Trouble at GOOGL and Jobless Claims Ahead

Wednesday gave us a gap lower at the open. SPY gapped down 0.37%, DIA opened just 0.10% lower, and QQQ gapped down 0.58%. However, this was a Bear trap with all three major index ETFs immediately rallying. SPY and QQQ recrossed its morning gap and reached their highs at 10:50 a.m. From there, both of those ETFs ground sideways the rest of the day. However, DIA rallied slower but continuously until the last 10 minutes where it took profits. This action gave us a bullish engulfing signal in the DIA and gap-down, large-body white candles with an upper wick in QQQ and to a smaller-wick extent the SPY. All three remain well above their T-lines (8emas). This all happened on far lower than average volume in all three of those major index ETFs.

On the day, five of the 10 sectors were in the green and the other five in the red. The Utilities (+0.78%) led the green sectors higher while Healthcare (-0.63%) led the red side lower. VXX fell a little more than a percent to close at 12.28 and T2122 dropped back out of its overbought territory to the top of the mid-range to close at 72.81. At the same time, 10-year bond yields rose to 4.498% and Oil (WTI) gained 1.05% to close at $79.20 per barrel. Meanwhile, SPY gained 0.01%, DIA gained 0.45%, and QQQ lost 0.06%. So, Wednesday, was largely a nothing day in the broader SPY and QQQ index ETFs, but was another modestly bullish day for DIA.

The major economic news scheduled for Wednesday was limited to EIA Weekly Crude Oil Inventories, which had a slightly smaller-than-expected inventory drawdown that was expected at -1.362 million barrels (compared to a forecasted drawdown of 1.430 million barrels and far below the prior week’s 7.265-million-barrel inventory build.

In Fed speak news, Boston Fed President Collins repeated the obvious, saying that the economy needs to cool for us to get back to the FOMC’s 2% inflation target. Collins said, “A slowdown in activity will be needed to ensure that demand is better aligned with supply for inflation to return (to target) durably.” She went on to explain that this means the Fed’s ‘higher for longer’ mantra will, in fact, need to come to pass…just as the Fed has been saying since last year. She said, “the recent upward surprises to activity and inflation suggest the likely need to keep policy at its current level until we have greater confidence that inflation is moving sustainably toward 2%.” Finally, Collins reiterated the “data driven” view of the Fed, saying “there is no pre-set path for policy – it requires decisions based on a methodical, holistic assessment of wide-ranging information.” Meanwhile, Fed Governor Cook said US households, banks, and companies are all largely in solid shape financially. Cook said even the commercial real estate sector isn’t in bad shape, saying it poses “sizable but manageable” risks and even then only to certain regional banks with high concentrations of commercial real estate loans. She said, Fed supervisors were also “working closely” with those banks that either suffered losses in the book value of some assets or who hold large amounts of loans secured by commercial real estate that may have lost value.

After the close, ABNB, AMC, APP, ARM, CART, CENTA, CENT, CAKE, CXW, EXAS, FLNC, HUBS, JXN, LNW, MFC, MMS, MKSI, MRC, HLI, HOOD, NTR, PAAS, SBGI, SNEX, STN, TKO, TSE, TTD, VSTO, WTS, and WES all reported beats on both the revenue and earnings lines. Meanwhile, ATO, CE, CPAY, CTLT, NWSA, SSRM, STE, RUN, and MODG missed on revenue while beating on earnings. On the other side, COMP, ET, FG, FNF, MATV, RGLD, and TTEC all beat on revenue while missing on earnings. However, CAPL, DOX, and QDEL missed on both the top and bottom lines.

In stock news, on Wednesday, Bloomberg reported that WBD is planning a cost-cutting program that will include an undetermined number of job cuts as well as a price hike for its MAX streaming platform. Later, GM announced it will end the production of its gasoline-powered Chevrolet Malibu model later this year in order to produce more electric vehicles. (More than 10 million Malibus have been sold since its introduction in 1964.) At the same time, BA announced that a crewed flight of its Starliner space capsule had been pushed back at least 10 more days. (The first crewed flight had been scheduled for Tuesday, but pushed back to Wednesday. Now it will be delayed at least another 10 days.) Meanwhile, TSLA announced it has told all employees at its Berline plant to stay home Friday, due to expected protests against the expansion of the company’s plant. Later, MSFT said it will close its software development operations in Nigeria. (That operation was opened in 2022 and was the company’s largest operation in Africa.) After the close, WBD and DIS announced they had agreed to bundle their Disney+, Hulu, and Max streaming services starting this summer. (No pricing or exact date was announced, only the agreement that had previously been reported as under discussion.) Also after the close, there was bad blood in the air as GOOGL employees grilled top executives over the poor morale as the company has reported another blowout quarter…but also laid off a bunch of employees, blew up entire groups, and openly stated they plan to let higher-cost US employees go to move development to lower-priced labor countries.

In stock legal and governmental news, on Wednesday, three insurance companies rejected CVX’s $57 million claim related to an Iranian-seized oil cargo. The three companies filed suit in US federal court asking that the court uphold their determination that the Iranian seizure did not constitute a “war risk” loss. At the same time, Reuters reported that US Dept. of Justice prosecutors are evaluating whether to file securities and wire fraud charges against TSLA for misleading investors about their car’s “self-driving” capabilities. (Many times, CEO Musk told conferences that TSLA cars could drive themselves from CA to NY with no human help within the year.) Later, Bloomberg reported that PFE has agreed to settle more than 10,000 Zantac cancer-risk lawsuits for an undisclosed sum. At the same time, GOOGL announced it will fight the UK’s $17 billion lawsuit alleging the company abused its market dominance in the online advertising market.

Elsewhere, US House and Senate negotiators agreed to a deal that will codify the recent Dept. of Transportation rules requiring airlines to ensure quick and automatic refunds for canceled flights and fees for services not available. (US airlines had opposed both the bill and DOT rules.) At the same time, Turkey’s competition board fined META $37.2 million related to two data-sharing probes. Later, a group representing SPOT and other music streaming platforms urged the European Commission to reject AAPL’s proposal for complying with the antitrust case ruling against the company in March. At the same time, HYMTF (Hyundai) and Kia agreed to pay $335k to settle charges it had illegally repossessed 26 vehicles belonging to US military members on active duty. After the close, a federal judge grilled the head of AAPL’s App Store about whether the company is violating the judge’s order to allow alternative payment options. The judge said AAPL has set up what seemed to be a series of exasperating hurdles meant to discourage consumers from buying Apps by any way other than through its app store (where AAPL gets a 30% cut). The tone of the questioning showed frustration and skepticism about AAPL’s complying with the court’s orders.

Overnight, Asian markets were mixed but leaned toward the red side. India (-1.55%), South Korea (-1.20%), and Australia (-1.06%) led the region lower. In Europe, we see the opposite picture taking shape at midday with mixed bourses that lean toward the green side. Belgium (-1.08%) is the biggest mover, but the CAC (+0.15%), DAX (+0.47%), and FTSE (+0.43%) lead the region higher on volume in early afternoon trade. In the US, as of 7:30 a.m., Futures are pointing toward a modestly down start to the morning. The DIA implies a -0.22% open, the SPY is implying a -0.21% open, and the QQQ implies a -0.29% open at this hour. At the same time, 10-year bond yields are up to 4.512% and Oil (WTI) is up 0.78% to $79.60 per barrel in early trading.

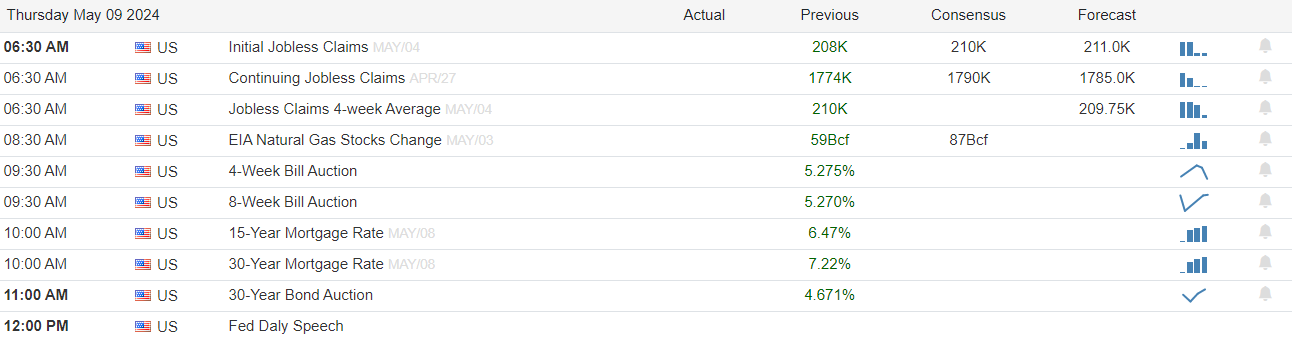

The major economic news scheduled for Thursday is limited to Weekly Initial Jobless Claims and Weekly Continuing Jobless Claims (both at 8:30 a.m.), and Fed Balance Sheet (4:30 p.m.). In addition, Fed member Daly speaks at 2 p.m. The major earnings reports scheduled for before the open on ADV, ALE, AZUL, BERY, CSIQ, CRL, COMM, CEG, EDR, EPAM, EVRG, HBI, HGV, H, ICL, IHRT, IBP, KELYA, NXST, NOMD, PZZA, PLTK, ACDC, RPRX, RBLX, SBH, SN, SOLV, SPB, TPR, TEF, TIXT, VTNR, VTRS, WBD, and WMG. Then, after the close, AKAM, COLD, AMN, BAP, DBX, SSP, EVH, FIHL, GEN, G, HRB, IAG, IOSP, MTD, PBA, RXT, RBA, and SLF report.

In economic news later this week, on Friday, Michigan Consumer Sentiment, Michigan Consumer Expectations, Michigan 1-Year Inflation Expectations, Michigan 5-Year Inflation Expectations, the WASDE report, and April Federal Budget Balance as well as Fed members Bowman and Vice Chair Barr speak.

In terms of earnings reports later this week, on Friday, AQN, AMCX, CLMT, CPG, CRH, ENB, HMC, and DNOW report.

In miscellaneous news, a cyberattack disrupted “clinical operations” at major non-profit healthcare provider Ascension Wednesday. (Ascension operates 140 hospitals and 40 “senior living” facilities across 19 states.) In politics, MAGA extremist MTG made a surprise motion to vacate the Speaker again. However, the House voted resoundingly to kill her motion (table it) by a 359-43 vote. (Only 11 MAGA Republicans, including MTG, voted for the motion along with 32 Democrats. Meanwhile, 196 Republicans and 163 Democrats voted to table her proposal.) Meanwhile, a UK-based think tank (Ember) reported Wednesday that 30% of global electricity was generated by renewable sources in 2023. (This included Hydropower, which fell as a percentage but was still by far the largest renewable source, Wind, and Solar.) Interestingly, China was the leader, generating nearly 10 times more renewable energy (279.6 Terawatt Hours) than the second-largest producer (Brazil at 35.7 TWh). The US was in the fourth spot at 24 TWh of renewable electric produced in 2023.

So far this morning, AVAH, CSIQ, CRL, CCO, COMM, EPAM, ICL, IBP, KELYA, SN, SOLV, SPB, VTNR, and WMG all reported beats on both the revenue and earnings lines. Meanwhile, BERY, CEG, HBI, HGV, NXST, PZZA, RPRX, TAK, TPR, and TIXT missed on revenue while beating on earnings. On the other side, EVRG, FOUR, and USFD reported beats on revenue while missing on earnings. However, ADV, ALE, H, NOMD, SBH, VTRS, and WBD missed on both the top and bottom lines.

With that background, it looks as if markets are heading toward an indecisive, if slightly bearish open. All three major index ETFs started the premarket with a modest gap down. However, all three have also put in white-bodied candles in the early session as the Bulls push back toward even. The SPY, DIA, and QQQ all remain above their T-line (8ema). So, the short-term trend is now bullish again. Meanwhile, the mid-term remains sideways but is leaning toward the bullish again now. The longer-term market remains Bullish as all three major index ETFs have returned within a few percent of all-time highs. Overall, the character of the market is gappy and more than a bit volatile. In terms of extension, none of the three major index ETFs are “too far” extended above their T-line. The T2122 indicator has pulled back a bit, outside of its overbought area. So, while both sides still have room to run if they can gain the momentum to do so. In terms of those 10 big dog tickers, nine of the 10 are in the red this morning putting a considerable drag on the QQQ and SPY. Again, keep in mind that this is not a heavy news week but we do have a lot of earnings reports. Perhaps more importantly, there are several Fed speakers and undoubtedly a few others will also pop off. Any of those statements could swing markets, especially as Bulls are now dreaming of Fed rate cuts again.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the Man in the Green Bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby, it’s a job. The gains are real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service