TGT Misses Revenue and Lowers Outlook

Tuesday saw markets gap down again with SPY opening down 0.44%, DIA opening down 0.45%, and QQQ opening down 0.32%. After that open, the Bears were able to follow through to the downside for the first hour. At that point, all three major index ETFs meandered sideways in waves not far up off the lows until 3 pm. From there, all three sold off in the last hour, reaching new lows for the day. This action gave us gap-down, large-body, black candles in all three major index ETFs. DIA printed what can easily be seen as an Evening Star signal that broke through the recent support level. Meanwhile, QQQ printed a Bearish Harami that failed its T-line. SPY did not print a signal, but definitely took out recent lows and at best (from a Bullis standpoint) could be seen as right at the potential support level now..

On the day, all 10 sectors were in the red with Financial Services (-1.85%) and Basic Materials (-1.84%) out front leading the way lower and Healthcare (-0.41%) holding up far better than the other sectors. At the same time, the SPY lost 1.16%, DIA lost 1.01%, and QQQ lost 1.05%. VXX gained 5.76% to close at 24.77 and T2122 dropped deep into the oversold area at 5.76. 10-year bond yields continued to climb to 4.217% while Oil (WTI) was down 1.85% to close at $80.97 per barrel. This all took place on less-than-average volume across all three major index ETFs. So, the bears got a big tailwind overnight from the Fitch banking sector warnings and that was reinforced when Fed Member Kashkari advocated “significantly higher” capital requirements for banks (beyond even the just hinted and not yet proposed new ones from the Fed, FDIC and Comptroller of the Currency).

The major economic news reported Tuesday included the July Export Price Index, which came in much higher than expected at +0.7% (compared to a forecast of +0.2% and far higher than the June reading of -0.7%). At the same time, the July Import Price Index also came in high at +0.4% (versus the forecast of +0.2% and the June value of -0.1%). July Retail Sales also increased much more than predicted at +0.7% (compared to a +0.4% forecast and a June value of +0.3%). However, the Preliminary August NY Empire State Mfg. Index was reported far lower than anticipated at -19.0 (versus a forecast of -1.0 and even worse compared to the July reading of +1.10). Later in the morning, June Business Inventories came in lower than expected at +0.0% (versus the forecast of +0.1% and the May value of +0.2%). At the same time, June Retail Inventories also came in lower than predicted at +0.3% (compared to a forecast of +0.4% and a May reading of -0.1%). Then, at the close, the June TIC Net Long-Term Transactions (which is the difference between foreign securities bought by the US citizens versus US securities bought by foreigners…it measures whether money is flowing into or out of our markets) came in higher than expected at +$195.9 billion (compared to a forecast of +107.2 billion and far above the May value of +$23.6 billion). Finally, after the close, the API Weekly Crude Oil Stocks Report showed a larger-than-expected inventory drawdown of 6.195 million barrels (versus the forecasted drawdown of 2.050 million barrels and much lower than the prior week’s 4.067-million-barrel inventory build).

In Fed-speak news, in addition to his statements calling for even stricter banking regulations, Minneapolis Fed President Kashkari said he was not ready to say the Fed is done raising rates. Specifically, Kashkari said, “I’m seeing positive signs that say, hey, we may be on our way; we can take a little bit more time to get some more data and before we decide whether we need to do more.” At the same time, he said the Fed is “a long way” from cutting rates, even though there is a possibility of cutting them next year “just to keep monetary policy at a stable point.”

SNAP Case Study | Actual Trade

In stock news, Reuters reported that sporting-related companies NKE, ADDYY, and DKS are scrambling to unload products at significant discounts after the US Women’s World Cup Soccer team failed to make the second round of the World Cup Soccer Tournament. They reported that various retail analysts were seeing 25%-35% discounts on jerseys, t-shirts, sweats, and other branded apparel. Elsewhere, BP announced they have invested in a start-up company that is seeking to use vapor from heavy industry locations to sharply reduce the production costs of zero-carbon hydrogen. At the same time, financially troubled UP said Tuesday that it will give up to 95% of its common stock to investment firms in return for a $500 million lifeline. The investors include DAL and two private equity firms. Later, BLNK announced it will be expanding its Latin American electric charging network. The company had previously committed to 2,100 EV chargers across eight countries in the region. In unrelated news, TSLA launched two cheaper and shorter-range versions of its Model S and Model X cars. (Both will have exactly the same hardware, but will use software to limit the range. The shorter-range version will be about $10,000 less than their “full range” sister products.) Late in the day, private firm Esmark said it had $7.8 billion of cash in the bank and was ready to close an acquisition of X (the all-cash offer was made Monday). After the close, OXY announced it would be acquiring carbon-capture firm Carbon Engineering for $1.1 billion. At the same time, drugmaker MNKKQ announced it is preparing to seek bankruptcy protection for the second time in three years after failing to make a $200 million settlement payment to opioid victims. In addition, LUV announced it has reached a tentative agreement with the union representing over 17,000 transport of its workers who handle ramp, cargo, and provisioning operations.

In stock legal and regulatory news, the White House and CFPB announced plans to regulate companies in the surveillance industry, including the data brokers that accumulate and sell consumer personal data. The announcement specifically called out EXPGF, TRU, and EFX (consumer credit rating agencies) for selling “credit header information” such as names, addresses, and social security numbers. This comes after the FTC sued (in late 2022) an Idaho company for selling cell phone geolocation data. Elsewhere, the 4th Circuit Court of Appeals ruled that WBA must face trial (it revived the lawsuit) for defrauding the US and the state of VA related to billing and eligibility of patients for expensive hepatitis C drugs. (A lower court had dismissed the trial on the odd reasoning that WBA had violated federal law in its pre-authorization filings making the post-treatment billing irrelevant. The Appeals Court rejected that idea.) At the same time, Canada’s corporate ethics watchdog announced Tuesday that it is investigating RL over allegations the company uses forced labor (including Uyghur labor) in its Chinese production facilities. Meanwhile, NY state fined CAR $275,000 for refusing to rent vehicles to people who do not have credit cards, even if they offered to pay a deposit.

After the close, A, HRB, JKHY, NU, and LRN all reported beats on both the revenue and earnings lines. It is worth noting that A also lowered its forward guidance. So far this morning, JD, TCEHY, and TJX reported beats on both the revenue and earnings lines. Meanwhile, EAT, PFGC, and TGT missed on revenue while beating on the earnings line. It is worth noting that TGT cut its full-year guidance.

Overnight, Asian markets were nearly red across the board with only two of the twelve exchanges barely hanging onto green territory. Meanwhile, South Korea (-1.76%), Japan (-1.46%), and Hong Kong (-1.36%) led the region lower. In Europe, the picture is more mixed but still leans toward the red at midday. The CAC (-0.07%), DAX (+0.05%), and FTSE (-0.48%) are leading the region lower with five green and 10 red bourses (Russia being down 2.11%) in early afternoon trade. In the US, as of 7:30 am, Futures are pointing toward a flat start to the day. The DIA implies a +0.01% open, the SPY is implying a -0.03% open, and the QQQ implies a -0.05% open at this hour. At the same time, 10-year bond yields have pulled back a bit to 4.186% and Oil (WTI is flat at $80.97 per barrel in early trading.

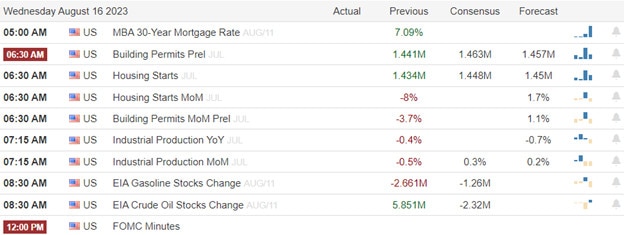

The major economics news scheduled for Wednesday includes July Building Permits and July Housing Starts (both at 8:30 am), July Industrial Production (9:15 am), EIA Crude Oil Inventories (10:30 am), and FOMC Meeting Minutes (2 pm). The major earnings reports scheduled for before the opening bell include EAT, JD, PDGC, TGT, TCEHY, TJX, and ZIM. Then, after the close, AVT, SQM, CSCO, KE, STNE, and SNPS report.

In economic news later this week, on Thursday, we get Weekly Initial Jobless Claims, Philly Fed Mfg. Index, Philly Fed Mfg. Employment, and the Fed Balance Sheet. Finally, on Friday, there is no significant economic news scheduled.

In terms of earnings reports, on Thursday, we hear from ARCO, BILI, DOLE, NICE, TPR, WMT, AMAT, FTCH, GLOB, KEYS, and ROST. Finally, on Friday, DE, EL, VIPS, XPEV, and PANW report.

In miscellaneous news, China lowered its one-year and medium-term interest rates by 15 basis points to 2.5% on Tuesday. Even as modest as it was, that was the largest cut in three years. However, interest rates are far from China’s largest problems as another of China’s largest real estate developers is at risk of loan defaults and the country’s largest financial conglomerate (Zhongzhi Enterprise Group, often called China’s Blackstone) just missed payments on its investment products. In addition, later Tuesday, it was reported that new bank loans fell to a 14-year low. Elsewhere, Bloomberg reported that CS’s Annual Global Wealth Report found that global household wealth fell last year for the first time since the 2008 financial crisis. Total net private wealth decreased by 2.4% to a total of $454.4 trillion in 2022.

In late-breaking news, Nielsen reports that for the first time ever, TV (broadcast and cable) viewing dropped below 50% of all views. At the same time, streaming media viewing rose to 39%. Elsewhere, Bloomberg reports there is discontent in the ranks of senior management at GS. Apparently, a large faction of senior GS managers want the CEO (Soloman) replaced. Finally, China is going further in its efforts to prop up its economy by asking some of the largest investment funds in both the Shanghai and Shenzhen exchanges to be “net buyers of stocks.” No carrot or stick was mentioned in the report. Instead, it was just a request and exhortation, which may imply something in China that it doesn’t in other parts of the world. China is also considering reducing the country’s “stamp duty” (which is a government fee for approval of loans, leases, insurance, and other financial contracts).

With that background, it looks like traders are undecided this morning with small-body candles near Tuesday’s close level. The trend remains bearish with all three major index ETFs below their T-line (8ema). Only the SPY is sitting at a potential support level at this moment but the other two are not far above their own potential support. Of course, the long-term trend is still hanging on to a bullish incline but it is being pushed by the Bears over the last three weeks. As far as extension goes, none of the major index ETFs are too far from the T-line. However, the T2122 indicator is now oversold, but not yet quite pegged to the bottom of its range. So, both sides have some slack to work with. However, the Bulls have more room to run.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the man in the green bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is absolutely no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby. It’s a job. The money is real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service