The SPY Has Rallied From $252.92

The SPY has rallied from $252.92 back to the 50-SMA where it will decide who takes control, the Bulls or the Bears and maybe even both with a sideways move. The market on a weekly chart SPY, DIA, QQQ’s, IWM it is still in a bullish trend. Switch to a daily chart, and we see the struggle. The daily chart is in the Blue Ice Failure trap and needs the buyers to come to this party, or a retest of the recent test is in the cards. If the buyers show up, then we will see constructive consolidation and a bull move.

A little of the recent fear has dried up causing the VXX to pull back to the 200-SMA. The close yesterday was also at prior support, be sure there are plenty of traders watching ready to jump in if the fear starts to heat up again.

►HRC Recent and Current Trades

- Recently closed – VIPS 118% • VXX 375% • TWTR 180% • QQQ 179% • QQQ 28%

- Current holdings – SKX • TWTR

- RWO public Saturday event

- TradeHawk Tuesday afternoon event

- HRC member Thursday Night event

- Trader Vision 20/20 Wednesday event

- Trader Vision 20/20 Thursday event

- Professional Traders Summit Saturday event

- Look Ahead Sunday night event

- To see all events Click Here

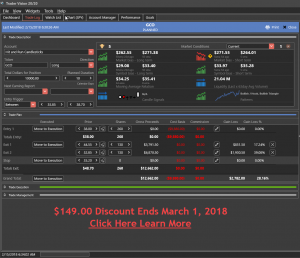

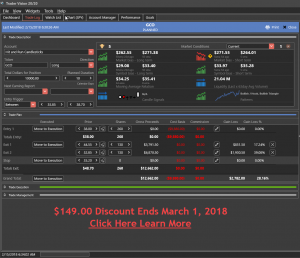

►Hit and Run Candlesticks • Right Way Options • Trader Vision

We hear from our members every day how we have helped their trading through education. We don’t just post trades for you we teach you about the trade as well. There is always that person that just wants the stock pick and thinks they’re going to trade it for profit and success “Bull Crap” how’s that been working out?

Candlesticks • Price Action • T-Line • T-Line Bands • Support • Resistance • Trends • Trendlines • Chart Patterns • Buy Box • Volatility Stops • Profit Zones • Entry Zones • Protective Stops • RBB Rounded Bottom Breakout Strategy • Pop Out of The Box Strategy • Pinball Strategy • Continuation Patterns • Trade Planning.

Rick’s Swing Trade ideas

Member Login – Full Daily List

[button_1 text=”Take%20Control%20%E2%80%A2%20Learn%20to%20Pay%20Yourself%20More%20″ text_size=”32″ text_color=”#000000″ text_bold=”Y” text_letter_spacing=”0″ subtext_panel=”Y” subtext=”Get%20Started%20Now” subtext_size=”18″ subtext_color=”#f90b0b” subtext_bold=”Y” subtext_letter_spacing=”0″ text_shadow_panel=”N” styling_width=”40″ styling_height=”30″ styling_border_color=”#000000″ styling_border_size=”1″ styling_border_radius=”6″ styling_border_opacity=”100″ styling_gradient_start_color=”#2ed632″ styling_gradient_end_color=”#2ed632″ drop_shadow_panel=”N” inset_shadow_panel=”N” align=”center” href=”https://hitandruncandlesticks.com/become-a-member/” new_window=”Y”/]

Candlesticks • Price Action T-Line • T-Line Bands • Support • Resistance • Trendlines • Chart Patterns • Buy Box • Volatility Stops • Profit Zones • Entry Zones • Protective Stops • RBB Rounded Bottom Breakout Strategy • Pop Out of The Box Strategy • Pinball Strategy • Continuation Patterns

Investing and Trading involve significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

*************************************************************************************

Fear of Missing Out

Another day and another big gap expected as volatile price action continues. With so much drama in the price actions, it’s easy to feel the as if your missing out. The fear of missing out is a very powerful emotion that will often cloud a traders judgment, and the chaise is on. Traders will leap without looking buying positions at or near price resistance level. Sometimes you will be rewarded for taking this risk, but often you get in right at the point where profit-taking begins. If the futures remain at current prices, the DIA and the SPY will gap up to 50-day average resistance. That means both indexes will be up over 17% in just five days. Consider that as you plan the day ahead.

Another day and another big gap expected as volatile price action continues. With so much drama in the price actions, it’s easy to feel the as if your missing out. The fear of missing out is a very powerful emotion that will often cloud a traders judgment, and the chaise is on. Traders will leap without looking buying positions at or near price resistance level. Sometimes you will be rewarded for taking this risk, but often you get in right at the point where profit-taking begins. If the futures remain at current prices, the DIA and the SPY will gap up to 50-day average resistance. That means both indexes will be up over 17% in just five days. Consider that as you plan the day ahead.

On the Calendar

A big day on the Economic Calendar this Thursday. We have four important reports coming at 8:30 AM Eastern. 1. Jobless Claims – expected to rise to 229K vs. the 221K on the last reading. 2. Pilly Fed Bus. Survey – expected to hold steady and strong at 21.0 which is said to be near capacity. 3. Empire State Mfg. – Is expecting to slow slightly from the Jan. 17.7 reading to the Feb. consensus of 17.5. 4. PPI – forecasters see overall producer prices gaining 0.4%, less food, and energy up 0.2% and trade services also up 0.2%.

At 9:15 is the Industrial Production numbers which consensus expects to increase 0.2% with capacity utilization up one-tenth to 78.0%. The Housing Market Index is out at 10:00 AM and is expected to show steady strength but unchanged at 72. Treasury International at 4:00 PM is not forecasted forward but tracks the flow of financial instruments into and out of the United States. Also on the calendar are several non-market-moving reports as well as a bunch of bond events.

On the Earnings Calendar, I show just over 170 reporting results today to keep us on our toes.

Action Plan

Nice rallies across all four major indexes but only the QQQ’s have managed to cross back above the 50-day average. Dow Futures are very strong this morning pointing to more than a 200 point gap up testing 50-day average on the DIA and the SPY. A failure at or near the 50 SMA would set up a possible Blue Ice Failure pattern so be careful not to chase this gap up to resistance. With any luck, the leadership in the QQQ will help lift the markets out of the danger zone. Another positive for the market is that the VIX finally broke lower yesterday to close below a 20 handle. Continue to expect very fast price action and watch price closely for possible whipsaw action at resistance levels.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/fgLFsNhTpvc”]Morning Market Prep Video[/button_2]

A Smooth Breakout for GCO

GCO recently tested the 200-SMA after a smooth breakout on the daily chart. In the current GCO daily chart, a few clues popping out to me. One, the Bullish engulf off the 50 and 200-SMA, the Bullish Flag pulls back and then there the not so perfect Bullish Morning Star reversal clue. Drill up to the 2-3-4-and 5-day charts, and you will find the RBB chart pattern set up for the RBB trading strategy. FYI. The weekly Morning Star is a beauty.

GCO recently tested the 200-SMA after a smooth breakout on the daily chart. In the current GCO daily chart, a few clues popping out to me. One, the Bullish engulf off the 50 and 200-SMA, the Bullish Flag pulls back and then there the not so perfect Bullish Morning Star reversal clue. Drill up to the 2-3-4-and 5-day charts, and you will find the RBB chart pattern set up for the RBB trading strategy. FYI. The weekly Morning Star is a beauty.

Have you ever asked yourself why someone will make a darn good profit on a trade and someone else may struggle for a dime or even lose money on the same trade?

[button_2 color=”blue” align=”center” href=”https://hitandruncandlesticks.com/hrc-rwo-30-day-offer/” new_window=”Y”]Learn and Earn • 30-Day Trial[/button_2]

►Up Coming Events

►SPY Up Date

The SPY has now closed for the last 3 bars above the Lower T-Line Band, today price just might push through the Upper Band and close above it as well. Price closed yesterday about 2 points away from the 50-SMA, a challenge today is likely. 3-4 points on either side of the 50-SMA are important for both the Buys and Sellers, the both will fight for the place, and this is the battleground.

►Learn Our Tools and Trading Techniques

On February 8, Rick shared SRNE as a trade for members to consider and how to use the trading tools listed below. Currently, the profits could have been about 68.5% or $335.00 with 100 shares. Using our Simple, Proven Swing Trade Tools and techniques to achieve swing trade profits.

Candlesticks • Price Action • T-Line • T-Line Bands • Support • Resistance • Trend • Trendlines • Chart Patterns • Buy Box • Volatility Stops • Profit Zones • Entry Zones • Protective Stops • RBB Rounded Bottom Breakout Strategy • Pop Out of The Box Strategy • Pinball Strategy • Trade Planning

►The VXX short-term futures

The VXX has been resting it’s bullish pasture and will likely dip below the 200-SMA today. On a side, note price is approaching the Fib 50% retracement.

►Rick’s Swing Trade ideas Reserved for Subscribing Members

30-Day Trial • Monthly • Quarterly • Semi-Annual • Annual

To learn more about our trading tools join us in the trading room or consider Private Coaching. Rick will help coach you to trading success.

Investing and Trading involve significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

*************************************************************************************

Danger still lurks.

Although short-term rally has eased tensions and provided some sweet relief, danger still lurks. It’s so easy to become fixated on the hard right edge of the chart and getting lost in the intra-day gyrations in price. If we take a critical look at an index entire chart, we have several important clues that should have you on the edge of your seat. First and most obvious is that all the major indexes are in a current downtrend. The rally is testing not only the downtrend but also some very significant price resistance levels. Also, we are still below the 50-day average, the T-line, and that the 34 EMA is dangerously close to dropping below the 50.

Although short-term rally has eased tensions and provided some sweet relief, danger still lurks. It’s so easy to become fixated on the hard right edge of the chart and getting lost in the intra-day gyrations in price. If we take a critical look at an index entire chart, we have several important clues that should have you on the edge of your seat. First and most obvious is that all the major indexes are in a current downtrend. The rally is testing not only the downtrend but also some very significant price resistance levels. Also, we are still below the 50-day average, the T-line, and that the 34 EMA is dangerously close to dropping below the 50.

Trust me I want to market to resume its uptrend as much and anyone else. However, if I allow that bias to cloud my view of the potential dangers displayed in the chart, I’m failing as a technical analyst. Always take the time to look at the big picture and remember Price is King!

On the Calendar

The hump day Economic Calendar has four important reports. Inflation hawks will be keeping a very close eye on the Consumer Price Index which comes out at 8:30 AM Eastern. The consensus is looking for a gain of 0.3% on the month but also expecting the yearly rate to slightly decline. Also at 8:30 is Retail Sales where forecasters see an overall moderate 0.3% gain. Then at 10:00 AM we get the Business Inventories Report which forecasters expect an increase of 0.3%. The EIA Petroleum Status report is at 10:30 AM. They don’t forecast this number, but the last 2-reports have shown a build in supplies, a 3rd would begin a trend hurting oil-related stock prices.

On the Earnings Calendar, I show just about 180 companies will report results. Make sure your check and planning for these events to avoid undue risk to your account.

Action Plan

The market spent another day chopping sideways taking a break from the huge daily price moves. On the positive side, the bulls were able to shrug off the morning gap down and close just slightly higher. On the negative side, the market continues to deliver triple point gaps daily and remains under price resistance and the 50-day average. At the close yesterday, the VIX drifted just below 25 but seems stubbornly resistant to a pullback keeping traders on their toes.

The CPI this morning could be very import today to determining market direction. A print below 2.0 could bring out the bulls while a number over 2.0 could bring out the bearish inflation hawks. Currently, the Dow Futures are pointing to 100 point gap up, but that could quickly change if inflation raises its ugly head. Please keep in mind that all the major indexes are below significant price resistance levels. Which means a failure pattern near resistance is still possible which could once again inspire the bears. Extreme caution is still warranted as we approach resistance with high volatility.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/tI7ELAgjxxE”]Morning Market Prep Video[/button_2]