National Doughnut Day

National Doughnut Day

Ya, it’s Friday and National Doughnut Day, being that it’s Friday we don’t usally post any trade ideas. As choppy as this markets been I don’t think it’s a great idea to be entering trades on a Friday’s and holding over the weekend. Rather it’s a better idea to close a few positions and take your money or even a loss or two. I just flipped through the recent trade ideas, and plenty looks like there set up and ready to run. FYI I don’t close all my positions before the weekend, but I do tighten up the account.

Trading Proof Provided

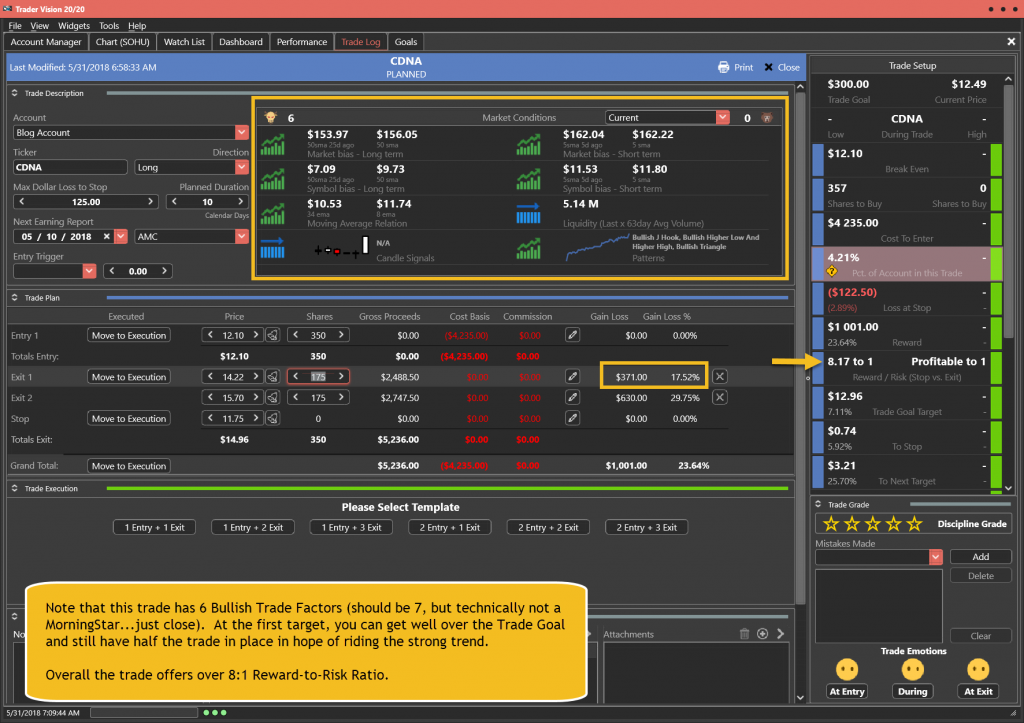

If you have been following the progress of my 2018 project “Road To Wealth” I have a little update. It looks like the account is up 175% ending with May, not to bad. The project started January 1, 2018, with $5,000.00, Starting June 1, the account is now worth $13,568.00.

Every month we have an educational workshop to help become a better trader. On June 6th the workshop will be on Fibonacci Retracements and Extensions. Check it out Click Here

SPY Market

The is no doubt the SPY and the market has been a bit choppy and difficult to navigate from time to time we still think the bulls have the upper hand. The charts tell the story. Education is the key to beating the charts.

Testimonial

In the past eight months, I have been a fortunate member of Hit and Run Candlesticks Right Way Options. The education on a day-to-day basis is both informative and fun. The E-learning further cements the learning experience along with the educational archives and methodology. If you enjoy working with other members to solve mutual options strategies engagingly with a sense of purpose, then this membership can be yours.

Jerry Hefner

Testimonial

This is not your usual service that sends out a ton of stock recommendations, and then cherry picks the winners to show you how great they are. Hit and Run Candlesticks and Right Way Options are truly educational services. They taught me how to trade not what to trade. The entire team: Rick, Doug, Steve, and Ed are there to help and answer your questions. They are awesome. They cut years off my learning curve. And it’s a team effort. Everyone in the room (all the members) are there to help with invaluable insights and advice. The only service you will ever need. Thanks to all the team for how you have helped me and for all you do.

Jonathan Bolnick

Investing and Trading involve significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

*************************************************************************************