CPI in AM Arraignment in Afternoon

Monday was another Bullish day starting with higher opens. (SPY gapped 0.23% higher, DIA gapped 0.13% higher, and QQQ gapped 0.48% higher.) At that point, all three major index ETFs chopped sideways in a volatile way. At 11 am, the SPY and QQQ started a strong rally that lasted the rest of the day. Meanwhile, DIA finally began to follow at noon, sold off again from 1:20 pm until 3 pm, and then followed higher again the last hour of the day. This action gave us gap-up strong white candles with small lower wicks and almost no upper wick. SPY broke through a resistance level not tested since mid-August 2022 while QQQ is back at levels not seen since March 2022. All three index ETFs remain above their T-line (8ema) as the trend remains Bullish.

On the day, seven of the 10 sectors were in the green as Technology (+1.99%) led the market higher, while Energy (-1.16%) was by far the lagging sector. At the same time, SPY gained 0.91%, DIA gained 0.56%, and QQQ gained 1.69%. The VXX gained a half of a percent again to 28.49 and T2122 climbed back into the overbought territory to 89.41. 10-year bond yields fell slightly to end at 3.742% while Oil (WTI) plummeted 4.45% to end the day at $67.05 per barrel. So, Monday was the Bulls’ Day again. We took out resistance levels and pushed on up with technology leading the way higher. However, it should be noted that this all happened on well-below-average volume in all three major index ETFs.

The only major economic news on Monday was the May Federal Budget Balance which came in a bit worse than expected with a $240.0 billion deficit (compared to a forecast for a $236.0 billion deficit and much worse than the April reading of a $176.0 billion surplus). The primary cause of the deficit is that revenues were down 21% from a year earlier (mostly coming from a decline in high-end tax returns). However, spending was up too, with a tripling of the cost of the Medicare program driving much of the increase. Elsewhere, the NY Fed released a survey Monday which found American inflation expectations have fallen to the lowest level in two years. The May Survey of Consumer Expectations found that respondents project inflation a year from now will be at 4.1% (down from 4.4% in the prior month’s survey). The same respondents expect inflation to be at 3.0% in three years (slightly up from April’s 2.9% average).

SNAP Case Study | Actual Trade

In stock news, the Wall Street Journal reported Monday that VZ is looking for a new CFO who would also become the CEO-in-waiting to succeed current CEO Vestberg. At the same time, LMT and GFS announced a partnership to secure a domestic supply of semiconductors for defense systems. The partnership aims to garner part of the $52 billion provided by the Chips Act from the previous Congress. Elsewhere, CAVA released details of their IPO scheduled for later this week. The offering will be 14.4 million shares with a planned price range between $19 and $20 per share. In boycott news, MDLZ is facing growing boycotts by corporate entities in the Nordic region over its continued operation in Russia. Several airlines, railways, hotel chains, retailers, and even the Norwegian Football Assn. are among those who announced they will stop selling MDLZ products in the last few days. In the auto space, following on the heels of similar stories at other locations (MI and TX), GM announced they will invest $632 million to expand its Ft. Wayne IN internal combustion truck plant capacity. In other auto news, TSLA sent emails to Canadian customers canceling the customers’ orders for US-built “Model Y Long Range” vehicles. The email offered those affected the option to instead select Chinese-built “Model Y Long Range” vehicles. After the close, CB announced it has authorized a $5 billion stock repurchase program effective July 1.

In stock legal and regulatory news, it was announced Monday that GOOGL settled with composer Maria Schneider on Sunday, a day before her case against the company for enabling piracy of her works was scheduled to begin. Terms of the settlement were not released. Elsewhere, Reuters reported AVGO is set to win conditional approval for its $61 billion purchase of VMW from the EU Antitrust regulator. The approval will be tied to remedies relating to interoperability with rival products (such as those from MRVL). The official decision is not due until July 17, but Reuters says multiple sources have leaked the outcome to them early. However, in the US, the FTC filed a motion to seek a court order to block the MSFT acquisition of ATVI. (Antitrust experts say the FTC faces an uphill battle because MSFT has already offered voluntary concessions to allay fears it could dominate the online gaming market.) JPM has agreed to settle with the victims of Jeffrey Epstein for $290 million. The settlement still requires the approval of the federal judge overseeing the case. In the afternoon, US District Judge Sorokin delayed the effective date of the permanent injunction blocking the “effective merger” of AAL and JBLU in the Northeast. Originally scheduled to be effective June 20, the revision will make the injunction effective 21 days after his final ruling. This comes after the airlines petitioned for him to not block their “mutual frequent flyer and codeshare arrangements” late last week. At the end of the day, a jury found BRK.A subsidiary PacifiCorp is liable in a $1.6 billion class action lawsuit over wildfires in Oregon. At the same time, Bloomberg reported GOOGL will be hit with a formal antitrust complaint to be announced Wednesday. The new suit targets GOOGL’s ad business model which targets individuals based on information gained by tracking them.

In real estate news, Bloomberg reports that office occupancy in New York has increased. Their survey found that occupancy is above 50% for the first time since before the pandemic. This is welcome news for some as the city estimates that remote work has been costing the New York economy $12 billion a year. However, the same survey found that other major cities such as Washington DC and San Francisco remain below 50% office occupancy.

After the close, ORCL reported beats on both the revenue and earnings lines. The company also raised forward guidance after reporting jumps in the company’s cloud services revenue growth.

Overnight, Asian markets leaned heavily to the green side with only two exchanges in the red. Japan (+1.80%), Taiwan (+1.54%), and Shenzhen (+0.76%) led the gainers. Meanwhile, in Europe, the picture is more mixed at midday. Seven of the 15 European exchanges are in the red with the CAC (-0.08%), DAX (+0.08%), and FTSE (-0.16%) leading on volume. Sadly, Russia (+1.39%) is the biggest positive mover on the day as of early afternoon. In the US, as of 7:30 am, Futures are pointing to a mixed and modestly positive start to the day. The DIA implies a -0.01% open, the SPY is implying a +0.12% open, and the QQQ implies a +0.33% open at this hour. At the same time, 10-year bond yields are down a bit to 3.736% and Oil (WTI) is up 1.94% to $68.43 per barrel in early trading.

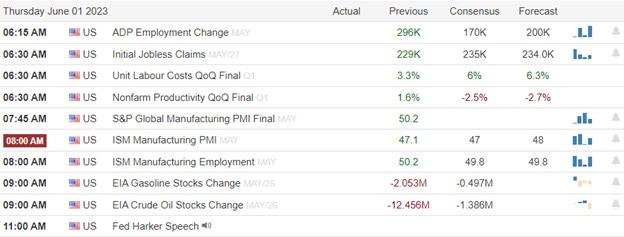

The only major economic news events scheduled for Tuesday are May CPI (8:30 am) and API Weekly Crude Oil Stocks (4:30 pm). There are no major earnings reports scheduled for either before the open of after the close.

In economic news later this week, on Wednesday, May PPI, EIA Crude Oil Inventories, Q2 Fed Interest Rate Projections for the current year, 1st year, and 2nd year, FOMC Economic Projections, FOMC statement, Fed Interest Rate Decision, and Fed Chair Press Conference are reported. On Thursday, May Retail Sales, May Imports, May Exports, Weekly Initial Jobless Claims, NY Empire State Mfg. Index, Philly Fed Mfg. Index, May Industrial Production, April Business Inventories, and April Retail Inventories are reported. Then, on Friday, we get Michigan consumer Sentiment, and a Fed Speaker (Waller at 7:45 am).

In terms of earnings reports later this week, on Wednesday, we hear from LEN. Then Thursday, KR, JBL, WLY, and ADBE report. Finally, there are no reports on Friday.

In miscellaneous news, overnight TM announced plans for a new EV unit that will offer a full lineup of “extended range” electric vehicles in 2026. The company also announced it plans to achieve annual sales of 3.5 million all-electric vehicles by 2030. Finally, the ex-President with a persecution complex has called on his backers to show up to support for him and denounce his indictment today as he is arrested, booked, and arraigned in Miami. Worse yet, some of his right-wing Congressional and social media supporters have stoked that fire by falsely claiming the 37-count indictment to be a political attack and calling for everything from the abolition of the FBI and Dept. of Justice to actual militant action. (Rep. Higgins of LA called for the taking of bridges and knowing the points of attack on the maps. Later, he said there is a “3% militia solution” to the indictments.) As a result, this will undoubtedly be the top news story by day-end Tuesday (probably sooner) and has the potential to throw markets into turmoil based on the action taken by “those people” who show up to protest…and whether authorities are prepared to respond appropriately if they step out of line.

With that background, it looks like the Bulls are looking to make another modest push at the open today but also that the DIA remains the laggard (and mostly undecided this morning). The SPY looks like it wants to retest the Mid-April 2022 lows while QQQ seems to be looking to chasing the March 2022 high level. DIA lags, but has a little room before reaching a strong resistance level starting at the May 1, 2023 high. The main takeaway from this for me is that the bulls have all the momentum this morning. However, QQQ is back to being a bit over-extended from its T-line at this point and it would not take a huge move for SPY to join it in that condition. Meanwhile, the T2122 indicator is back up mid-way into the overbought territory. So, we do have some room to run, but we are also a bit stretched. Obviously CPI this morning will drive early action. Expectations are for the report to show modestly moderating inflation (giving fuel to the Fed Doves for a pause in hikes tomorrow). However, as I said above, the situation in Miami has the potential to cause a massive jerk in the market. So, we might see extreme volatility or a reversal of trend, depending on what the MAGA types do and how authorities react. Just be prepared.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the man in the green bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is absolutely no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby. It’s a job. The money is real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service