Indecisive Price Action

Indecisive Price Action

Looking over yesterdays price action, I see indecisive candle patterns with bulls working very hard to defend against intermittent bear attacks. The index trends are still clearly intact and bullish, but the cloud of a potential 200 billion in new tariffs continues to embolden the bears to test bullish defenses. Thus far the bulls are still in control and holding above key support levels.

Looking over yesterdays price action, I see indecisive candle patterns with bulls working very hard to defend against intermittent bear attacks. The index trends are still clearly intact and bullish, but the cloud of a potential 200 billion in new tariffs continues to embolden the bears to test bullish defenses. Thus far the bulls are still in control and holding above key support levels.

Unfortunately, the bulls are also having to fight against declines in Asia and Europe overnight, so futures are pointing to negative open to test the resiliency of the bulls. Thus far the VIX has remained in check, so this could prove to be nothing more than a light volume pullback and a good setup for the indexes to move higher. On the other hand, the tariff threat could green light a bear attack that breaks through support levels. Watch price action closely and be careful not to anticipate and allowing your bias to cloud your view. Whipsaw and quick price action are possible as we approach important support levels.

On the Calendar

We have an interesting Economic Calendar this Wednesday with a Fed presence as I’ve never seen before on a single day. First, we have a potential market-moving report from International Trade @ 8:30 AM which consensus suggests will show a widening deficit to 50.2 billing vs. the 46.3 billing reading in June. We have the Mortgage Application report at 7:00 AM and the Redbook at 8:55 but both are unlikely to move the market. 9:20 AM kicks off a parade of Fed speakers beginning with James Bullard, John Williams @ 12:30 PM, John Williams again @ 3:00 PM, Neal Kashkari @ 4:00 PM, John Willams for the 3rd time at 5:30 PM, with Raphael Bostic finishing up @ 6:30 PM.

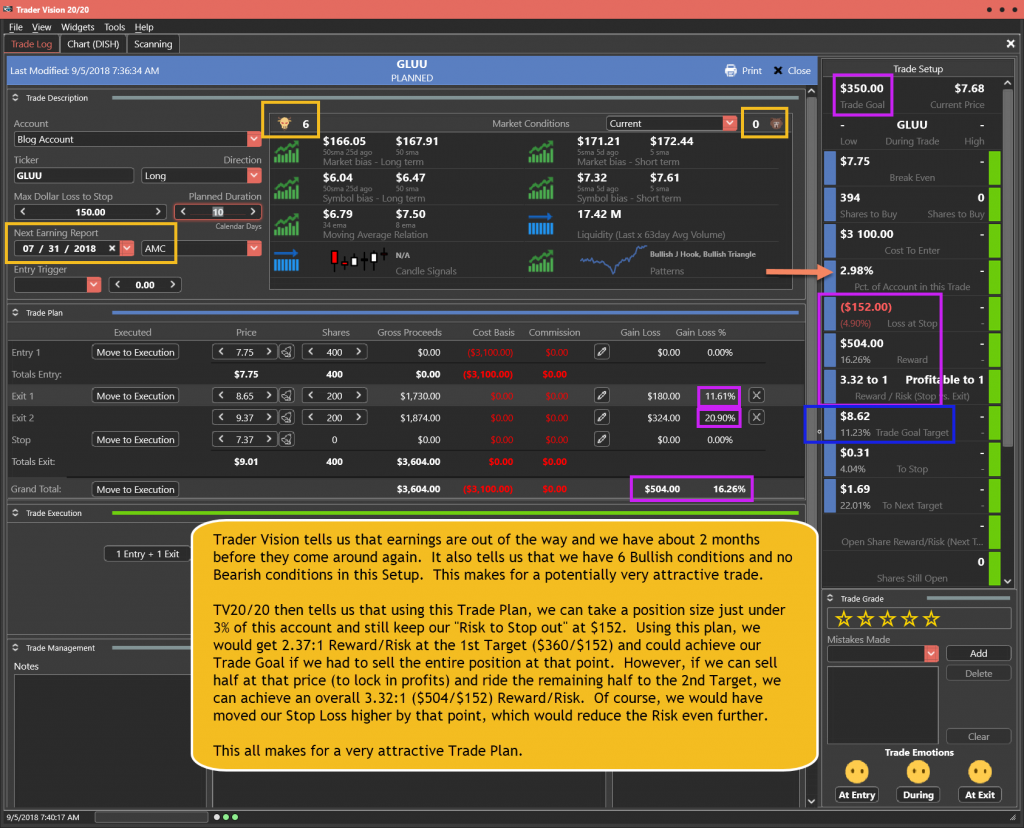

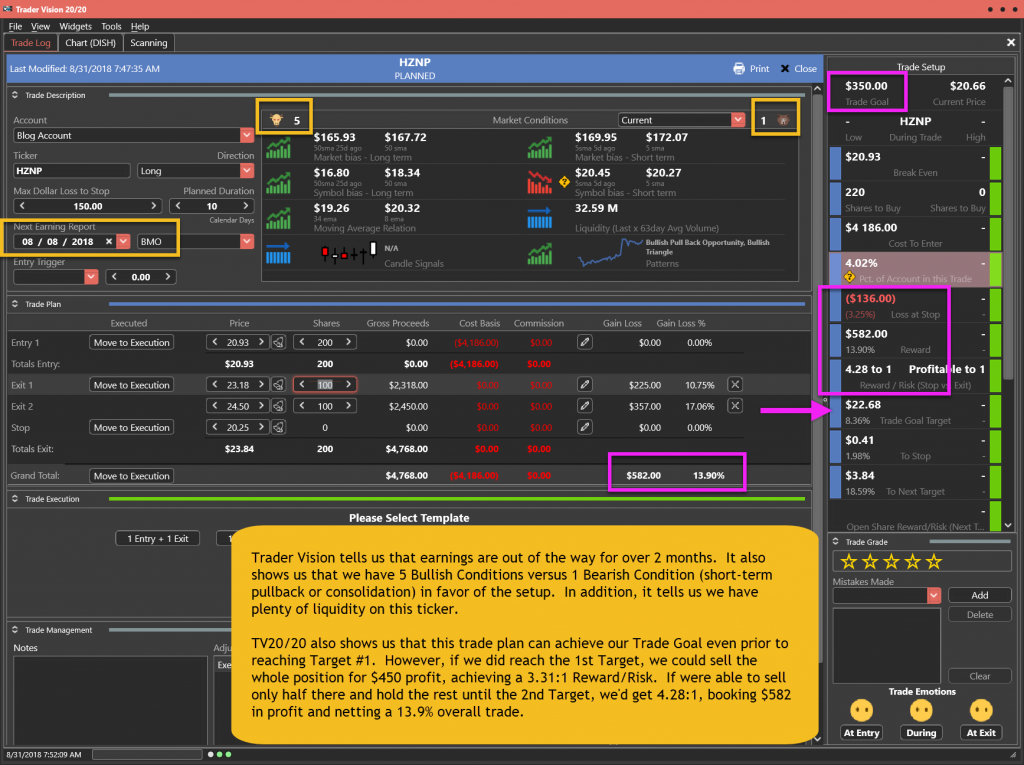

On the Earnings Calendar, we have just over 30 companies reporting. Among those reporting, today are HDS, CLDR, CTRP, CWK, DOCU, GWRE, MDB, OLLI, and ZS. Make sure you are continuing to check reporting date against current holdings or before entering new positions.

Action Plan

Yesterday saw another intra-day bear attack with a very quick selloff in the morning followed by a slow grind higher as the bulls worked to defend supports. Although the rally was nice to see, it left behind more questions than answers with indecisive candle patterns. While we slept Asian markets closed lower across the board with the European market following the trend also currently showing losses across the board.

US Futures are currently suggesting a negative start to today’s trading, but they have currently rallied off the lows cutting the potential gap down by nearly half at this point. Yesterday I suggested using some caution and being careful not to overtrade because of the current price action in the indexes is indecisive. With market around the world showing pullback it would not be a big surprise if the bears attempt to test the overnight lows. The bulls, however, will not give up control easily so we should also watch for price action clues or bullish strength as we approach important levels of support. Quick price action and whipsaws are likely as the bears continue to test the bullish defenses.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/cwS-3nkuzpE”]Morning Market Prep Video[/button_2]