Debt Downgraded, Earnings, Indictments

Tuesday saw a mixed start to the day with the SPY gapping down 0.39%, the QQQ gapping down 0.37%, and the DIA opening just 0.11% lower. However, after the open all three major index ETFs ground sideways with a very modest Bullish trend. This left both SPY and QQQ inside of their morning gap and DIA modestly above their prior close. This action gave us a Doji in the SPY, a white-bodied Spinning Top in the QQQ, and a white-bodied candle with a small upper wick in the DIA. All three remain above their T-line (8ema) with only the QQQ actually retesting that T-line during the day. This all happened on a well below-average volume in the DIA, SPY, and QQQ.

On the day, nine of the 10 sectors were in the red with Utilities (-1.29%) leading the way lower while Industrials (+0.16%) was the only sector hanging onto the green area. At the same time, the SPY gained 0.19%, DIA gained 0.30%, and QQQ gained 0.05%. The VXX climbed 1.55% for the day to 22.95 and T2122 dropped back to just outside of the overbought territory at 76.70. 10-year bond yields climbed above the key 4% level to 4.035% while Oil (WTI) was flat to close at $81.73 per barrel. So, Tuesday was another day of indecision and sideways drift where mega-caps again had the strongest showing as we have seen very recently but not all year.

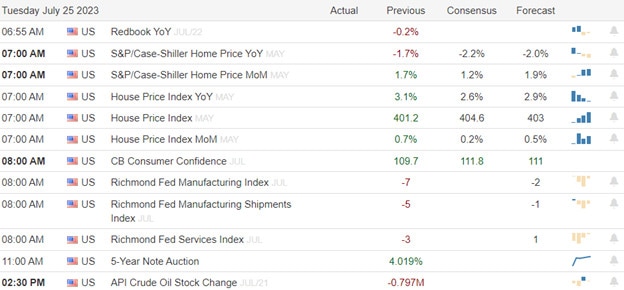

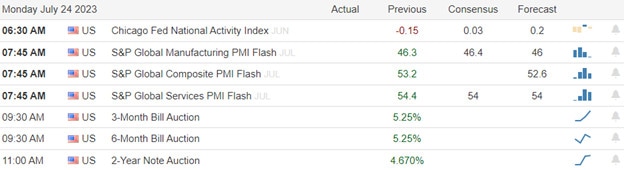

The major economic news reported Tuesday included the July S&P Manufacturing PMI which came in exactly as predicted at 49.0 (compared to a forecast of 49.0 and up from the June reading of 46.3). Shortly afterward, the July ISM Manufacturing PMI was reported a bit lower than expected at 46.4 (versus a forecast of 46.8 but slightly better than the June value of 46.0). At the same time, the July ISM Mfg. Price Index was just a bit better than anticipated at 42.6 (compared to the forecast of 42.8 but up from the June reading of 41.8). Elsewhere, the June JOLTs Job Openings were lower than expected at 9.582 million (versus a forecast of 9.610 million and the May value of 9.616 million). Finally, after the close, the API Weekly Crude Oil Stock Report showed a huge surprise drawdown of 15.400 million barrels (compared to an expected draw of only 0.900 million barrels and the prior week’s 1.319-million-barrel inventory build).

In Fed speak, Chicago Fed President Goolsbee said he thinks the Fed is on track and is bringing down inflation. However, he hedged his bets on whether or not he thought another hike would be needed in 2023, saying that decision would depend on the data. Goolsbee told Reuters, “I’m closet optimistic … my forecast is that we manage this, that we walk the fine line of the path that we get inflation down, not immediately but at a reasonable pace without a big, a huge increase, in unemployment.” He went on to say, “So far so good; it’s a tight line to walk … (but we’re) on the golden path.” Later in the day, Atlanta Fed President Bostic said he doesn’t think the Fed needs to hike rates in September. In fact, in a Zoom call with reporters, Bostic said that after “significant progress in slowing inflation” there is a growing risk the Fed could overdo tightening, potentially damaging the economy unnecessarily.

SNAP Case Study | Actual Trade

In stock news, Tuesday CVS announced it will be cutting 5,000 employees to reduce costs. (CVS had 300,000 employees as of year-end 2022.) At the same time, F said it has restarted F-150 Lightning pickup production after a six-week shutdown. The truck maker said after expansion (during the shutdown) they are on track to triple production capacity (to 150,000 trucks/year) by this fall. Elsewhere, the Financial Times reported that META is preparing to launch AI-powered chatbots as soon as September. The chatbots will have different “personalities” capable of having human-like discussions with users as the company seeks to boost user engagement to boost retention and increase screen (ad display) time. At the same time, BRKB-owned BNSF Railway announced it had reached a tentative agreement with the union which represents its locomotive engineers. Meanwhile, Bloomberg reported that APO (the lead creditor outside of the US government) is nearing a deal that would allow YELL to have cash and come out of bankruptcy. (YELL is the country’s third-largest trucking company and only filed for bankruptcy on Sunday.) YELL stock shot up 121.59% on the news. At the same time, ETRN said it now expects to complete its Mountain Valley natural gas pipeline this year after the US Supreme Court removed the last obstacle last week.

In stock legal, government, and regulatory news, Bloomberg reported Tuesday that TSLA has applied for $100 million in federal grants to build nine semi-truck recharging stations between the TX-Mexico border and Northern CA. (The TSLA proposal said each station would include eight TSLA truck chargers and four non-TSLA truck chargers.) Elsewhere, ESLOF (Essilor Luxottica, parent of Lenscrafters) agreed to pay $39 million to consumers in NY, FL, and CA for misleading advertising about the accuracy of automated eye measurement (Accufit). Then at midday, the NHTSA announced it has opened a new investigation into 280,000 TSLA vehicles over the loss of steering control and loss of power steering. At the same time, TMO settled a lawsuit by the estate of a woman whose cells have been used as the basis of biomedical research for decades. The terms of the deal are confidential. Meanwhile, GM announced a recall of 900 (more) older vehicles due to Takata airbag inflator defects. (Worldwide, over 100 million cars have been recalled in the last decade for the same defective inflator.) Finally, META began blocking access to news to its Canadian users as the new law in Canada took effect requiring online publishers to pay news organizations for the news content they create. (META and GOOGL threatened the same thing in Australia in 2021, but eventually negotiated deals to compensate Australian news outlets.)

After the close, AMD, AFL, ALIT, AIG, AIZ, AXS, BXP, BFAM, CZR, CHK, COLM, EA, EHC, EXAS, FLS, HY, MTCH, MATX, OI, PINS, PXD, SCI, SEDG, SFM, STE, TEX, UIS, UNM, and VRTX all reported beats on both the revenue and earnings lines. At the same time, DVN, ULCC, KWR, LUMN, NUS, SBUX, and TX all missed on revenue while beating on earnings. On the other side, ALL, CACC, MOS, and VFC beat on revenue while missing on earnings. Unfortunately, AXTA, CWH, LFUS, PRU, and JBT all missed on both the top and bottom line. It is worth noting that AXTA, BFAM, COLM, LFUS, and NUS all lowered their forward guidance. However, BXP, EHC, SBUX, and TEX all raised their forward guidance.

Overnight, global stocks were sharply lower following a downgrade of US debt rating. Asian markets were strongly in the red across the board. Hong Kong (-2.47%), Japan (-2.30%), and South Korea (-1.90%) lead the region lower. Meanwhile, in Europe, we see a similar picture taking shape with only Russia (+0.63%) in the green at midday. The CAC (-0.65%), DAX (-0.78%), and FTSE (-1.06%) are leading the bourses lower in early afternoon trade. In the US, as of 7:30 am, Futures have recovered some to point toward a modestly lower start to the day. The DIA implies a -0.23% open, the SPY is implying a -0.41% open, and the QQQ implies a -0.68% open at this hour. At the same time, 10-year bond yields are down a bit to 4.017% and Oil (WTI) is up almost one percent to $82.14 per barrel in early trading.

The major economics news scheduled for Wednesday is limited to July ADP Nonfarm Employment Change (8:15 am) and EIA Crude Oil Inventories (10:30 am). The major earnings reports scheduled for before the opening bell include ADNT, ATI, ALGT, ABC, BLCO, BWA, BLDR, BG, CG, CDW, SID, CVS, DD, DVRN, EMR, EXC, RACE, FIS, FDP, FTDR, GRMN, GNRC, GFF, HUM, IBP, JCI, KHC, LPX, DNOW, PSN, PSX, QUAD, RCM, RXO, SMG, SGEN, SPR, SUN, TEVA, TRI, TT, VRSK, VRT, WAT, XYL, and YUM. Then, after the close, ALB, ATUS, DOX, AEE, AFG, ANSS, APA, ATO, BKH, CHRW, CPE, CENT, CF, CAKE, CHRD, CIVI, CLX, COKE, CTSH, CYH, CODI, CCRN, CW, DASH, ET, ETSY, FMC, GT, GXO, HLF, HI, HUBS, NGVT, KGC, LNC, MRO, MKL, VAC, MMS, MCK, MELI, MET, MGM, MKSI, MOD, NFG, NCR, NTR, OXY, PTVE, PK, PYPL, CNXN, PR, PSA, QRVO, QCOM, O, HOOD, SHOP, SPG, SBGI, RUN, TRIP, UFPI, UGI, U, WCN, WTS, WMB, WSC, ZG, and Z report.

In economic news later this week, on Thursday, we get Weekly Initial Jobless Claims, Preliminary Q2 Nonfarm Productivity, Preliminary Q2 Unit Labor Costs, July S&P Global Composite PMI, July S&P US Services PMI, June Factory Orders, ISM Non-Mfg. Employment, July ISM Non-Mfg. PMI, and Fed Balance Sheet. Finally, on Friday, July Avg. Hourly Earnings, July Nonfarm Payrolls, July Participation Rate, July Private Nonfarm Payrolls, and July Unemployment Rate are reported.

In terms of earnings reports, on Thursday, GOLF, WMS, APD, BUD, APG, APO, APTV, ARW, BALY, BHC, BCE, BDX, BV, BIP, BRKR, CNQ, FUN, CQP, LNG, CI, CLVT, COMM, COP, CEG, CMI, DQ, DLX, DNB, EPC, ENTG, EPAM, EXPE, FCNCA, FOCS, HAS, DINO, HGV, HII, H, ICE, IRM, ITRI, ITT, K, MMP, MDU, MIDD, MUR, NJR, ONEW, PZZA, PH, PBF, PNW, PBI, PRVA, PWR, REGN, SABR, SBH, SNDR, SRE, FOUR, SO, SAVE, STWD, TRGP, TGNA, TFX, TPX, TKR, BLD, TRMB, VC, VMC, WBD, W, WCC, WLK, WRK, AES, AGL, AL, ATSG, ABNB, LNT, AMZN, COLD, AMGN, AAPL, ACA, TEAM, BGS, BIO, SQ, BKNG, BWXT, ED, CTVA, DVA, DKNG, DBX, EOG, EXPI, FND, FTNT, GEN, GILD, GDDY, ICFI, MTZ, MCHP, MODV, MNST, MSI, ZEUS, OTEX, OPEN, PBA, PBR, POST, RMD, RBA, RKT, RYAN, SWN, SYK, TPC, VTR, and WERN report. Finally, on Friday, we hear from ADV, AMR, AXL, AMRX, BSAC, BBU, BEPC, BEP, CLMT, CNK, CRBG, D, ENB, EVRG, FLR, FYBR, GTES, GLP, GTN, GPRE, LSXMK, LSXMA, LYB, MGA, OMI, PAA, PAGP, PPL, QRTEA, TU, TIXT, TNC, and XPO report.

In miscellaneous news, as mentioned above, Fitch downgraded US debt on Tuesday night, reducing the US long-term foreign-currency issuer default rating from AAA to AA+. Fitch went on to say they are “expecting fiscal deterioration over the next three years” and also cited “deteriorating governance” based on Congress playing politics with the Debt Ceiling in June. (Global stocks and US Futures both plummeted on the news.) Meanwhile, ERCOT (the TX electric grid operator) reported that TX electric demand hit a record high for the second straight day. ERCOT said Tuesday that it still has the resources to meet demand but again urged consumers to reduce their usage. (ERCOT’s real-time market held prices between $1,000 and $3,000 per MWh at its peak Monday.) Elsewhere, the main news Tuesday evening was the latest (and third) set of felony indictments of ex-President Trump. These particular indictments stem from the attempts to illegally overturn his 2020 election loss and were handed down by a Federal Grand Jury in Washington DC. The actual charges of this set of indictments will remain sealed until Trump is arraigned Thursday. However, the 45-page indictment covers four counts of conspiracy across three major laws and also mentions six unnamed co-conspirators. In addition, the investigation also remains ongoing. So, there is a chance additional charges or co-conspirators are later added to the indictments.

So far this morning, ABC, ADNT, BWA, CDW, CVS, DD, EMR, EXC, FIS, FDP, GRMN, HUM, NMR, PSN, RITM, TEVA, TT, VRT, WAT, and XYL all reported beats on both the revenue and earnings lines. Meanwhile, BLCO, BG, CG, JCI, KHC, RXO, TRI, and YUM all missed on revenue while beating on earnings. On the other side, BGNE, DRVN, GNRC, DNOW, and SUN beat on revenue while missing on earnings. Unfortunately, LPX, RACE, RCM, and SMG missed on both the top and bottom lines. It is worth noting that GNRC, RCM, and SMG all lowered their forward guidance.

With that background, it looks like the Bears are working off of the debt downgrade news. The gap lower will take all three major index ETFs back below their T-lines. However, all three are giving us white-bodied candles near the top of their premarket range and are retesting those T-lines. As far as extension goes, all of them are very close to their T-line and the T2122 indicator is outside of, but near, the overbought region. So, both sides of the market have room to run there is room to run if they can summon the momentum to do so. Remember that this is a heavy earnings week (Q2 earnings have been modestly good so far), that we get July Payrolls data at the end of the week, and the Trump indictment (as well as the next one expected to come from Georgia any day) are likely to generate a lot of news and have some potential to cause temporary volatility.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the man in the green bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is absolutely no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby. It’s a job. The money is real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service