Cradle • Pop Out of The Box Patterns ►Free Trading Room today Thursday 7/5/18

Cradle • Pop Out of The Box Patterns

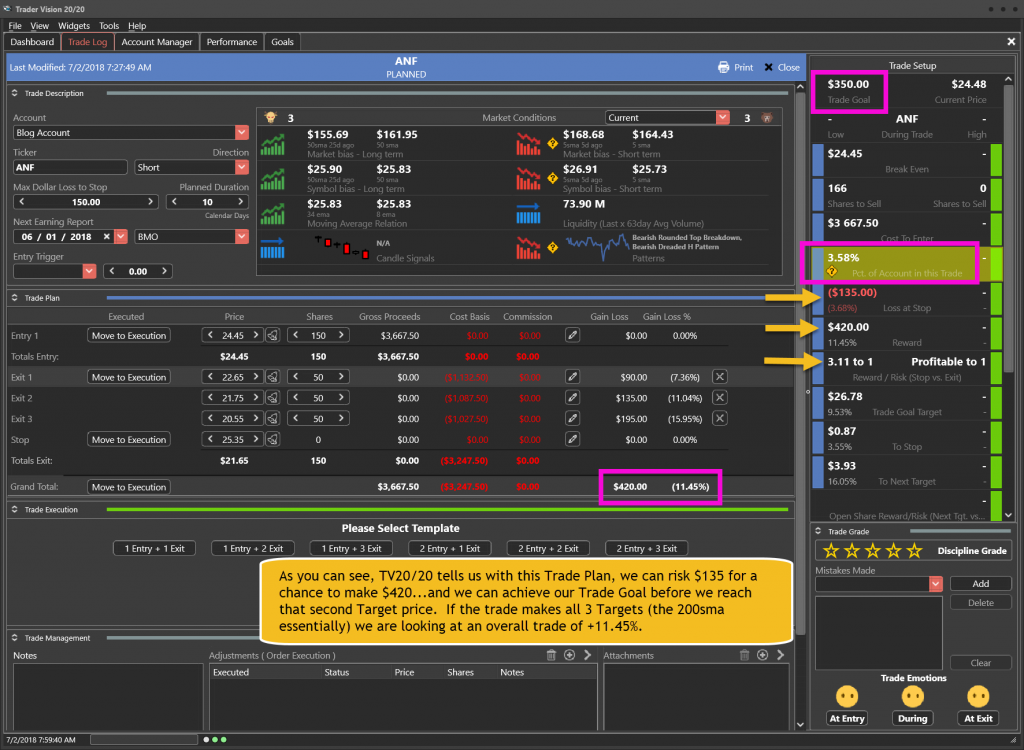

On the 2-day chart, NIHD has produced a Bullish Cradle and Pop Out of The Box Patterns. The daily chart has drawn a breakout with a 2 bar flag with a breakout as well. The Volatility Stop has turned green. These are the kind of conditions we look for before we have a reason to buy. Check out the TV2020 Trade plan for details

Free Live Trading Room, Right Here Today and Friday

Trader Vision Trade Plan Right Here

HRC Monthly Trading Results Right Here

Monthly • Quarterly • Semi-Annual • Annual • Private 2-Hour Coaching

SPY Stoped By The Volatility Stop

On Tuesday the price action was controlled by the sellers, price could not get past the Volatility Stop or the 34-EMA and closed below the 50-SMA. Today’s futures are suggesting the buyers want there ground back and may try to close above the 34-EMA. As I said last week and Monday, and Tuesday until the buyers can get price above $273.65 they have nothing. The Red White and Blue chart is still in negative territory, but not full-blown bearish; this suggests choppy back and forth until the bear or bull gives up.

VXX – The VXX chart at Tuesday’s close suggest bullishness, today’s morning futures suggest the bullishness has a weekend. Above $34.15 the VXX chart still has gas in the tank.

Rick’s Trade-Ideas Reserved for Members Right Here

Focus Trading Education

Candlesticks • Price Action • T-Line • T-Line Bands • Support • Resistance • Trend • Trendlines • Chart Patterns • Buy Box • Volatility Stops • Profit Zones • Entry Zones • Protective Stops • RBB Rounded Bottom Breakout Strategy • Pop Out of The Box Strategy • Pinball Strategy • Trade Planning, Fibonacci, Stoch/RSI

To learn more about our trading tools join us in the trading room or consider Private Coaching.

Testimonial

This is not your usual service that sends out a ton of stock recommendations, and then cherry picks the winners to show you how great they are. Hit and Run Candlesticks and Right Way Options are truly educational services. They taught me how to trade not what to trade. The entire team: Rick, Doug, Steve, and Ed are there to help and answer your questions. They are awesome. They cut years off my learning curve. And it’s a team effort. Everyone in the room (all the members) are there to help with invaluable insights and advice. The only service you will ever need. Thanks to all the team for how you have helped me and for all you do. –Jonathan Bolnick

Rare to have a service teach you how they find their choices but, HRC/RWO teach you how to fish instead of fishing for you. And, your ideas are not panned but shared, implemented, or improved. Sharing is caring. –Thomas Bradly

Past performance is not indicative of future returns

Investing and Trading involve significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, Right Way Option, Trader Vision 2020 or Rick Saddler, Doug Campbell, Ed Carter, Steve Risner is to be considered financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler, Doug Campbell, Ed Carter, Steve Risner is not a licensed financial adviser nor do they offer trade recommendations or advice to anyone.