premarket trends hold. However, QQQ is getting extended from its T-line to the upside. The T2122 indicator tells us the market remains oversold. With all of this said, we have to remember that this is the Friday before a 3-day weekend and there is still a lot of potential for politicians to throw a wrench into market works (drama for drama’s sake) related to the Debt Ceiling. (Not only today but over the long weekend as well.) So, be careful and position your account for the day and the long news cycle ahead. Take profits, move stops, lighten up, and consider the appropriate hedges.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the man in the green bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is absolutely no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby. It’s a job. The money is real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Little Progress

The debt ceiling negotiations showing little progress brought out the bears Wednesday with the DIA suffering the majority of the technical damage closing below its 50-day average. The NVDA blowout report has the tech sector flying high this morning despite the Fitch AAA negative watch on the U.S. with the House saying they will go home for the weekend with no deal! Europe is now officially in a recession and the substantial decline shown in the Monday Suppy report suggests the U.S. is not far behind unless something changes soon. With a big day earnings, economic reports, and plenty of uncertainty to go around plan for substantial price volatility.

Asian markets closed mostly lower overnight with Hong Kong declining 1.93% as the Bank of Korea holds rates steady. After officially entering a recession, European markets trade mixed near the flatline this morning as they monitor the debit ceiling dog and pony show that shows little progress. With a busy morning of earnings and economic data pending U.S. futures trade mixed as the tech sector surges on the back of the NVDA homerun report.

Economic Calendar

Earnings Calendar

Notable reports for Thursday include ADSK, BBY, BURL, CTLT, COST, DECK, DLTR, GPS, GCO, MANU, MRVL. MDT, NTES, NTNX, ME, PDD, RL, SUMO, TITN, TD, ULTA, VMW, WB, & WDAY.

News & Technicals’

Nvidia, the leading provider of advanced GPU chips for artificial intelligence, reported stellar first-quarter earnings for its fiscal 2024 on Wednesday. The company beat analysts’ expectations on both revenue and earnings per share, thanks to the surging demand for its data center products. Nvidia’s shares spiked 26% in extended trading, reaching a new all-time high. The company’s CEO Jensen Huang attributed the strong performance to the growing adoption of generative AI applications like OpenAI’s ChatGPT, which rely on Nvidia’s GPU chips to train and deploy. Nvidia also raised its guidance for the next quarter, signaling confidence in its future growth prospects.

The United States’ AAA long-term foreign-currency issuer default rating, the highest possible rank by Fitch Ratings, is under threat due to the ongoing political deadlock over the debt ceiling. Fitch has placed the rating on negative watch, meaning that it could downgrade it if the U.S. fails to raise or suspend the debt limit before the x-date, which could be as early as June 1. The rating agency warned that such a scenario could lead to the government missing payments on some of its obligations, which would have severe implications for the global financial system. The news rattled the markets, as futures linked to the Dow Jones Industrial Average fell after Fitch issued its warning. However, Fitch also noted that it still expects a resolution to be reached before the deadline, as it has been in previous episodes of debt ceiling brinksmanship. House Speaker Kevin McCarthy said that negotiations with the White House were progressing toward a deal, but disagreements over spending remain.

The big overhang for markets Wednesday was the U.S. debt ceiling negotiations showing little progress engaged the bears creating some index technical damage in the DIA. Bond yields rose slightly adding pressure to already challenged banks and the Money Supply report indicated substantial contraction. After the bell, NVDA reported blowout earnings fueled by the massive interest in AI chips lighting a fire under the NASDAQ futures this morning. Today is our biggest earnings day with a GDP, Jobless Claims, Pending Home Sales, and more Fed speeches to add to the likely volatility as the House goes home for the weekend with no deal.

Trade Wisely,

Doug

NVDA Report Trumps Debt Cliff Fear Early

Markets gapped lower on Wednesday (down 0.40% in the SPY, down 0.21% in the DIA, and down 0.60% in the QQQ). The bears then followed through for an hour in all three major indices. At that point, all three then ground sideways near the lows for 4.5 hours. However, at that point, the Bulls stepped in to rally strongly for 25 minutes only to see a selloff the last 25 minutes of the day. This action gave us a gap-down black-bodied Spinning Top in the SPY, a gap-down white-bodied Doji-type candle in QQQ, and a gap-down black-bodied large candle (with small wicks at each end) in the DIA. This all happened on above-average volume in the QQQ and just less-than-average volume in the two large-cap indices.

On the day, nine of the 10 sectors were in the red with Basic Materials (-1.72%) out in front leading the way lower as Energy (+0.13%) was the only sector in the green and, again, held up considerably better than the others. At the same time, the SPY lost 0.72%, DIA lost 0.79%, and QQQ lost 0.51%. VXX gained 4.03% on the day to end at 37.96 and T2122 fell but remains in the mid-range at 39.79. 10-year bond yields spiked up to 3.746% while Oil (WTI) climbed 1.71% to end the day at $74.16 per barrel. So, Wednesday was the Bears’ Day as markets were spooked by fear of default grew (for the most part on GOP posturing and messages to the press, but certainly not helped by Treasury Sec. Yellen). However, it is notable that a handful of the tech “big dogs” did resume trying to hold the market up tech names were holding up markets (NFLX, AMZN, and META in particular).

The only economic news Wednesday, EIA Weekly Crude Oil Inventories showed a huge and unexpected 12.456-million-barrel drawdown of inventory (compared to a forecasted 0.920-million-barrel drawdown and the prior week’s 5.040-million-barrel build of inventory). This was in addition to a 1.6-million-barrel release from the strategic petroleum oil reserves during the week. So, the draw was actually more than 14 million barrels. In addition, Treasury Sec. Yellen spoke during the day, answering questions on a variety of topics. On the topic of inflation, she said that “inflation has come down very meaningfully” and went on to cite headline inflation as having fallen more than four percent from the peak and gas prices down more than $1.50 a gallon. On labor, she said (that the US labor market) “is a bit less hot” and has seen a big rise in participation but also “the labor market remains tight.” Related to bank consolidation, Yellen said greater concentration among big banks is undesirable, going on to say that diversity (between small, mid-sized, and big banks) is vital with each group serving a different need in the market. So, while she had said a few days ago that there may be more consolidation in the banking sector, she opposes consolidation among the big banks (JPM, C, BAC, WFC, GS, MS). Elsewhere, (and contrary to conventional wisdom) Fed Governor Waller said that while an inverted yield curve in the context of stable inflation usually points to a bad economic outlook…the current yield curve may signal better times ahead. He told a University of CA economic conference “What you’re seeing in the inversion is not so much fears about bad economic outcomes in the future, but belief and trust that we’re going to bring inflation back down and rates will be lower in the future once we do that,”. (Whether you believe him, you believe he really believes that, or whether it is true…you be the judge.)

SNAP Case Study | Actual Trade

In stock news, sadly, TGT announced it is removing some LGBTQ-themed products from their stores “in order to safeguard stores and employees” as well as because of the pressure from groups opposed to such products. At the same time, C announced it’s scrapping the idea of selling its Mexican unit (Banamex) after failing to find a buyer at what it believed was a fair price. Instead, C intends to spin off that unit in an IPO in 2025. Meanwhile, the largest shareholder of FRPT (Jana Partners) said it intends to pursue a proxy fight (July annual meeting) as it will seek to replace four board members. The announcement came as Jana heavily criticized management and the board’s supervision of them. Later, Bloomberg reported that AAPL is preparing to introduce a new interface for all its “iProducts” with a smart display that will appear on locked devices. (Bloomberg said it will be announced at AAPL’s June 5 Developer Conference.) Elsewhere, META has begun the next round of its previously announced elimination of 10,000 jobs. This round of layoffs is focused on business teams (marketing, program management, content strategy, corporate communications, etc.). This is the last batch of layoffs of the 10,000 announced in March.

In stock legal and regulatory news, UK anti-trust watchdog said Wednesday that both DB and C have admitted to anti-competitive behavior (exchanging sensitive UK bond data in order to fix prices). The agency also announced that it has provisionally found five banks had breached rules (were part of the ring) but that HSBC, MS, and RY had not yet admitted their guilt. Elsewhere, the Biden Administration urged the Supreme Court to reject an appeal by AAPL and AVGO stemming from their loss of a district-level appeal of a $1.1 billion judgment in a patent infringement case. (Separate cases against MSFT, SSNLF, DELL, and HPQ are still pending over the infringement of the same patents.) The original ruling was for AAPL to pay $837.8 million and AVGO to pay $270.2 million. At the same time, Bloomberg reported that the US prosecutors are reviewing stock trading evidence against former FRCB employees. Meanwhile, Reuters reported that the FTC is investigating whether ABT, British company Reckitt (who owns Mead Johnson), and NSRGF (Nestle) over collusion in bidding on state contracts for baby formula (WIC programs). After the close, MSFT filed an appeal of the UK anti-trust watchdog’s April decision to prohibit the company’s acquisition of ATVI. (The US FTC had previously also blocked the deal and MSFT has appealed that decision as well.)

In debt ceiling news, in the morning, House Speaker McCarthy said the sides “were far apart” (which hit the markets). On the other side, the White House criticized Republicans for holding the full faith and credit of the United States hostage. At the same time, Treasury Sec. Yellen also reiterated that she expects the country will be unable to pay its bills as of June 1, but said it is hard to estimate the exact date. Meanwhile, she has instructed Treasury to stop paying any bills without a definite due date. Speaker McCarthy also said he accepts Yellen’s default deadline as true (some of his GOP Congressional colleagues had questioned the legitimacy of that date Tuesday). For their part, GOP negotiators rejected the Biden Administration’s proposals to set corporate and billionaire tax minimums (which would raise revenue) or to expand the ability to negotiate cheaper drug prices (which would significantly reduce military, Medicare, and Medicaid spending). (The latter seems odd for a group screaming about cutting spending, but these negotiations are about making political points and not about making sense or positive change.) Speaker McCarthy also increased the pressure slightly by saying the House now plans to adjourn for a full week on Thursday (rather than the previously planned Friday). However, Congress can be recalled. At the end of the day, both President Biden and Speaker McCarthy told reporters that progress had been made Wednesday and that was very positive, with negotiations continuing Wednesday night. Unfortunately, by mid-evening, Moody’s disagreed and put the US AAA credit rating on “negative watch” which is typical prior to a rating reduction. This immediately hit DJIA Futures and if lowered increases the cost of governance by raising bond rates.

After the close, NVDA, AEO, ENS, SPLK, GES, MOD, PLUS, and SNOW all reported beats on both the revenue and earnings line. (The first clean sweep of companies with more than $500 million in quarterly revenue in quite a while.) It is worth noting that NVDA and SPLK both raised their forward guidance. However, AEO and SNOW both lowered their own guidance. Among the earnings surprises were a 200% upside surprise (SNOW), 92% upside surprise (SPLK), 75% upside surprise (GES), 40% upside surprise (MOD), and a 32% upside surprise (ENS). The largest revenue surprise was a 10.3% upside surprise from NVDA.

Overnight, Asian markets leaned heavily toward the red side. Once again, Hong Kong (-1.93%) led the region lower with Australia (-1.05%) next among the losers. On the plus side, Taiwan (+0.82%) was the standout. All other moves in the region were half of a percent or less in both directions. In Europe, we see a mixed market at midday. The largest mover is Norway (+1.02%) to the upside while the CAC (-0.28%), DAX (-0.12%), and FTSE (-0.27%) lead the region on volume as usual in early afternoon trade. In the US, as of 7:30 am, Futures point to a VERY mixed start to the day. The DIA implies a -0.32% open, the SPY is implying a +0.57% open, and QQQ implies a +1.90% open at this hour. At the same time, 10-year bond yields are up to 3.761% and Oil (WTI) is down 2% to $72.86/barrel in early trading.

The major economic news events scheduled for Thursday include Preliminary Q1 GDP, Preliminary Q1 GDP Price Index, and Weekly Initial Jobless Claims (all at 8:30 am), April Pending Home Sales (10 am), the Fed Balance Sheet and Bank Reserve Balances with the Fed (both at 4:30 pm). The major earnings reports scheduled for the day are limited to AMWD, BBY, BURL, CM, DLTR, GCO, HEPS, MDT, NTES, RL, RY, TD, and TITN before the open. Then, after the close, ADSK, COST, DECK, GPS, MRVL, RH, ULTA, and WDAY report.

In economic news later this week, on Friday, April Durable Goods Orders, April Goods Trade Balance, Aprile PCE Price Index, April Personal Spending, April Retail Inventories, and Michigan Consumer Sentiment are reported.

In terms of earnings reports later this week, on Friday, BIG, BAH, and HIBB report.

So far this morning, LNVGY (Lenovo), MDT, CM, NTES, and AMWD all reported beats on both the revenue and earnings lines. Meanwhile, RY, TD, DLTR, and GCO beat on revenue while missing on earnings. On the other side, TITN missed on revenue while beating on earnings. Unfortunately, BBY and BURL missed on both the top and bottom lines. It is worth noting that DLTR and GCO both lowered their forward guidance. The biggest surprises came from RY (110% upside revenue surprise), CM (130% upside revenue surprise), AMWD (64% upside earnings surprise), BBY (50% downside earnings surprise), GCO (45% downside earnings surprise), and NTES (31% upside earnings surprise).

With that background, it looks like the Bulls are on fire in the QQQ, which is near the premarket highs and appears as if it will challenge a breakout above the recent (Monday) highs. At the same time, it looks like SPY is headed back up to retest its T-line as resistance. However, DIA continues its move lower despite being up off of its premarket lows. Of course, all this is before the data dump at 8:30 am. Extension is not a problem in SPY obviously. However, DIA is starting to get a little stretched to the downside and, if it opens where it is now, QQQ will be a bit stretched to the upside. The T2122 indicator is now well into oversold territory. So, we have a divided market with the mega-cap DIA perhaps showing the fear of a debt default while NVDA’s blowout report has the tech-heavy QQQ in “buy, buy, buy” mode. This may be a sign of very short-term rotation into “risk on” mode. However, be careful that bad GDP, Jobless Claims, or word from the debt ceiling negotiations does not rain (hard) on that parade.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the man in the green bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is absolutely no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby. It’s a job. The money is real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Grew Nervous

Investors grew nervous Tuesday bringing out the bears as another day passed with no progress on the debt ceiling negotiations with the June I deadline looming. The DIA suffered a little technical damage by failing its 50-day morning average and though the SPY, QQQ and IWM experienced some selling no technical damage was created. Today we have a light morning economic calendar with the release of the FOMC minutes this afternoon. We have a few more earnings events to keep traders guessing with the possible market-moving NVDA report coming after the bell.

As we slept Asian markets declined across the board led by Hong Kong down 1.62% as another wave of pandemic infections breaks out in China. European markets are also decidedly bearish this morning despite the decline in U.K. inflation to 8.7%. U.S. futures suggest a bearish open as debt negotiation uncertainty moves ever closer to the deadline with little to no progress. Plan for possible big moves as the news and rhetoric spew from Washington.

Economic Calendar

Earnings Calendar

Notable reports for Wednesday include ANF, AEO, ADI, APPS, CRMT, DY, GES, KSS, MOD, NVDA, WOOF, PLAB, PLCE, PATH, SNOW, and SPLK.

News & Technicals’

The U.K. economy has shown resilience in the face of Brexit uncertainty, but inflation has been a persistent challenge. In April, however, inflation fell sharply to 8.7% year-on-year, the lowest level since December 2021. This was mainly due to lower prices for clothing, footwear, and household goods, as well as a base effect from the spike in energy prices a year ago. Some analysts believe that inflation will continue to decline in the coming months, as weak consumer demand and tighter monetary policy take their toll. The Bank of England, which has raised interest rates four times since November 2022, may have to revise its inflation forecast downward in its next report.

The U.S. government is facing a looming deadline to raise the debt ceiling and avoid a default that could have consequences for the global economy. Treasury Secretary Janet Yellen warned that the Treasury Department will run out of cash by June 1 unless Congress acts soon. However, House Republicans questioned the urgency of her warning and accused her of using scare tactics to pressure them into a deal. President Joe Biden and House Speaker Kevin McCarthy met on Monday to try to break the impasse, but they still have several sticking points to resolve. These include Republican demands for changes in energy policy, welfare programs, and pandemic relief spending.

The U.S. stock market closed lower on Tuesday, as investors grew nervous about the possibility that debt negotiations could fail to reach a deal by June 1. President Biden and House Speaker McCarthy met on Monday to try to reach a deal, but they did not announce any breakthrough. The uncertainty weighed on market sentiment, especially in Europe, where luxury goods makers also suffered from China’s crackdown on excessive consumption. The only bright spot was the energy sector, which benefited from higher oil prices. Bond yields and the dollar also rose slightly, reflecting the risk-off mood. Today traders will have to deal with Mortgage Apps, Petroleum Status, Fed speak, bond auctions, and the FOMC minutes.

Trade Wisely,

Doug

Debt Ceiling Drama and FOMC Minutes

Tuesday saw a gap lower to start the day (down 0.40% in the SPY, down 0.28% in the DIA, and down 0.50% in the QQQ). At that point, all three major indices ground sideways until noon, with the DIA even actually recrossing its gap in a modest bullish trend. However, at noon, the Bears stepped in to lead a selloff that lasted until 2:30 pm before grinding sideways into the close near the lows. This action gave us larger, black-bodied candles with more upper wick and small lower wick. The DIA failed a retest of its T-line (8ema) and crossed back below its 50sma. Meanwhile, the SPY crossed back below its own T-line. This happened on less-than-average volume in all three of the major index ETFs.

On the day, nine of the 10 sectors were in the red with Technology (-1.44%) out in front leading the way lower as Energy (+0.67%) was the only sector in the green and held up considerably better than the others. (This was likely due to the warning from Saudi Oil Minister for oil speculators to “watch out,” which oil markets took to indicate more production cuts might be on the way soon.) At the same time, the SPY lost 1.12%, DIA lost 0.69%, and QQQ lost 1.27%. VXX gained 1.90% on the day to end at 36.49 and T2122 fell but remains in the mid-range at 39.79. 10-year bond yields fell a bit to 3.698% while Oil (WTI) climbed 2.40% to end the day at $73.78 per barrel. So, Tuesday saw a pullback in the QQQ and SPY as well as retesting of the recent lows in the DIA. It was notable that none of the “big dog” tech names were holding markets up Tuesday with only AMD (+0.11%) even slightly in the green.

The only economic news Tuesday, Building Permits came is extremely low at 1.147 million (compared to a forecast of 1.416 million and the prior reading of 1.430 million). This was a massive miss of nearly 20%. Later in the morning, Preliminary May Mfg. PMI came in below expectation at 48.5 (versus a forecast of 50.0 and an April value of 50.2). However, at the same time, Preliminary May Services PMI came in stronger than had been anticipated at 55.1 (compared to a forecast of 52.6 and an April reading of 53.6). The Preliminary S&P Global Composite PMI also came in significantly stronger than expected at 54.5 (versus a forecast of 50.0 and an April value of 53.4). Finally, after the close, the API Weekly Crude Stocks Report showed a large and unexpected drawdown of 6.799-million-barrels (compares to a forecast of a 0.525-million-barrel inventory build and the prior week’s 3.690-million-barrel build).

SNAP Case Study | Actual Trade

In debt ceiling news, the political drama continued Tuesday. GOP Congressmen publicly “expressed doubt” on whether June 1 was a real deadline (as opposed to an artificial date set by the White House to put pressure on the GOP). This implies the GOP side may be less likely to worry about it. Meanwhile, GOP Speaker McCarthy said Tuesday that “negotiators are nowhere near (a deal)” and that “a deal must be reached by Friday to avoid default” (the latter based on McCarthy promising his party conservatives 3 full days to read any agreed deal before a vote) … but he also added, “there was still time.” For their part in the drama, Congressional Democrats did two things Tuesday. First, they introduced a bill to expand Social Security by raising taxes on the wealthy. Secondly, they began circulating a “discharge petition” which would bring a vote on increasing the debt ceiling to the floor. They have 213 signatures as of Tuesday evening and need 218 to force the vote (regardless of House Speaker McCarthy’s feelings on the matter). Meanwhile, the White House said talks continue and tried to stay “above the fray.” At the end of the day, very few people believe there will be a default. However, any deal before the deadline would mean one side or the other caved. So, expect more of the same drama and a last-minute deal. For what that is worth, The Financial Times reported that the combination of this news (and in particular the GOP portions) was the cause behind the down day on Wall Street.

In stock news, climate activists repeatedly attempted to storm the stage at SHEL’s shareholder meeting after their resolution (calling for SHEL to set more ambitious climate strategy) only got 20% of the shareholder votes. Despite an overall week tape, the regional banks had a good day Tuesday with PACW (+7.74%), ZION (+4.63%), WSFS (+4.35%), and BKU (+4.32%) leading the group higher. Elsewhere, AAPL announced a deal with AVGO to expand their relationship (AAPL already accounts for 20% of AVGO revenue) to supply AAPL with 5G chips for their phones. Later UBER announced it is partnering with GOOGL (Waymo division) to offer driverless cars for ride-hailing and food delivery in the 180 square miles around Phoenix AZ. At the same time, WH was halted briefly Tuesday after it was announced CHH is seeking to buy WH. It is unclear at this point what WH management or board feels about the idea. After the close, Elon Musk attempted to rev up a bidding war as he said TSLA will decide on the location of a new factory before the end of this year.

In stock legal and regulatory news, in the wake of FOX’s $787.5 million defamation settlement, another pending defamation case, and more recent on-air “misreporting” (on homeless veterans, migrants, and a hotel) activist investors have filed a proxy resolution calling for the network to study using “on-air labels” to distinguish news from its notorious opinion content. However, with Chairman Murdoch holding 42% of the voting shares, it is unlikely this resolution will pass. At the same time, across the pond, EU antitrust regulators have closed an investigation into the video licensing policies of a trade group whose members include GOOGL, AMZN, AAPL, and META. Elsewhere, the NTSB announced it will hold a two-day investigative hearing on June 22-23 over the NSC train derailment in East Palestine OH back in March. Meanwhile, the state of CA has filed a request with the US EPA asking for permission to ban internal combustion-only vehicle sales in that state by 2035. The same request also asks the EPA to approve the state’s proposed increasingly stricter car emission standards starting in 2026. Finally, the Netherlands said late Tuesday that MMM had been notified that the company will be held financially responsible for the cleanup of “forever chemicals” in a Dutch river. No dollar value or estimate is yet available but it is expected to be significant since the contamination includes ground and water with the river dispersing contamination over a large area.

After the close, VFC, TOL, A, PANW, and URBN reported beats on both the revenue and earnings line. Meanwhile, INTU missed on revenue while beating on earnings. It is worth noting that INTU and A lowered their forward guidance. At the same time, TOL and PANW both raised forward guidance. Surprises included +51% (TOL), +31% (VFC), and +20% (PANW) on earnings.