Member e-Learning 7-20-23 – RBB – Doug

Rounded Bottom Breakout | Member E-Learning

Replay of the Rounded Bottom Breakout pattern and how approach it an trade it.

Member e-Learning 7-20-23 – RBB – Rick

Earnings, Philly Fed, And Jobless Claims

Markets were indecisive on Wednesday after gapping higher (opening up 0.18% in SPY, up 0.24% in the DIA, and up 0.27% in the QQQ). At that point, all three major index ETFs did some version of just moving sideways until 12:15 pm. Then we saw a selloff that lasted until 2 pm, modest in the SPY and DIA and more pronounced in the QQQ (which recrossed its morning gap). However, the bulls righted the ship, rallying until 3:30 pm when we saw modest selling in the last 30 minutes. This action gave us indecisive candles in all three major index ETFs. The DIA printed what could easily be seen as a Shooting Star of Gravestone Doji-type candle. At the same time, the SPY printed a gap-up Doji of its own and the QQQ printed a black-bodied Spinning Top candle. All three remain comfortably above their T-line (8ema).

On the day, eight of the 10 sectors were in the green with Communications Services (+1.90%) leading the way higher and both Technology (-0.34%) and Basic Materials (-0.33%) lagging behind the other sectors. At the same time, the SPY gained 0.22%, DIA gained 0.32, and QQQ lost 0.02%. The VXX climbed 1.79% to 23.90 and T2122 climbed even higher into the overbought territory to 96.79. 10-year bond yields fell to 3.746% while Oil (WTI)was down 0.63% to close at $75.27 per barrel. So, Wednesday was an indecisive day after the earnings-driven modest gap higher. It seems traders are getting wary of whether the Bulls can keep up the momentum of the last 7 days of action and are thinking better of chasing at the current highs. This happened on less-than-average volume in the SPY and QQQ, and above-average volume in the DIA.

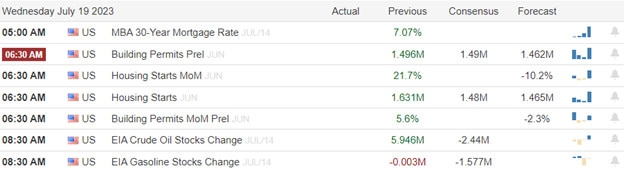

The major economic news on Wednesday included Preliminary June Building Permits, which came in below expectations at 1.440 million (compared to a forecast of 1.490 million and a May reading of 1.496 million). At the same time, June Housing Starts also came in light at 1.434 million (versus a forecast of 1.480 million and a May value of 1.559 million, which was admittedly a blowout high number). Later in the morning, the EIA Crude Oil Inventories showed a smaller-than-anticipated drawdown of 0.708 million barrels (compared to a forecast of -2.440 million barrels but well down from the prior week’s number which showed a 5.946-million-barrel increase in inventories.

SNAP Case Study | Actual Trade

In stock news, Bloomberg reported Wednesday that AAPL is working on artificial intelligence tools to rival OpenAI, GOOGL, META and others. However, reportedly, AAPL has not yet developed a clear strategy for AI offerings. Elsewhere, after criticism related to the recent allegedly Chinese hacks, MSFT is expanding the suite of free security tools it offers customers. At the same time, NFLX announced it will scrap its cheapest ad-free plan in order to boost the number of ad-supported members it has on the books. Meanwhile, AAL and its pilots have resumed negotiations to improve their previously agreed tentative contract (after the UAL offer to its own pilots was sweeter). AAL pilot voting is set to begin on Monday. After the close, HCCI announced it has agreed to be bought by private equity firm J.F. Lehman for $1.2 billion in case ($45.50 per share).

In stock legal and regulatory news, on Wednesday, ATVI announced that it agreed to extend the deadline for closing the purchase by MSFT to October 18. (Previously the deadline was August 29 and if the deal was not completed by that date MSFT owed ATVI $3 billion. Along with the extension, the walk-away fee increases to $3.5 billion.) This extension was done to help secure UK approval for the acquisition. Elsewhere, a federal judge in NY ordered TSLA to turn over emails from CEO Musk to JPM as part of a lawsuit over a bond contract (related to Musk saying “he had secured funding to take TLSA private in 2018”). In other bank news, the Fed fined DB $186 million for failing to address previously identified money laundering. At the same time, 200 US lawmakers said that they will not intervene if Teamsters go on strike against UPS. (Although, truthfully, Congress has no power to intervene anyway other than to ask the President to invoke a cooling-off period prior to the strike.) In related news, after-hours UPS said it would return to the negotiating table and sweeten its offer to the Teamsters. Meanwhile, in Delaware, the Governor has signed a new law that will enable NKLA to double the number of shares from 800 million to 1.6 billion. NKLA will resume its shareholder meeting on August 3 and with the new law will have the votes to offer new shares despite non-insider shareholder objections. After the close, the SEC reported that it has accepted six ETF applications for the spot price of Bitcoin. There was no schedule announced for any approval decisions.

After the close, TSLA, UAL, LVS, CCI, WTFC, and FNB all reported beats on both the revenue and earnings lines. Meanwhile, AA, EFX, IBM, KMI, and NFLX all missed on revenue while beating on earnings. On the other side, COLB, DFS, and ZION all beat on revenue while missing on earnings. Unfortunately, LBRT and STLD missed on both the top and bottom line. It should be noted that CCI and EFX lowered their forward guidance. However, UAL raised its forward guidance.

Overnight, Asian markets mostly in the red. Japan (-1.23%), Shenzhen (-1.06%), and Thailand (-1.01%) paced the losses. On the green side, India (+0.74%) was by far the biggest gainer. Meanwhile, in Europe, the bourses are mostly green at midday. The CAC (+0.40%), DAX (+0.25%) and FTSE (+0.64%) lead the region mostly higher in early afternoon trade. In the US, as of 7:30 am, Futures are pointing toward a mixed start to the day. The DIA implies a +0.10% open, the SPY is implying a -0.17% open, and the QQQ implies a -0.74% open at this hour. At the same time, 10-year bond yields are up sharply to 3.787% and Oil (WTI) is on the green side of flat at $75.46 per barrel in early trading.

The major economic news events scheduled for Thursday include the Weekly Initial Jobless Claims and Philly Fed Mfg. Index (both at 8:30 am), June Existing Home Sales (10 am), and the Fed’s Balance Sheet (4:30 pm). The major earnings reports scheduled for before the opening bell include ABT, ALFVY, AAL, BX, DHI, EWBC, FITB, FCX, GPC, INFY, JNJ, KVUE, KEY, MAN, MMC, NEM, NOK, PM, POOL, SAP, SNA, SNV, TSM, TRV, TFC, and WBS. Then, after the close, COF, CSX, ISRG, KNX, PPG, and WRB report.

In economic news later this week, on Friday, there are no major economic news scheduled.

In terms of earnings reports, on Friday, AXP, ALV, AN, CMA, HBAN, IPG, RF, ROP, and SLB report.

In miscellaneous news, Russia announced that starting today it is setting up a shipping lane in an attempt to continue its own grain exports. However, at the same time, it said any ships traveling to Ukrainian ports will be assumed to be carrying military cargo. (The obviously implied threat being the ships would be captured or sunk.) Elsewhere, Elon Musk may have put a scare into TSLA investors, hinting that more price cuts may be coming and seeming much less concerned about profits now than self-driving as a potential profit engine in the future. Musk said “The short-term variances in gross margin and profitability really are minor relative to the long-term picture. Autonomy will make all of these numbers look silly.” Meanwhile, overnight, TSM beat but also made less revenue than a year prior (for the first time in 4 years). It also revised its forecast, now expecting a 10% drop in revenue for the year. The world’s largest chipmaker cited weak global demand for everything from cars to cell phones. (Oddly, carmakers have been saying sales continue to be very strong.) However, TSM also cited high demand for high-end chips to support artificial intelligence as offsetting some of the weakness.

So far this morning, AAL, ABT, BX, DHI, FITB, JNJ, KVUE, MMC, PM, SNA, TSM, and TCBI all reported beats on both the revenue and earnings lines. Meanwhile, ALFVY and GPC missed on revenue while beating on earnings. On the other side, INFY, KEY, TRV, and TFC all beat on revenue while missing on earnings. Unfortunately, ELUXY, NEM, NOK, and POOL all missed on both the top and bottom lines.

With that background, markets are looking to diverge in the premarket (ahead of data and more earnings). All three major index ETFs are looking at very small premarket candles at this point. However, the QQQ is gapping down strongly on last night’s NFLX report and TSLA. Nonetheless, all three remain above their T-line. So, at this point, it is looking a pause or pullback with no indication trend has changed. As far as extension goes, with the morning pullback in QQQ, none of the major index ETFs are too far away from their T-line, but the T2122 indicator is again deep into the overbought region. Just remember that markets can stay extended longer than we can stay solvent predicting the reversion to the mean.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the man in the green bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is absolutely no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby. It’s a job. The money is real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Massive Enthusiasm

Tuesday started the day slightly negative but the bulls quickly surged higher on massive enthusiasm as better-than-expected earnings triggered a fear of missing out rally pushing indexed into an extremely overbought condition. AI announcements kept the bullish energy going right into the close of the day. Today we ramp up the number of earnings events that could keep the party going but traders chasing already-extended stocks is risky because a pullback wave could begin at any time. Plan your risk carefully to avoid the fear of missing out chase.

Asina markets mostly advanced while we slept with only the tech-heavy Hong Kong exchange ending the day down modestly. European indexes trade bullishly this morning as the U.K. posted inflation figures less than expected at 7.9%. With a big day of earnings data, U.S. futures suggest another bullish open in anticipation but remember that can get much better or reverse as the data is revealed. Plan for another wild day of highly emotionally charged trading.

Economic Calendar

Earnings Calendar

Notable reports for Wednesday include AA, ALLY, ASML, BKR, CFG, CNS, CCI, DFS, DFX, FHN, GS, HAL, IBM, KMI, LVS, MTB, NDAQ, NFLX, REXR, SLG, STLD, TSLA, USB, UAL, ZION.

News & Technicals’

Microsoft’s stock price soared to a new record high after the tech giant unveiled its latest innovation: an AI-powered add-on for its Office suite. The Copilot service, which will be available as a monthly subscription for $30, promises to enhance the productivity and creativity of Office users by providing smart suggestions, insights, and automation for Word, Excel, and Teams. Analysts estimate that Copilot could boost Microsoft’s revenue by up to 83% from enterprise customers who are willing to pay more for the advanced features.

The US antitrust authorities have issued new rules for assessing the competitive impact of mergers and acquisitions in the rapidly evolving digital economy. The Federal Trade Commission and the Department of Justice Antitrust Division announced that they will apply a more dynamic and forward-looking analysis to determine if a deal harms consumers or innovation. The new guidelines are intended to provide clarity and transparency to businesses and courts on how the agencies evaluate the potential benefits and harms of a merger.

Tuesday started a bit bearish but despite the weak retail sales and industrial production figures stretching the indexes back into an extremely overbought condition with massive enthusiasm. The bulls keyed off better-than-expected earnings from major banks to begin the day and then surged after Microsoft announced a $30 generative AI subscription. Today with a big increase in earnings events, Housing, and Petroleum numbers the bullish enthusiasm may well continue. After the bell today we will get reports from TSLA and NFLX so expect morning gaps to begin as the market reacts. At the risk of sounding redundant raise stops or consider taking some profits and try to avoid chasing stocks that are already extended because a pullback wave could begin at any time due to the short-term overextended conditions.

Trade Wisely,

Doug

Public e-Learning 7-18-23 – Trading Plans

Good Earnings And UK Inflation Surprise

Tuesday was the Bull’s day. After strong earnings from the big banks, we saw a very modest gap lower (down 0.06% in the SPY, down 0.05% in the DIA, and down 0.16% in the QQQ). However, the two large-cap index ETFs immediately started to rally steadily. The SPY kept up a 45-degree rally all day long. Meanwhile, the DIA rallied more sharply until noon and then traded sideways the rest of the way. For its part, QQQ continued lower for 10 minutes after the open and then ground sideways for an hour, but then it rallied strongly all the way into the close. There was a small amount of profit-taking in the last 15 minutes of the day in all three major index ETFs. This action gave us large, white-bodied candles in all three with the QQQ having more wick on both ends than the other two. It is worth noting that DIA finally broke through the resistance level that had held it down all year while the SPY and QQQ were already at new highs for the year.

On the day, eight of the 10 sectors were in the green with Financial Services (+1.41%) leading the way higher and Utilities (-0.42%) lagging behind the other sectors. At the same time, the SPY gained 0.73%, DIA gained 1.07%, and QQQ gained 0.82%. The VXX fell 1.63% to 23.48 and T2122 climbed higher into the overbought territory to 94.01. 10-year bond yields fell to 3.783% while Oil (WTI) spiked 2.06% to close at $75.68 per barrel. So, Tuesday saw markets drive higher all day following the strong morning earnings. This happened on less-than-average volume in the SPY, average volume in the QQQ, and higher-than-average volume in the DIA.

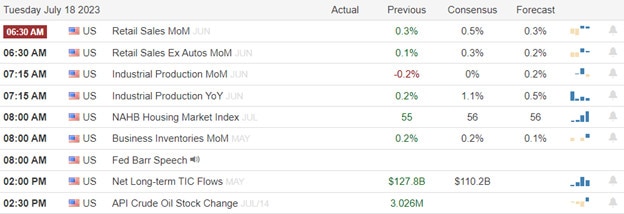

The major economic news on Tuesday, June Retail Sales (month-on-month) came in below expectation at +0.2% (compared to a forecast of +0.5% and a May reading of +0.5%). At the same time, June Industrial Production (month-on-month) also came in below what was anticipated at -0.5% (versus a forecast calling for dead flat +0.0% but in line with May’s -0.5%). This resulted in a very low June Industrial Production (year-on-year) growth of -0.43% (compared to a forecast of +1.10% and the May value of +0.03%). Later, May Business Inventories were reported as expected at +0.2% (versus a forecast of +0.2% and the April reading of +0.1%). May Retail Inventories came in lower than predicted at -0.1% (compared to a forecast of +0.0% but did not fall as much in April’s -0.2% number). Then after the close, API Weekly Crude Oil Stocks did not show as big of a drawdown as expected at -0.797 million barrels (versus a forecast of -2.250 million barrels but still far below the prior week’s inventory build of 3.026 million barrels.

SNAP Case Study | Actual Trade

In stock news, the US announced another $1.3 billion in defense aid for Ukraine. This included significant orders for LHX and AVAV products. At the same time, WMG has announced it has partnered with TikTok in a broad deal that was the first of its kind, to license WMG music. Elsewhere, PFE announced it has partnered with venture capital firm Flagship Pioneering to invest $100 million to develop 10 new drugs. At the same time, META released a commercial version of its artificial intelligence model Llama 2. Later, MSFT announced a 50% premium for its Office suite with access to a new AI Co-Pilot. The charge will be $30 per month, per user for the Office 365 Co-Pilot. In the Auto space, carmaker STLA announced it has secured long-term semiconductor supply contracts with IFNNY, NXPI, ON, and QCOM worth $11.2 billion and running through 2030. Meanwhile, TDOC told Reuters it is expanding its partnership with MSFT with plans to use the tech giant’s artificial intelligence to automate clinical documentation on its telehealth platform. In the defense space, LMT raised its full-year guidance on strong sales and profit outlooks from weapons contracts. After hours, AUR announced it plans to sell $600 million of Class A stock in a private placement to raise capital. (AUR shares fell 10% in post-market trading on the news.) Also after hours, Reuters reported that the AAL pilots union has warned that the ratification of the recently agreed contract deal is now in jeopardy after the UAL pilots union got a better deal. (The AAL deal raises pilot pay 42.5% over four years while the UAL pilot deal offers cumulative pay increases of 34.5% – 40%. The ratification vote is scheduled to start next week.)

In stock legal and regulatory news, the NHTSA announced it has opened another investigation of TSLA following another deadly crash in CA, this time of a 2018 TSLA Model 3 which was operating under “Full Self Driving” mode. In other TSLA news, in Germany, TSLA faced a grilling from the public in a q-and-a session meant to ease citizens’ minds about the impact of the electric carmaker’s plant expansion to become the largest TSLA factory in the world. (The plant now makes 5,000 cars per week and is expecting to double capacity and then double again to 1 million cars per year. The current largest car plant in Germany is VLKAF’s Wolfsburg plant which has the capacity to make 800k cars per year, but now produces 400k a year.) Back in the US, 22 Republican Congressmen (mostly from the MAGA caucus) wrote and published an open letter to the FTC urging the agency to drop its objections to the MSFT purchase of ATVI, calling the opposition an egregious example of rejecting sound antitrust policy. (Sound policy would apparently mean not opposing mergers.) At the same time, YUM’s Taco Bell brand won its bid to bust the trademark on the term “Taco Tuesday” (which had been held by the much smaller and private Taco John’s chain). Meanwhile, the FTC spearheaded 101 federal and state law enforcement agencies on a crackdown on telemarketing robocalls with one of the main targets being FLNT. (FLNT previously agreed to pay a $2.5 million fine while three other firms agreed to a total of $15.7 million in fines.) In lawsuits going the other way news, JNJ added its name to the list of pharmaceutical companies suing the US government in a bid to prevent the US from negotiating drug prices for Medicare. (All of those cases may have a steep hill to climb since in every instance the companies sell the drugs in question in smaller quantities at lower prices to other countries than what is charged to Medicare.) After the close, T made a court filing saying that it no longer intends to immediately remove lead cable in the ground in Lake Tahoe that it had previously agreed to remove. The telecom company says it will now do further analysis before deciding. (This move mentioned and pushed back against the recent Wall Street Journal article discussing the risks of lead cables to groundwater.)

After the close, AIR, PNFP, and HWC all reported beats on both the revenue and earnings lines. Meanwhile, OMC reported a miss on revenue while beating on earnings. On the other side, IBKR and WAL both beat on revenue while missing on earnings. Unfortunately, JBHT missed on both the top and bottom lines. The biggest surprises were huge upside revenue shocks from the financials (76% upside from IBKR, 71% upside from WAL, and 80% upside from PNFP).

Overnight, Asian markets leaned to the green side. Japan (+1.24%) was by far the leader to the upside while Singapore (+0.64%) and Australia (+0.55%) followed. On the downside, Taiwan (-0.65%) led the four red exchanges lower. Meanwhile, in Europe, stocks are in the green as only two of the 15 bourses are in the red at midday. The FTSE (+1.50%) is far-and-away the leader after a massive reduction in inflation. Thile the CAC (+0.27%) and DAX (-0.04%) lag behind. In the US, as of 7:30 am, Futures are pointing toward the day starting just on the green side of flat. The DIA implies a +0.09% open, the SPY is implying a -0.02% open, and the QQQ implies a +0.11% open at this hour. At the same time, 10-year bond yields are down to 3.764% and Oil (WTI) is just on the green side of flat at $75.87 per barrel in early trading.

The major economic news events scheduled for Wednesday include Preliminary June Building Permits and Preliminary June Housing Starts (both at 8:30 am), and EIA Crude Oil Inventories (10:30 am). The major earnings reports scheduled for before the opening bell include ALLY, ASML, BKR, CFG, ELV, FHN, GS, HAL, MTB, NDAQ, NTRS, and USB. Then, after the close, AA, COLB, CCI, DFS, EFX, IBM, KMI, LVS, LBRT, NFLX, STLD, TSLA, UAL, WTFC, and ZION report.

In economic news later this week, on Thursday, we get Weekly Initial Jobless Claims, Philly Fed Mfg. Index, June Existing Home Sales, and the Fed’s Balance Sheet. Then Friday, there are no major economics news scheduled.

In terms of earnings reports, on Thursday, we hear from ABT, ALFVY, AAL, BX, DHI, EWBC, FITB, FCX, GPC, INFY, JNJ, KVUE, KEY, MAN, MMC, NEM, NOK, PM, POOL, SAP, SNA, SNV, TSM, TRV, TFC, WBS, COF, CSX, ISRG, KNX, PPG, and WRB. Finally, on Friday, AXP, ALV, AN, CMA, HBAN, IPG, RF, ROP, and SLB report.

In miscellaneous news, the UK reported 7.9% annual inflation as of June, which is the worst among major economies. However, that number is down sharply from 8.7% on an annual basis in May. As a result, UK government borrowing costs also dropped abruptly today and the UK market now sees it less likely that the BoE will deliver another half-percent hike in August as had been expected. Elsewhere, in the US, YELL (the country’s third-largest less-than-truckload freight carrier) faces a strike by 22,000 teamsters as soon as next week. This comes after the company failed to make $50 million in contractually-required benefits contributions. (YELL is on the edge of bankruptcy again, for the fifth time since 2009, after getting lenders to agree to a waiver in June. YELL had proposed operational changes that were rejected a few weeks ago by the union, which had previously already made concessions on wages, hours, and some benefits. As an aside, YELL was formed by consolidating large and small trucking companies and has never (dating back to the 1980s) been good at the process of combining. In recent years, the company has bought non-union firms with the apparent goal of continuing to get more Teamster concessions. Now 8,000 of the company’s 30,000 employees are non-union.

So far this morning, ASML, ELV, USB, BKR, MTB, FHN, SDVKY, CBSH, NDAQ, and CVNA have all reported beats on both the revenue and earnings lines. Meanwhile, VLVLY beat on revenue while missing on earnings. On the other side, HAL, CFG, and WDS all missed on revenue while beating on earnings. It is worth noting that ASML and ELV both raised their forward guidance.

With that background, it looks like markets are again pausing ahead of economic data and earnings, even after receiving a number of good earnings reports this morning. All three major index ETFs are looking at very small, inside-day, candles at this point. As has been the case all year, DIA looks the weakest of the three while SPY and QQQ are seemingly pausing at the top of their year-long rallies. However, SPY was the laggard Tuesday. All three remain above their T-line and are, so far at least, just giving us a strong uptrend. As far as extension goes, we have been up a very long number of consecutive candles in the QQQ and it is getting a little stretched from its T-line (8ema). However, the two large-cap indices are fine in that regard and have had recent pullback days. The T2122 indicator is again well up into the overbought region. Just remember that markets can stay extended longer than we can stay solvent predicting the reversion to the mean.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the man in the green bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is absolutely no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby. It’s a job. The money is real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Focused on Earnings

With very little data to begin the week, markets focused on earnings that ramp up today and the high hope the results can support the very extended condition of the indexes. The VIX suggests high confidence or perhaps complacency while at the same time, the T2122 indicator flashes overbought warnings in the short term. Today we have both market-moving data on earnings and economic calendars so traders should plan for the possibility of gaps, whipsaws, and considerable price volatility as the market reacts.

Asian markets mostly declined with only the Nikkei seeing gains up 0.32% with Hong Kong leading the selling down 2.05%. European markets are also mixed with modest moves this morning as they wait on the busy day of data ahead. U.S. futures currently suggest an uncertain open ahead of retail sales, industrial production, and a slew of earnings reports that could fuel the rally higher or inspire profit-taking if the bears find a reason to engage. Get ready for the bumpy ride ahead!

Economic Calendar

Earnings Calendar

Notable reports for Tuesday include BAC, BK, SCHW, HAS, IBKR, JBHT, LMT, MS, NVS, OMC, PNFP, PNC, PLD, SYP, & WAL.

News & Technicals’

The latest data on inflation has given some hope to the financial markets that the worst of the price pressures may be over. However, the economy still faces many challenges, such as the high cost of energy and the sluggish housing sector. Some experts warn that the current situation may not last long and that more work is needed to ensure a sustainable recovery. The White House also acknowledged that the inflation problem is not solved yet and that it will continue to monitor the situation closely.

The CEO of Stability AI, a company that develops software using artificial intelligence, has warned that most of India’s coders are at risk of losing their jobs due to the advances in AI. He said that AI can now create software with much less human input and that this will affect different countries differently. He said that in France, for example, coders have more job security than in India, where many of them work for outsourcing firms. He predicted that most of the low-level and mid-level programmers in India will be replaced by AI in the next couple of years.

. Monday was a quiet day in terms of news and data, so the market focused on earnings and the possibilities of what comes next in the price action. The financial’s and technology sectors led the gains, along with increases in small caps. Global stocks were lower, the dollar declined with metals rising as oil declined with worries of China demand after missing growth targets. Today trades should plan for considerable price volatility as earnings ramp up with several big banks reporting before the bell. We will also have some potential market-moving economic data with Retail Sales, Industrial Production, Business Inventories, and Housing Market Index numbers to inspire the bulls or bears. Fear remains low in the VIX while the T2122 Indicator continues to flash an overbought condition which is a very interesting circumstance as earnings numbers increase.

Trade Wisely,

Doug

Earnings Good This AM with Data Ahead

Monday saw stock open flat and mixed (down 0.04% in the SPY, down 0.12% in the DIA, and up 0.23% in the QQQ). However, at that point, all three major index ETFs got in sync and the Bulls led a very slow, steady rally all the way up to 3:30 pm. Then the last 30 minutes of the day saw modest but steady profit-taking. This action gave us white-bodied candles in the SPY, DIA, and QQQ. Specifically, the SPY and DIA both printed Bullish Engulfing candles with upper wicks. Interestingly, the DIA closed right up against the resistance level it has failed multiple times (including Monday) since mid-June. Meanwhile, the QQQ could be seen to have completed a Doji Continuation (Sandwich) signal.

On the day, seven of the 10 sectors were in the green with Technology (+1.21%) in the lead and Communications Services (-2.28%) far and away the worst-performing sector. At the same time, the SPY gained 0.35%, DIA gained 0.20%, and QQQ gained 0.93%. The VXX fell very slightly to 23.87 and T2122 climbed back up into the low end of the overbought territory at 83.72. 10-year bond yields fell to 3.811% while Oil (WTI) also dropped 1.76% to close at $74.10 per barrel. So, Monday saw follow-through on the strong week and strong premarket earnings. However, then it was time to lock in profits and get ready for the weekend news cycle. This happened on less-than-average volume in the QQQ and DIA and very-low volume in the SPY.

The major economic news on Monday was limited to NY Fed Empire State Mfg. Index came in above expectations coming in at a barely positive (barely indicating improving conditions relative to overall economic conditions) at 1.10 (compared to a forecast of -4.30 but lower than the June reading of 6.60). In economic speak news, Treasury Sec. Yellen did an interview with Bloomberg Monday morning (speaking from India where she was attending a G-20 Finance Ministers meeting). Yellen said, “For the United States, growth has slowed, but our labor market continues to be quite strong. I don’t expect a recession.” Later she also said, “The most recent inflation data were quite encouraging.” After being asked, Yellen she expects a new executive order restricting investment in three Chinese sectors (semiconductor, quantum computing, and artificial intelligence). Elsewhere, the NY Fed released its monthly survey of Consumer Expectations, which looked at the credit markets. In June, the Fed found consumers were finding it tougher to borrow as credit application rejection rates rose to 21.8% (the highest level since June 2018). Drilling down, auto loan applications had a 14.2% rejection rate, new mortgages were refused 13.2% of the time, and 20.8% of mortgage applications for refinancing were turned down.

SNAP Case Study | Actual Trade

In stock news, FSR announced it plans to produce 100 limited edition electric SUVs for the Indian market, with deliveries scheduled to being during Q4. In other EV news, MULN announced they have received a 30-truck order from Newgate Motor Group in Ireland. Elsewhere, GM executive told Reuters that the carmaker simply can’t make and deliver cars fast enough to keep up with demand at dealerships. On Monday, the GM President for North America told the news outlet, “At this particular point in time, we could just about sell every product that we can build.” A week after a Wall Street Journal article identified VZ and T as being among several telecom giants that are guilty of abandoning huge networks of lead cables in the ground across the country, analysts downgraded both companies’ stock on the risk they will be required to pay for the cleanup. As a result, the whole sector fell sharply with VZ (-7.50%) and T (-6.69%) leading the way. At midday, MAR signed a 20-year licensing deal with MGM which will allow Marriott rewards members to redeem points to book stays at MGM resorts. Meanwhile, F announced that they are slashing prices on the F-150 Lightning trucks (by 17%) in hopes of gaining market share amid the current EV price wars. The move comes after F sales of electric vehicles fell 2.8% in June and also about 36 hours after TSLA said it had produced the first of its long overdue Cyber trucks.

In stock legal and regulatory news, BKI announced it will sell its “Optimal Blue” unit for $700 million in the hope of addressing FTC antitrust concerns. (The $700 million price tag was much lower than expected in this previously-hinted move.) The FTC said back in March that it will oppose the ICE’s $11.7 billion acquisition of BKI over monopolistic pricing power concerns. Elsewhere, the FDA approved a therapy (to treat respiratory syncytial virus) developed by a partnership from SNY and AZN for toddlers and infants. At the same time, the TSLA board of directors agreed to return $735 million to settle a shareholder lawsuit claiming they had grossly overpaid themselves. Across the pond, the MSFT appeal of the UK block on the acquisition of ATVI has been placed on hold for two months to “give the parties more time to resolve the issue out of court.” Back in the US, TSLA filed suit against London-listed CAP-XX, claiming the company violated two patents owned by a TSLA subsidiary. Meanwhile, a group of individual plaintiffs asked the US Supreme Court to temporarily halt the MSFT acquisition of ATVI after the 9th District US Court of Appeals rejected the FTC bid to get the same injunction at the end of last week. After the close, the FTC and US Dept. of Justice sued FLNT for allegedly operating massive “consent farms” to trick nearly 1 million people into providing personal information and consent to receive telemarketing calls. (These farms used deceptive ads promising free rewards from AMZN, WMT, and others as well as interviews for non-existent jobs in order to gain consent.) At the same time, the CA Supreme Court ruled against UBER saying the company must face a lawsuit claiming it should have covered UberEats driver’s work-related expenses. Finally, the FAA began an investigation of a UAL flight (flying a BA 767-300 jet) that lost its emergency evacuation ramp prior to landing in Chicago. (The flight originated in Zurich, Switzerland and the ramp was found in a neighborhood near O’Hare airport.)

So far this morning, BAC, LMT, MS, NVS, PNC, BK, and SYF have all reported beats to both the revenue and earnings lines. (SCHW reports at 8 am.) The big banks in particular showed tremendous quarter-on-quarter growth with BK giving the market 87% revenue growth and 20% earnings growth, BAC delivering 72% revenue and 21% earnings growth, and PNC showing 45% revenue growth. It is worth noting that PNC did lower its forward guidance.

Overnight, Asian markets were mostly in the red. Hong Kong (-2.05%) was by far the biggest loser, followed by Taiwan (-0.61%) and South Korea (-0.43%). Meanwhile, in Europe, the bourses are mostly green at midday. While leading on volume, the CAC (-0.01%), DAX (-0.07%), and FTSE (+0.07%) are lagging the smaller exchanges on their moves. It should be noted that Russia (+1.13%) is the biggest gainer in early afternoon trade. In the US, as of 7:30 am, Futures point toward a start to the day just on the red side of flat. The DIA implies a -0.01% open, the SPY is implying a -0.05% open, and the QQQ implies a -0.11% open at this hour. At the same time, 10-year bond yields are lower again to 3.768% and Oil (WTI) is up a half of a percent to $74.52 per barrel in early trading.

The major economic news events scheduled for Tuesday include June Retail Sales (8:30 am), June Industrial Production (9:15 am), May Business Inventories and May Retail Inventories (both at 10 am), and API Weekly Crude Oil Stocks (4:30 pm). The major earnings reports scheduled for before the opening bell include Tuesday, we hear from BAC, BK, SCHW, LMT, MS, NVS, PNC, PLD, and SYF. Then, after the close, AIR, IBKR, JBHT, and WAL report.

In economic news later this week, on Wednesday, Preliminary June Building Permits, Preliminary June Housing Starts, and EIA Crude Oil Inventories are reported. Thursday, we get Weekly Initial Jobless Claims, Philly Fed Mfg. Index, June Existing Home Sales, and the Fed’s Balance Sheet. Then Friday, there are no major economics news scheduled.

In terms of earnings reports, on Wednesday, ALLY, ASML, BKR, CFG, ELV, FHN, GS, HAL, MTB, NDAQ, NTRS, USB, AA, COLB, CCI, DFS, EFX, IBM, KMI, LVS, LBRT, NFLX, STLD, TSLA, UAL, WTFC, and ZION report. On Thursday, we hear from ABT, ALFVY, AAL, BX, DHI, EWBC, FITB, FCX, GPC, INFY, JNJ, KVUE, KEY, MAN, MMC, NEM, NOK, PM, POOL, SAP, SNA, SNV, TSM, TRV, TFC, WBS, COF, CSX, ISRG, KNX, PPG, and WRB. Finally, on Friday, AXP, ALV, AN, CMA, HBAN, IPG, RF, ROP, and SLB report.

In miscellaneous news, GS cut its estimate of the probability of a recession within the next 12 months to just 20%. GS Chief Economist Hatzius said “The main reason for our cut is that the recent data have reinforced our confidence that bringing inflation down to an acceptable level will not require a recession.” Elsewhere, delayed filings with the SEC showed that BRKB reduced its holdings of ATVI from 6.7% to 1.9% during Q1. (This was before recent MSFT victories that have the company inching closer to closing the acquisition of ATVI.) Meanwhile, Bloomberg reported that CUBI (PA-based regional bank) has become the darling bank of the crypto industry, serving hundreds of digital-asset companies since Silvergate Capital, SBNY, and Silicon Valley banks failed in March. This includes several crypto exchanges, market-makers, and stablecoin issuers. There was no word on whether Fed or other regulators have (yet) expressed any interest in CUBI.

With that background, it looks like markets are again unsure ahead of economic data, even after we received blowout earnings reports this morning. All three major index ETFs are looking at very small, inside-day, black candles at this point (ahead of data). As has been the case all year, DIA looks the weakest of the three while SPY and QQQ are seemingly pausing at the top of their year-long rallies. All three remain above their T-line and are, so far at least, just giving us a pullback within an uptrend. As far as extension goes, QQQ may be getting a little stretched from its T-line (8ema) but the two large-cap indices are fine in that regard. However, the T2122 indicator has climbed back up to the bottom of the over-bought region. So, once again, there is room to run (available buyers/sellers) in either direction. Nonetheless, also note that volume has been decreasing as a trend. There is a chance that means the big pool of traders is drying up now that we are three weeks into the new quarter.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the man in the green bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is absolutely no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby. It’s a job. The money is real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service