Unprecedented AAPL Buyback Program

Markets gapped up Thursday as traders rethought their late-day selloff from the day before. SPY gapped up 0.76%, DIA gapped up 0.61%, and QQQ gapped up 0.94%. At that point, all three major index ETFs faded and recrossed the gap by 10:10 a.m. However, this was a Bear Trap with all three major index ETFs starting a steady rally at 10:15 a.m., recrossing the gap and continuing North and reaching the highs of the day at 3:15 p.m. From there, SPY, DIA, and QQQ all sold off modestly the last 45 minutes of the day. This action gave us white-bodied Hammer-type candles in all three major index ETFs. All three crossed back above their T-line (8ema) during the session. This all happened on less than average volume in all three, with QQQ have by far the weakest volume relative to its average.

On the day, all 10 sectors were in the green with Consumer Cyclical (+2.01%) far out front of Technology (+1.50%) which was far out in front of the other sectors, leading markets higher. At the same time, SPY gained 0.93%, DIA gained 0.89%, and QQQ gained 1.28%. VXX dropped 3.29% to close at 13.24 and T2122 popped higher and is now in the top-end of its mid-range at 70.16. 10-year bond yields fell to 4.589% and Oil (WTI) was just on the red side of flat, closing at $78.96 per barrel. So, Thursday was a rebound day after Wednesday’s Fed indecision. However, truly, nothing major has changed in the last 10-12 days as bullish moves are met with bearish moves and visa-versa.

The major economic news scheduled for Thursday included March Exports, which came in lower at $257.60 billion (compared to February’s $263.00 billion reading). The March Imports also fell to $327.00 billion (down from $331.90 billion in February). This gave us a March Trade Balance of -$69.40 billion, which was down slightly from the February -$69.50 billion value. At the same time, Weekly Initial Jobless Claims were lower than expected at 208k (compared to a 212k forecast but flat from the prior week’s 208k). On the ongoing side, Weekly Continuing Jobless Claims were flat at 1,774k (versus a forecast of 1,800k and the prior week’s 1,774k). Meanwhile, the Q1 Nonfarm Productivity was down slightly to +0.3% (compared to a much higher forecast value of +0.8% but only down a touch from Q4’s +3.5%). However, the bigger miss was on Q1 Unit Labor Cost (preliminary) which was up 4.7% (versus a +3.6% forecast and greatly higher than Q4’s +0.4%). Later, March Factory Orders were up to +1.6% (which was in line with the +1.6% forecast but up nicely from February’s +1.2%). Then, after the close, the Fed Balance Sheet showed a $40 billion reduction from $7.402 trillion to $7.362 trillion.

After the close, AMGN, AAPL, ACA, SQ, BKNG, BFAM, COIN, CTRA, DVA, EOG, EXPE, FTNT, GDDY, HOLX, HUN, ILMN, MTZ, MELI, MSI, OPEN, OTEX, PTVE, REZI, RGA, RKT, RYAN, SEM, and TXRH all reported beats on both the revenue and earnings lines. At the same time, AES, DLR, ED, FND, IR, ZEUS, POST, SM, and X missed on revenue while beating on earnings. On the other side, ALHC, BECN, CIVI, DKNG, LYV, MODV, and WSC beat on the revenue line while missing on earnings. However, AEE, WTRG, MNST, OEC, and SWN missed on both the top and bottom lines.

In stock news, on Thursday, CB told the Wall Street Journal is it preparing to pay a $350 million claim to the state of MD related to the collapse of the Francis Scott Key Bridge in March. At the same time, NVO announced it will be reducing the price of its blockbuster weight loss drug Wegovy amidst an increase in competition from LLY. After the close, AAPL reported that iPhone sales fell less than expected (down 10% year on year in Q1) while overall sales fell 4%. However, AAPL also announced the biggest stock buyback program in the history of the market at $110 billion (a 22% increase over their record $90 billion repurchase program from last year). AAPL share soared in post-market trading on the news. Also after the close, AMGN announced it had scrapped plans for a pill version of a weight loss drug and will move ahead with an injection version similar to NVO and LLY drugs in the same class. For what it is worth, the CEO of AMGN touted excellent early-phase results of its injectable weight loss candidate. Finally, SONY and APOS both expressed interest in buying PARA for $26 billion in cash as the company considers a bid from Skydance. Under the alternate offer, SONY would be the majority shareholder with APOS holding a minority position.

In stock legal and governmental news, on Thursday, a Russian court ruled that JPM assets held in accounts which cannot be transferred outside of Russia will not be seized. The court said this covered $2.25 billion of JPM’s assets. Later, the FCC told Congress Thursday that 40% of US telecom providers report they will need additional government money to fund the removal of Chinese equipment from Huawei and ZTE from their networks. (Congress approved $1.9 billion and the telecom companies report $4.98 billion will be needed to cover the 39.5% of replacement cost that the law said would be covered.) At the same time, SPR filed suit in US district court to block TX from demanding documents and conducting a probe of the company (which does no manufacturing in TX). Later, RIVN reported that it received $827 million in incentive packages from the state of IL to help fund the expansion of the company’s operations in that state. At the same time, the Wall Street Journal reported that the US Dept. of Justice has launched a probe into how Chinese drug traffickers have laundered money from the sale of fentanyl through TD (TD Bank). After the close, the USDA announced that WMT had recalled 16,000 pounds of ground beef due to a suspicion it is infected with E. coli.

Overnight, Asian markets were evenly mixed. Hong Kong (+1.48%) led the gainers while Shenzhen (-0.90%) paced the losses. In Europe, the bourses are much more bullish with 12 of 15 exchanges in the green at midday. The CAC (+0.53%), DAX (+0.40%), and FTSE (+0.49%) lead the region higher in early afternoon trade. In the US, as of 7:30 a.m., Futures are pointing toward another green start to the day. The DIA implies a +0.79% open, the SPY is implying a +0.40% open, and the QQQ implies a +0.68% open at this hour. At the same time, 10-year bond yields are down to 4.559% and Oil (WTI) is up 0.34% to $79.22 per barrel in early trading.

The major economic news scheduled for Friday include April Avg. Hourly Earnings, April Nonfarm Payrolls, April Private Nonfarm Payrolls, April Participation Rate, and April Unemployment Rate (all at 8:30 a.m.), April S&P Global Services PMI and April S&P Global Composite PMI (both at 9:45 a.m.), ISM Non-Mfg. Employment, ISM Non-Mfg. PMI, and ISM Non-Mfg. PMI Price Index (all at 10 a.m.), and Fed Member Williams speaks at 7:45 p.m. The major earnings reports scheduled for before the open include on Friday, ADNT, AXL, AMRX, BEPC, BEP, CBOE, CBRE, GTLS, LNG, CRBG, FLR, FYBR, GPRE, HSY, KOP, MGA, NMRK, NVT, PAA, PAGP, TRP, TAC, TRMB, and XPO. Then, after the close there are no major earnings report scheduled.

So far this morning, AMRX, BBU, CBOE, CRBG, FYBR, HSY, NVT, TRP, TRMB, and XPO all reported beats on both the revenue and earnings lines. Meanwhile, ADNT, CBRE, OMI, and TAC all missed on revenue while beating on earnings. On the other side, BEP and LNG beat on revenue while missing on earnings. However, GTLS, FLR, GPRE, and MGA missed on both the top and bottom lines. It is worth noting that MGA lowered its forward guidance.

With that background, it looks as if the Bulls are gapping markets higher today as all three major index ETFs opened the premarket higher. However, with the exception of DIA’s significant white body, they have only printed indecisive candles since the open of the early session. All three are back above their T-line (8ema). So, the short-term trend is now bullish again. Meanwhile, the mid-term remains bearish. The longer-term market remains Bullish but under pressure. Overall, the character of the market is indecisive, choppy, and volatile. In terms of extension, none of the three major index ETFs is extended above their T-line. At the same time, the T2122 indicator is now in the upper-end of its mid-range. So, both sides have room to run if they can gain the momentum to do so. In terms of those 10 big dog tickers, they are evenly split with 5 in the green and 5 in the red this morning. However, AAPL (+6.02%) is by far the biggest mover and dragging the overall market higher on its massive buyback program announced last night. Keep in mind that we still have the April Jobs Report is likely to cause volatility or a change in market direction this morning. Also, don’t forget this is Friday, pay day. So prepare your account for the weekend news cycle.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the Man in the Green Bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby, it’s a job. The gains are real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Bulls Looking to Gap Higher on Fed Rethink

Wednesday saw a mixed start to the day for markets. SPY opened 0.14% lower, DIA opened 0.07% higher, and QQQ gapped down 0.39%. From that point, all three major index ETFs chopped sideways until early afternoon. Oddly, instead of waiting on the Fed decisions and statement, all three started to rally at 1:30 p.m. However, the rally really picked up steam with a strong spike higher between 2:30 p.m. and 3 p.m. This was followed by 30 minutes of a sideways grind in all three. At that point, the Bears woke up and markets sold off sharply the rest of the day. This action gave us Inverted Hammer candles in all three major index ETFs. DIA gave us a white version while SPY and QQQ printed black versions. This means that all three also retested and failed their T-line (8ema) during the session. This all happened on about average volume. We saw average volume in the QQQ and SPY along with heavier-than-average volume in the DIA.

On the day, the 10 sectors were evenly split with Utilities (+1.18%) far out front leading the five gainers while Energy (-1.36%) was way out front leading the five red ones. At the same time, SPY lost 0.29%, DIA gained 0.20%, and QQQ lost 0.72%. VXX gained 0.59% to close at 13.69 and T2122 climbed out of the oversold territory to close in the lower-end of the mid-range at 28.51. 10-year bond yields fell to 4.639% and Oil (WTI) plummeted 3.31% to close at $79.20 per barrel. So, on Wednesday, saw a typical “wait and see” in the morning. However, oddly, markets seemed to think they knew how the wind would be blowing about a half hour ahead of the Fed announcements. Then we saw a spike, followed by rest and then a sharp selloff. In short, traders seem relieved the Fed left rates where they were and loved the fact Chairman Powell essentially took more rate hikes off the table. However, they also then realized there won’t be a rate cut anytime soon and that scared them back into a bearish move.

The major economic news scheduled for Wednesday included the ADP Nonfarm Employment Change, which came in stronger than expected at 192k (compared to a forecast of 179k but down from the March reading of 208k). Later, April S&P Global Mfg. PMI was just a tick stronger than predicted at 50.0 (versus a 49.9 forecast but down from March’s 51.9). After that, March Construction Spending was well down from what was anticipated at -0.2% (compared to a +0.3% forecast but slightly better than February’s -0.3% value). Meanwhile, April ISM Mfg. Employment came in a bit stronger than expected at 48.6 (versus a 48.2 forecast and the March 47.4 reading). At the same time, April ISM Mfg. PMI was lower than predicted at 49.2 (compared to a 50.0 forecast and a March 50.3 value). However, the April ISM Mfg. Price Index was well above expectations at 60.9 (versus a 55.5 forecast and a 55.8 March reading). On the jobs front, March JOLTs Job Openings were down at 8.488 million (compared to the 8.680 million forecast and significantly down from the February 8.813 million). Later, EIA Weekly Crude Oil Inventories showed a large, unexpected inventory build of 7.265 million barrels (versus a predicted drawdown of 2.300 million barrels and the prior week’s 6.368-million-barrel drawdown).

However, the big news of the day was the Fed. The FOMC held rates flat, but the statement added a note that there has been a lack of progress on inflation toward its 2% goal since its last meeting. Beyond that, the statement added a flat declaration that, beginning in June, the FOMC will slow the pace of its balance sheet reductions (in terms of bonds) from an average of $60 billion to $25 billion per month. However, it will also maintain the $35 billion per month pace of reductions for non-Treasury balance sheet items (mortgage-backed securities and agency debt). In terms of Powell’s press conference, the Chair poo-pooed the idea of stagflation, saying “I don’t see the ‘stag’ or the ‘-flation’,” … “(So,) I don’t really understand where that’s coming from.” When asked about the possibility of a rate hike, Powell said “I think it’s unlikely that the next policy rate move will be a hike. I’d say it’s unlikely.” When pushed further on what it would take to cause a rate hike, the Fed Chair replied “I think we’d need to see persuasive evidence that our policy stance is not sufficiently restrictive to bring inflation sustainably down to 2% over time. That’s not what we think we’re seeing.” The rest of the press conference really boiled down to Powell saying the Fed has not gained any additional confidence that inflation is on path to 2% (which the Fed has said is the required trigger for a rate cut). Powell said, “It is likely that gaining such greater confidence will take longer than previously expected. We are prepared to maintain the current target federal funds rate for as long as appropriate.”

In stock news, on Wednesday, TELL sent Houston-based workers home as it is in talked to sell its shale gas business in order to raise funds for its “Driftwood LNG Export” plant. At the same time, research firm S3 Partners released a report saying that the so-called Magnificent 7 (GOOGL, MSFT, AAPL, NVDA, AMZN, META, and TSLA) now account for $1.08 trillion in short interest. This means they represent 12% of the US market’s total shorts. Later, Bloomberg reported that KR is in talks with DIS about adding DIS+ streaming as a benefit of the grocery chain’s membership program for the remainder of 2024 at no cost. At the same time, SPR announced it had a plan that gives it “a high degree of confidence” it can meet BA’s quality and production rate demands for 737 MAX jets. (BA and the FAA declined to comment to Reuters on the announcement.)

In stock legal and governmental news, on Wednesday, Reuters reported that sources tell it the FTC will rule on its antitrust investigation of the XOM acquisition of PXD for $60 billion within days. Later, the Wall Street Journal reported that the FTC is planning to approve the deal, but will prohibit the PXD CEO from joining the board of XOM as a condition of approval. After the close, CMCSA stopped broadcasting Bally Sports channels. This puts the bankruptcy restructuring of a SBGI subsidiary (Diamond Sports) at risk of collapse. At the same time, Bloomberg reported that US bank regulators are discussing finalizing bank capitalization rules by as soon as August. After the close, JPM made a filing that indicated it expects bank assets in Russia to be seized by that country. (The filing did not specify the dollar value of the bank’s assets in Russia.)

After the close, AFL, AIG, AXS, BHE, CHRW, CWH, CVNA, CTSH, CW, DLX, EBAY, ENSG, EXPI, FLSR, FNV, GIL, HST, MGM, MYRG, PAYC, PGRE, PPC, PTC, QRVO, QCOM, SEB, SCI, SFM, TTEK, VMI, VICI, VTR, ZG, and Z all reported beats on both the revenue and earnings lines. Meanwhile, ACHC, ALL, BBSI, BV, BZH, CTVA, DVN, ES, HLF, THG, MRO, MET, MOS, SUM, and UGI missed on revenue while beating one earnings. On the other side, AFG, AWK, CAR, CF, DASH, GFL, KMPR, MAA, MKL, and TROX beat on revenue while missing on earnings. However, ALB, ANSS, BALY, CMPR, CODI, NVST, ETSY, JAZZ, CNXN, MUSA, RHP, SIGI, and TWI missed on both the top and bottom lines. It is worth noting that BHE, MPWR, SFM, and TTEK raised their guidance. At the same time, QRVO and ZG lowered forward guidance.

Overnight, Asian markets were mixed, Hong Kong (+2.50%) was by far (by 1.6%) the biggest mover on the day. On the other side, Shenzhen (-0.90%) and Taiwan (-0.85%) paced the losers on a day where six exchanges were green and six red. In Europe, we see a similar picture taking shape at midday with seven of 15 bourses in the green. The CAC (-0.73%), DAX (+0.08%), and FTSE (+0.39%) lead the region on volume as Norway (-0.88%) has made the biggest move in early afternoon trade. In the US, as of 7:30 a.m., Futures are pointing toward a solidly green start to the day. The DIA implies a +0.48% open, the SPY is implying a +0.71% open, and the QQQ implies a +0.93% open at this hour. At the same time, 10-year bond yields have dropped to 4.602% and Oil (WTI) is up 0.43% to $79.38 per barrel in early trading.

The major economic news scheduled for Thursday includes March Exports, March Imports, March Trade Balance, Weekly Initial Jobless Claims, Weekly Continuing Jobless Claims, Q1 Nonfarm Productivity, and Q1 Unit Labor Cost (all at 8:30 a.m.), March Factory Orders (10 a.m.), and Fed Balance Sheet (4:30 p.m.). The major earnings reports scheduled for before the open include AGCO, ATUS, AME, APA, APG, APO, APTV, MT, ARES, ARW, BHC, BAX, BCE, BDX, BDC, BWA, BTSG, BRKR, CNQ, CAH, CHD, CI, CNK, CNHI, CIGI, COP, CMI, XRAY, DBD, D, DRVN, DNB, ENOV, NVRI, EXC, ULCC, HWM, HII, NSIT, ICE, IQV, IRM, ITRI, ITT, JHG, K, KTB, LNC, LIN, MCO, MUR, NFG, NVO, ONEW, OGN, PH, PATK, PBF, BTU, PTON, PENN, PNW, PBI, PWR, REGN, RXO, SABR, SNDR, SEE, SHEL, SO, SWK, TRGP, TFX, TRI, UPBD, VAL, VSTS, VMC, W, WEN, WCC, WRK, XYL, ZBH, and ZTS. Then, after the close, AES, ALHC, AEE, AMGN, AAPL, ACA, BECN, SQ, BKNG, BFAM, CIVI, COIN, ED, CTRA, DVA, DLR, DKNG, EOG, WTRG, EXPE, FND, FTNT, GDDY, HOLX, HUN, ILMN, IR, LYV, MTZ, MODV, MNST, MSI, ZEUS, OTEX, OPEN, OEC, PTVE, PXD, POST, RGA, REZI, RKT, RYAN, SEM, SM, SWN, TXRH, X, and WSC report.

In economic news later this week, on Friday, April Avg. Hourly Earnings, April Nonfarm Payrolls, April Private Nonfarm Payrolls, April Participation Rate, April Unemployment Rate, April S&P Global Services PMI, April S&P Global Composite PMI, ISM Non-Mfg. Employment, ISM Non-Mfg. PMI, ISM Non-Mfg. PMI Price Index, and Fed Member Williams speaks.

In terms of earnings reports later this week, on Friday, ADNT, AXL, AMRX, BEPC, BEP, CBOE, CBRE, GTLS, LNG, CRBG, FLR, FYBR, GPRE, HSY, KOP, MGA, NMRK, NVT, PAA, PAGP, TRP, TAC, TRMB, and XPO report.

So far this morning, MT, BDX, BWA, BTSG, BRKR, CHD, CI, CNK, CNHI, ENOV, NVRI, ULCC, GEL, GVA, HWM, ICFI, IQV, IRM, ITT, KTB, LAMR, MCO, MUR, NVO, PBF, PBI, PWR, SWK, TFX, TRI, UPBD, VNT, W, XYL, ZBH, and ZTS all reported beats on both the revenue and earnings lines. Meanwhile, AME, APTV, BCE, CAH, COP, XRAY, LIN, RXO, SHEL, WEN, and WRK all missed on revenue while beating on earnings. On the other side, ACDVF, APO, and EXC beat on revenue while missing on earnings. However, ARES, PENN, REGN, and WCC missed on both the top and bottom lines. It is worth noting that CI raised its forward guidance.

In miscellaneous news, on Wednesday, GS strategists told clients that the single-stock options volume decline prior to the start of earnings season signaled weakness in stocks. However, the report says that this volume has now stabilized and even shows a modest increase, which GS says indicates that the market has an appetite to buy the weakness in equity prices. (In other words, “buy the dip” is still in play.) Meanwhile, BestEx Research that roughly one-third of all S&P 500 stock trades happen in the last 10 minutes of the trading session. This is up significantly from the 27% happening in those minutes found in the company’s 2021 study.

In other news, the US Treasury and State Departments issued hundreds of sanctions related to targeting the Russian invasion of Ukraine. This included 20 companies in China and Hong Kong. Unsurprisingly, a spokesman for the Chinese embassy in Washington said Beijing firmly opposes what he called the US’s “illegal unilateral sanctions.” Meanwhile, in Japan, the Yen jumped 3% against the Dollar late in the US session. This has led to broad speculation that the Bank of Japan has intervened for the second time this week. Finally, in late-breaking news, PTON announced it will lay off 15% of its staff and the CEO will step down.

With that background, it looks as if the Bulls have rethought yesterday’s late selloff and are looking to gap all three major index ETFs higher. All three opened just under their T-line (8ema) but are printing small, indecisive, white-bodied candles after that gap. The SPY, DIA, and QQQ all remain just below their T-line (8ema). So, the short-term trend is now bearish but under pressure from the Bulls. Meanwhile, the mid-term remains bearish. The longer-term market remains Bullish but under pressure. In terms of extension, none of the three major index ETFs is extended below their T-line. At the same time, the T2122 indicator is now in the lower-end of its mid-range. So, both sides have room to run if they can gain the momentum to do so. In terms of those 10 big dog tickers, all 10 are in the green this morning with the biggest dog NVDA (+1.75%) out front leading the way higher. Keep in mind that we still have the April Jobs Report on Friday morning. So, after the rethink of Fed reaction we may see an afternoon drift waiting for those Friday morning numbers.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the Man in the Green Bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby, it’s a job. The gains are real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Index Whipsaws

In the wake of the U.S. index whipsaws in an FOMC decision reaction, the Hang Seng index in Hong Kong emerged as the frontrunner, registering a notable 2.4% increase. This uptick was further accentuated in the technology sector, with the Hang Seng Tech index experiencing a significant 4.4% surge. Meanwhile, Mainland China markets were closed in observance of the Labor Day holiday.

European markets experienced a modest downturn on Thursday morning, in response to the U.S. FOMC’s recent decision and the impact of various corporate earnings reports. The Stoxx 600 index saw a slight decline of 0.25% as of 11 a.m. in London, indicating a mixed bag of sectoral performance. While bank stocks showed resilience with a 0.5% rise, the oil and gas sectors weren’t as fortunate, witnessing a 1.35% fall.

U.S. stock futures indicate a bullish gap this morning as investors’ anticipation grew for the upcoming corporate earnings. However, the initial enthusiasm was tempered by the end of Wednesday’s volatile price action. The Dow managed to eke out a modest gain, closing approximately 0.2% higher, while both the S&P 500 and Nasdaq Composite receded, ending the day down by nearly 0.3%.

Economic Calendar

Earnings Calendar

Notable reports for Thursday before the bell include AGCO, AGIO, ATUS, APO, APTV, MT, ARES, ARW, BAX, BDX, BWA, BTSG, GOOS, CAH, CHD, CNK, CNHI, CGNX, COP, CMI, CYBR, D, DRVN, ENOV, ES, EXC, EXLS, RACE, FTDR, ULCC, HWM, HII, IDA, INMD, NSIT, ICE, IDCC, IQV, IRM, ITRI, ITT, JHG, K, KRP, KIM, KTB, LAMR, LANC, LNC, LIN, LXP, MBUU, NRMA, MCO, MUR, OGN, PH, BTU, PTON, PENN, PNW, PBI, PWR, REGN, SABR, SEE, SHAK, SSTK, SWI, SO, SWK, CI, TPB, UTZ, WNT, VMC, WD, W, WEN, WRK, XPEL, XYL, & ZTS.. After the bell include AAPL, AAON, ACCO, AES, AMH, AMGN, ACA, ASUR, BECN, BBAI, BILL, BJRI, SQ, BKNG, BFAM, CABO, CPT, CIVI, NET, COHU, COIN, ED, CTRA, DVA, DRH, DLR, DLB, DKNG, LOCO, EOG, EXPE, FRT, FIVN, FND, FTNT, FOXF, GDDY, HOLX, HUN, ILMN, KRC, LYV, MTZ, MSI, MP, OHI, OTEX, OPEN, PCTY, PXD, POST, KWR, RMAX, RGA, RKT, RYAN, SIMO, SM, SWN, TNDM, TXRH, X, OLED, VIAV, WK, WW, XRH, & XPOF.

News & Technicals’

Jeffrey Gundlach, CEO of DoubleLine Capital, provided a revised outlook on Wednesday, suggesting that there may be at most one interest rate cut by the end of the year. This statement came in the wake of the Federal Reserve’s policy meeting, where Chair Jerome Powell made a pivotal announcement that virtually eliminated the prospect of an interest rate hike in the near future. Following Powell’s remarks, the financial markets reacted swiftly; treasury yields plummeted to their lowest points of the session, while stock prices soared to their highest, reflecting investor sentiment that the next move by the Fed would steer clear of increasing rates.

The perception of China among Americans has notably shifted, with 42% now considering China as an adversary of the United States—a significant increase from just 25% two years prior. This sentiment is echoed in Pew Research findings, where for the fifth consecutive year, approximately 80% of respondents harbored unfavorable views towards China, and nearly half of that group expressed a very unfavorable stance. Notably, older Republican demographics, alongside individuals dissatisfied with the U.S.’s economic climate, exhibited the strongest opposition toward China. This data underscores a growing trend of skepticism and concern regarding U.S.-China relations among the American populace.

Carvana’s stock experienced a remarkable surge, soaring over 30% in after-hours trading on Wednesday. This leap was fueled by the company’s announcement of record-breaking results and a profitable first quarter. A key metric, the gross profit per unit (GPU), stood at an impressive $6,432, capturing the attention of investors. Additionally, Carvana reported an adjusted EBITDA profit margin of 7.7% for the quarter. These strong financial indicators are the fruits of a strategic shift implemented over the past two years, emphasizing profitability in response to previous bankruptcy worries in 2022. The company’s pivot from aggressive expansion to financial stability appears to be paying off, as evidenced by these positive outcomes.

Peloton is set for a leadership transition as CEO Barry McCarthy prepares to step down, marking the end of his tenure that began in February 2022. McCarthy, who previously held executive roles at Netflix and Spotify, was instrumental in steering Peloton through a period of transformation aimed at cost reduction and revitalizing growth. Despite his departure from the CEO role, McCarthy will continue to influence Peloton’s strategy, serving as a strategic advisor until the year’s end. In the interim, the company will be guided by two of its board members who will assume the roles of co-CEOs, ensuring continuity in Peloton’s journey towards sustainable growth.

Trade Wisely,

Doug

FOMC rate decision

Amidst a tense atmosphere, the Australian and Japanese markets experienced a downturn on Wednesday. Investors are holding their breath in anticipation of the FOMC rate decision. Adding to the market’s unease is the performance of the yen, which has had a tumultuous beginning to the week, with suspected interventions occurring as early as Monday. Currently, the yen is hovering around the 157.7 mark when paired against the U.S. dollar, a level that market participants will be watching closely as these events unfold.

This morning London’s FTSE 100 index saw a modest increase, standing out in a quiet European market landscape, as most markets were closed in observance of the May Day/Labor Day public holiday. Despite the regional pause, investors have their work cut out for them, with the U.S. Federal Reserve’s impending interest rate announcement looming large.

US futures indexes declined Wednesday morning. The focus of traders is now shifting to the Federal Reserve’s interest rate decision. Investors are keenly awaiting insights from Fed Chair Jerome Powell regarding the conditions necessary for a potential rate decrease in the future.

Earnings Calendar

Notable reports for Wednesday before the bell include MA, AER, ALKS, APA, ARCC, ADP, AVA, AVT, AXTA, BLCO, BRY, TECH, BIP, CDW, GIB, CHEF, CLH, CNDT, CTS, CVS, DAY, DD, EL, EXTR, GRMN, GNRC, ROCK, GSK, GPN, IDXX, JCI, KKR, KHC, LTH, LIVN, MAR, NBIX, NCLH, OGE, PSN, PFE, PPL, RGEN, SMG, SLGN, SDHC, SR, STGW, COCO, TRN, TTMI, WLK, WING, & YUM. After the bell include ACHC, AFL, ALB, ALKT, ALL, AFG, AIG, AWK, ANSS, CAR, ACLX, CAR, ACLX, AXS, BALY, BZH, BV, CHRW, CWH, CVNA, CF, CWAN, CDE, CTSH, CRK, CTVA, CCRN, CW, DVN, DGII, DASH, EBAY, NVST, EPR, EQC, ETSY, EXPI, FSLY, FSLR, FRSH, GKOS, GRBK, THG, HTLF, HLF, HST, HPP, INFA, JAZZ, KMPR, KN, KLIC, MRO, MET, MTG, MGM, MCW, MPWR, MOS, MUSA, NFG, NSA, NTGR, PGRE, PAYC, PPC, PCOR, PTC, QRVO, QCOM, RDN, RYN, RSI, RHP, SDGR, SFM, NOVA, TTEK, UGI, UPWK, VMI, VTR, VICI, WOLF, & ZG.

Economic Calendar

News & Technicals’

In a significant move, the Biden administration has announced the cancellation of over $6.1 billion in student loans, affecting approximately 317,000 former students of The Art Institutes. This decision comes after the U.S. Department of Education’s investigation into the for-profit education chain and its parent company, the Education Management Corporation (EDMC). The investigation revealed that both institutions engaged in “pervasive and substantial” deceptive practices, misleading students about crucial factors such as employment rates, potential salaries, and the effectiveness of career services post-graduation. As a result of these findings, all eligible borrowers will automatically receive debt forgiveness. This relief extends even to those who have not formally applied for loan forgiveness under the borrower defense program, ensuring that all affected individuals are covered by this unprecedented act of financial reprieve.

In a landmark shift, the Biden Administration is set to reclassify marijuana as a Schedule III controlled substance, aligning it with drugs such as Tylenol with codeine, anabolic steroids, and testosterone. This groundbreaking decision, as reported by NBC News citing four informed sources, marks the end of marijuana’s over 50-year designation as a Schedule I drug—a category it shared with substances like heroin and methamphetamines. The reclassification reflects a significant change in the federal stance on marijuana, acknowledging its medical benefits and lower potential for abuse. Concurrently, this news has sparked a notable upswing in cannabis-related stocks, which stood out with gains in contrast to the overall market’s downturn.

The Federal Reserve appears to be in a state of inertia, with expectations set for this status quo to be evident at the conclusion of its meeting on Wednesday. Market analysts predict virtually no possibility of the Federal Open Market Committee (FOMC), which is responsible for setting the central bank’s monetary policy, to alter the current interest rates. The most noteworthy announcement anticipated from the meeting is the Federal Reserve’s plan to decelerate the reduction of its bond holdings on the balance sheet. This move signals a cautious approach by the Fed amidst economic uncertainties, as it opts to maintain a steady course rather than introducing new monetary policy changes.

Anticipate a turbulent trading day filled with significant earnings and economic reports, culminating with a FOMC rate decision. Traders should brace for potential sharp swings in points as they respond to the influx of data. Additionally, it’s wise to monitor bond yields closely for any shifts that may occur following comments from Fed Chair Jerome Powell later today, which could offer hints at the market’s future trajectory.

Trade Wisely,

Doug

Big News and Earnings Day With Fed On Tap

Markets opened lower on Tuesday in response to a higher-than-expected Employment Cost Index. SPY gapped down 0.28%, DIA gapped down 0.33%, and QQQ gapped 0.41% lower. From there, all three major index ETFs meandered sideways (perhaps lulling the Bulls to sleep) until 10:50 a.m. At that point, all three began a wavy selloff that lasted the rest of the day and accelerated the last 10 minutes. (In particular, QQQ had a massive move that last 10 minutes.) This action gave us large, black-bodied candles with small upper wicks and which closed on the lows in all three major index ETFs. All three could also be called Evening Star signals if you are a little lenient on the first candle of that 3-candle signal. All three also crossed back below their T-line (8ema), with DIA even coming into the range of the lows from roughly two weeks ago.

On the day, all 10 sectors were in the red with Energy (-2.92%) far out front leading the rest of the market lower. Healthcare (-0.28%) held up far better than the other sectors but obviously was also in the red. Meanwhile, SPY lost 1.58%, DIA lost 1.48%, and QQQ lost 1.89%. VXX gained more than three percent to close at 13.61 and T2122 plummeted back down into the oversold area at 15.51. 10-year bond yields spiked to 4.682% and Oil (WTI) dropped 1.20% to close at $81.64 per barrel. So, Tuesday was clearly a day for the Bears. A gap lower led to treading water for almost 90 minutes but then the selling kicked in and did not stop the rest of the day. All this happened on a bit less than average volume in all three major index ETFs.

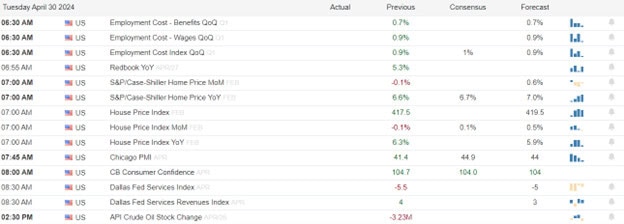

The major economic news scheduled for Tuesday included the Q1 Employment Cost Index, which, as said above, came in higher than expected at +1.2% (compared to a forecast of +1.0% and a Q4 reading of +0.9%). Later, April Chicago PMI was lower than predicted at 37.9 (versus a 44.9 forecast and a 41.4 March value). Then, Conf. Board Consumer Confidence also came in a bit low at 97.0 (compared to a predicted 104.0 and a previous reading of 103.1). After the close, API Weekly Crude Oil Stocks showed a n unexpected 4.906-million-barrel inventory build (versus a forecast 1.500-million-barrel drawdown and the prior week’s 3.230-million-barrel drawdown).

After the close, AMD, AMZN, ASH, AX, BXP, CACC, FANG, EXR, FBIN, INVH, LFUS, LPLA, MCY, MDLZ, OI, PINS, PK, QUAD, SYK, UMBF, and UNM all reported beats on both the revenue and earnings lines. Meanwhile, AMCR, CC, CLX, EIX, EQH, HI, MATX, NGD, RNR, RSG, SWKS, SON, and SMCI missed on revenue while beating on earnings. On the other side, CHK, PRU, and PSA beat on revenue while missing on earnings. However, CZR, LEG, LUMN, OKE, RYI, SBUX, and WERN missed on both the top and bottom lines. It is worth noting that AMZN and SWKS lowered their guidance. At the same time, PINS and SMCI raised their forward guidance. It is also worth noting that PSNY announced it will delay its earnings reports for a second time.

In stock news, on Tuesday, TLSA announced plans to layoff more of the recently announced 10,000 workers. This time, CEO Musk fired two senior executives and all of the 500 people reporting up through one of them (the entire “Supercharger group”). The other senior executive fired was the Director of the New Vehicles program. At the same time, WMT rolled out a new “house” grocery brand (BetterGoods) while also saying it will close all of its health-care clinics and close its telehealth operation as it gets out of the healthcare field. Later, CMCSA announced it will raise prices on it Peacock streaming service by $2/month ahead of what it expects to be a large audience draw, the Summer Olympics. Meanwhile, GOOGL agreed to pay NWSA $5 million to $6 million annually to develop new AI-related content and products with the company (owner of the Wall Street Journal). Later, Reuters reported that sources tell it that the PARA ousting (“stepping down”) of former CEO Bakish will cost the company “North of $50 million.”

In stock legal and governmental news, on Tuesday BRKB subsidiary PacifiCorp was hit with $30 billion in new claims (from 1,000 plaintiffs) for damages caused by 2020 wildfires started by the utility’s equipment. (This is four times the amount the company had projected.) This is on top of the $735 million that PacifiCorp had paid in claims up through February and a $90 million judgement the company lost to 17 victims in a case last year for gross negligence during a windstorm. Later, the FTC said it will crack down on what it is calling “junk patents” associated with 20 brand-name drugs. These “junk patents” are minor variations from existing patents that extend price protections. (NVO’s wildly popular weight loss drugs Ozempic and Wegovy are the major drugs impacted, but they are protected by “legitimate” patents.)

Elsewhere, the US Dept. of Justice moved to reclassify marijuana out of “schedule three.” That drug is currently classified the same as heroin and LSD. The new classification would put it in a group with ketamine and Tylenol with codeine. Cannabis stocks like TLRY, TCNNF, ACB, CGC, FLGC, and other soared on the news. Later, the 50 GOOGL workers fired for protesting the company cloud computing contract with the Israeli military and other government departments filed a complaint with the NRLB alleging that the firing was illegal. At the same time, IBM won its appeal of a $1.6 billion judgement from a suit filed by BMC Software (owned by KKR). The case will return to the district court after being instructed on how to determine liability. Later, the first trial over GSK’s drug Zantac potentially causing cancer began in Chicago with jury selection. In late-breaking news this morning, JNJ announced it had reached a $6.5 billion settlement ending 99% of the tens of thousands of “talc-caused cancer” lawsuits the company had pending.

Overnight, Asian markets were mostly in the red with only four of 12 exchanges green. Australia (-1.23%), Shenzhen (-0.90%), and New Zealand (-0.75%) led the region lower. Meanwhile, in Europe, we see a sea of red with two bourses, led by Norway (+0.24%), in the green at midday. The CAC (-0.99%), DAX (-1.03%), and FTSE (+0.02%) lead the region, as always, on volume in early afternoon trade. In the US, as of 7:30 a.m., Futures are pointing to a red start to the day. The DIA implies a -0.23% open, the SPY is implying a -0.40% open, and the QQQ implies a -0.65% open at this hour. At the same time, 10-year bond yields are at 4.684% and Oil (WTI) is down 1.46% to $80.72 per barrel in early trading.

The major economic news scheduled for Wednesday includes the ADP Nonfarm Employment Change (8:15 a.m.), April S&P Global Mfg. PMI (9:45 a.m.), March Construction Spending, April ISM Mfg. Employment, April ISM Mfg. PMI, April ISM Mfg. Price Index, and March JOLTs Job Openings (all at 10 a.m.), EIA Weekly Crude Oil Inventories (10:30 a.m.), FOMC Rate Decision and FOMC Statement (both at 2 p.m.), and Fed Chair Press Conference (2:30 p.m.). The major earnings reports scheduled for before the open include AER, ARCC, ADP, AVA, AVT, AXTA, GOLD, BLCO, CG, CRS, CDW, COR, CVE, CENX, GIB, CHEF, CLH, CNDT, CVS, DD, ENTG, ESAB, EL, EEFT, FLEX, FTS, GRMN, GTES, GNRC, GSK, GPN, IDXX, NSP, JCI, KKR, KHC, DRS, LTH, MAR, MA, NBIX, NCLH, OGE, PSN, PFE, PPL, SMG, SLGN, SR, STGW, TRN, TTMI, UTHR, VRSK, WEC, WLK, and YUM. Then, after the close, ACHC, AFL, ALB, ALL, AFG, AIG, AWK, ANSS, CAR, AXS, BALY, BBSI, BZH, BV, CHRW, CWH, CVNA, CF, CMPR, CTSH, CODI, CTVA, CW, DLX, DVN, DASH, EBAY, ENSG, NVST, ETSY, ES, EXPI, FLSR, FNV, GFL, GIL, THG, HLF, HST, JAZZ, KMPR, MRO, MKL, MET, MGM, MAA, MOS, MUSA, MYRG, PGRE, PTEN, PAYC, CNXN, PTC, QRVO, QCOM, RHP, SIGI, SCI, SFM, SUM, TTEK, TWI, TROX, UGI, VMI, VTR, VICI, ZG, and Z report.

In economic news later this week, on Thursday, we get March Exports, March Imports, March Trade Balance, Weekly Initial Jobless Claims, Weekly Continuing Jobless Claims, Q1 Nonfarm Productivity, Q1 Unit Labor Cost, March Factory Orders, and Fed Balance Sheet. Finally, on Friday, April Avg. Hourly Earnings, April Nonfarm Payrolls, April Private Nonfarm Payrolls, April Participation Rate, April Unemployment Rate, April S&P Global Services PMI, April S&P Global Composite PMI, ISM Non-Mfg. Employment, ISM Non-Mfg. PMI, ISM Non-Mfg. PMI Price Index, and Fed Member Williams speaks.

In terms of earnings reports later this week, on Thursday, we hear from AGCO, ATUS, AME, APA, APG, APO, APTV, MT, ARES, ARW, BHC, BAX, BCE, BDX, BDC, BWA, BTSG, BRKR, CNQ, CAH, CHD, CI, CNK, CNHI, CIGI, COP, CMI, XRAY, DBD, D, DRVN, DNB, ENOV, NVRI, EXC, ULCC, HWM, HII, NSIT, ICE, IQV, IRM, ITRI, ITT, JHG, K, KTB, LNC, LIN, MCO, MUR, NFG, NVO, ONEW, OGN, PH, PATK, PBF, BTU, PTON, PENN, PNW, PBI, PWR, REGN, RXO, SABR, SNDR, SEE, SHEL, SO, SWK, TRGP, TFX, TRI, UPBD, VAL, VSTS, VMC, W, WEN, WCC, WRK, XYL, ZBH, ZTS, AES, ALHC, AEE, AMGN, AAPL, ACA, BECN, SQ, BKNG, BFAM, CIVI, COIN, ED, CTRA, DVA, DLR, DKNG, EOG, WTRG, EXPE, FND, FTNT, GDDY, HOLX, HUN, ILMN, IR, LYV, MTZ, MODV, MNST, MSI, ZEUS, OTEX, OPEN, OEC, PTVE, PXD, POST, RGA, REZI, RKT, RYAN, SEM, SM, SWN, TXRH, X, and WSC. Finally, on Friday, ADNT, AXL, AMRX, BEPC, BEP, CBOE, CBRE, GTLS, LNG, CRBG, FLR, FYBR, GPRE, HSY, KOP, MGA, NMRK, NVT, PAA, PAGP, TRP, TAC, TRMB, and XPO report.

So far this morning, AER, ARCC, ADP, AXTA, BIP, CG, GIB, CHEF, DD, ENTG, ESAB, EL, EEFT, GRMN, GNRC, GSK, GPN, KKR, LTH, PSN, PFE, SMG, SHOO, TRN, UTHR, VRSK, and WLK all reported beats on both the revenue and earnings lines. Meanwhile, GOLD, COR, CVE, FTS, IDXX, JCI, KHC, NYCB, SLGN, and WEC all missed on revenue while beating on earnings. On the other side, AVA, BLCO, MAR, SITE, and SR beat on revenue while missing on earnings. However, CDW, CVS, NBIX, OGE, and YUM missed on both the top and bottom lines. It is worth noting that AXTA raised its guidance while CVS and ENTG lowered forward guidance.

In miscellaneous news, on Tuesday, Oil (WTI) prices closed lower on record US oil production. US crude output popped by the most since October 2021, reaching 13.15 million barrels per day in February (up from 12.58 million barrels per day in January). In other oil-related news, Israeli PM Netanyahu vowed this military will continue attacks on Rafah (the last standing city in the Gaza strip) regardless of whether a cease-fire deal is reached or not. (I’m just a country boy, but a ceasefire without a halt in firing doesn’t seem like much of a ceasefire.) Netanyahu also vowed to invade Rafa to “finish the job” sooner or later. (It may be worth noting that Israel has been building tents to house 500k in the desert outside Rafa, presumably as a relocation site for during an invasion.) In other energy news, the G7 Energy Ministers agreed Tuesday to halt the use of coal in power generation in the first half of the 2030s (10 years). (In the US, about 15.3% of electricity is currently generated by burning coal. For the overall G7, 15% of electricity is generated from coal today.)

In other news, the US Labor Dept. urged all western companies to exit from China’s Xinjiang region (it’s a province-sized area but does not have province status). The reason is that the Labor Dept. says China continues to operate internment camps and forced labor camps in that region focused largely on Uyghurs and other Muslim minority groups. China made it illegal to conduct human rights audits in that region, although they deny all allegations of abuses or forced labor. Late in the day, the Insurance Institute for Highway Safety specifically cited AMZN and FDX as needing to implement more safety technologies in their delivery vans. The group said delivery vans were involved in 935,000 police-reported crashes in 2023, including 98,000 crashes that involved injuries. The group (funded by auto insurers) said many of the crashes could have been prevented by technologies available in cars like “automated emergency braking” and “collision warning technologies.”

With that background, it looks as if the Bears are looking to follow through on Tuesday’s move, at least early. All three major index ETFs gapped down to start the premarket but have put in indecisive Spinning Top type candles since then. The QQQ in particular has pulled away below its T-line, perhaps on AMD which reported in line and moved guidance as expected but that was not enough for overnight markets. In fact, all three major index ETFs are now below their T-line (8ema). So, the short-term trend is now bearish. Meanwhile, the mid-term remains bearish. The longer-term market remains Bullish but under pressure. In terms of extension, the QQQ is the only one of the major index ETFs that could be called too far extended below their T-line. However, the T2122 indicator is now in the upper end of its oversold range. So, both sides have room to run if they can gain the momentum to do so but the Bulls have much more slack to work with. In terms of those 10 big dog tickers, seven of the 10 are in the red with AMD (-6.38%) out front leading the way lower. Keep in mind that today is a Fed day. So, after the open, we may see a “dead money” market until we get volatility about 2 p.m. and then a second jolt of volatility following after 2:30 p.m.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the Man in the Green Bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby, it’s a job. The gains are real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Anticipation and Uncertainty

Traders and investors are dealing with a mix of anticipation and Unertainty with post-market earnings announcements from Amazon, Advanced Micro Devices, and Starbucks garnering significant attention. At the same time there is a palpable uncertainty surrounding the Wednesday FOMC and the possible hawkish tone and higher for longer statemets as the inflation fight continues

During the night, Asian markets mostly upticked on Tuesday, mirroring the trends set by Wall Street. Investors’ attention was particularly focused on the April manufacturing purchasing managers’ index (PMI) from China. The latest data revealed that China’s manufacturing sector grew at a reduced rate in April, with the official PMI registering at 50.4, a slight decrease from March’s 50.8.

European trade mixed and lower this morning, marked by the release of numerous earnings reports and critical economic indicators. Most industry sectors experienced a minor downturn, with, the euro zone’s inflation rate unchanged at 2.4% in April. The core inflation rate, which excludes volatile items such as energy, food, alcohol, and tobacco, was reported at 2.7%.

Economic Calendar

Earnings Calendar

Notable reports for Tuesday before the bell include MMM, ACIW, APD, AEP, AMT, ADM, AWI, ATI, EAT, CNP, CO, GLW, DAN, ETN, ECL, LLY, EPD, ETRN, FELE, IT, GEHC, GPK, HRMY, HUBB, ITW, INCY, LEA, MAC, MPC, MLM, MCD, TAP, MPLX, NOG, OCSL, OMF, PACR, PYPL, PAG, PEG, SIRI, SYY, SMHC, TT, UFPI, & ZBRA. After the bell reports include AMZN, AMD, ASH, AX, BLKB, BXP, CZR, CHK, CLX, DENN, FANG, DBRG, EIX, EQH, ESS, EXEL, EXR, GPOR, HI, HURN, INVH, LEG, LMND, LC, LFUS, LPLA, LUMN, MATX, MIR, MDLZ, OI, OKE, PK, PDM, PINS, POWL, PRU, PSA, RSG, SWKS, STAG, SBUX, SYK, SMCI, SKT, UDR, UNM, VOYA, WPC, & WERN.

News & Technicals’

McDonald’s disclosed mixed financial outcomes. The fast-food giant reported a modest surpass on revenue, indicating a resilient performance in sales. However, the earnings per share (EPS) fell marginally short of market expectations, reflecting some underlying challenges. In the U.S., McDonald’s observed a downturn in expenditure among low-income consumers, signaling economic pressures that could affect the company’s domestic market share. Internationally, the brand contended with boycotts sparked by its Israeli licensee’s promotional offers to soldiers, leading to a temporary shutdown of several outlets. This controversy has notably impacted McDonald’s sales in the Middle East, adding to the complexities of operating a global franchise amid varying geopolitical climates.

Walmart has announced a significant shift in strategy, revealing plans to shut down all of its healthcare clinics nationwide. This move marks a departure from its previous ambitions to extend its affordability ethos to medical services, alongside its traditional retail offerings. Additionally, the retail giant is set to close its telehealth service, which was acquired in 2021 for an undisclosed sum. Citing the inability to sustain a profitable healthcare business model, Walmart pointed to the difficult reimbursement landscape and escalating expenses as the primary reasons for this decision. This development represents a notable retreat from the company’s healthcare venture, underscoring the complexities of the healthcare industry.

Volkswagen’s first-quarter financials have signaled a challenging period for the automotive giant, with a 20% decline in operating profit. This downturn is attributed to a faltering demand for its high-end vehicle lines. The total vehicle sales stood at 2.1 million units, marking a slight decrease of approximately 2% from the previous year. The impact was more pronounced in Volkswagen’s luxury division, Porsche, which experienced a steep 30% fall in operating profit. Concurrently, the global car manufacturer Stellantis also faced economic headwinds, reporting a 12% drop in revenue. Stellantis attributes this decline to diminished sales volumes and the adverse effects of foreign exchange rates, despite maintaining stable net pricing. These reports from Volkswagen and Stellantis reflect the broader challenges faced by the auto industry, including shifting consumer preferences and economic pressures.

In a pivotal moment for the cryptocurrency industry, U.S. District Judge Richard Jones is set to deliver a sentence to the founder and former CEO of Binance, Changpeng Zhao, in a Seattle court on Tuesday. This sentencing follows Zhao’s guilty plea to criminal charges last November, an admission that led to his resignation from the helm of the world’s largest crypto exchange. The decision by Judge Jones comes after months of deliberation over the suitable penalty for Zhao’s actions, which have had significant repercussions within the crypto community and beyond. The outcome of this sentencing is highly anticipated, as it could set a precedent for how legal systems around the world handle similar cases in the rapidly evolving digital currency landscape.

Plan for considerable price volatility as the market deals with anticipation and uncertainty of pending big tech reports with the looming FOMC decision. Keep a close eye on overhead resistance levels and of course the bond yields that continue to trend upward as the inflation battle continues.

Trade Wisely,

Doug

KO Beats, LLY Mixed But Hikes, and MCD Misses

Monday saw a modest gap higher in the markets. SPY gapped up 0.35%, DIA gapped up 0.22%, and QQQ gapped up 0.51% with TSLA dragging markets higher on China FSD approval news. From there, all three major index ETFs chopped sideways the entire day, meandering back and forth around that modest gap. All three ended on an upswing the last 50 minutes. This action gave us gap-up indecisive candles in all three with a Doji in the SPY and QQQ and more of a white-bodied Spinning Top in the DIA. All three closed above their respective T-lines (8ema). This happened on well below-average volume in all three major index ETFs.

On the day, eight of the 10 sectors were in the green again with Utilities (+1.44%) way out in front leading the rest of the market higher. At the same time, the only red sectors were Financial Services (-0.12%) and Technology (-0.06%). Meanwhile, SPY gained 0.35%, DIA gained 0.39%, and QQQ gained 0.41%. VXX fell 1.71% to close at 13.20 and T2122 climbed but remained in the upper end of its mid-range at 75.00. 10-year bond yields fell to 4.609% and Oil (WTI) dropped 1.31% to close at $82.75 per barrel. So, Monday was a typical indecisive pre-Fed day. The TSLA news popped stocks higher at the open. However, from there it was an all-day meander back-and-forth in and slightly above the opening gap. At the end of the day, all three major index ETFs were little changed from their opens.

There was no major economic news scheduled for Monday.

After the close, AMKR, ACGL, CLW, FLS, ST, SUI, WELL, WWD, and YUMC all reported beats on both the revenue and earnings lines. Meanwhile, CNO beat on revenue while missing on earnings. On the other side, CCK, CWK, ESI, EG, FFIV, NXPI, PARAA, PARA, SBAC, and RIG missed on the revenue line while beating on earnings. However, CVI and SANM missed on both the top and bottom lines. It is worth noting that WWD raised its forward guidance.

In stock news, on Monday, UMBF announced a deal to acquire HTLF in a $2 billion all stock deal. (Analysts expect the deal to create a strong regional bank with operations spanning 13 states.) Later, Bloomberg reported that KO is gearing up to IPO its $8 billion African bottling operation. At the same time, Reuters reported that BA tapped the debt market to raise $10 billion after burning through almost $4 billion of cash in Q1 amidst slowing production and sluggish sales. Later, the CA New Car Dealers Assn. reported TSLA vehicle registrations in CA fell 8% during Q1, the second consecutive quarterly decline in those registrations (sales). (CA is one of the most important EV markets.) At the same time, MBGAF (Mercedes), BMWYY, RIVN, and HYMTF (Hyundai) saw increases in EV vehicle registrations. Later, LUV announced it has launched a “delay compensation” program. (This was part of the airline’s $140 million settlement with DOT over the airline’s December 2022 holiday debacle.) The airline said the program actually launched April 16 and it has already heard from thousands of customers seeking compensation for delays. After the close, PARA announced the widely-expected resignation of CEO Bakish as the board works on a merger/sale to Skydance. Bakish will be replaced by a triumvirate of internal executives.

In stock legal and governmental news, on Monday, PHG announced it had reached a $1.1 billion settlement (many, many times smaller than the expected $4-$10 billion) to resolve all personal injury claims due to its respiratory devices. Later, the Financial Times reported that the European Commission is opening an investigation into how META is handling Russian disinformation in political advertising on Facebook and Instagram. (However, the investigation report is not expected to single out Russia, instead calling the sources “foreign actors.”) At the same time, US House and Senate negotiators said they had reached a deal to boost air traffic controller staffing. However, the deal will not increase the mandatory airline pilot retirement age. (Airlines had lobbied to increase the age of mandatory retirement to 67 from the current 65.) Later, EU antitrust regulators announced that AAPL’s iPad operating system has been designated a “gatekeeper.” This makes AAPL subject to the EU’s recent landmark DMA legislation for iPad users in addition to phone and Mac users. At the same time, the NHTSA announced it is opening a probe into 130k F vehicles equipped with the company’s “hands-free driving” technology BlueCruise after two fatal crashes of those vehicles striking parked cars. Later, the FCC fined T ($57 million), VZ ($47 million), and TMUS ($92 million) for illegally sharing phone service customer location data. The TMUS fine included $80 million for T-Mobile and $12 million for Sprint. The wireless carriers protested and said they would appeal. At the same time, a US District Judge threw out challenges by BMY and JNJ, which had filed lawsuits challenging the law that requires them to negotiate prices with Medicare. (This was the fourth federal judge to rule in favor of the Biden administration requirement that pharma companies negotiate price with Medicare in the same way it negotiates with insurers and foreign market entities. The conservative 5th-circuit Court of Appeals will hear an pharma trade group appeal to revive suits to challenge the law later this week.)

Overnight, Asian markets were mixed but leaned toward the green. Japan (+1.24%) was by far the biggest mover in the region followed by Shenzhen (-0.90%) and the rest of the region was at least a half of a percent closer to even on the day. In Europe, we see a similar mixed market leaning slightly to the red side with seven of the 15 bourses in the green. Once again, the CAC (-0.04%), DAX (-0.33%), and FTSE (+0.59%) lead the region by far on volume in early afternoon trade. In the US, as of 7:30 a.m., Futures are pointing toward a start just on the red side of flat. The DIA implies a -0.04% open, the SPY is implying a -0.10% open, and the QQQ implies a -0.18% open at this hour. At the same time, 10-year bond yields are back up to 4.626% and Oil (WTI) is up four-tenths of a percent to $82.97 per barrel in early trading.

The major economic news scheduled for Tuesday includes Q1 Employment Cost Index (8:30 a.m.), Chicago PMI (9:45 a.m.), Conf. Board Consumer Confidence (10 a.m.), and API Weekly Crude Oil Stocks (4:30 p.m.). The major earnings reports scheduled for before the open include MMM, APD, ATI, AEP, AMT, ARCB, ADM, BGC, EAT, CNP, KO, GLW, DAN, ETN, ECL, LLY, EPD, FELE, IT, GEHC, GPK, HSBC, HUBB, ITW, INCY, KBR, LEA, LDOS, MPC, MLM, MCD, MLCO, TAP, MPLX, NOG, OMF, PCAR, PYPL, PAG, PNM, PEG, QSR, RITM, SIRI, STLA, SCL, SYY, TMHC, THC, TKR, TT, and UFPI. Then, after the close, ABRA, AMD, AMZN, AMCR, ASH, EQH, BXP, CZR, CC, CHK, CLX, FANG, EIX, EXR, FBIN, HI, INVH, LEG, LFUS, LPLA, LUMN, MATX, MCY, MDLZ, NGD, OI, OKE, PK, PINS, PSNY, PRU, PSA, QUAD, RNR, RSG, RYI, SWKS, SBUX, SYK, SMCI, UNM, and WERN report.

In economic news later this week, on Wednesday, ADP Nonfarm Employment Change, March Construction Spending, April S&P Global Mfg. PMI, ISM Mfg. Employment, ISM Mfg. PMI, ISM Mfg. Price Index, March JOLTs Job Openings, EIA Weekly Crude Oil Inventories, FOMC Rate Decision, FOMC Statement, and Fed Chair Press Conference are reported. On Thursday, we get March Exports, March Imports, March Trade Balance, Weekly Initial Jobless Claims, Weekly Continuing Jobless Claims, Q1 Nonfarm Productivity, Q1 Unit Labor Cost, March Factory Orders, and Fed Balance Sheet. Finally, on Friday, April Avg. Hourly Earnings, April Nonfarm Payrolls, April Private Nonfarm Payrolls, April Participation Rate, April Unemployment Rate, April S&P Global Services PMI, April S&P Global Composite PMI, ISM Non-Mfg. Employment, ISM Non-Mfg. PMI, ISM Non-Mfg. PMI Price Index, and Fed Member Williams speaks.

In terms of earnings reports later this week, on Wednesday, AER, ARCC, ADP, AVA, AVT, AXTA, GOLD, BLCO, CG, CRS, CDW, COR, CVE, CENX, GIB, CHEF, CLH, CNDT, CVS, DD, ENTG, ESAB, EL, EEFT, FLEX, FTS, GRMN, GTES, GNRC, GSK, GPN, IDXX, NSP, JCI, KKR, KHC, DRS, LTH, MAR, MA, NBIX, NCLH, OGE, PSN, PFE, PPL, SMG, SLGN, SR, STGW, TRN, TTMI, UTHR, VRSK, WEC, WLK, YUM, ACHC, AFL, ALB, ALL, AFG, AIG, AWK, ANSS, CAR, AXS, BALY, BBSI, BZH, BV, CHRW, CWH, CVNA, CF, CMPR, CTSH, CODI, CTVA, CW, DLX, DVN, DASH, EBAY, ENSG, NVST, ETSY, ES, EXPI, FLSR, FNV, GFL, GIL, THG, HLF, HST, JAZZ, KMPR, MRO, MKL, MET, MGM, MAA, MOS, MUSA, MYRG, PGRE, PTEN, PAYC, CNXN, PTC, QRVO, QCOM, RHP, SIGI, SCI, SFM, SUM, TTEK, TWI, TROX, UGI, VMI, VTR, VICI, ZG, and Z report. On Thursday, we hear from AGCO, ATUS, AME, APA, APG, APO, APTV, MT, ARES, ARW, BHC, BAX, BCE, BDX, BDC, BWA, BTSG, BRKR, CNQ, CAH, CHD, CI, CNK, CNHI, CIGI, COP, CMI, XRAY, DBD, D, DRVN, DNB, ENOV, NVRI, EXC, ULCC, HWM, HII, NSIT, ICE, IQV, IRM, ITRI, ITT, JHG, K, KTB, LNC, LIN, MCO, MUR, NFG, NVO, ONEW, OGN, PH, PATK, PBF, BTU, PTON, PENN, PNW, PBI, PWR, REGN, RXO, SABR, SNDR, SEE, SHEL, SO, SWK, TRGP, TFX, TRI, UPBD, VAL, VSTS, VMC, W, WEN, WCC, WRK, XYL, ZBH, ZTS, AES, ALHC, AEE, AMGN, AAPL, ACA, BECN, SQ, BKNG, BFAM, CIVI, COIN, ED, CTRA, DVA, DLR, DKNG, EOG, WTRG, EXPE, FND, FTNT, GDDY, HOLX, HUN, ILMN, IR, LYV, MTZ, MODV, MNST, MSI, ZEUS, OTEX, OPEN, OEC, PTVE, PXD, POST, RGA, REZI, RKT, RYAN, SEM, SM, SWN, TXRH, X, and WSC. Finally, on Friday, ADNT, AXL, AMRX, BEPC, BEP, CBOE, CBRE, GTLS, LNG, CRBG, FLR, FYBR, GPRE, HSY, KOP, MGA, NMRK, NVT, PAA, PAGP, TRP, TAC, TRMB, and XPO report.

So far this morning, MMM, ATI, AMT, EAT, KO, ETN, ECL, EPD, IT, HUBB, KBR, LEA, LDOS, LKNCY, MPC, TAP, OMF, PYPL, QSR, RITM, SIRI, TMHC, THC, TKR, TT, and ZBRA all reported beats on both the revenue and earnings lines. Meanwhile, APD, ADM, CNP, GLW, LLY, GEHC, GPK, MLM, and SCL all missed on revenue while beating on earnings. On the other side, ARCB, DAN, and PEG beat on revenue while missing on earnings. However, AEP, INCY, MCD, MPLX, PAG, and PNM all missed on both the top and bottom lines. It is worth noting that KO, LLY, LDOS, and TMHC all raised their forward guidance.

In geopolitical news, on Monday, the Yemeni Houthi rebels fired missiles at a British-owned, Panamanian-flagged ship in the Red Sea. At least one missile struck the vessel, causing unknown damage. At the same time, the Houthi fired three missiles at a Malta-flagged container ship which was in the Gulf of Aden travelling from Djibouti to Saudi Arabia. This comes after the Houthi shot down a US military MQ-9 Reaper drone on Saturday. In short, the Houthi threat to Red Sea and Suez Canal merchant traffic has ticked up the last few days.

In miscellaneous news, on Monday S&P reported that margins shrank at all five of China’s top banks in Q1. This came as those banks are under pressure, supporting weak property developers while new loan demand is weak. Elsewhere in Asia, the Japanese Yen surged Monday on speculation that the Bank of Japan will intervene to support the currency, which was at a 34-year low versus the US Dollar. Ban in the US, the Philly Fed released data Monday showing that only one in 50 employees changed employers in March (going directly from one employer to another). This is near the historic lows of 2020 and 2010-2011. (This suggests employees may be unsure of the job market and headhunting firms are less active. Both potential forerunners of a weakening labor market…which is what the Fed is looking to cause with high rates.)

With that background, it looks as if the markets are opening indecisive and just on the red side of flat. QQQ is showing us the largest premarket candle body and its still just a small, black-body, Spinning Top candle. The two large cap index ETFs are tru Doji at this point. All three major index ETFs remain above their T-line (8ema), although the DIA is just barely so. So, the short-term trend is bullish but under pressure. Meanwhile, the mid-term remains bearish but under pressure from Bulls. The longer-term market remains Bullish but trend has been broken and is clearly under pressure. Therefore, in general we can say we have a choppy, undecided market. In terms of extension, none of the major index ETFs is too far extended from their T-line and the T2122 indicator is in its mid-range, although now at the top end. So, both sides have room to run if they can gain the momentum to do so. In terms of those 10 big dog tickers, seven of the 10 are in the red with TSLA (-1.95%) out front leading the way lower. Keep in mind that we’ve seen a lot of whipsaw lately. So, be careful not to chase a gap. Also remember that this is a Fed week and the last day of April, meaning we’ll get April Jobs data on Friday as well as a ton of earnings over the week. There will be a tendency to “wait and see” and a ton of ammunition for over-reaction on news this week. Just be careful.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the Man in the Green Bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby, it’s a job. The gains are real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Heavy Earnings, Fed, and April Jobs Week

On Friday, markets diverged at the open. SPY gapped up 0.60%, QQQ gapped up 0.77%, but DIA opened 0.03% lower. From there, all three major index ETFs saw some follow-through, with DIA rallying until 10:15 a.m. and then meandering sideways the rest of the day. Meanwhile, SPY and QQQ continued their rally until about 1:45 p.m. before starting their own sideways meanders for the remainder of the session. This action gave us white-bodied candles in all three major index ETFs. SPY printed a Spinning Top type crossing back above its T-line (8ema). QQQ could be called a fat body Spinning Top that also gapped up above, retested and stayed above its T-line. DIA had the weakest candle, with a larger upper wick, but also crossed back above its T-line and closed just a few cents above. This all happened on below-average volume in all three.

On the day, eight of the 10 sectors were in the green with Technology (+2.14%) way out in front (by more than one percent) leading the rest of the market higher. At the same time, Utilities (-0.78%) lagged far behind the other sectors. Meanwhile, SPY gained 0.95%, DIA gained 0.36%, and QQQ gained 1.54%. VXX fell another 3.24% to close at 13.43 and T2122 climbed but remained in its mid-range at 61.21. 10-year bond yields rose to 4.663% and Oil (WTI) was just on the green side of flat to close at $83.66 per barrel. So, Friday, the market thumbed its nose at conventional wisdom and took the PCE reading as Bullish. Or perhaps traders just ignored that data while focusing on strong earnings from MSFT and a great report (a beat), first-ever dividend, and raised forward guidance from GOOGL. In either case, it was the Bulls’ Day and ended the strongest week for the markets (SPY and QQQ) since November.

The major economic news scheduled for Friday included March Core PCE Index Year-on-Year, which was flat at 2.8% (higher than the forecast 2.6% but in-line with the February 2.8% value). On a Month-on-Month basis the March Core PCE Price Index was flat as expected at +0.3% (compared to a +0.3% forecast and prior reading). On the headline number, March PCE Price Index Year-on-Year was hotter than predicted at +2.7% (versus a forecast of +2.6% but up two ticks from February’s +2.5%). For the Month-on-Month basis, the PCE Price Index was flat, as predicted and seen the prior month, at +0.3%. At the same time, March Personal Spending remained flat at +0.8% (compared to a forecast of +0.6% and a February reading of +0.8%). Later, Michigan Consumer Sentiment was down to 77.2 (versus a 77.8 forecast and the previous value of 79.4). At the same time, Michigan Consumer Expectations were also low at 76.0 (compared to a 77.0 forecast and a previous value of 77.4). In terms of forward-looking, the Michigan 1-Year Inflation Expectation if up to 3.2% (versus a forecast of 3.1% and well up from the prior +2.9% value). On the longer-term, the Michigan 5-Year Inflation Expectations are +3.0% (in-line with the forecast of +3.0% but up two ticks from the previous +2.8% reading).

In stock news, on Friday, SBUX and US worker’s union met for contract negotiations. In other labor news, Reuters reported that MBGAF (Daimler Truck) faces an imminent strike at six US facilities by 7,300 UAW workers if a deal was not reached by 10 p.m. Friday. At the same time, the staff of a Las Vegas CVS facility voted to join a pharmacy union by an overwhelming 87% vote. (The was the first CVS facility to unionize.) Later, GM announced it is closing manufacturing operations in Columbia and Ecuador. With plans to lay off 850 workers in Columbia and an unspecified number in Ecuador. At the same time, AAL announced it will have to adjust flights and routes in the second half to adjust for BA 787 jet delivery delays. (This comes one day after LUV said it will need to shut down operations at some airports for the same reason.) Later, GOOGL filed a motion with a federal court in VA, asking the court to reject the US government lawsuit accusing it of anticompetitive online advertising practices. At the same time, LHX confirmed earlier reports that the company will cut 5% of its workforce in a bid to streamline. After the close, Bloomberg reported that AAPL has re-opened its talks with OpenAI in a bid to catch up to its peers in the AI race. The talks are aimed toward brining generative AI features to iPhones. (AAPL is also in talks with GOOGL to license its AI technology named Gemini.) Late Friday evening, MBGAF did reach a new contract agreement with the UAW. (Daimler workers will get an immediate 10% raise, with an additional 3% increase in 3-months, then at 6-months, and finally at 12-months after ratification. There will also be additional cost-of-living increases and profit-sharing.

In stock legal and governmental news, on Friday, the BRKB subsidiary real estate brokerage reached a $250 million settlement on antitrust litigation related to how realtors are paid. Later, the NHTSA announced it is investigating TSLA’s 2023 recall related to “Full Self Driving” software, after 20 crashes attributed to that feature have been reported after the software patch. (The hypothesis is that TSLA’s system meant to ensure the driver remains attentive and in control of the vehicle is lax or faulty.) The re4call covered 2 million TSLA vehicles (every one ever sold). Later, by a 2-1 vote a federal appeals court revived a NY state law requiring the provision of affordable high-speed internet to low-income families. (T, VZ, and industry trade groups had sued to block the 2021 law and r in the original trial.) At the same time, FAA investigators are looking into an incident Friday where a DAL jet had its emergency slide fall off the plane after takeoff from NY. The jet involved was a BA 767 enroute to Los Angeles. Later, the FDIC announced it had sold seized bank FRBK (closed by PA state banking regulators Thursday night) to FULT in order to protect depositors and continue bank operations. On Saturday. MBGAF (Mercedes-Benz) announced that the US Dept. of Justice has closed its probe into the company over emissions test manipulation on its diesel engines.

Overnight, Asian markets were green across the board. Shenzhen (+2.22%), Taiwan (+1.86%), and South Korea (+1.17%) led the region higher. In Europe, we see a similar picture taking shape with only three of 15 bourses in red at midday. (Greece at -0.44% was the only appreciable red bourse.) The CAC (+0.12%), DAX (-0.04%), and FTSE (+0.48%) lead the region modestly higher in early afternoon trade. In the US, as of 7:30 a.m., Futures are pointing toward a green start to the day. The DIA implies a +0.16% open, the SPY is implying a +0.23% open, and the QQQ implies a +0.33% open at this hour. At the same time, 10-year bonds are down to 4.624% and Oil (WTI) is flat at $83.88 per barrel in early trading.