VNDA Doji Continuation Pattern VNDA entry bullish buy box or a tradable breakout, stop below $22.90

VNDA Doji Continuation Pattern

VNDA is presenting us with a Doji Continuation pattern after finding support near the 200-SMA and a gap that took price from below the T-Line Bands to above the T-Line Bands. The weekly chart is also one to look at with several candle patterns that are well represented. I will add VNDA to the LTA-Live Trading Alerts Real Time Market Scanner watchlist for a buying alert. VNDA entry bullish buy box or a tradable breakout, stop below $22.90

Trading Services We Offer

321% This Year

Rick uses three main trading tools and has dialed them in for max performance. Rick also freely shares his insights on what makes the tools the best and how to use them. Rick is also one of the only traders in the industry that shares his trading account. Traspaerancey and Trading Results.

- LTA – Live Trading Alerts Get your 30-Day Trail

- TC2000 Charting Get $25.00 Off

- TradeHawk Trading Platform

Past performance is not indicative of future returns

Good Trading, Rick, and Trading Team

____________________________________________________________

SPY • Closes Over 200-SMA

The SPY has been and still is trying to construct a bottom, above $279.45 this week would be positive for the bulls and below $273.40 good for the bears. The weekly chart is still under our T-Line Bands, and this gives me great concern.

****VXX – VXX is flirting with support in the $31.50 area, but without bullish price action, the current direction continues. Over $36.00 and the bulls might have the edge.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

YouTube Videos

Trading at the Beach • How to set up the T-Line Regression Lines • MetaStock Automated • Trading the T-Line Trap • Shorting the Blue Ice Pattern

Past performance is not indicative of future returns

Investing and Trading involve significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, Right Way Option, Trader Vision 2020, Top Gun Futures or Rick Saddler, Doug Campbell, Ed Carter, Steve Risner is to be considered financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

Rick Saddler, Doug Campbell, Ed Carter, Steve Risner is not a licensed financial adviser nor do they offer trade recommendations or advice to anyone.

Good morning from the Las Vegas Money Show. Asian markets closed modestly higher across the board overnight, and the European markets are currently mixed but mostly lower this morning. Consequently, US futures are pointing to a mixed open as I write this. Keep in mind that bond and currency markets are closed today in observance of Veterans Day. As a result, don’t be to surprise if price action becomes light and choppy after the morning rush.

Good morning from the Las Vegas Money Show. Asian markets closed modestly higher across the board overnight, and the European markets are currently mixed but mostly lower this morning. Consequently, US futures are pointing to a mixed open as I write this. Keep in mind that bond and currency markets are closed today in observance of Veterans Day. As a result, don’t be to surprise if price action becomes light and choppy after the morning rush. Is your market bias robbing you of profits? As a trading coach, I answer questions almost every day from traders that fail to see the price action clue in the chart due to bias. Perma-bulls dreaming of a Santa Clause rally, fail to see the possibility of a pullback even after a 2000 point rally in just 8-days. Perma-bears are just as negligent believing that the market has gone up so much that it has to come down. Have you ever failed to close position moving strongly against you because, darn it, you have to be right!

Is your market bias robbing you of profits? As a trading coach, I answer questions almost every day from traders that fail to see the price action clue in the chart due to bias. Perma-bulls dreaming of a Santa Clause rally, fail to see the possibility of a pullback even after a 2000 point rally in just 8-days. Perma-bears are just as negligent believing that the market has gone up so much that it has to come down. Have you ever failed to close position moving strongly against you because, darn it, you have to be right!

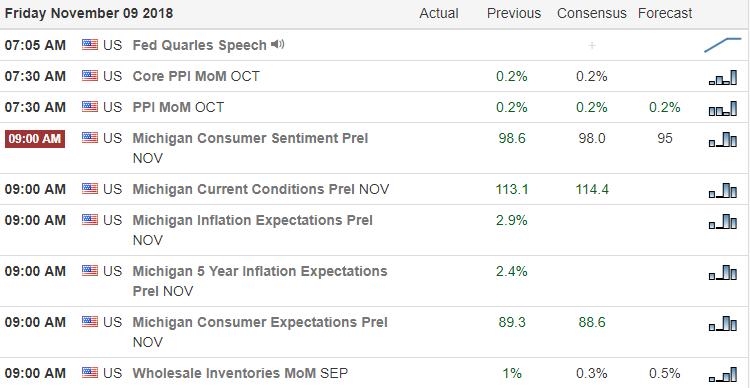

Today is the last really big day of reports this quarter, and with the election behind us, the market is free to react to earnings and the FOMC decision. Asian markets were mixed but mostly higher overnight, and the European markets are currently flat to mostly lower. The US Futures are only pointing to a modest gap down this morning but after such a huge rally don’t be surprised to see some profit-taking.

Today is the last really big day of reports this quarter, and with the election behind us, the market is free to react to earnings and the FOMC decision. Asian markets were mixed but mostly higher overnight, and the European markets are currently flat to mostly lower. The US Futures are only pointing to a modest gap down this morning but after such a huge rally don’t be surprised to see some profit-taking.