My Apologies

There will not be market comments today Monday, June 18, 2018

Please remember to check out the Trader Vision trade idea and trade plan

Focus Trading Education

Candlesticks • Price Action • T-Line • T-Line Bands • Support • Resistance • Trend • Trendlines • Chart Patterns • Buy Box • Volatility Stops • Profit Zones • Entry Zones • Protective Stops • RBB Rounded Bottom Breakout Strategy • Pop Out of The Box Strategy • Pinball Strategy • Trade Planning, Fibonacci, Stoch/RSI

To learn more about our trading tools join us in the trading room or consider Private Coaching.

Testimonial

This is not your usual service that sends out a ton of stock recommendations, and then cherry picks the winners to show you how great they are. Hit and Run Candlesticks and Right Way Options are truly educational services. They taught me how to trade not what to trade. The entire team: Rick, Doug, Steve, and Ed are there to help and answer your questions. They are awesome. They cut years off my learning curve. And it’s a team effort. Everyone in the room (all the members) are there to help with invaluable insights and advice. The only service you will ever need. Thanks to all the team for how you have helped me and for all you do. –Jonathan Bolnick

Rare to have a service teach you how they find their choices but, HRC/RWO teach you how to fish instead of fishing for you. And, your ideas are not panned but shared, implemented, or improved. Sharing is caring. –Thomas Bradly

Investing and Trading involve significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. or Rick Saddler is to be considered financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone.

*************************************************************************************

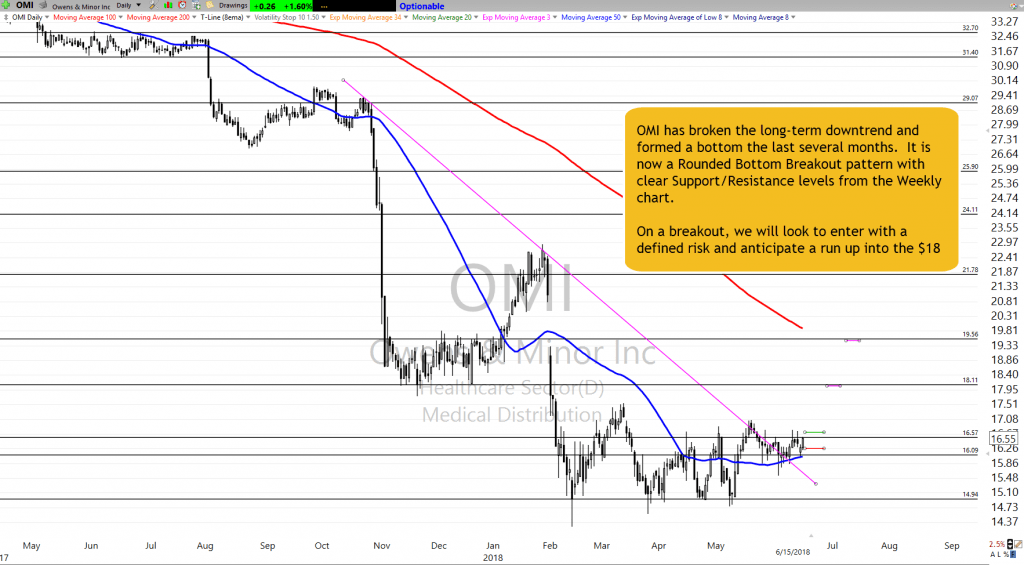

Today’s Featured Trade Idea is OMI.

Rick had a family emergency today and cannot do a morning blog post. However, members can listen to his detailed analysis in the trading room at 9:10am Eastern.

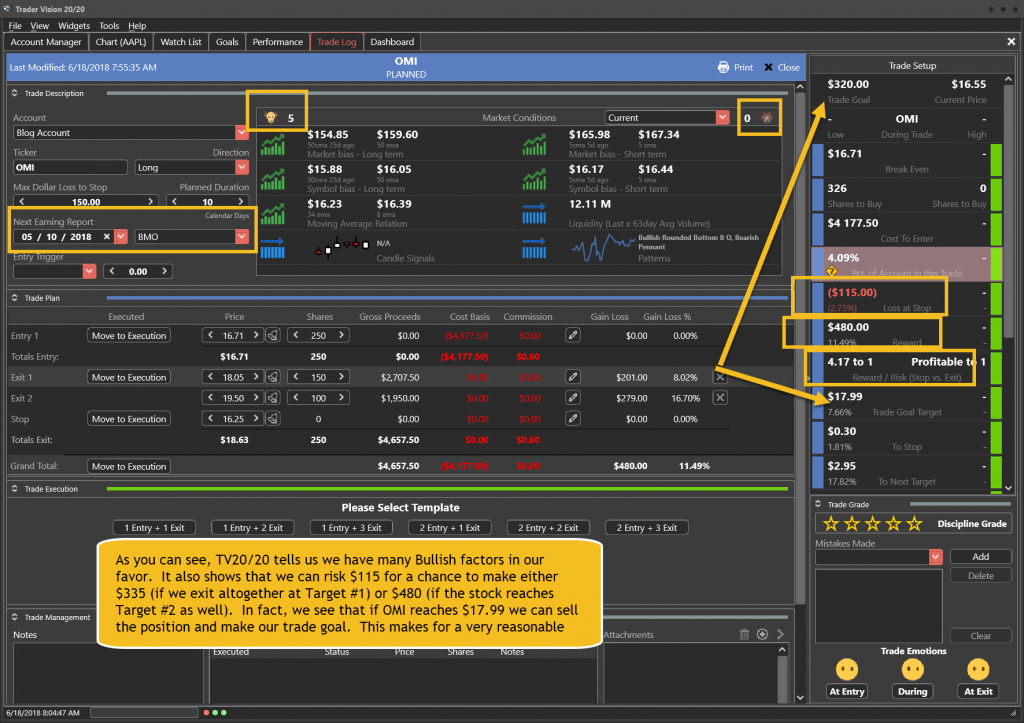

Nonetheless, for now, here is my analysis and a potential trade plan made using our Trader Vision 20/20 software.

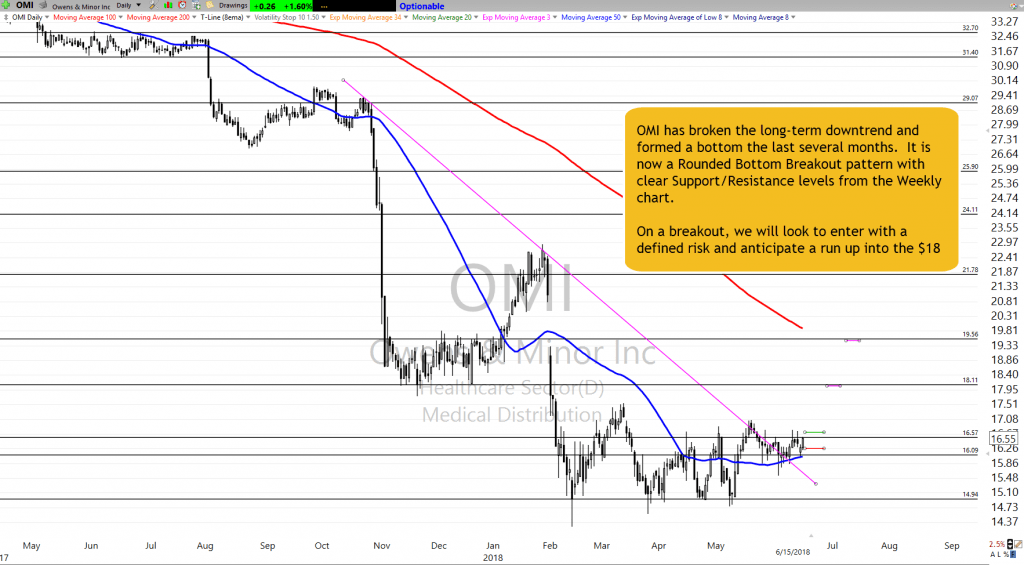

OMI has formed a bottom over the last few months. It has broken into an RBB pattern and is right at the next potential Resistance level. On a breakout, we can have a defined, small risk looking for a run up into the next potential resistance level (defined on the Weekly chart). Below is my markup of the chart and the trade plan as laid out by Trader Vision 20/20. As a bonus, if you click the green button below, you’ll be able to watch a video of the chart markup and trade planning process.

The OMI Trade Setup – As of 6-15-18

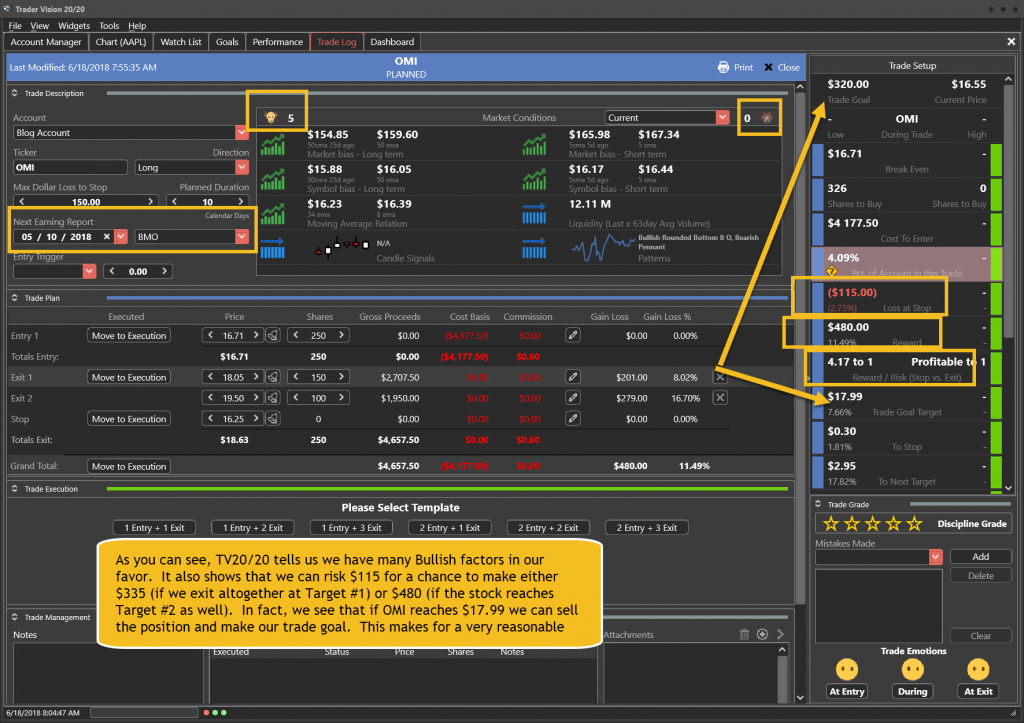

The OMI Trade Plan

Note how Trader Vision 20/20 does so much of the work for you. As we see above, Trader Vision shows you that the stock only needs to move 7.61% to make the Goal for the trade, while the anticipated first Target price is 10.37%. We also see that the Risk is very low and the potential Reward quite nice. Knowing the Risk, Reward and how far a stock must move to reach our goal…before a trade…really takes the pressure off. No guesswork. No surprises. No emotional roller coaster.

To see a short video of this trade’s chart markup and trade planning, click the button below.

[button_2 color=”light-green” align=”center” href=”https://youtu.be/IOGWsmZfFXg” new_window=”Y”]Trade Plan Video[/button_2]

If you’re interested in putting the power to Trader Vision 20/20 to work for you, click below.

[button_2 color=”orange” align=”center” href=”https://hitandruncandlesticks.com/product/trader-vision-20-20-monthly-subscription2/” new_window=”Y”]TV20/20 Software[/button_2]

Testimonial

Trader Vision immediately simplified the process…immediately it provided that information and guidance to me. I knew what I would risk for how much reward, I began taking trades off at the 1st target, 2nd target, I was no longer holding all my trades for the homerun. I also began implementing the stop losses if and when they were reached, not just hoping the stock would recover. It then became easier to see what patterns were working for me and which were not. It provided a much more relaxed and stress-free environment. –Joan G

***************************************************************************************************

Investing and Trading involve significant financial risk and are not suitable for everyone. Ed Carter is not a licensed financial adviser nor does he offer trade recommendations or investment advice to anyone. No communication from Hit and Run Candlesticks Inc. is to be considered financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

***************************************************************************************************

Patience is a virtue.

We have all heard the axiom that patience is a virtue. With 13 years experience as a full-time trader, I can confidently confirm that patience is a key quality for all traders to develop. Currently, we see the DIA and SPY pulling back with the futures pointing to significant gap down open this morning. There will be bullish traders that will try and anticipate or predict the turning point. There will also be traders that only see bearishness in the market and will chase short positions on the gap down. Both actions demonstrate a lack of patience.

We have all heard the axiom that patience is a virtue. With 13 years experience as a full-time trader, I can confidently confirm that patience is a key quality for all traders to develop. Currently, we see the DIA and SPY pulling back with the futures pointing to significant gap down open this morning. There will be bullish traders that will try and anticipate or predict the turning point. There will also be traders that only see bearishness in the market and will chase short positions on the gap down. Both actions demonstrate a lack of patience.

Good traders with high win/loss ratios share some similarities to a good sniper. They will wait patiently, quietly and unemotionally focused on the right time to act. If you’re bullish, wait for the bullish signal when buyers step back in at or near price support. If you’re bearish, wait for the signal of failure at or near price resistance. Be patient, focus on price and wait for that good signal to pull the trigger. If to rush or anticipate your shot you’re very likely to miss your target and have an undesirable effect on your account.

On the Calendar

The Monday Economic Calendar gets going at 10:00 AM Eastern with the Housing Market Index. Consensus expects the housing index to remain steady and strong with an unchanged reading at 70 in June. We then have three bond events and two Fed Speakers at 1:00 PM and 4:00 PM to close the calendar day.

On the Earnings Calendar, there are only nine companies expected to report results today, none of which are market moving.

Action Plan

After gaping down Friday morning, the Bulls stepped back in lifting the Dow and the SPY off the morning low and finishing the day with hammer patterns. The QQQ traded sideways and the IWM finished the day at a new record high close. Unfortunately, it currently looks unlikely the hammer patterns will get the follow-through higher to confirm this morning with the Dow futures pointing to more than a 150 point gap down. Of course, it could be a very different picture at the end of the day if the Bulls dig in and fight back but political uncertainty seem to have given the Bears the upper hand at least for the short-term.

The good news is that the overall market uptrend is still valid, but there is reason to exercise a little caution. If the Bulls step up defending the trend, this pullback could produce nice low-risk entry points, but I would caution you not to anticipate entries. I would also be cautious about chasing short positions with uptrends still intact especially after a gap down open. There is no rush. Stay focused on price action and wait for a signal before jumping in.

Trade Wisely.

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/rFEFYLg5QPE”]Morning Market Prep Video[/button_2]

New Tariffs

With new tariffs likely to be levied by the US, China, and Europe it seems that the Bear’s are ready to go back to work this morning. Currently, the Dow futures are pointing to more than a 100 point gap down at the open. With the QQQ and the IWM closing at new record highs yesterday its easy for the trader to feel a bit cheated with an overnight change in attitude like this. We all hate the feeling of helplessness and being out of control.

With new tariffs likely to be levied by the US, China, and Europe it seems that the Bear’s are ready to go back to work this morning. Currently, the Dow futures are pointing to more than a 100 point gap down at the open. With the QQQ and the IWM closing at new record highs yesterday its easy for the trader to feel a bit cheated with an overnight change in attitude like this. We all hate the feeling of helplessness and being out of control.

The best way to deal with that is always to be taking profits. It’s normal to want the maximum profit possible out of every trade, but that is allowing greed to get in the way of good decision making. If you’re walking down the street and a hundred dollar bill blows across the sidewalk in front of you, most will stop and pick it up. Right? Why don’t we do that in trading? Taking partial profits along the way puts you in control and makes overnight reversals much easier to handle.

On the Calendar

The Economic Calendar kicks off at 8:30 AM Eastern with the Empire State Mfg. Survey. Consensus suggests a reading of 19.1 in June vs. Mays’s 20.1 reading with new orders remaining strong. The 9:15 AM Industrial Production expects an increase of 0.1 percent and capacity utilization should hold steady at 79.0 percent according to forecasters. At 10:00 AM Consumer Sentiment expects an increase to 98.5 in June vs. the already strong May reading of 98.0. Wrapping up the potential market-moving reports for the week is reading on Treasury International Capital 4:00 PM which tracks financial instruments in and out of the US. There is the Baker-Hughes Rig Count at 1:00 PM and a Fed Speaker at 1:30 PM but are not expected to move the market.

On the Earnings Calendar, we have a very light day with only nine companies reporting.

Action Plan

Yesterday was a day of missed signals with the QQQ’s and IWM closing at new record highs while the DIA found more sellers than buyers and the SPY chopped in consolidation. Overall with up trends holding there was the reason for caution, but the Bulls maintained their dominance. Ths morning however with the news that the President is likely to levy tariffs against China today futures are pointing to a sharply lower open with the Dow gapping down triple digits. Of course, China has promised immediate retaliation with its own set of tariffs as the so-called trade war heats up.

As always I will be more focused on protecting profits than adding new risk ahead of the weekend. I wish you all a fantastic weekend.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/nAgkyzokGgU”]Morning Market Prep Video[/button_2]

The Magic You Need Is?

The magic you need is within you. Everyone seems to think there is some ‘secret’ that a professional trader has that makes them successful. The truth is they are individuals, just like you, who made a personal commitment to themselves and then took the necessary steps to make that success happen – no matter how long it took or how hard they had to look at and adjust their trading habits to get there. Now they can share that experience with you to shorten your learning time. Consider private personal coaching right from the pros. Review the Coaches Right Here

The magic to trading success is not with an indicator or moving averages.

The magic you need is within you – take steps to bring it to life in your trading experience.

********************

TV20/20 Friday Performance Update

Trader Vision 2020 is up $1956.75 the past two weeks, to view the full blog post Click Right Here

“The Road to Wealth” Trading Results

The Hit and Run Candlesticks trading results are updated about the 7th of each month when the Tradier statement is made available. The last statement shows we are positive by 154.08% At the close of 6/14/18 the account is positive by 225% To view the “Road To Wealth” Trading Account Click Right Here

SPY Below The T-Line

It looks as if we are going to open today below the T-Line. The sellers were able to hold us back yesterday from breaking out; the last four candles gave clues that the balance between the buyers and sellers was in question. The SPY may need to pull back to the $274.80 – $273.50 area before it finds enough support to rise again, and only if the buyer is willing to step forward.

Testimonial

In the past eight months, I have been a fortunate member of Hit and Run Candlesticks Right Way Options. The education on a day-to-day basis is both informative and fun. The E-learning further cements the learning experience along with the educational archives and methodology. If you enjoy working with other members to solve mutual options strategies engagingly with a sense of purpose, then this membership can be yours.

Jerry Hefner

Testimonial

This is not your usual service that sends out a ton of stock recommendations, and then cherry picks the winners to show you how great they are. Hit and Run Candlesticks and Right Way Options are truly educational services. They taught me how to trade not what to trade. The entire team: Rick, Doug, Steve, and Ed are there to help and answer your questions. They are awesome. They cut years off my learning curve. And it’s a team effort. Everyone in the room (all the members) are there to help with invaluable insights and advice. The only service you will ever need. Thanks to all the team for how you have helped me and for all you do.

Jonathan Bolnick

Investing and Trading involve significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc. is financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler is not a licensed financial adviser nor does he offer trade recommendations or advice to anyone except for the trading desk of Hit and Run Candlesticks Inc.

*************************************************************************************

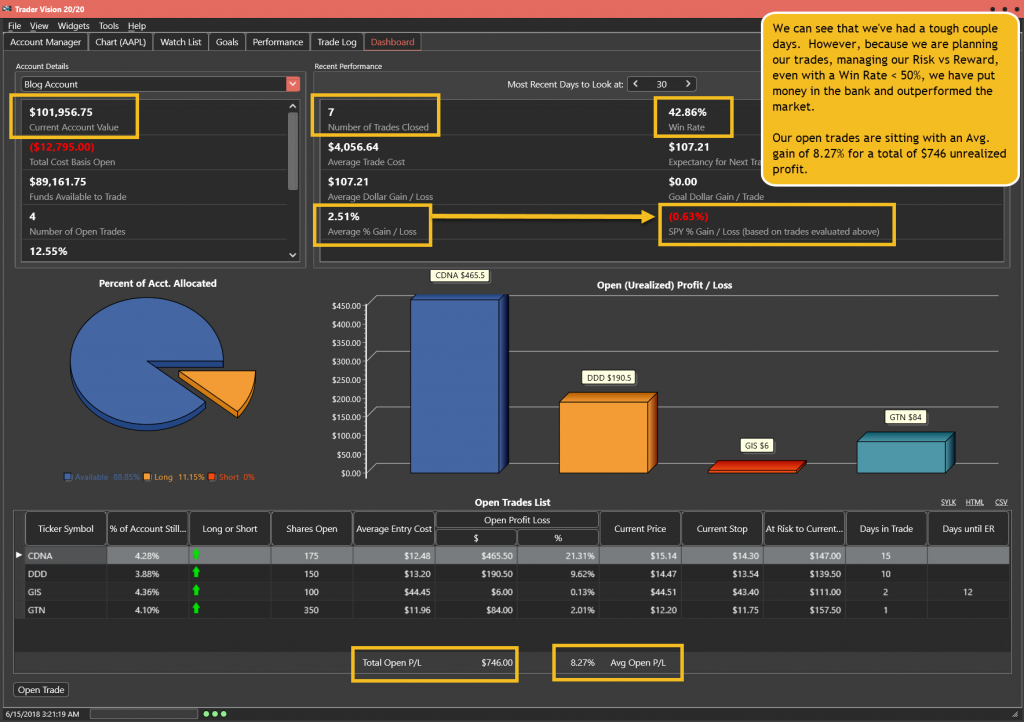

As you know, Hit and Run Candlesticks does not issue Featured Trade Ideas on Fridays. So, instead of planning a new trade, we’ll use Friday’s to check the performance of our trades to date, check on our open trades and adjust and positions as needed.

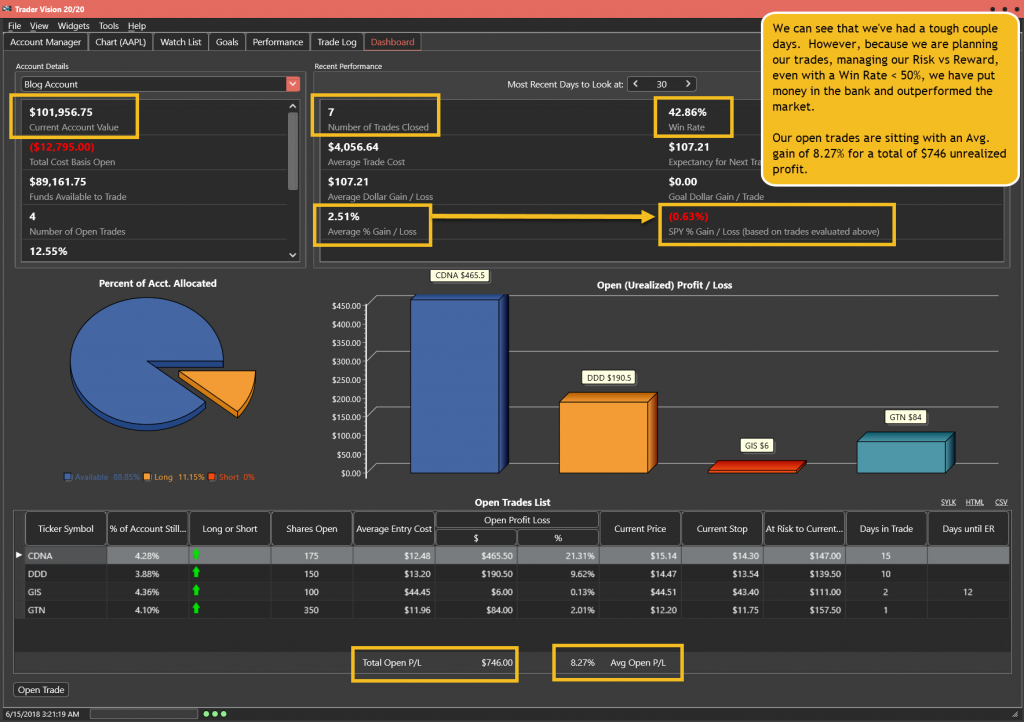

Bear in mind that this update covers the period up through 6-14-18 (only 2.5 weeks of trade ideas).

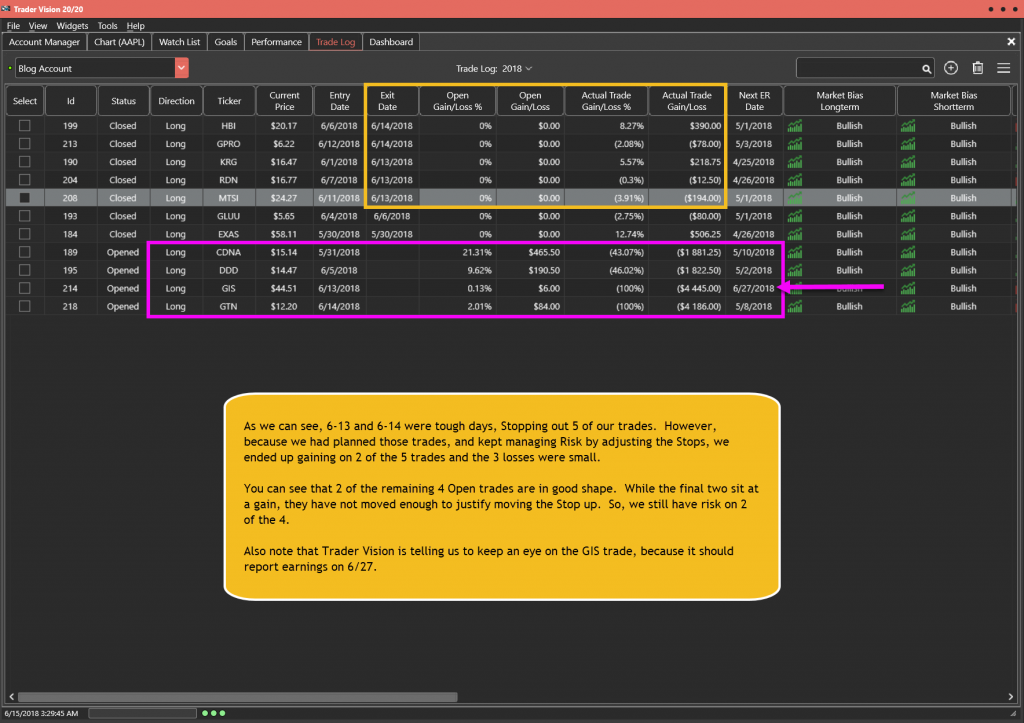

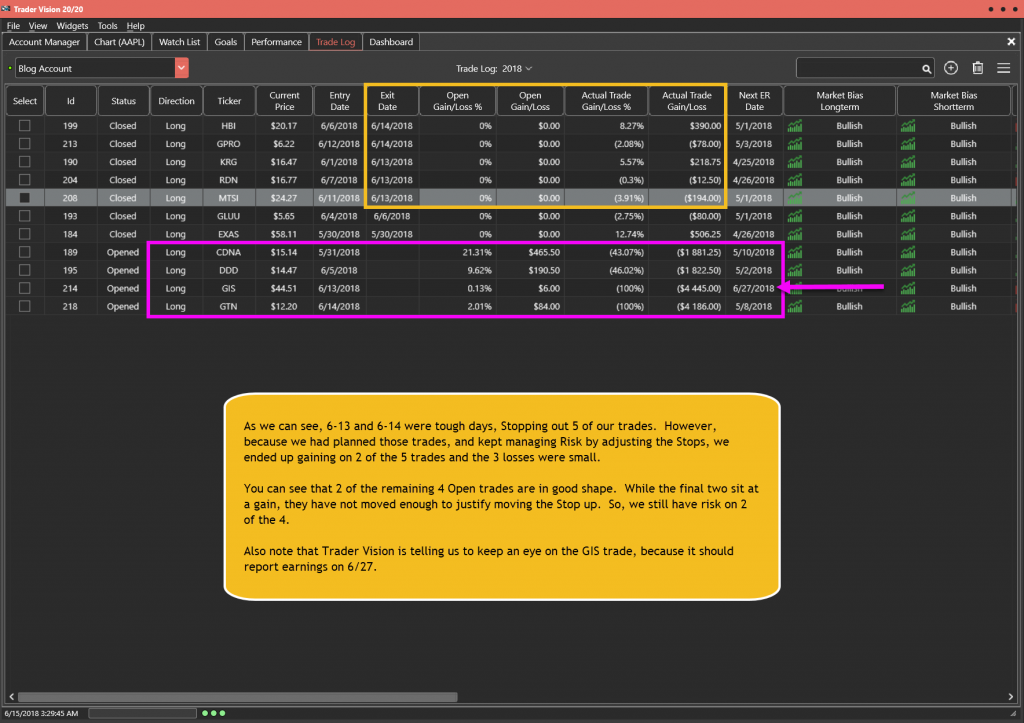

As you can see below, we had a couple rough days that Stopped us out of 5 trades. However, by using Trader Vision 20/20 to plan and manage our trade risk, we still managed to post a profit over those trades and we continue to outperform the broader market. You can see that we have 4 Open trades remaining and all are profitable as of Thursday’s close. On two of those four, we’ve already taken some profits and moved our Stops up. So, by focusing on the managing Reward/Risk and taking profit, those two trades are basically safe. The other 2 are profitable as of Thursday’s close, but have not moved enough yet to justify taking profit or moving Stop.

As a bonus, if you click the green button below, you’ll be able to watch a video where I review these trades and discuss how and why I adjust my positions using Trader Vision 20/20 software.

Of course, members can listen to Rick’s analysis of the overall market and his open position in the trading room at 9:10am Eastern.

Featured Trade Idea Plan Performance

(As of 6-14-18 Close)

+$1,956.75 over 2.5 weeks

$782.70/week profit -or-

almost 0.8%/week profit on the Account

Blog Account Trade Log as of 6-7-18 Close

Note how Trader Vision 20/20 does so much of the work for you. All of your trades are logged, in incredible detail. This will allow you to analyze patterns in your trading, identifying problems and improving your performance. You’ll also be able to get back inside your own head even if you revisit the trade years later. Having all this information give you the ability to keep improving and reducing the emotional roller coaster that the amateurs face every day!

[button_2 color=”light-green” align=”center” href=”https://youtu.be/hypnDjo2x3A” new_window=”Y”]Trade Review Video[/button_2]

If you’re interested in putting the power to Trader Vision 20/20 to work for you, click below.

[button_2 color=”orange” align=”center” href=”https://hitandruncandlesticks.com/product/trader-vision-20-20-monthly-subscription2/” new_window=”Y”]TV20/20 Software[/button_2]

***************************************************************************************************

Investing and Trading involve significant financial risk and are not suitable for everyone. Ed Carter is not a licensed financial adviser nor does he offer trade recommendations or investment advice to anyone. No communication from Hit and Run Candlesticks Inc. is to be considered financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

***************************************************************************************************

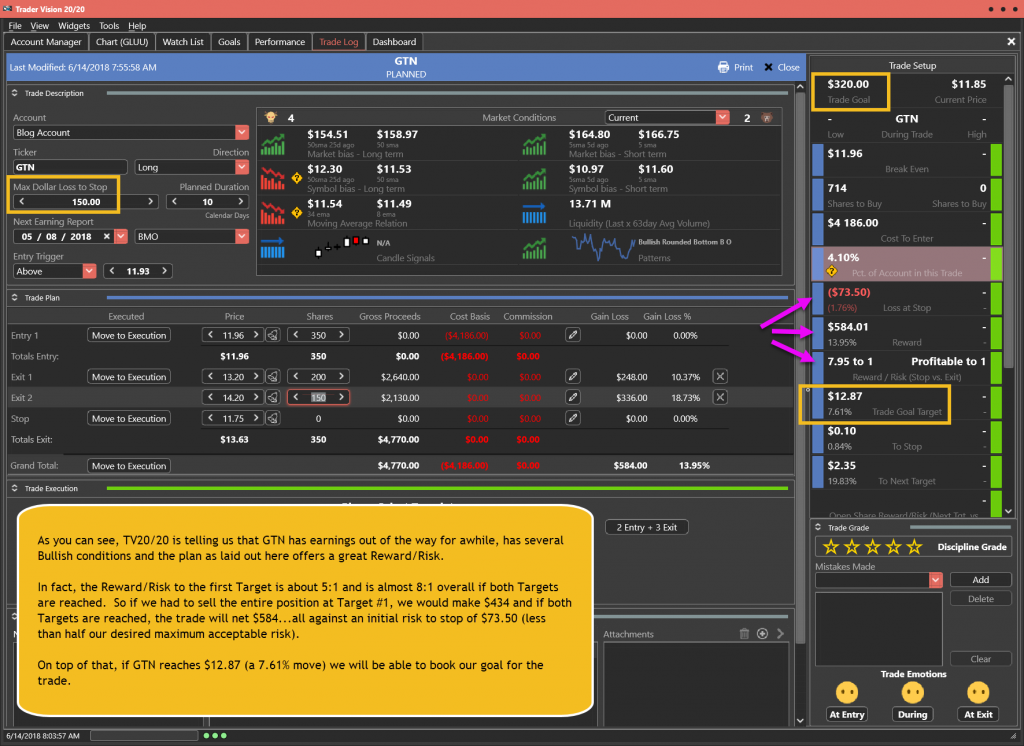

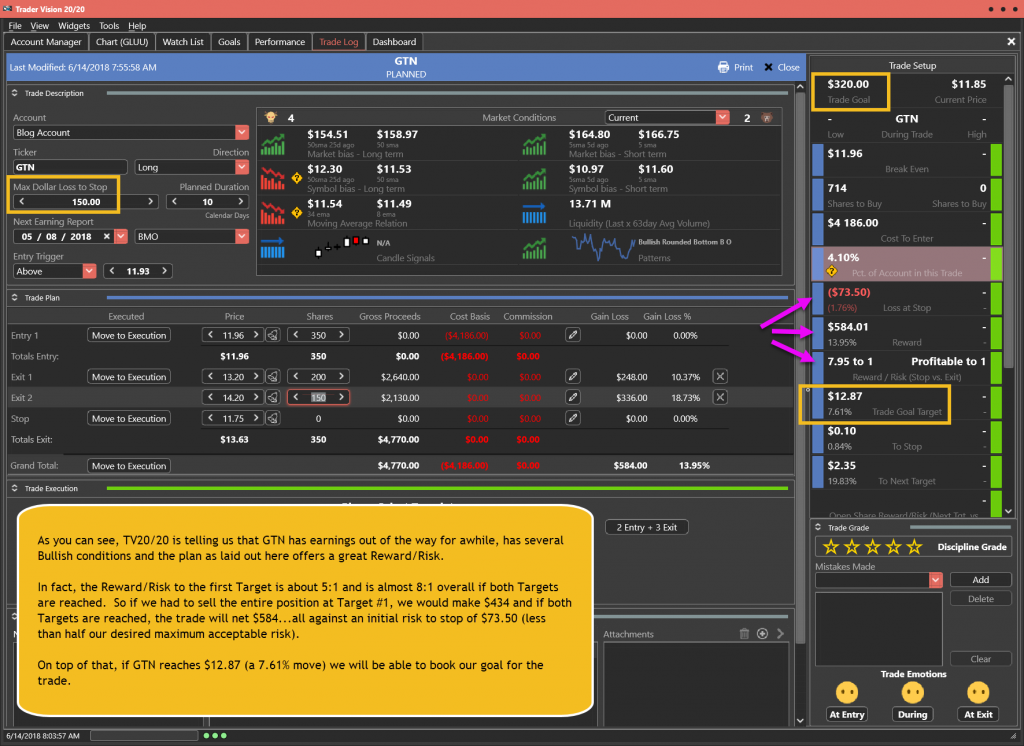

Today’s Featured Trade Idea is GTN.

For a more detailed analysis of the ticker, refer to Rick’s Public Stock Trade Idea for today…or, of course, members can listen to his detailed analysis in the trading room at 9:10am Eastern.

However, for now, here is my analysis and a potential trade plan made using our Trader Vision 20/20 software.

GTN has formed a double bottom (or W pattern) and broke into a Rounded Bottom Breakout pattern on Monday. The next couple days it held the 50sma on two retests…forming a Bullish Harami on Wednesday. With a clear Support/Resistance range around price now and clear potential Resistance levels above for Targets, this setup makes for a good trade. Below is my markup of the chart and the trade plan as laid out by Trader Vision 20/20. As a bonus, if you click the green button below, you’ll be able to watch a video of the chart markup and trade planning process.

The GTN Trade Setup – As of 6-13-18

The GTN Trade Plan

Note how Trader Vision 20/20 does so much of the work for you. As we see above, Trader Vision shows you that the stock only needs to move 7.61% to make the Goal for the trade, while the anticipated first Target price is 10.37%. We also see that the Risk is very low and the potential Reward quite nice. Knowing the Risk, Reward and how far a stock must move to reach our goal…before a trade…really takes the pressure off. No guesswork. No surprises. No emotional roller coaster.

To see a short video of this trade’s chart markup and trade planning, click the button below.

[button_2 color=”light-green” align=”center” href=”https://youtu.be/YEWHnhL7WMU” new_window=”Y”]Trade Plan Video[/button_2]

If you’re interested in putting the power to Trader Vision 20/20 to work for you, click below.

[button_2 color=”orange” align=”center” href=”https://hitandruncandlesticks.com/product/trader-vision-20-20-monthly-subscription2/” new_window=”Y”]TV20/20 Software[/button_2]

Testimonial

Trader Vision immediately simplified the process…immediately it provided that information and guidance to me. I knew what I would risk for how much reward, I began taking trades off at the 1st target, 2nd target, I was no longer holding all my trades for the homerun. I also began implementing the stop losses if and when they were reached, not just hoping the stock would recover. It then became easier to see what patterns were working for me and which were not. It provided a much more relaxed and stress-free environment. –Joan G

***************************************************************************************************

Investing and Trading involve significant financial risk and are not suitable for everyone. Ed Carter is not a licensed financial adviser nor does he offer trade recommendations or investment advice to anyone. No communication from Hit and Run Candlesticks Inc. is to be considered financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

***************************************************************************************************

Is the sky falling?

Is the sky falling with more interest rate increases forecast by the Fed? We certainly saw some selling yesterday after the news, but I have to say it seemed quite controlled with the Bulls holding up better than one might have expected. The candle patterns left behind certainly warrant some caution but unless there is follow-through selling the daily bearish patterns will not valid. So as for now, the sky is not falling, and in fact, with current futures pointing to a flat to a marginally higher, there is a chance the Bulls might maintain control.

Is the sky falling with more interest rate increases forecast by the Fed? We certainly saw some selling yesterday after the news, but I have to say it seemed quite controlled with the Bulls holding up better than one might have expected. The candle patterns left behind certainly warrant some caution but unless there is follow-through selling the daily bearish patterns will not valid. So as for now, the sky is not falling, and in fact, with current futures pointing to a flat to a marginally higher, there is a chance the Bulls might maintain control.

Although the Bulls held up quite well, it would be wise to exercise a little caution staying focused on price again for clues. Guard yourself against predicting or becoming biased and simply follow price action or you might miss the next big potential to profit up or down.

On the Calendar

The Thursday Economic Calendar has four potential market-moving reports. The first is the Weekly Jobless Claims at 8:30 AM Eastern which expects strong labor demand to continue with a reading of 222,000. The second 8:30 report is Retail Sales which according to consensus will show consumer strength with a gain of 0.4 percent in May. The last 8:30 report is Import/Export Prices with Import prices rising 0.5% and Export prices up a more moderate 0.3 percent. The last potential market-moving report comes at 10:00 AM with Business Inventories rising 0.3 percent in for April according to forecasters, but it’s important to note that underlying sales are growing at a faster rate. We have Consumer Comfort @ 9.45, Natural Gas @ 10:30, Fed Balance Sheet & Money Supply @ 4:30 as well as four bond events to round out the day.

On the Earnings Calendar, FRED will report before the bell with ADBE taking center stage after the close which is among the 31 companies reporting results today.

Action Plan

As expected, the Fed raised the interest rate by a quarter point but sent the market lower after forecasting two more rate increases this year followed by another two next year. Although there was some selling after the news, it was rather controlled but signaled a pullback or consolidation of recent gains has possibly begun. Bearish Engulfing patterns were printed in the DIA, SPY, and IWM while the QQQ left behind a possible shooting star pattern. Keep in mind these patterns require follow-through to be valid and with the current futures pointing to a flat to slightly bullish open validation could possibly not occur.

Current positions held up quite well yesterday however if we do see follow-through selling today it may be wise to capture gains and wait for new entry signals. We all knew a pullback was possible and considering the Fed news I have to say at this point the Bulls held up quite well and bodes well for the current uptrend.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/GpeGhgq-WFs”]Morning Market Prep Video[/button_2]