Turbulent Price Action

Turbulent Price Action

Put your tray table in the upright and locked position, fasten your seat-belts low and tight across your lap because traders should expect some turbulent price action this week. With nearly 900 companies stepping up to report in the midst of a market correction could be volatility’s definition of the perfect storm. Expect very fast price action and daily market gaps as just a couple of the challenges traders will face.

Put your tray table in the upright and locked position, fasten your seat-belts low and tight across your lap because traders should expect some turbulent price action this week. With nearly 900 companies stepping up to report in the midst of a market correction could be volatility’s definition of the perfect storm. Expect very fast price action and daily market gaps as just a couple of the challenges traders will face.

Asian and European markets are bullish thus the US Futures are pointing to a gap up open this morning. Is this confirmation of higher lows in the indexes or a prelude to another nasty whipsaw? Only time will tell but be careful chasing the morning gap. Wait for proof that buyers step in supporting the gap and as always have a plan to manage the risk before you enter. If you don’t feel you have an edge, then protect your capital and don’t trade. Trading is a marathon, not a sprint.

On the Calendar

We start Monday with a light Economic Calendar and no expected market-morning reports throughout the day. The Chicago Fed National Activity Index kicks off the day at @ 8:30 AM Eastern. We have two Bill Announcements @ 11:00 AM and two Bill Auctions at 11:30 AM to end the calendar day.

Traders will need to stay very alert and flexible this week as the 4th quarter earnings season kicks into high gear with nearly 900 companies reporting. Today there are 77 expected to fess up to their result today with the most notable being CADE, HAL, HAS, IQV, KMB, ONB, PETS, PHG, PII, SALT, TCF.

Action Plan

Market correction jitters coupled with nearly 900 earnings reports this week will likely create a very challenging price action this week. Morning gaps, fast price action, high volatility, head fakes, whipsaw, and earnings reports are just a few of the issues traders may have to deal with this week. While very quick day traders may find this kind of market very much their liking, swing traders may find it very difficult to find or maintain an edge.

Asian markets closed sharply higher across the board last night with Shanghai rallying over 4 percent. European markets are also decidedly bullish this morning, up nearly half a percent. As a result, the current US Futures are suggesting a gap up of more than 75 points Dow points at the open. Although it’s encouraging the indexes could be putting a higher low we also must give respect to the price resistance that rejected last Tuesdays big rally. Anything is possible so buckle up everyone it could be an exciting yet very bumpy ride!

Trade Wisely,

Doug

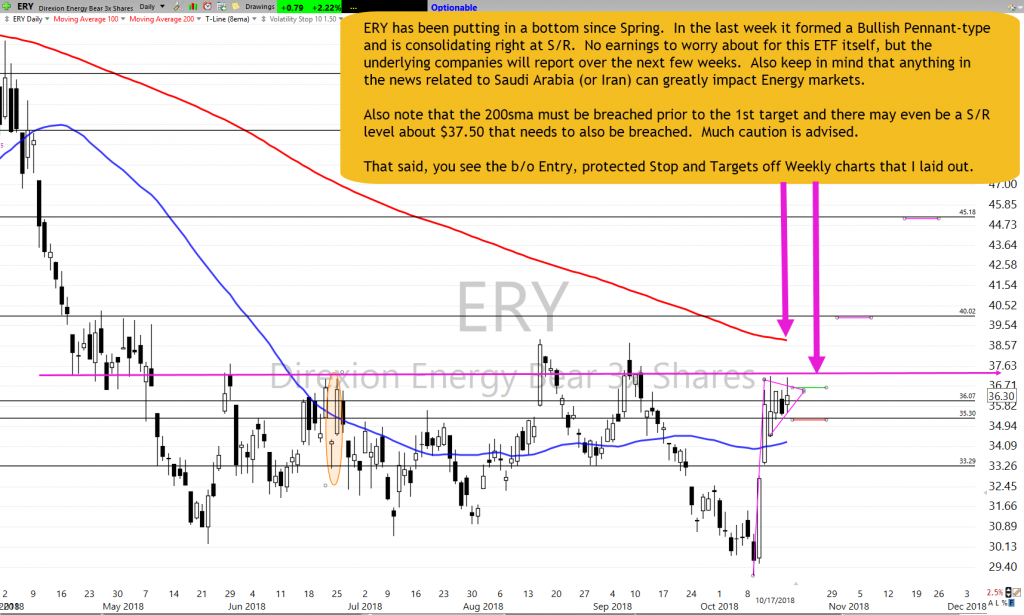

Can we trust what we see this morning? The futures markets are suggesting a gap up open recovering part of Thursday’s 327 point selloff. However, with Asian markets having sold off strongly last night and European markets mostly lower this morning I would be very careful not to rush in this morning. With the weekend approaching and tensions growing not only with China but also Saudi Arabia we seem perfectly set up for a pop and drop this morning.

Can we trust what we see this morning? The futures markets are suggesting a gap up open recovering part of Thursday’s 327 point selloff. However, with Asian markets having sold off strongly last night and European markets mostly lower this morning I would be very careful not to rush in this morning. With the weekend approaching and tensions growing not only with China but also Saudi Arabia we seem perfectly set up for a pop and drop this morning.

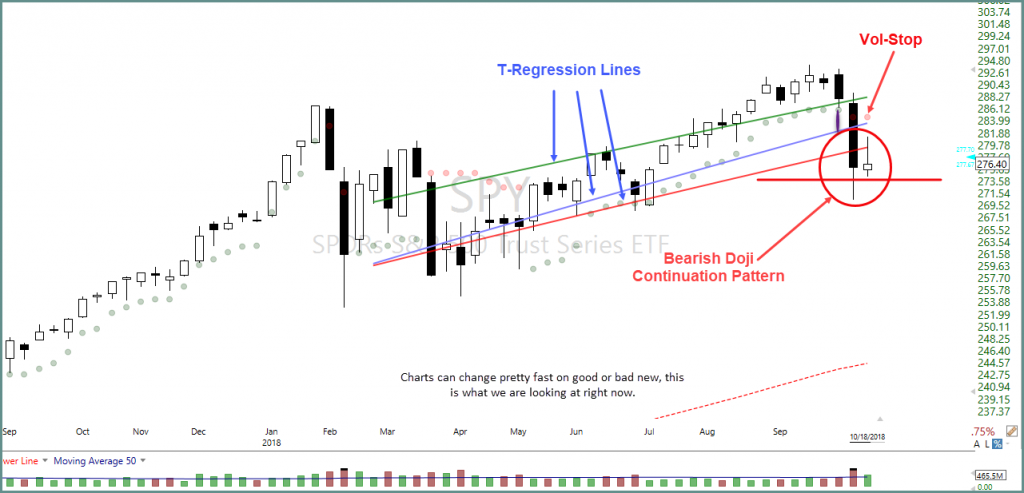

Although we have access to a plethora of fancy indicators on your charting platform simply technical analysis of price action support, resistance, and trend still rule supreme. Price is King! Tuesday’s, big rally pushed the major right into price resistance levels. Yesterday, resistance did its job preventing a follow move higher, and the clues to that possibility were evident to those that study price.

Although we have access to a plethora of fancy indicators on your charting platform simply technical analysis of price action support, resistance, and trend still rule supreme. Price is King! Tuesday’s, big rally pushed the major right into price resistance levels. Yesterday, resistance did its job preventing a follow move higher, and the clues to that possibility were evident to those that study price.