7-24-18 Public e-Learning Effectively Using Brokerage Orders

Effectively Using Brokerage Orders

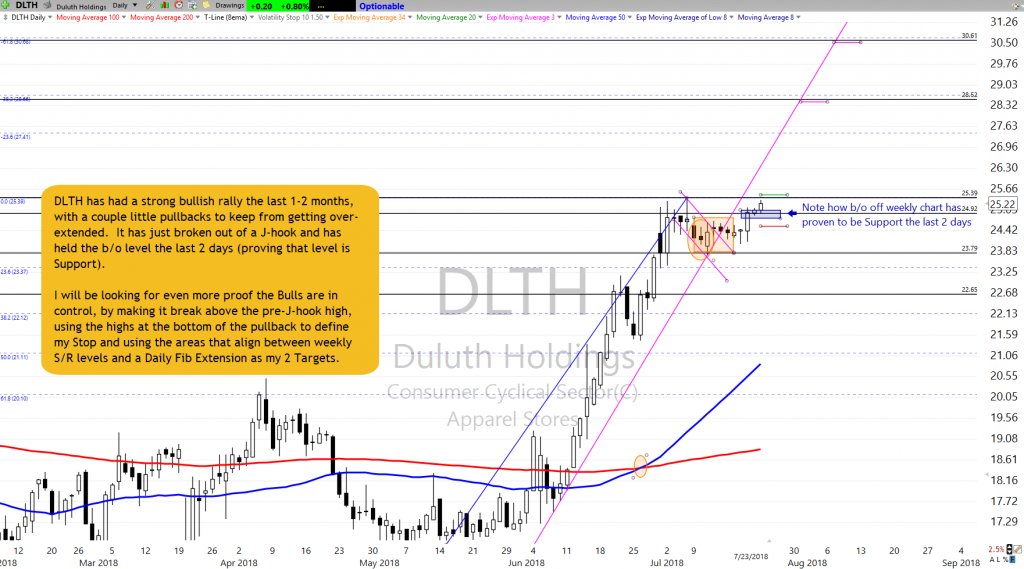

In this video, Doug Campbell discusses how to use different types of Brokerage order effectively, in order to make your life easier as a Trader. Numerous charts and trades are reviewed and used as current examples.

1 hour 28 minutes

Candlesticks • Price Action • T-Line • T-Line Bands • Support • Resistance • Trend • Trendlines • Chart Patterns • Buy Box • Volatility Stops • Profit Zones • Entry Zones • Protective Stops • RBB Rounded Bottom Breakout Strategy • Pop Out of The Box Strategy • Pinball Strategy • Trade Planning, Fibonacci, Stoch/RSI

[video_player type=”embed” style=”1″ dimensions=”custom” width=”640″ height=”480″ align=”center” margin_top=”0″ margin_bottom=”20″ ipad_color=”black”]Investing and Trading involve significant financial risk and are not suitable for everyone. No communication from Hit and Run Candlesticks or it’s associates should be considered as financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service

[testimonials style=”8″ margin_top=”” margin_bottom=””][testimonial name=”Alan%20Helmstetter” company=”” href=””]%3Cp%3EI’ve%20been%20managing%20my%20own%20money%20for%20many%20years%20and%20have%20been%20interested%20and%20dabbled%20in%20trading%20stocks.%20I%20joined%20some%20services%20over%20the%20years%2C%20but%20none%20worked%20for%20me.%20I%20am%20getting%20closer%20to%20retirement%20and%20wanted%20to%20learn%20more%20about%20trading%20stocks%20as%20something%20to%20do%20in%20retirement%20and%20to%20supplement%20income.%20I%20learned%20all%20about%20candlesticks.%20Did%20much%20paper%20trading%20of%20stocks.%20Results%20were%20good%2Fbad%20and%20never%20got%20ahead.%20Came%20across%20a%20free%20HRC%20webinar%20and%20really%20liked%20the%20approach.%20Joined%20a%20month%20trial%20and%20also%20attended%20an%20RWO%20webinar.%20Decided%20to%20join%20RWO%20because%20of%20the%20options%20approach%20and%20have%20been%20a%20member%20for%20four%20months.%20Rick%20and%20Doug%20are%20the%20real%20deal.%20Both%20are%20amazing%20at%20reading%20charts%2Fprice%20as%20well%20as%20teaching%20their%20expertise.%20In%20the%20daily%20chatroom%20you%20will%20get%20potential%20trades%2C%20but%20more%20importantly%2C%20you%20will%20become%20part%20of%20a%20team%2C%20learn%20how%20to%20identify%20trades%20and%20even%20more%20importantly%20how%20to%20properly%20plan%20and%20manage%20trades.%20You%20know%20the%20adage%20–%20%22You%20give%20a%20man%20a%20fish%2C%20and%20you%20feed%20him%20for%20a%20day.%20You%20teach%20him%20to%20fish%2C%20and%20you%20give%20him%20an%20occupation%20that%20will%20feed%20him%20for%20a%20lifetime.%22%20%3Cstrong%3EGive%20them%20a%20try%20you%20will%20not%20regret%20it!%3C%2Fstrong%3E%3C%2Fp%3E%0A [/testimonial][/testimonials]