Public e-Learning 12-6-23 – Rick

Stocks Rested

Stocks rested though the bears briefly made an appearance after the China credit downgrade but we quickly shook off the mounting debits as traders bought the dip in the tech giant’s. The labor market data in the JOLTS report pointed to a slowing economy but encouraged the bulls as bond yields fell that additional rate hikes are unlikely. Today we have more labor data pending in the ADP along with Mortgage, Trade, Productivity, and Petroleum data along with a handful of notable reports to inspire traders. Corporate buybacks will begin winding down as their blackout period begins next week so plan your risk accordingly.

Overnight Asian markets shook off the China downgrade with the Nikkei leading the buying up 2.04% with only the Shanghai seeing modest selling. European markets trade green across the board this morning with the DAX extending its record high. U.S. futures also point to a resurgence of buyers after a brief two-day rest ahead of earnings and economic data.

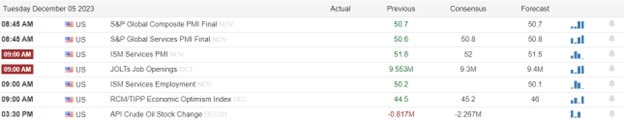

Economic Calendar

Earnings Calendar

Notable reports for Wednesday include AI, BF.B, CPB, CHPT, CHWY, DSGX, GME, GEF, OLLI, OXM, SMTC, SPWH, THO, UNFI, VEEV, VRNT.

News & Technicals’

The world is facing a major change in 2024, according to the Danish investment bank. The bank said that the past decade’s trends are coming to an end, and that the future will be shaped by some unexpected events that could have a huge impact on the financial markets. These events are unlikely but possible, and the bank warned that investors should be prepared for them. Some of the events that the bank predicted are: a global cyberattack, a new pandemic, a war between China and Taiwan, a collapse of the European Union, and a massive solar storm. These events could disrupt the global economy, politics, and society, and create new opportunities and challenges for the financial sector.

Generative artificial intelligence, which can create realistic texts, images, and sounds, is attracting a lot of attention and investment from Big Tech companies. However, these models also consume a lot of water, which raises environmental concerns. A study by Shaolei Ren, a researcher at the University of California, Riverside, revealed that ChatGPT, a popular chatbot developed by OpenAI, uses 500 milliliters of water for every 10 to 50 prompts, depending on the location and time of its deployment. The water is needed to cool down the servers that run the model, which requires a lot of computing power. The study suggests that generative AI models should be designed and deployed more efficiently, and that their water footprint should be taken into account when evaluating their social and economic impacts.

The U.S. consumer spending, which has been the main driver of the economic growth, is facing a challenge from the high interest rates on credit cards, according to some economists. Carl Weinberg, an economist at High Frequency Economics, told CNBC that consumer spending is being financed by credit cards, where interest is “over the top, out of control, off the hook right now”. He predicted that consumers will cut back on their spending in the new year, as their debt burdens increase. However, he did not expect this to push the U.S. economy into a recession. Monica Defend, the head of the Amundi Investment Institute, had a more pessimistic view. She said that she sees a coming pullback in consumer spending as sufficient to trigger a recession in the first half. She cited the weak consumer confidence, the rising inflation, and the uncertainty over the fiscal and monetary policies as the main factors behind her forecast.

Stocks rested a second day largely shaking of the credit downgrade of China as the tech giant’s found their footing as buyer bought the dip. The JOLTS report showed signs of slowing economy, weakening bond yields as odds of additional rate hikes shrink. However, some doubts emerged about whether markets are too optimistic about rate cuts with the higher for longer theme gaining some attention. Today traders will look for inspiration in a handful of notable earnings as well as Mortgage Apps, ADP, International Trade, Productivity and Petroleum data on the economic calendar. Corporate buybacks continue but keep in mind their blackout period is quickly approaching so a last ditch effort may well surge the market higher the rest to of the week.

Trade Wisely,

Doug

Banks See Soft Landing, Q3 Labor Data On Deck

Markets opened lower again on Tuesday. SPY gapped down 0.30%, DIA gapped down 0.22%, and QQQ gapped down 0.50%. At that point, DIA ground sideways along the opening level. Meanwhile, the SPY and QQQ also ground sideways but with a bit of a bullish trend. The left the SPY near the top of the gap, DIA at the bottom of its gap, and the QQQ back a bit above its gap at the close. This action gave us a white-bodied candle with an upper wick, which retested and held the T-line (8ema), DIA printed a Doji (indecisive) Harami candle, and the QQQ printed a large, white-bodied Bullish Engulfing candle that retested and failed its T-line. This happened on average volume in the DIA and well-below-average volume in the SPY and QQQ.

On the day, nine of the 10 sectors were in the red with Energy (-1.49%) out in front leading the way lower while Technology (+0.04%) held up much better than any of the other sectors. At the same time, the SPY lost 0.02%, DIA lost 0.20%, and QQQ gained 0.25%. The VXX fell 0.69% to close at 17.16 and T2122 fell back out of its overbought territory and back into the mid-range at 62.89. 10-year bond yields dropped sharply to 4.167% and Oil (WTI) dropped 0.32% to close at $72.09 per barrel. So, Tuesday was another day where the main portion of the move was made at the open. It felt like a day of rest with traders waiting on more information (waiting on the other shoe to drop) and happy for the consolidation/pullback to continue until it does get dropped.

The major economic news reported Tuesday, S&P Global Services PMI came in exactly as expected at 50.8 (compared to a forecast of 50.8 and an Oct. reading of 50.6). At the same time, the S&P Global Composite PMI also came in on target at 50.7 (versus a 50.7 forecast and 50.7 Oct. value). Later, Nov. ISM Non-Mfg. PMI was reported stronger than predicted at 52.7 (compared to a forecast of 52.0 and an Oct. reading of 51.8). In addition, Nov. ISM Non-Mfg. Employment came in lower than was anticipated at 50.7 (versus a 51.4 forecast but still up from October’s 50.2). At the same time, Nov. ISM Non-Mfg. Prices Index was a bit higher than expected at 58.3 (compared to a 58.0 forecast but down from October’s 58.6 value). Later, after the close, the API Weekly Crude Oil Stock Report showed a modest inventory build of 0.594 million barrels (versus a forecast that called for a 2.267-million-barrel drawdown and a prior week’s reading of -0.817 million barrels.

After the close, TOL reported beats on both the revenue and earnings lines. At the same time, PLAY missed on revenue while beating on earnings. It is worth noting that TOL also lowered its forward guidance.

In stock news, F announced a partnership with XEL that will install 30k electric vehicle chargers throughout the US by 2030. Later, PG unexpectedly announced it would record a $2.5 billion write-down in the value of its Gillette unit. At the same time, GDRX took a hit Tuesday when CVS announced a plan to implement a more transparent model of reimbursement from pharmacy benefit managers like GDRX. (CVS rose 4% on the announcement while GDRX fell more than 6% on the day.) Elsewhere, auto industry analysts at MS said Tuesday that TSLA’s market share of the global EV market fell to 13% in October (down sharply from TSLA’s 17% share in September). At the same time, the CFO of CHTR (speaking at a UBS conference) said he expects a reduction in broadband subscribers in Q4. (This news hit the stocks of CHTR as well as competitor CMCSA.) Later, Axios reported that DEO is seeking to sell its portfolio of beer brands (except the flagship Guinness brand) due to concerns over margins. At the same time, TSLA CEO Musk said Tuesday that “his projections” indicate the newly released Cybertruck will not have a significant impact on TSLA finances until 2025. In other news, Reuters reported BA delivered 46 narrowbody 737s in November. That brings the 2023 total to 351 units, leaving BA 25 planes short of the low end of its already reduced target range of 375-400 for the year. After the close, MA announced it had approved a new $11 billion share buyback program. The new program takes effect as soon as its current $9 billion buyback program is complete.

In stock government, legal, and regulatory news, a bankruptcy court announced that XPO was the winning bidder and would acquire 28 service centers formerly owned by bankrupt YELL. XPO will pay $870 million for the 28 centers. Later, the trial over the US Dept. of Justice seeking to block the JBLU acquisition of SAVE (for $3.8 billion) ended. The judge suggested he might approve the deal if JBLU agreed to divest more assets, also saying he was “having trouble with the DOJ’s request for a permanent injunction” in a dynamic marketplace. Elsewhere, an FTC inquiry has delayed the XOM’s planned $60 billion acquisition of PXD. According to SEC filings, PXD has been asked for additional information for an expanded investigation. (XOM and PXD remain optimistic the deal will eventually be approved.) Later, AMZN lent its voice to the calls asking the British antitrust authority to investigate and sanction MSFT for business practices that restrict customers’ ability to choose non-MSFT platforms for cloud computing. At the same time, a group of Catholic nuns filed suit against SWBI, trying to force the gunmaker to abandon manufacturing and sales of “assault-style” weapons. After the close, JNJ announced it had settled an unspecified number of additional talc cancer lawsuits. (JNJ settled with several major law firms with settlements covering all their clients in such suits.) Also after the close, BAYRY (Bayer) was ordered to pay $3.5 million to a woman by a Philadelphia jury in the latest lawsuit over Roundup weedkiller causing cancer.

In major retraction news, late Tuesday evening, the National Retail Federation retracted previous claims by it and its members that nearly half of all retail losses in 2021 were due to “organized retail crime rings.” The group admitted that it made and repeated that claim despite data showing this was nowhere near true. (Clearly, this was another case of lying in politics and attempting to shift blame from its members in the stock market.)

Overnight, Asian markets leaned toward the green side with only two of region’s 12 exchanges in the red and another (New Zealand) unchanged. Japan (+2.04%) and Australia (+1.65%) led the region higher on the day. In Europe, we see a similar picture taking shape with only four of the 15 bourses in the red at midday. Russia (-1.31%) is by far the biggest loser while the CAC (+0.50%), DAX (+0.30%), and FTSE (+0.49%) lead the rest of the region higher in early afternoon trade. In the US, as of 7:30 a.m., Futures are pointing toward a start to the day modestly on the green side of flat. The DIA implies a +0.09% open, the SPY is implying a +0.14% open, and the QQQ implies a +0.16% open at this hour. At the same time, 10-year bond yields are back up a bit to 4.193% and Oil (WTI) is down another percent to $71.61 per barrel in early trading.

The major economic news scheduled for Wednesday includes Nov. ADP Nonfarm Employment Change (8:15 a.m.), Oct. Exports, Oct. Imports, Oct. Trade Balance, Q3 Nonfarm Productivity, and Q3 Unit Labor Costs (all at 8:30 a.m.), and Weekly EIA Crude Oil Inventories (10:30 a.m.). The major earnings reports set for before the open are limited to BF.A, CPB, KFY, OLLI, THO, and UNFI. Then, after the close, CHWY, GME, GEF, and VEEV report. (We are also supposed to get testimony from all the major bank (JPM, MS, C, GS, and BAC) CEOs. They are expected to testify that banks will be pushed to the brink of failure (and the economy is in big trouble) IF…IF Fed-proposed additional banking oversight and reporting is enacted OR the requirements for capital held in reserve for runs is raised. (JPM CEO Dimon has already said he will testify that higher cash reserve requirements for banks will mean higher interest rates, driving homebuyers out of the market, and hurting low-to-moderate income borrowers.)

In economic news later this week, on Thursday, we get the Weekly Initial Jobless Claims and the Fed Balance Sheet. Finally, on Friday, we get, Nov. Nonfarm Payrolls, Nov. Private Nonfarm Payrolls, Nov. Participation Rate, Nov. Unemployment Rate, Nov. Avg. Hourly Earnings, Michigan Consumer Sentiment, Michigan Consumer Expectations, Michigan 1-year Inflation Rate, Michigan 5-year Inflation Rate, and WASDE Ag Report.

In terms of earnings reports later this week, on Thursday, we hear from CIEN, DG, GMS, AVGO, COO, DOCU, LULU, and RH. Finally, on Friday, there are no major earnings reports scheduled.

In economic/banking outlook news, the heads of four major US banks told a GS conference that they are all expecting some version of a soft landing, thanks in large part to a resilient consumer. GS CEO Soloman said, “People continue to be cautious on the U.S. economy, but I think it’s very, very clear that the U.S. economy has been more resilient than we expected.” Meanwhile, WFC CEO Scharf remarked, “The consumer is still very, very strong…as we sit here today, our base case is something closer to a soft landing as opposed to something far more serious than that.” Then BAC CEO Moynihan said, “We’ll be at about $1 billion in fees this quarter,” (which reflects a low single-digit decline that outperforms the average industry expectation). Finally, SYF CEO Wenzel said delinquencies are not as bad as feared, saying, “As we think about the fourth quarter, delinquency rates will rise, with losses peaking in the first half of the year” (while still being below industry forecasts).

In China news, MCO (Moody’s) downgraded China’s sovereign debt credit rating outlook from stable to negative. It kept its “A1” rating on Chinese debt, but similarly to the way outlooks were reduced on US debt during various political games in the US, the “outlook” was reduced. MCO cited property sector pressures and warning signs related to Chinese growth (including a major national pneumonia outbreak).

So far this morning, KFY and OLLI reported beats on both the revenue and earnings lines. Meanwhile, CPB, THO, and UNFI all missed on revenue while beating on earnings. (Note that UNFI’s earnings beat was just a significantly lower loss than had been forecasted.) It is worth noting that OLLI raised its forward guidance. (BF.A reports closer to the opening bell.)

With that background, it looks like all three major index ETFs are looking to make a modest gap higher this morning. All three major index ETFs opened the premarket higher and are putting in small candles so far in the early session. QQQ opened up above its T-line (8ema) again and has traded back down to retest that level this morning. However, the overall character of the early session suggests nothing has changed yet and more consolidation remains Mr. Market’s plan. On balance, the Bulls are in control of the longer-term trend but the short-term trend is consolidating or sideways. In terms of extension, none of the three major index ETFs is extended too far from its T-line. At the same time, the T2122 indicator is back down in its mid-range. So, both the Bulls and the Bears have plenty of slack to run…if they can find the momentum.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the man in the green bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is absolutely no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby. It’s a job. The money is real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Corporate Buybacks

The urgency of corporate buybacks as we near the beginning of the blackout period was not quite enough to recover the early selling with only the IWM managing to close the day in the green. The rest of this week’s jobs data will be the center of attention as we head toward the market-moving Employment Situation report Friday morning. Today we will begin with the JOLTS report and a handful of notable earnings to provide bullish or bearish inspiration. However, Moody’s credit downgrade highlighting the weakening economic conditions in China could start the day with some bearish activity so plan your risk carefully.

Overnight Asian markets have had a rough session selling off across the board after a credit downgrade adding the economic concerns in China. However, European markets trade with modest gains and losses as Ericsson surges while Nokia plunges. Ahead of earnings and economic reports U.S. Futures point to bearish open.

Economic Calendar

Earnings Calendar

Notable reports for Tuesday include AZO, AVAV, CRMT, ASAN, BOX, CNM, PLAY, FERG, GIII, MDB, PHR, S, SIG, SFIX, TOL, & YEXT.

News & Technicals’

Moody’s, a global credit rating agency, has lowered its outlook on China’s government credit ratings from stable to negative, citing concerns over the country’s fiscal, economic, and institutional strength. Moody’s said that China’s government may have to provide more support and bailouts for local governments and state-owned enterprises that are facing financial difficulties, which could weaken China’s fiscal position and increase its debt burden. Moody’s also said that China’s economic growth may slow down further due to structural challenges and external pressures and that China’s institutional capacity may not be able to cope with the rising complexity and risks of its economy. Moody’s maintained China’s long-term rating on its sovereign bonds at “A1”, which is the fifth-highest level in its scale, but warned that it could downgrade it in the future if China’s fiscal, economic, and institutional situation deteriorates.

Some experts believe that the Fed is lagging behind the market expectations and needs to cut interest rates sooner rather than later. Paul Gambles, managing partner at MBMG Group, said that the Fed is behind the curve and that traders are anticipating a 25-basis-point cut as early as March 2024. David Roche, a veteran investor and president of Independent Strategy, said that he is “almost certain that the Fed is done raising rates” and that inflation will not go back to 2% anymore. These views suggest that the Fed may have to adjust its policy stance and communication in response to the changing economic and financial conditions.

Banque Pictet, a major Swiss bank that provides private banking services, has admitted that it helped U.S. taxpayers and others evade taxes by hiding over $5.6 billion from the IRS. The bank has reached an agreement with the U.S. prosecutors to pay about $122.9 million in restitution and penalties and to cooperate with the ongoing investigation. In exchange, the Justice Department will defer the prosecution of the bank for three years and then drop a criminal charge of conspiracy to defraud the IRS, if the bank complies with the terms of the deal. The bank is one of the several Swiss banks that have been accused of facilitating tax evasion by U.S. clients, and the latest to settle with the U.S. authorities.

The S&P 500 ended its five-week winning streak on Monday, with most of the indexes closing lower despite the energy of the corporate buybacks. The best-performing sector was real estate, while sectors that rely on growth, such as information technology and communication services, lagged. Small-cap stocks gained nearly 1% today adding to their more than 3% increase last week. Today’s market movement may reflect some profit-taking in areas like large-cap technology that have driven the market higher in the recent rally. The bulls and bears will look for inspiration in several reports on the labor market, starting with the JOLTS report today. There will also be a dozen or so notable earnings reports that have the potential to inspire price action. The Moody’s credit downgrade of China could make the bears a bit more aggressive so it may be wise to take some profits or raise stoploss orders to protect your capital.

Trade Wisely,

Doug

NOK Loses Deal as PMI and JOLTS Ahead

Monday was a day that saw most of the move made at the open. The SPY gapped down 0.75%, DAI gapped down 0.49%, and QQQ gapped down 0.99% at the open. At that point, the DIA immediately recrossed the opening gap and then spent the rest of the day meandering back and forth inside that gap area, closing near the top end (near Friday’s close). Meanwhile, SPY and QQQ traded to the lows of the day at 11 a.m., rallied back to the highs by 1 p.m., and then stayed there in a tight range the rest of the day. This action gave us a gap-down, white-bodied, large-bodied Hammer-type candle in the SPY. SPY also successfully retested its T-line (8ema) as support during the day. At the same time, QQQ printed a gap-down, white-bodied, Dragonfly Doji-type candle that crossed back below its T-line. Finally, DIA gave us a gap-down, white-bodied, inside-day candle.

On the day, six of the 10 sectors were in the red again with Basic Materials (-1.13%) out in front leading the way lower while Healthcare (+0.53%) held up much better than any of the other sectors. At the same time, the SPY lost 0.52%, DIA lost 0.10%, and QQQ lost 0.93%. The VXX gained slightly (+0.29%) to close at 17.28 and T2122 fell just a touch but remains in the top of its overbought territory at 97.01. 10-year bond yields climbed to 4.253% and Oil (WTI) dropped 1.03% to close at $73.31 per barrel. So, Monday was one of those days where the move was either captured at the open or it was missed. Surprisingly, DIA was again the strongest of the major index ETFs (with particular strength in MMM) while QQQ was the weakest (with INTC, NVDA, and NFLX dragging the most). This all happened on average volume in the DIA and below-average volume in the SPY and QQQ.

The major economic news reported Monday was limited to October Factory Orders (month-on-month), which came in well below expectations at -3.6% (compared to a forecast of -2.6% and significantly below a September reading of +2.3%). However, in the afternoon, the NY Fed released a report (Multivariate Core Trend) which indicated that underlying inflation pressures eased in October (2.6%) compared to September (2.88%).

After the close, JOAN missed on revenue while beating on earnings (albeit still a loss).

In stock news, SPOT announced that it will lay off about 1,500 employees (roughly 17% of the workforce). (This was SPOT’s third round of cuts, although the other two were much smaller, in 2023.) At the same time, the Chinese Passenger Car Assn. released date Monday that indicated TSLA sales fell 18% in November (this was TSLA’s worst drop since December 2022). Later, TWLO also announced it would cut 5% of its workforce. At the same time, RIOT announced a $290+ million order from a crypto miner. Elsewhere, F reported a 0.5% decline in US sales in November. (Sales had dropped 5.3% in October.) However, F’s electric vehicle sales jumped 43.3% versus the same month a year ago. Near the close, Bloomberg reported that ZM is in discussion to acquire (via merger) FIVN. After the close, T announced it has selected ERIC to build a telecom network that uses new technology, a project covering 70% of the US and scheduled to be completed by late 2026. (ERIC was selected over NOK.) Also after the close, Bloomberg reported that Mark Zuckerberg’s trust had just sold 682,000 shares of META.

In stock government, legal, and regulatory news, ATR was awarded an FDA contract for $6 million contract to develop an environmentally-friendly metered-dose inhaler. At the same time, NIO was given a license to produce electric vehicles in China. In Spain, a group representing 83 Spanish media outlets filed a $600 million lawsuit against META. The case alleges META engaged in unfair competition in the advertising market. The case also alleges that META violated EU data protection rules between 2018-2023. (The worry is that this is a case that could easily be replicated throughout the EU.) Later, analysts are saying that questioning from the US Supreme Court seems to indicate a divided court in the case involving Purdue Pharma whose bankruptcy filing immunized the Sackler family (Purdue owners, but not declaring bankruptcy) from responsibility in the opioid settlement the company had agreed prior to filing for that bankruptcy. At the same time, in Asia, VFS is now under investigation following a massive $93.00 to $4.59 share price decline. Law firms are investigating the company for allegedly disseminating false and misleading statements prior to the decline. Later, in a re-ignition of tensions, FL Gov. DeSantis’ hand-picked board leveled accusations at DIS and the previous board that controlled the DIS park region. The new board said DIS controlled the old board via millions of dollars in free tickets, discounted hotel prices, merchandise, and other gifts. After the close, DHR received court approval to acquire UK firm Abcam plc. Finally, in another case being heard by the US Supreme Court, the court is hearing arguments Tuesday on whether to preclude Congress and the Executive branch from being able to tax stock holdings, real estate, and other asset appreciation. In other words, stocks, real estate, art, and commodities owned would not be taxable until or unless sold. (I am unsure whether the case could make state and local property taxes void as well, but it would certainly seem possible.)

Overnight, Asian markets leaned heavily to the downside. Shenzhen (-1.97%), Hong Kong (-1.91%), Shanghai (-1.67%), and Japan (-1.37%) led the region lower. However, in Europe, markets are leaning to the upside (on mostly modest moves) at midday. The CAC (+0.28%), DAX (+0.24%), and FTSE (-0.57%) lead the region on volume with Greece (-0.99%) being by far the biggest mover in early afternoon trade. In the US, as of 7:30 a.m., Futures are pointing toward another lower start to the day. DIA implies a -0.25% open, the SPY is implying a -0.33% open, and the QQQ implies a -0.48% open at this hour. At the same time, 10-year bond yields are back down to 4.234% and Oil (WTI) is just on the red side of flat at $72.90 per barrel in early trading.

The major economic news scheduled for Tuesday includes Nov. S&P Global Services PMI and Nov. S&P Global Composite PMI (both at 9:45 a.m.), Nov. ISM Non-Mfg. PMI, Nov. ISM Non-Mfg. Employment, Nov. ISM Non-Mfg. Price Index, and Oct. JOLTs Job Openings (all at 10 a.m.), and API Weekly Crude Oil Stocks (4:30 p.m.). The major earnings reports set for before the open are limited to AZO, CNM, DBI, FERG, GIII, HOV, SJM, NIO, and SIG. Then, after the close, PLAY, and TOL report.

In economic news later this week, on Wednesday, Nov. ADP Nonfarm Employment Change, Oct. Exports, Oct. Imports, Oct. Trade Balance, Q3 Nonfarm Productivity, Q3 Unit Labor Costs, and Weekly EIA Crude Oil Inventories are reported. On Thursday, we get the Weekly Initial Jobless Claims and the Fed Balance Sheet. Finally, on Friday, we get, Nov. Nonfarm Payrolls, Nov. Private Nonfarm Payrolls, Nov. Participation Rate, Nov. Unemployment Rate, Nov. Avg. Hourly Earnings, Michigan Consumer Sentiment, Michigan Consumer Expectations, Michigan 1-year Inflation Rate, Michigan 5-year Inflation Rate, and WASDE Ag Report.

In terms of earnings reports later this week, on Wednesday, BF.A, CPB, KFY, OLLI, THO, UNFI, CHWY, GME, GEF, and VEEV report. On Thursday, we hear from CIEN, DG, GMS, AVGO, COO, DOCU, LULU, and RH. Finally, on Friday, there are no major earnings reports scheduled.

In miscellaneous news, in China, a court granted China Evergrande Group (the troubled and bankrupt real estate developer) an extension until January 29 to revise its offshore debt restructuring plan. Evergrande has $300 billion in liabilities. Meanwhile, the White House announced Monday that it is essentially out of funds to support Ukraine’s defense (more than 90% of which are actually paid to US corporations and not sent abroad). A letter from the White House to Congress said the funds would be exhausted by the end of the month. In Asia, Japan announced that Japanese CPI fell more than expected in November (flat) after a +0.4% gain in October.

So far this morning, AZO, FERG, and SIG have reported beats on both the revenue and earnings lines. Meanwhile, GIII, SJM, and NIO missed on revenue while beating on earnings. Unfortunately, DBI missed on both the top and bottom lines. It is worth noting that DBI and NIO lowered their forward guidance. At the same time, GIII raised its guidance.

With that background, it looks like all three major index ETFs are continuing their consolidation or pullback. The DIA started the premarket lower and is printing a small, black-bodied, “inside day” candle in the early session. At the same time, SPY also opened the premarket lower and is printing a small black-bodied candle that is now retesting its T-line (8ema). Meanwhile, the QQQ is following the DIA’s lead, but its “inside day” premarket candle is inside Monday’s long lower wick (instead of inside of Monday’s candle body). So, on balance, the Bulls are in control of the longer-term trend but the short-term trend is consolidating or sideways. In terms of extension, none of the three major index ETFs is extended too far from its T-line. However, at the same time, the T2122 indicator remains at the high end of its overbought territory. So, the market may still need some relief from extension in the form of more consolidation or pullback. With that said, remember that the market can remain overbought longer than you can remain solvent predicting the turn too early. So, don’t be too quick to predict a turn is underway. In the long run, successful traders follow trend while those who predict reversals have a few big winners while getting beat to death most of the time.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the man in the green bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is absolutely no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby. It’s a job. The money is real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Slow Day as Oct Factory Orders On Tap

On Friday, the Bulls closed out another week with a strong performance. SPY gapped down 0.12%, DIA gapped up 0.09%, and QQQ gapped down 0.29%. At that point, all three major index ETFs ground sideways for the first hour. However, at that point, all three rallied steadily for 2.5 hours, reaching the highs of the day at 1 p.m. From there it was a sideways grind in a tight range (perhaps with a slight bearish trend) the rest of the day. This action gave us large-body white candles in the SPY and DIA as well as a not-quite-bullish-engulfing candle with 50% wick in the QQQ. QQQ also crossed back above its T-line (8ema) while the other two remained above their own T-lines. So, DIA and SPY continued their rallies while QQQ continued its Bull Flag pattern. This took place on above-average volume in the DIA and a bit less-than-average volume in the QQQ.

On the day, all 10 sectors were in the green again with Basic Materials (+2.06%) out in front leading the way higher as Energy (+0.47%) lagged well behind the other sectors. At the same time, the SPY gained 0.59%, DIA gained 0.85%, and QQQ gained 0.29%. The VXX fell slightly to close at 17.23 and T2122 spiked up to the top of its overbought territory at 99.01. 10-year bond yields dropped to 4.209% (which was the low since mid-September) and Oil (WTI) dropped 2.05% to close at $74.40 per barrel. So, Friday saw the three major index ETFs diverge at the open but then basically move in lockstep the rest of the day. This came as the Bulls drove the price up to finish a fifth-straight gain on strong white candles in the large-cap index ETFs. Meanwhile, QQQ also gave us a fifth-straight week of gains but on a much more indecisive Doji-type candle.

The major economic news reported Friday included November S&P Global Mfg. PMI, which came in just as expected at 49.4 (compared to a forecast of 49.4 and an Oct. value of 50.0). Later, the November ISM Mfg. Employment Index came in lower than the October value at 45.8 versus October’s 46.8 reading. At the same time, Nov. ISM Mfg. PMI remained flat at 46.7 (lower than the forecast of 47.6 but in line with the Oct. value of 46.7). In addition, the Nov. ISM Mfg. Price Index came in significantly higher at 49.9 (versus a forecast of 46.2 and the October reading of 45.1).

In Fed Speak news, Chicago Fed President Goolsbee said he believes that inflation was “on track” to reach the FOMC’s 2% target. Goolsbee’s upbeat comments included that (the inflations fight) “It’s working the way we’ve anticipated,” then adding that there is “no evidence” that inflation has stalled or reversed course at 3%. Goolsbee said, “I still think it’s on track to get back to 2%.” (Goolsbee was one of six voting members who indicated they think rates have increased enough during the week.) Later, Fed Chair Powell also said there was a risk of the Fed going too far with rate hikes and that since the economy is slowing, it makes sense for the Fed to become “more balanced” in their approach and the Fed should “move carefully” going forward. Powell said, “We are getting what we wanted to get (out of the economy), … Having come so far so quickly, the (FOMC) is moving forward carefully, as the risks of under and over-tightening are becoming more balanced.” However, as he is wont to do, Powell kept to a non-committal path by later saying “We are prepared to tighten policy further if it becomes appropriate to do so.”

In stock news, BK announced Friday that it will raise its minimum wage to $22.50 per hour and expand its health benefits to include mental health. All this takes effect in March 2024. Elsewhere, WMT added its name to the growing chorus of major ad buyers who have said they will no longer advertise on X (Twitter) after Elon Musk’s tirade against advertisers boycotting his platform after his recent antisemitic statements. Later, Reuters reported that the LUV pilots union is very near a new labor deal with the airline. The report said the few remaining details may take a couple of weeks to iron out, but the basic framework of the agreement is in place. After the close, it was announced that UBER, JBL, and BLDR would join the S&P500 on Dec. 18. At the same time SEE, ALK, and SEDG will be removed from the S&P500. On Sunday it was announced that ALK has also agreed to buy HA in a $1.9 billion deal. (ALK will pay $18/share for HA as well as taking on $900 million of HA’s debt. HA closed Friday at $4.86/share.)

In stock government, legal, and regulatory news, the NHTSA announced it had opened an investigation into 73k GM Chevrolet Volt hybrid cars. (The inquiry comes from customer reports that the cars lose power suddenly and unexpectedly.) Elsewhere, national security interests prompted the US to force Saudi Aramco-backed venture capital firm Prosperity-7 to divest from an AI startup (Rain Neuromorphics). That startup is backed by OpenAI co-founder and returned CEO Sam Altman (which has led to wide speculations that OpenAI will acquire Rain at some point, which would impact MSFT among others). Later, the US Dept. of Justice argued with the National Assn. of Realtors in a US Appeals Court Friday. NAR wanted the court to prevent the DOJ from reopening its antitrust case against realtors in relation to “pocket listings” (properties that are not listed to the public but still sold with the seller charged thousands of dollars in fees). Late in the afternoon Friday, the NHTSA said it is expanding its investigation into HMC Civic steering issues. (The probe covers 238k 2022-2023 Honda Civics after 145 reports of loss of steering control while in motion.) After the close, Reuters reported that BA has been eliminated from the US Air Force competition for an $8.3 billion initial contract (through 2028) to develop a successor to the E-4B Nightwatch (Doomsday Plane). Also after the close, an NRLB judge found that AMZN as well as consultants hired by AMZN broke several federal labor laws by calling union organizers “thugs” (and other epithets) as well as interrogating employees, sending suspected union sympathizers home early (and changing their shift assignments), confiscating union pamphlets, conducting surveillance of employees at the company’s Staten Island NY distribution facility.

Overnight, Asian markets were mixed but leaned toward the red side with seven of the 12 regional exchanges down on the day. Hong Kong (-1.09%), Shenzhen (-0.62%), and Japan (-0.60%) paced the losses while India (+2.07%) was by far the biggest gainer. In Europe, we see a similar mixed picture taking shape at midday. The CAC (-0.25%), DAX (+0.06%), and FTSE (-0.45%) lead the region in early afternoon trade. In the US, as of 7:30 a.m., Futures are pointing toward a down start to the day. The DIA implies a -0.26% open, the SPY is implying a -0.41% open, and the QQQ implies a -0.57% open at this hour. At the same time, 10-year bond yields are up to 4.259% and Oil (WTI) is off by 0.55% to $73.66 per barrel in early trading.

The major economic news scheduled for Monday is limited to October Factory Orders (10 a.m.). The major earnings reports set for before the open are limited to SAIC. Then, after the close, JOAN reports.

In economic news later this week, on Tuesday, we get Nov. S&P Global Services PMI, Nov. S&P Global Composite PMI, Nov. ISM Non-Mfg. PMI, Nov. ISM Non-Mfg. Employment, Nov. ISM Non-Mfg. Prices, Oct. JOLTs Job Openings, and API Weekly Crude Oil Stocks. Then Wednesday, Nov. ADP Nonfarm Employment Change, Oct. Exports, Oct. Imports, Oct. Trade Balance, Q3 Nonfarm Productivity, Q3 Unit Labor Costs, and Weekly EIA Crude Oil Inventories are reported. On Thursday, we get the Weekly Initial Jobless Claims and the Fed Balance Sheet. Finally, on Friday, we get, Nov. Nonfarm Payrolls, Nov. Private Nonfarm Payrolls, Nov. Participation Rate, Nov. Unemployment Rate, Nov. Avg. Hourly Earnings, Michigan Consumer Sentiment, Michigan Consumer Expectations, Michigan 1-year Inflation Rate, Michigan 5-year Inflation Rate, and WASDE Ag Report.

In terms of earnings reports later this week, on Tuesday we hear from AZO, CNM, DBI, FERG, GIII, HOV, SJM, NIO, SIG, PLAY, and TOL. Then Wednesday, BF.A, CPB, KFY, OLLI, THO, UNFI, CHWY, GME, GEF, and VEEV report. On Thursday, we hear from CIEN, DG, GMS, AVGO, COO, DOCU, LULU, and RH. Finally, on Friday, there are no major earnings reports scheduled.

In oil news, speaking of algo traders, Bloomberg reported that the roller coaster in oil prices (moving as much as 6% in one day) in the past two months is being increasingly driven by algos. Oil has traded near $100 and near $70 per barrel during that time, having fallen a net two percent in November. One analyst told Bloomberg that the bots are trading positions that are larger than BP, SHEL, and Koch…combined. Right now, nearly 60% of all oil trades are made by algorithm. Elsewhere, the US imposed more sanctions on Russia in measures intended to reduce the price cap on Russian oil by targeting three entities and three oil tankers. With the closing of these loopholes, higher-priced Russian oil is removed from the market. Separately, the US, EU, and UK increased oversight of ships carrying Liberian, Marshall Islands, and Panamanian flags after accusing vessels under those flags of violating price-cap sanctions on Russian oil. Meanwhile, oil prices fell Friday as both analysts and investors were skeptical of OPEC+ additional production cuts after there was no firm schedule or assignment of the amount of cuts that will be made by each OPEC+ member.

In miscellaneous news, Bloomberg reported Friday evening that quant traders had been working under the belief they had discovered a scientific algorithm that could accurately predict US bond markets. However, a doctoral candidate at the UK’s Warwick Business School discovered that the data used to create and test that model (algorithm) was actually in error. This caused the professor who originally published the research leading to the bond market algorithm to retract his paper and left several quant funds scrambling to figure out what to do. Finally, in earnings news, SAIC beat on both the top and bottom lines this morning and also raised its forward guidance.

With that background, it looks like all three major index ETFs are starting the day with smaller, black, inside day-type candles. The QQQ is retesting its T-line (8ema) in the premarket session with the DIA again looking the strongest of the three early. The SPY sits above its T-line and the DIA sits comfortably above its own. So, on balance, the Bulls are still in control of both the shorter and the longer-term trends. In terms of extension, only the DIA could in any way be seen as extended from its T-line and that would be a marginal call. However, at the same time, the T2122 indicator is now nearly pegged at the very top of its overbought territory. So, the market needs extension relief in the form of consolidation or pullback. With that said, remember that the market can remain overbought longer than you can remain solvent predicting the turn too early.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the man in the green bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is absolutely no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby. It’s a job. The money is real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

PFE Takes a Hit with ISM PMI Ahead

Markets diverged on Thursday. SPY gapped up 0.16%, DIA gapped up a whopping 0.58%, and QQQ opened flatish, up just 0.08%. From there, the SPY traded sideways with a very slight bearish trend until 2 p.m. when it slowly rallied, crossing back across the gap and closing very near the highs of the day. At the same time, DIA traded sideways from the open with a very slight bullish trend until 2 p.m. when it too began a stronger rally, also closing very near the highs of the day. Finally, QQQ sold off pretty strongly until noon, traded sideways along the lows until 2 p.m., and then also rallied the last two hours of the day, closing about halfway between the lows and the open. This action gave us a white-bodied, Bullish Harami Hammer candle in the SPY, a large body white candle that could be seen as a “Best Friend” in the DIA, and a black-bodied Hammer candle in the QQQ. All three major index ETFs remain above their T-line (8ema) and now-rising 50sma.

On the day, eight of the 10 sectors were in the green again with Healthcare (+1.02%) and Industrials (+0.98%) out front leading the way higher while Technology (-0.28%) lagged well behind the other sectors. At the same time, the SPY gained 0.39%, DIA gained 1.51%, and QQQ lost 0.25%. (DIA was led by a massive +9.36% day by CRM.) The VXX fell 1.54% to close at 17.29 and T2122 rose a bit to the middle of its overbought territory at 89.59. 10-year bond yields rose to 4.33% and Oil (WTI) dropped 2.89% to close at $75.61 per barrel. So, Thursday saw divergence with DIA popping and running to new highs going back to January 2022. Meanwhile, SPY and QQQ both continued to grind sideways in their consolidations. This happened on average volume in the DIA and QQQ, as well as less-than-average volume in the SPY.

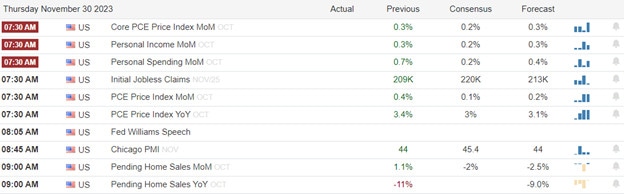

The major economic news reported Thursday included the October PCE Price Index (month-on-month) which came in lower than expected at 0.0% (compared to a forecasted +0.1% and the September value of +0.4%). On a year-on-year basis, October’s PCE Price Index was in line with predictions at +3.0% (versus a +3.0% forecast and down significantly from the +3.4% September reading). At the same time, the Oct. Core PCE Price Index was right in line with anticipated values (which means down significantly) as month-on-month at +0.2% (compared to a +0.2% forecast but far lower than September’s +0.7% reading). On a year-on-year basis, Oct. Core PCE Price Index came in at +3.5% (versus a forecast of +3.5% and down only a bit from September’s +3.7% value). Elsewhere, the Weekly Initial Jobless Claims came in very near expectation at 218k (compared to a forecast of 220k and up a bit from the prior week’s 211k). At the same time, October Personal Spending (month-on-month) was at +0.2% (versus a +0.2% forecast and well down from the Sept. reading of +0.7%). Later, Chicago PMI came in much better than predicted at 55.8 (compared to a 45.4 forecast and the previous value of 44.0). Then, Oct. Pending Home Sales fell less than expected, down 1.5% (versus a -2.0% forecast but far worse than September’s +1.0%). Finally, after the close, the Fed Balance Sheet continued its fall, dropping from $7.811 trillion to $7.796 trillion (down $15 billion for the week).

After the close, AMWD, MRVL, and ULTA all reported beats on both the revenue and earnings lines. Meanwhile, DELL missed on revenue while beating on earnings. It is worth noting that also DELL lowered its guidance.

In retrospect, November is the best month the market has seen all year. The SPY gained 9.13% (most since July of 2022) for the month. Meanwhile, DIA added 8.93% (the biggest monthly gain it has seen since October 2022). Finally, QQQ saw 10.82% of gains, which was its biggest monthly bullish move since July 2022 as well. At the same time, 10-year bond yields were down nearly 11%.

In stock news, Reuters reported Wednesday that WMT has shifted its supply chain to import more from India and less from China. WMT now sources 25% of its goods from India (compared to just 2% in 2018). Meanwhile, shipments from China have fallen from 80% to 60% of its total imports over the same period. Later, JPM CEO Dimon said the bank would exit China if required to do so by the US government (as if, not complying with US government requirements was an option for the bank). At the same time, UBER struck a deal with London’s black cabs. The deal will roll out a new service in 2024 where London’s “knowledge-tested” cabbies to sign up with UBER to take pre-booked journeys. (UBER is taking no commission for the first six months of the deal in an effort to smooth over a decade of friction between the two sides.) At the same time, mem stock GME had another monster volatility day, opening 15% higher, trading at more than 30% higher one point, and closing up 20.46%. Elsewhere, in China, NIO announced a partnership with EV-maker Geely to create a battery hot-swapping network across China (as opposed to charging stations). Later, the Wall Street Journal reported that CI and HUM are in advanced talks on a merger. (The two had considered merging in 2015, but HUM chose to partner with Aetna at that time.) At the same time, OKTA notified customers that hackers had stolen information including the name and email address of every OKTA customer support user. Meanwhile, Reuters reported after the close that AVGO is reviewing strategic options for two business units (End-User Computing and Carbon Black) that it had acquired in the purchase of VMW. Finally, self-proclaimed genius Elon Musk claimed advertisers that pulled their ads from his former Twitter (now X) platform were blackmailing him related to his antisemitic posts. In a fiery interview Wednesday, the bright bulb told any such advertisers to “Go f*@k yourself” and then asked if that was clear enough (message to the advertisers). He went on to double down that his post referencing the supposed “great replacement theory” on Nov. 15 did speak the actual truth. However, he also said it was a very foolish post and was akin to handing his detractors a loaded gun.

In stock government, legal, and regulatory news, the USDA has extended its trial program to allow US pork processing plants to operate at higher speeds (while still collecting data on the impact of the speed increase on workers, safety, and quality). This is a big win for TSN, JBSAY, WHGRF, BRFS, and HRL. Later, Reuters reported that EU antitrust lawyers initially opposed sending a charging sheet to AMZN related to its acquisition if IRBT. (This indicates there are some in the EU antitrust group who do not oppose the deal and some feel this gives hope for eventual deal approval.) Later, a lawsuit was filed against CSX claiming that a Thanksgiving-eve train derailment that spilled molten sulfur in Eastern KY was caused by company negligence, recklessness, and failure to follow federal train regulations. Elsewhere, the US Supreme Court gave hints that its right-wing super majority is leaning toward limiting the SEC’s power to enforce securities laws. (The case stems from a fund manager being found guilty of securities fraud and the SEC fining and barring him from the industry.) Later, VZ agreed to pay $23.5 million to resolve an FCC investigation into its TracFone subsidiary violating government program rules (collecting millions of dollars in undeserved emergency broadband benefit funds). After the close, DD, CTVA, and CC agreed to pay the state of OH $110 million to resolve claims related to the release of toxic PFAS “forever chemicals.”

Overnight, Asian markets were mixed but leaned to the green side in terms of breadth. Hong Kong (-1.25%) and South Korea (-1.19%) were by far the biggest movers in the region with India (+0.67%) leading the more numerous green exchanges to gains. In Europe, with the exceptions of Russia (-0.47%) and Denmark (-0.14%) we see green across the board at midday. The CAC (+0.38%), DAX (+0.74%), and FTSE (+0.65%) are leading the region higher in early afternoon trade. In the US, as of 7:30 a.m., the Futures are pointing toward a mixed and modest start to the day. The DIA implies a +0.12% open, the SPY is implying a -0.07% open, and the QQQ implies a -0.25% open at this hour. At the same time, 10-year bond yields are up slightly to 4.344% and Oil (WTI) is just on the green side of flat at $76.07 per barrel in early trading.

The major economic news scheduled for Friday includes Nov. S&P Global Mfg. PMI (9:45 a.m.), Nov. ISM Mfg. Employment, Nov. ISM Mfg. PMI, and Nov. ISM Mfg. Price Index (all three at 10 a.m.). We also hear from Fed Chair Powell at 11 a.m. The major earnings reports set for before the open are limited to GCO and BMO. There are no earnings reports scheduled for after the close.

So far this morning, BMO reported a huge beat ($14 billion vs $6.07 billion estimate) on revenue while coming in just in-line on earnings. Unfortunately, GCO missed on both the top and bottom lines.

In miscellaneous overseas news, Reuters reports that the third-largest investment bank in China (CICC) has been told not to publish any bearish views on the Chinese economy or markets. The bank was also told that its staff should not wear luxury brand clothing and accessories or disclose their pay. Elsewhere, OPEC+ agreed to raise its production cuts by 2.2 million barrels per day for Q1 2024. (The group had already reduced production by five million barrels per day, mostly by Saudi Arabia, to support oil prices.) However, there was major confusion in Oil markets as the group provided no details on which countries were going to cut their output, by exactly how much, or exactly when. The group’s communique just said “early 2024” with individual countries (like UAE, who said “during Q1”, and Saudi Arabia, who said “during 2024”) muddying the waters. Lastly, Bloomberg said Friday that there are signs President Biden’s meeting with Chinese President Xi and the US’s low-key approach to China are bearing some fruit. The report a series of “market opening” measures taken by China since the recent event, including approving joint ventures and mergers as well as allowing visa-free access to citizens of six more countries (five in Europe plus Malaysia). The report also pointed out Chinese intervention to bolster and stabilize its stock markets.

In late-breaking news, PFE announced it has stopped development of a twice-daily version of its experimental weight-loss drug due to high rates of adverse side effects discovered during mid-stage trials. However, PFE said it will still continue development and release data on a once-daily version of the drug (different dosage means different side effects). This is a significant blow to PFE, which was trying to cash in on the wildy popular and fast-growing $10 billion weight-loss drug market now dominated by NVO and LLY. (PFE said it expects the niche to grow to $90 billion per year eventually.)

With that background, it looks like markets are again diverging and are undecided so far in the premarket session. The DIA gapped up in the early session but has sold off steadily to form a black bodied candle that is little changed from Thursday’s close. SPY did the same thing but had gapped up less and sold off more to creat a Bearish Engulfing candle so far this morning. For its part, QQQ opened the premarket flat and has sold off since, now retesting its T-line (8ema) for support. The SPY and DIA remain above their T-line (8ema) and all three are well above their 50smas. So, the Bulls are still in control of both the shorter and the longer-term trend. In terms of extension, the major index ETFs are all near their T-lines (8emas). At the same time, the T2122 indicator has now climbed back up into the center of its overbought territory. So, the Bulls still have some slack to work with if they are intent on continuing the really. Of course, the Bears have tons of room to run if they could mount a charge. Lastly, remember that it’s Friday…pay day. So, take some money off the table and get your account ready (lightened up or hedged) for the coming weekend news cycles,

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the man in the green bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is absolutely no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby. It’s a job. The money is real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Declining Market Breadth

After an energetic gap up to begin the Wednesday session, it faded away after more tough-talking Fed speak to end the mostly flat suffering from low-volume and declining market breadth. Today has the potential to a wild on with Jobless Claims, PCE figures, and a dozen or notable earnings events for investors to decipher. With pre-market futures pumping hard this morning working to finish the month strong we can’t rule out the possibility of a big point whipsaw so be prepared. If OPEC decides to cut production in today’s meeting it would be wise to keep an eye on the energy sector as well.

While we slept Asian markets closed the day green across the board despite another month of manufacturing declines in China. European markets are also bullish this morning as they work to close November strong. Overnight futures gained strength pointing to a gap up that may well pop the Dow to a new high for the year but be careful the data out this morning could provide considerable price volatility including big point whipsaws.

Economic Calendar

Earnings Calendar

Notable reports for Thursday include ASO, AMBA, AMWD, BIG, CBRL, DELL, DOMO, FRO, KR, PD, RY, TITN, TD, UBS, ULTA, PATH, ZUMZ.

News & Technicals’

Sweden’s bid to join NATO has been delayed by the opposition of two member states, Hungary and Turkey. Sweden, along with Finland, applied to join the military alliance in May 2022, hoping to strengthen their security and cooperation with other European countries. Finland became a full member of NATO in April 2023, but Sweden’s accession has been stalled by the veto of Hungary and Turkey, who have expressed concerns over Sweden’s stance on human rights, migration, and regional conflicts. In July 2023, at a NATO summit, Turkish President Erdogan agreed to lift his veto and allow Sweden to join the alliance, after receiving assurances from Sweden’s Prime Minister Stefan Löfven on various issues. However, the Turkish Parliament still has to ratify the decision, and it is unclear when that will happen. Sweden’s NATO membership remains uncertain, as the country awaits the final approval from its last obstacle.

China’s factory activity contracted for the second consecutive month in November, as the country faced slowing demand and supply chain disruptions amid the COVID-19 pandemic. According to the official manufacturing Purchasing Managers’ Index (PMI), which measures the activity level of large and state-owned enterprises, China’s manufacturing sector shrank to 49.4 in November, down from 49.5 in October and below the median forecast of 49.7. A reading below 50 indicates contraction, while a reading above 50 indicates expansion. China’s non-manufacturing PMI, which covers the services and construction sectors, also weakened to 50.2 in November, from 50.6 in October. The data suggests that China’s economic recovery is losing momentum, as the country faces challenges from domestic outbreaks, power shortages, environmental regulations, and external pressures. China’s central bank has recently taken steps to ease monetary policy and support growth, such as cutting the reserve requirement ratio for banks and injecting liquidity into the financial system. However, analysts expect that China’s growth will remain subdued in the fourth quarter and the first half of 2024.

The Fed may face a difficult decision in 2024, as the market expects it to slash interest rates aggressively to support a weakening economy and a rising unemployment rate. According to Fed funds futures, which reflect the market’s expectations of future monetary policy, the Fed is expected to cut its benchmark rate by 1.25 percentage points in 2024, or five times by 0.25 percentage points each. However, some analysts doubt that the Fed will deliver such a dovish policy stance, as it may have to balance the risks of inflation, financial stability, and policy effectiveness. “The market keeps trying to front-run these rate cuts, only to be disappointed,” said Kathy Jones, chief fixed income strategist at Charles Schwab. The Fed has indicated that it will be data-dependent and flexible in its policy decisions, but it may face challenges in communicating and managing the market’s expectations.

The stock market ended the day mostly flat, whipsawing on low-volume and declining market breadth after attempting a break to a new annual high Dow. However, investors continued efforts to front-run lower interest rates but one might have to consider the hot 5.2 GDP provides the Fed all the coverage it needs to keep rates up. Today, we will look to Jobless Claims, PCE, PMI, Pending Home Sales, and several notable reports to find inspiration to keep the buying party going until the end of the month. It may be wise to keep an eye on the energy sector as well if Thursday’s OPEC+ meeting results in an overall production cut due to the weakening demand. With the big effort to gap the market higher this morning watch for clues of whipsaw from this very extended market condition.

Trade Wisely,

Doug

Inflation Down In Europe, US PCE On Tap

Wednesday saw markets gap higher on stronger than expected GDP only to spend the rest of the day fading that gap. The SPY gapped up 0.50%, DIA opened 0.26% higher, and QQQ gapped up 0.65%. However, as mentioned, all three major index ETFs sold the rest of the day with SPY and QQQ recrossing that opening gap at about 3 p.m. and DIA never quite filling the gap. This action gave us large black-bodied candles with upper wicks that nearly printed Dark Cloud Cover candles in the SPY and QQQ. At the same time, DIA printed a black-bodied Gravestone Doji-type candle. All three remain up above their T-line (8ema) with SPY and QQQ having potential support not far below while DIA may have run into resistance above at the highs of the day. This happened on lower-than-average volume in all three major index ETFs.

On the day, seven of the 10 sectors were in the green again with Financial Services (+0.79%) out front leading the way higher while Consumer Defensive (-0.74%) lagged behind the other sectors. At the same time, the SPY lost 0.07%, DIA gained 0.15%, and QQQ lost 0.10%. The VXX climbed 1.44% to close at 17.56 and T2122 climbed back into the lower end of the overbought territory at 86.61. 10-year bond yields fell again to 4.257% and Oil (WTI) popped another 1.68% to close at $77.69 per barrel. So, Wednesday Started as a gap higher but immediately turned into a “sell the news” day as traders began to worry that the good news was too good.

The major economic news reported Wednesday included Q3 GDP (quarter-on-quarter) which came in even better than expected or previously estimated at +5.2% (compared to a forecast of +4.9% and the Q2 reading of +2.1%). At the same time, the Q3 GDP Price Index (quarter-on-quarter) was exactly as predicted at +3.5% (versus a forecast of +3.5% and a Q2 value of +1.7%). Elsewhere, the October Goods Trade Balance came in worse than expected at -$89.84 billion (compared to a forecast of -$86.70 billion and the September reading of -$86.84 billion). At the same time, October Retail Inventories fell 0.9% (versus a September value of -0.4%). Later in the morning, EIA Weekly Crude Oil Inventories showed a build of 1.609 million barrels (compared to a forecasted drawdown of 0.933 million barrels but far lower than the previous week’s 8.701-million-barrel build).

In Fed Speak news, Atlanta Fed President Bostic indicated that he expects the US economy to slow its growth as well as see inflation continue to ease. Bostic said, “The research, data, survey results, and input from business contacts tell me that tighter monetary policy and tighter financial conditions more broadly are biting harder into economic activity … At the same time, I don’t think we’ve seen the full effects of restrictive policy, another reason I think we’ll see further cooling of economic activity and inflation.” Later, Cleveland Fed President Mester told a conference in Chicago, that inflation is improving and she thinks the Fed is already in a good place on rates. She said, “While it is still above our 2 percent goal, there has been discernible progress on inflation even while the overall economy has remained relatively strong. … Monetary policy is in a good place for policymakers to assess incoming information on the economy and financial conditions.”

In stock news, Reuters reported Wednesday that WMT has shifted its supply chain to import more from India and less from China. WMT now sources 25% of its goods from India (compared to just 2% in 2018). Meanwhile, shipments from China have fallen from 80% to 60% of its total imports over the same period. Later, JPM CEO Dimon said the bank would exit China if required to do so by the US government (as if, not complying with US government requirements was an option for the bank). At the same time, UBER struck a deal with London’s black cabs. The deal will roll out a new service in 2024 where London’s “knowledge-tested” cabbies to sign up with UBER to take pre-booked journeys. (UBER is taking no commission for the first six months of the deal in an effort to smooth over a decade of friction between the two sides.) At the same time, mem stock GME had another monster volatility day, opening 15% higher, trading at more than 30% higher one point, and closing up 20.46%. Elsewhere, in China, NIO announced a partnership with EV-maker Geely to create a battery hot-swapping network across China (as opposed to charging stations). Later, the Wall Street Journal reported that CI and HUM are in advanced talks on a merger. (The two had considered merging in 2015, but HUM chose to partner with Aetna at that time.) At the same time, OKTA notified customers that hackers had stolen information including the name and email address of every OKTA customer support user. Meanwhile, Reuters reported after the close that AVGO is reviewing strategic options for two business units (End-User Computing and Carbon Black) that it had acquired in the purchase of VMW. Finally, self-proclaimed genius Elon Musk claimed advertisers that pulled their ads from his former Twitter (now X) platform were blackmailing him related to his antisemitic posts. In a fiery interview Wednesday, the bright bulb told any such advertisers to “Go f*@k yourself” and then asked if that was clear enough (message to the advertisers). He went on to double down that his post referencing the supposed “great replacement theory” on Nov. 15 did speak the actual truth. However, he also said it was a very foolish post and was akin to handing his detractors a loaded gun.

In stock government, legal, and regulatory news, the USDA has extended its trial program to allow US pork processing plants to operate at higher speeds (while still collecting data on the impact of the speed increase on workers, safety, and quality). This is a big win for TSN, JBSAY, WHGRF, BRFS, and HRL. Later, Reuters reported that EU antitrust lawyers initially opposed sending a charging sheet to AMZN related to its acquisition if IRBT. (This indicates there are some in the EU antitrust group who do not oppose the deal and some feel this gives hope for eventual deal approval.) Later, a lawsuit was filed against CSX claiming that a Thanksgiving-eve train derailment that spilled molten sulfur in Eastern KY was caused by company negligence, recklessness, and failure to follow federal train regulations. Elsewhere, the US Supreme Court gave hints that its right-wing super majority is leaning toward limiting the SEC’s power to enforce securities laws. (The case stems from a fund manager being found guilty of securities fraud and the SEC fining and barring him from the industry.) Later, VZ agreed to pay $23.5 million to resolve an FCC investigation into its TracFone subsidiary violating government program rules (collecting millions of dollars in undeserved emergency broadband benefit funds). After the close, DD, CTVA, and CC agreed to pay the state of OH $110 million to resolve claims related to the release of toxic PFAS “forever chemicals.”

After the close, FIVE, LZB, NTNX, SNOW, and SNPS all reported beats on both the revenue and earnings lines. Meanwhile, NOAH, PSTG, PVH, and CRM all missed on revenue while beating on earnings. Unfortunately, VSCO missed on both the top and bottom lines.

Overnight, Asian markets were largely in the green. Australia (+0.74%), South Korea (+0.61%), and Japan (+0.50%) led a broad rally with only three exchanges in the red across the region. Meanwhile, in Europe, we see a similar picture taking shape at midday. Only Russia (-0.23%) and Belgium (-0.16%) are in the red, while the CAC (+0.48%), DAX (+0.41%), and FTSE (+0.62%) lead the rest of the region higher in early afternoon trade. In the US, as of 7:30 a.m., Futures are pointing toward another green start to the day (before data). The DIA implies a +0.50% open, the SPY implies a +0.24% open, and the QQQ implies a +0.28% open at this hour. At the same time, 10-year bond yields are up slightly to 4.301% and Oil (WTI) is up two-thirds of a percent to $78.40 per barrel in early trading.

The major economic news scheduled for Thursday includes Oct. Core PCE Price Index, Oct. PCE Price Index, Weekly Initial Jobless Claims, and Oct. Personal Spending (all at 8:30 a.m.), Nov. Chicago PMI (9:45 a.m.), Oct. Pending Home Sales (10 a.m.), and Fed Balance Sheet (4:30 p.m.). We also hear from Fed member Williams (9:05 a.m.). The major earnings reports set for before the open include ASO, BIG, DOOO, CM, CBRL, EXPR, KR, RY, TD, and TITN. Then, after the close, AMWD, DELL, MRVL, and ULTA report.

In economic news later this week, on Friday, we get Nov. S&P Global Mfg. PMI, Nov. ISM Mfg. Employment, Nov. ISM Mfg. PMI, and Nov. ISM Mfg. Price Index. We also hear from Fed Chair Powell at 11 a.m.

In terms of earnings reports later this week, on Friday, GCO and BMO report.

In miscellaneous news, GOOGL’s DeepMind supercomputer has used AI to predict the chemical structures and properties of two million new (unknown) materials. This includes 400,000 that could be produced in a lab now. This research offers incredible potential for more efficient batteries, computers, solar panels, etc. Elsewhere, in geopolitical news, Bloomberg reported Wednesday night that Saudi Arabia is dangling the prospect of economic investments as an enticement to its arch-rival Iran. The one condition is that it works against the escalation of the Israel-Hamas War. The Saudis have proposed that Iran restrain its allies in Lebanon, Gaza, and Syria in exchange for serious financial investment and relief for Iran’s sanctions-hobbled economy. The report suggested that this overture stemmed from a low-key US approach to stabilize the Middle East after the Oct. 7 Hamas attacks and the resulting Israeli reprisal offensive. In other geopolitical news, Chinese President Xi surprised the world Wednesday when he installed his trusted loyalist Li Qiang as leader of the Central Financial Committee. This comes after Li became the first Chinese Premier to represent China at the G20 in September. (This was a major change to Xi’s approach of eliminating opposition and taking all key jobs for himself for more than a decade. It has some analysts watching Li as a potential future successor to Xi.)

In late-breaking news out of Europe, Eurozone inflation came in far below expectation at +2.4% in November (compared to a +2.9% in October and a consensus forecast from analysts that was +2.7%). Core inflation also fell to +3.6% from the prior month’s +4.2%. While ECB officials say it’s too early to claim victory, there is no doubt that prices are on the right path after peaking at +10.6% in October 2022.

So far this morning, CM and RY have reported beats on both the revenue and earnings lines. Meanwhile, BIG and DOOO missed on revenue while beating on earnings. On the other side, TD beat on revenue while missing on earnings. Unfortunately, EXPR and TITN reported missed on both the top and bottom lines. (ASO, CBRL, and KR do not report until 8 a.m.)