PBO Flag Found A New Friend

CYCC – The Rounded Bottom and the PBO Flag found a new friend, “the Morning Star.” Excellent support with price, the big three moving averages and price support. A little volume kicked in Friday, and after $2.25 there’s a nice little gap that could reward in a good way.

CYCC – The Rounded Bottom and the PBO Flag found a new friend, “the Morning Star.” Excellent support with price, the big three moving averages and price support. A little volume kicked in Friday, and after $2.25 there’s a nice little gap that could reward in a good way.

Good Trading – Hit and Run Candlesticks

► Must Read Trade Update (NTNX)

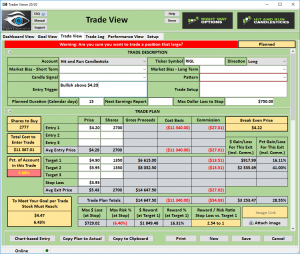

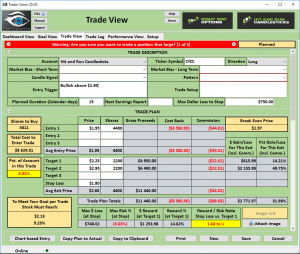

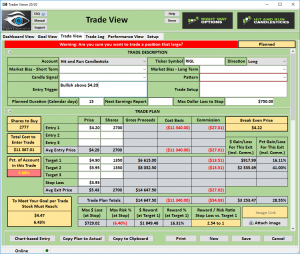

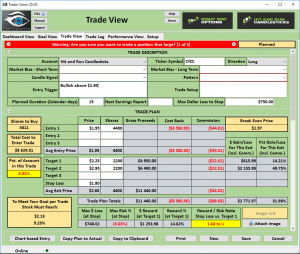

On October 16 we shared and covered in detail the technical properties of NTNX in the Trading Room, Friday the profits were about 35.5% or $945.00, with 100 shares. NTNX has been a T-Line run and continued to make higher highs and higher lows.

[button_2 color=”blue” align=”center” href=”https://ob124.infusionsoft.com/app/orderForms/Gold-Monthly-Membership-85″ new_window=”Y”]$2.83 Per Day • Receive Trading Education • Trade Ideas • 7 Hours A Day[/button_2]

Cancel any time

► Eyes On The Market

Can you believe this marker? I saw the DOW up over 200 points. At the close Friday the Bulls had come back strong, and with the TAX Bill this weekend the Bulls must be throwing a party. Today and this week it will be more important than ever to keep an eye on price. We don’t want the price to sneak across some line we don’t want it to. The trend is you, friend; friends do turn on each other on the playground.

Rick’s trade ideas for the day – MEMBERS ONLY

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

Learn how and what we trade: The T-Line • T-Line Bands • Support • Resistance • Patterns • Buy Box • Volatility Stops • Price Action • Candlesticks • Profit Zones • Entry Zones • Protective Stops

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

Bulletproof?

With the futures pointing to a 200 point gap up in the Dow on the back of the Tax Reform bill passage, it would seem the market is bulletproof. Even the threat of nuclear war seem to be nothing more than an annoying mosquito easily shooed away. Now the Dow has 25,000 in its cross-hairs and seems to have all the money and energy necessary to drive for that goal. However, I doubt the ascension to this plateau will be a smooth one. Friday’s full reversal intraday whipsaw may be a clue to fast and whippy price action ahead. Big price action swings could be possible as we move forward making it very challenging for swing traders. The bulls are obviously in control, but Friday’s price actions should serve as a reminder that the bears are still here and they have been waiting to eat for a long time. Plan your risk carefully.

With the futures pointing to a 200 point gap up in the Dow on the back of the Tax Reform bill passage, it would seem the market is bulletproof. Even the threat of nuclear war seem to be nothing more than an annoying mosquito easily shooed away. Now the Dow has 25,000 in its cross-hairs and seems to have all the money and energy necessary to drive for that goal. However, I doubt the ascension to this plateau will be a smooth one. Friday’s full reversal intraday whipsaw may be a clue to fast and whippy price action ahead. Big price action swings could be possible as we move forward making it very challenging for swing traders. The bulls are obviously in control, but Friday’s price actions should serve as a reminder that the bears are still here and they have been waiting to eat for a long time. Plan your risk carefully.

On the Calendar

On the First Monday of December, the Economic Calendar has a light day. At 10:00 AM we get the Factory Orders report which will likely show strength and confirm expectations for fourth-quarter manufacturing strength. After that just a few bound auctions and a nonmarket moving TD Ameritrade report.

On the earnings calendar, we have 14 companies reporting today. A quick scan of the list and I don’t see any that are particularly noteworthy unless of course, you happen to own one of them. Make sure to keep checking and remember you’re the boss. Expect the best from yourself.

Action Plan

Last Friday I suggested that the market was going to be very sensitive to the news and to prepare yourself for possible violent price moves. During the Flynn testimony, we go just that! A very fast and nasty whipsaw that looked like it had completely reversed in just 20 minutes of trading. The promise of the tax reform bill likely to pass in the Senate revered it once again as the bulls regained control.

Now that the bill has passed the bulls are running hard this morning. The Dow Futures are pointing to a gap up around 200 points and sending the charts into a parabolic territory. One would think a huge selloff should be just around the corner, but I sure would not want to be betting against the strength of this bull run. In fact, with Dow 25,000 in sight, it’s likely to attract the bulls like a moth to a flame. Continue to trade with the trend but plan carefully and avoid chasing. Expect elevated volatility with triple-digit gaps and whipsaws possible in the days ahead.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/Ie3ZCLlhXOo”]Morning Market Prep[/button_2]

Consistency is Key

No matter if the market up-trending, down-trending or moving sideways to achieve lasting success consistency is key. I trade stock options because no matter the condition of the market there is opportunity to make a profit. Most options services like to hype the big percentage returns that options can provide but I prefer to focus on the consistency of my win/loss ratio. To prove that point Right Way Options has traded an account “live” in full view of the membership. Starting with $10,000 on Jan. 1, 2017 and trading small one, two or three contract positions. The win/loss ratio ranged between 65% and 75% winners holding only 5 to 7 trades at a time. Focus on consistency and money will take care of itself. Currently up more than 90% this year.

No matter if the market up-trending, down-trending or moving sideways to achieve lasting success consistency is key. I trade stock options because no matter the condition of the market there is opportunity to make a profit. Most options services like to hype the big percentage returns that options can provide but I prefer to focus on the consistency of my win/loss ratio. To prove that point Right Way Options has traded an account “live” in full view of the membership. Starting with $10,000 on Jan. 1, 2017 and trading small one, two or three contract positions. The win/loss ratio ranged between 65% and 75% winners holding only 5 to 7 trades at a time. Focus on consistency and money will take care of itself. Currently up more than 90% this year.

I’m not telling you its easy. Trading consistently requires hard work, determination, planning and discipline. The good news is that anyone can learn trade consistently. Trust me if an old carpenter can support his family for more than 12 years from trading profits, any one can!

Recently Closed Trades

CSCO 17% • BAC 31% • CREE 48% • WMT 245% • NFLX -40% • STX 42% • 2nd CSCO Trade 30%

Today’s Market Prep Note

Yesterday the Tax Reform bill appeared to be a slam dunk and a vote to was expected to happen at any time. I mentioned yesterday the next couple weeks could be bumpy as all the political drama unfolds. Last night’s delay has the Washington spin machine at high speed with both sides churning out more and more dramatic rhetoric. Listen closely, and you can hear the dramatic music reaching a crescendo. One side vows to save the day while the other promises to fight to the death because of horror this bill will bring. Blah, Blah Blah! Unfortunately, the stock market is directly in the line of fire. Traders should be very cautious. Violent price shifts are possible in either direction so plan your risk accordingly.

Become a Member Today!

30 Day Trial Monthly Semi-Annual Annual

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Doug Campbell is not a licensed financial adviser, nor does he offer trade recommendations or advice to anyone except for the trading desk of Right Way Options Inc.

Political Drama

Yesterday the Tax Reform bill appeared to be a slam dunk and a vote to was expected to happen at any time. I mentioned yesterday the next couple weeks could be bumpy as all the political drama unfolds. Last nights delay has the Washington spin machine at high speed with both sides churning out more and more dramatic rhetoric. Listen closely, and you can hear the dramatic music reaching a crescendo. One side vows to save the day while the other promises to fight to the death because of horror this bill will bring. Blah, Blah Blah! Unfortunately, the stock market is directly in the line of fire. Traders should be very cautious. Violent price shifts are possible in either direction so plan your risk accordingly.

Yesterday the Tax Reform bill appeared to be a slam dunk and a vote to was expected to happen at any time. I mentioned yesterday the next couple weeks could be bumpy as all the political drama unfolds. Last nights delay has the Washington spin machine at high speed with both sides churning out more and more dramatic rhetoric. Listen closely, and you can hear the dramatic music reaching a crescendo. One side vows to save the day while the other promises to fight to the death because of horror this bill will bring. Blah, Blah Blah! Unfortunately, the stock market is directly in the line of fire. Traders should be very cautious. Violent price shifts are possible in either direction so plan your risk accordingly.

On the Calendar

Friday’s Economic Calendar has several important reports this morning, but before that happens, we will hear from two Fed Speakers. Bullard speaks at 9:05 AM and Kaplin at 9:30. The PMI Manufacturing Index is at 9:45 AM and forecasters expect a very strong 54.5 print today. At 10:00 AM the IWM Mfg. Index has topped consensus several weeks in a row. However, the forecasters today call for a slight pullback to 58.4 vs. 58.7 last month. Construction Spending is also at 10:00 with the October’s consensus increase at 0.5% due to strength in single-family home building. And then who would have guessed we will hear from yet another Fed speaker at 10:15 AM.

On the Earnings Calendar, we only have 18 companies reporting today none of which are particularly notable.

Action Plan

The promise of Tax Reform spurred the bulls into a full-on stampede yesterday as traders seemed to buy stocks with both hands. The Dow smash through 24,000 finally coming to rest up a whopping 331 points on massive volume. It’s also interesting to note that the VIX also rallied suggesting fear at this evaluation is growing. OPEC’s decision to extend their production reduction program also played a part in pushing the market higher. Oil companies surged higher on the news.

This morning futures are looking lower because the Tax Reform bill suddenly seems to have lost votes. The Senate now says the vote could happen today, but they are scrambling to rewrite provisions of the bill on the fly. I repeated over and over yesterday in the trading room a warning to not chase this rally. Those that did could have a tough lesson learned today. If by chance they fail to get this bill passed we could experience a very dark in the market.

Trade wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/N-IS_oPF00U”]Morning Market Prep Video[/button_2]

Charts Have Been Mean And Green

Wow, what a great week this has been, the charts have been mean and GREEN, and we love GREEN. Hey, thanks to all the members for posting and sharing the great charts. I see the morning futures are a looking a bit weak this morning, let’s keep our eye on the ball and the trend, using a couple of support and resistant lines can make all the difference in the world.

Wow, what a great week this has been, the charts have been mean and GREEN, and we love GREEN. Hey, thanks to all the members for posting and sharing the great charts. I see the morning futures are a looking a bit weak this morning, let’s keep our eye on the ball and the trend, using a couple of support and resistant lines can make all the difference in the world.

The DC politics is something I dislike, but we have to keep our eyes and ears open on whats going on and trade the charts based on the charts, not hopes and dreams.

►NewsFrom Our Team

Trader Vission 2020.2 is nearly ready to be launched; the testers have been testing it for about two months now. We are extremely confident that Trader Vission is a must-have tool for the trader that wants the next level of success.

How to save your membership cost – This project will be ready before Christmass, and one of the benefits is it will pay for all your membership cost or at least the largest portion. It is very important to the HRC/RWO team that you receive quality at the very best possible price.

►Sample • Members Recent Big Winners

EGLT 16.8% • WIN 28.9% • HOV 24.45% • ZUMZ 30% • URBN 21.20% • ARNA 21.5

► Eyes On The Market

In the past 11 bars, the SPY has gone from below the Lower T-Line and with a Bullish Morning Star price ran nearly 3.8%. All of our moving trend lines are still bullish. Price has gotten a bit overzealous and extended. I believe we are very close to seeing a little correction or at least price needs to be taken down a notch or two.

Rick’s trade ideas for the day – MEMBERS ONLY

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

Gap Back In October and Consolidated

RIGL – Gapped back in October and had consolidated for the past two months. The 34-EMA has caught up with the price. A few days ago price popped and is now seeing a little profit taking. The weekly chart shows good strong support and a Bullish Morning Star signal. You can also see the Bullish “W” pattern. I see a leg or 2 putting price around $7.00 with plenty of swing zones in between.

RIGL – Gapped back in October and had consolidated for the past two months. The 34-EMA has caught up with the price. A few days ago price popped and is now seeing a little profit taking. The weekly chart shows good strong support and a Bullish Morning Star signal. You can also see the Bullish “W” pattern. I see a leg or 2 putting price around $7.00 with plenty of swing zones in between.

Good Trading – Hit and Run Candlesticks

► Must Read • Trade Update (VIAB)

On November 20 we shared and covered in detail the technical properties of VIAB in the Trading Room, Yesterday the profits were about 8.7% or $227.00, with 100 shares. VIAB broke of a Bullish J-Hook continuation pattern within a Rounded Bottom Breakout setup.

[button_2 color=”red” align=”center” href=”https://hitandruncandlesticks.com/hrc-rwo-30-day-offer/” new_window=”Y”]In 30-Days Learn and Profit From Hit and Run Candlesticks [/button_2]

► Eyes On The Market

I had a few concerns going into the close yesterday with the QQQ’s and SMA getting crushed, and I am still very concerned. This morning the futures a bit positive and the Transports (IYT) smacked the cover off the ball yesterday. Overall I am still Bullish because the price of the SPY, IYT, and DIA are still trending above the T-Lines. Following price on the 1, 2, and three-day charts and how price interacts with all 3 of the T-Lines has had a positive impact on myself and the members of Hit and Run Candlesticks and Right Way Options.

Rick’s trade ideas for the day – MEMBERS ONLY

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

Learn how and what we trade: The T-Line • T-Line Bands • Support • Resistance • Buy Box • Volatility Stops • Price Action • Candlesticks • Profit Zones • Entry Zones • Protective Stops

Investing and Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

Washington DC Spin

The US Senate is now the top focus of the market as the Tax Reform bill head to the floor for debate. According to reports, a vote could come before the end of business Friday. In my opinion, there is never a more dangerous time in the market then when Politicians, rhetoric and the Washington DC Spin machine is in control. Anything is possible, and high volatility and big intra-day swings can occur. Also, keep in mind that even after the Tax Reform dog and pony show is over we still face a Federal Government shutdown in early December. Who knows what kind of political drama that could create. I suggest if you do trade then trade small and stay on your toes because the price could be very bumpy the next couple weeks.

The US Senate is now the top focus of the market as the Tax Reform bill head to the floor for debate. According to reports, a vote could come before the end of business Friday. In my opinion, there is never a more dangerous time in the market then when Politicians, rhetoric and the Washington DC Spin machine is in control. Anything is possible, and high volatility and big intra-day swings can occur. Also, keep in mind that even after the Tax Reform dog and pony show is over we still face a Federal Government shutdown in early December. Who knows what kind of political drama that could create. I suggest if you do trade then trade small and stay on your toes because the price could be very bumpy the next couple weeks.

On the Calendar

The Thursday Economic Calendar begins at 8:30 AM Eastern with two important reports. First, the consensus for the Jobless Claims number this week is 240K vs. 239K on the previous reading. If not for the impacts of Puerto Rico Jobless Claims would be at or near historic lows. Second, is the Personal Income and Outlays report. Personal Income is see rising 0.3% while consumer spending could slow slightly to 0.3%. The Core index expects a 0.2% increase for a yearly rate fo 1.4%. Also at 8:30 AM we have a Fed Speaker and then another at 1:00 PM to pontificate on interest rates. At 9:45 AM is the Chicago PMI which forecasters are calling for a decline to 63.5 vs. 65.2.

On the Earnings Calendar, we have 38 companies reporting. Please continue to check current holdings as well as those you are considering for purchase for reporting dates. Just a few seconds of effort can save you from significant losses if a company reports poorly.

Acton Plan

Yesterday’s price action left behind patterns of uncertainty in the DIA, SPY, and IWM. The QQQ’s on the other hand, reminded us that the bears still exist and their teeth are very sharp! Many trends in the Tech sector broke down yesterday, and there are reversal patterns galore. As bad as it was, please remember it’s not the first move lower that matters. A failure to make a new high after it bounces is where the real selling could begin. The sky is not falling.

New out of Washington that the Senate voted mover the Tax Reform bill forward to floor debate has fired up the Futures this morning. Currently, the Dow futures are suggesting a large gap up at the open. Remember gaps to new market highs can create whipsaw price action producing fast intraday reversals. Be careful not chase and get caught up in the morning drama. A vote to pass the Tax bill could happen within the next 24 to 48 hours. If it happened to fail; well, use your imagination.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/uKqlLAM72s8″]Morning Market Prep Video[/button_2]

CYCC – The Rounded Bottom and the PBO Flag found a new friend, “the Morning Star.” Excellent support with price, the big three moving averages and price support. A little volume kicked in Friday, and after $2.25 there’s a nice little gap that could reward in a good way.

CYCC – The Rounded Bottom and the PBO Flag found a new friend, “the Morning Star.” Excellent support with price, the big three moving averages and price support. A little volume kicked in Friday, and after $2.25 there’s a nice little gap that could reward in a good way.