Blood in the Street This Morning

Friday was another big day for the Bears as INTC’s terrible earnings after the bell on Thursday and worst than expected July Payroll data led to another large gap down. SPY gapped down 1.37%, DIA gapped down 0.83%, and QQQ gapped down 1.98%. From there, all three major index ETFs followed through to the downside. QQQ made it to the lows of the day by 10:15 a.m. but SPY and DIA did not reach their lows until 11:30 a.m. Once they reached the lows, all three put in a series of volatile waves that were modestly bullish side of sideways. This action gave us large gap-down, black body, Spinning Top candles with in the SPY, DIA, and QQQ. QQQ had evenly-split wicks (above/below) but SPY’s wicks lean mostly to the bottom and the DIA wicks were almost exclusively on the bottom of the candle. (So much so that DIA was much like a very large Black Hammer candle.) This all happened on heavier-than-average volume in all three major index ETFs.

On the day, nine of the 10 sectors were in the red with Technology and Energy (both -2.95%) and Consumer Cyclical (-2.94%) leading very broad-based large losses among the sectors. Meanwhile, Consumer Defensive (+0.39%) was the only green sector that was 0.65% stronger than the next strongest group on the day. At the same time, SPY dropped 1.83%, DIA fell 1.47%, and QQQ dropped 2.38%. VXX spiked a massive 23.88% to close at 62.57. Meanwhile, T2122 plummeted down into the top end of its oversold territory at 18.20. On the bond front, 10-year bond yields plummeted down to close at 3.799% and Oil (WTI) dropped 3.01% to close at $74.01 per barrel. So, Friday was a day when bad news was seen as bad news. The massive bad news out of INTC on Thursday night, coupled with weak July job growth data led traders to run for the exits. However, by late morning the sellers were done for the week and dip-buyers did a little nibbling for the rest of the day.

For the week, SPY logged its third consecutive down candle losing 2.12%. Meanwhile, DIA lost 2.18% on the week on its first down week since June. At the same time, QQQ printed its fourth consecutive weekly loss by falling 3.07%.

The major economic news scheduled for Friday included July Avg. Hourly Earnings (Year-on-Year), which showed a decline in rate of increase at +3.6% (compared to a +3.7% forecast and a +3.8% June reading). On the Month-on-Month side, July Avg. Hourly Earnings also showed a slowing increase of +0.2% (versus the +0.3% forecast and June value). At the same time, July Nonfarm Payrolls showed a much lower increase than predicted at +114k (compared to a +176k forecast and June’s +179k number). On the private side, July Private Nonfarm Payrolls also showed a much smaller increase than expected at +97k (versus a +148k forecast and June’s +136k reading). Meanwhile, the July Participation Rate increased to 62.7% (compared to a forecast and June value of 62.6%). This all resulted in a July Unemployment Rate that jumped to 4.3% (versus the forecast and June reading of 4.1%). Later, June Factory Orders fell significantly to -3.3% (compares to a -2.7% forecast and May’s -0.5%).

In Fed speak news, Richmond Fed President Barkin told the NY Times Friday that the July Payrolls report showing a significant slowdown in job gains was “reasonable.” However, he seemed to dismiss talk of recession and calls for more aggressive rate cuts. Barkin said, “More significant reductions typically would be associated with an economy that feels like it’s deteriorating rapidly. And again, 114,000 jobs, while not as good as we’ve been running, on a long-term basis, is a reasonable number.” Later, Chicago Fed President Goolsbee said the Fed should move in a “steady” fashion. He said, “We never want to overreact to any one month’s numbers.” Goolsbee continued, saying, “Our absolute goal now is we want to settle at something like full employment, not blow through normal and deteriorate.”

After the close, AMC missed on both the revenue and earnings lines.

In stock news, on Friday, the China Passenger Car Assn. reported that TSLA sales rose 15.3% year-over-year in July. (This sounds good, but their Chinese competitors saw sales growth of 30% and China’s overall EV sales grew 31% year-on-year for the month.) Later, Reuters reported that DNB is exploring a potential sale, including a takeover by its largest shareholder CNNE. DNB is reportedly looking for $9 billion to include debt assumption. Meanwhile, CVX announced plans to move its headquarters from CA to TX, citing an “oil adversarial” government in CA.

At the same time, AI startup Character.ai announced that it signed a non-exclusive deal with GOOGL for the its search engine to use the Character.ai large language model. Separately, two of the startup’s founders (both former GOOGL employees) will return to working for GOOGL. On Saturday, CNBC reported that after unloading stocks recently (including half of its AAPL and more of its BAC), BRKB has raised a record $277 billion in cash.

In stock legal and governmental news, on Friday, the NHTSA upgraded and expanded its investigations into almost 1 million STLA Dodge SUVs over faulty door locks and window controls that caused fires including at least one death. Later, the FDA reported that all dosages of LLY’s weight-loss and diabetes drugs are no longer in shortage and are available nationwide. At the same time, Reuters reported that JPM is considering filing suit against the Consumer Financial Protection Bureau for its regulation of Zelle, a peer-to-peer payment network that the seven largest banks jointly own.

Overnight, Asian markets were red across the board again with some massive losses in chip-making countries in follow-through from INTC’s dismal performance last week and Japan raising rates for the first time 2008 (or more directly, the upward move of the Yen). Japan (-12.40%), South Korea (-8.77%), and Taiwan (-8.35%) were by far the biggest loses, but a couple more exchanges were down well over 4% and none of the region’s exchanges lost less than 1.5%. In Europe, we see a similar, but not as dismal, picture taking shape at midday. The CAC (-1.91%), DAX (-2.53%), and FTSE (-2.33%) lead the region lower even while small exchanges like Athens (-5.78%) are out front in early afternoon trade. In the US, as of 7:30 a.m., Futures are pointing to our markets following the rest of the world in general (unwarranted) panic. The DIA implies a -2.04% open, the SPY is implying a -3.04% open, and the QQQ implies a -4.47% open in what is sure to be another tech bloodbath day at least to start. At the same time, 10-Year bond yields are dropping again to 3.724% and Oil (WTI) is down 1.88% to $72.14 per barrel in early trading.

The major economic news scheduled for Monday include July S&P Global Services PMI and July S&P Global Composite PMI (both at 9:45 a.m.), July ISM Non-Mfg. Employment, July ISM Non-Mfg. PMI, and July ISM Non-Mfg. Prices Index (all at 10 a.m.). We also hear from Fed member Daly (5 p.m.). The major earnings reports before the open include AMR, BRKB, CG, KOS, SOHU, SAH, THS, and TSN. Then, after the close, AAN, ACM, AHR, CAR, BRBR, BMRN, BCC, BWXT, CBT, CRGY, CSX, FANG, EHC, FG, FNF, HUN, ITUB, JELD, KMPR, OKE, PLTR, O, SPG, SPR, STRL, SUM, VSTO, WMB, and YUMC report.

In economic news later this week, on Tuesday we get June Exports, June Imports, June Trade Balance, EIA Short-Term Energy Outlook, and API Weekly Crude Oil Stocks. Then Wednesday, EIA Crude Oil Inventories and June Consumer Credit are reported. On Thursday we get Weekly Initial Jobless Claims, Weekly Continuing Jobless Claims, and the Fed Balance Sheet. Finally, on Friday, there are no major economic news scheduled.

In terms of earnings reports later this week, on Tuesday, we hear from FOX, GOLF, AHCO, ADNT, ALIT, ATI, GBTG, AU, ARMK, ATKR, AVNT, BAX, BLMN, BR, BRKR, BLDR, CAT, CLVT, CEG, DK, DUK, EPC, ENR, EXPD, FIS, FOXA, GFS, GPRE, GXO, HSIC, H, IDXX, INGR, J, JLL, KVUE. KNF, LCII, MPC, TAP, MPLX, VYX, NVT, OGN, OC, MD, SRE, SWX, STWD, SGRY, TPX, BLD, TDG, TRMB, UBER, UWMC, VVX, VMC, WLK, KLG, YUM, ZTS, AGL, ABNB, AFG, AMGN, ARKO, ASH, AIZ, CRC, CPNG, DVA, DVN, ENLC, PLUS, FTNT, GMED, GO, HY, IAC, ILMN, CART, IFF, LUMN, MASI, MOS, MRC, PR, RIVN, SVC, SKY, STE, SNEX, LRN, SU, RUN, SMCI, TOST, TSE, TRIP, VFC, and WYNN. Then Wednesday, ADV, BCO, BAM, CRL, CCO, SID, CNDT, CRH, CVS, DBD, DDL, EMR, ENOV, GEO, GLP, GPN, GFF, HLT, HMC, IEP, KMT, LPX, LYFT, NEUE, NYT, NI, NOMD, NVO, DNOW, ODP, OGE, OSCR, PLTK, RCM, RL, REYN, ROK, RXO, SHOP, SONY, SUN, TGNA, PRKS, VSTS, VSH, DIS, ZBH, AE, ALTG, DOX, APP, ATO, BHF, CACI, CENT, CENTA, CF, CHRD, CPA, CPAY, CPAY, CAPL, CW, EFXT, ET, ENS, NVST, EQIX, FWRD, HG, HI, HUBS, ICUI, JXN, LNW, MTW, MFC, MRO, MATV, MMS, MCK, MKSI, MODV, MNST, NTR, OXY, PRI, HOOD, RGLD, SBGI, SM, STN, TALO, MODG, UGI, VSAT, WBD, WTS, WES, ZG, and Z report. On Thursday, we hear from WMS, COLD, AVAH, AVT, AZUL, FUN, CQP, LNG, COMM, DDOG, ELAN, LLY, EDR, EPAM, FWONK, ULCC, GTN, HBI, HGV, IHRT, KELYA, KOP, LAMR, LSXMK, LSXMA, MLM, MUR, NXST, NRG, PZZA, PH, PENN, ACDC, RPRX, QSR, SBH, SEE, SN, SPB, TKO, UAA, UA, USFD, VTNR, VTRS, VST, WMG, ATSG, AKAM, AMN, BTG, CIB, CPRI, CENX, BAP, DBX, DXC, SSP, EVH, EXPE, G, GILD, IAG, NWSA, NGL, PAAS, PARAA, PARA, PBA, PBI, RXT, REZI, SOLV, TTWO, TTD, and TTEC. Finally, on Friday, AQN, AMCX, AXL, AMRX, CLMT, ROAD, ERJ, EVRG, and NFE report.

So far this morning, AMR, BRKB, THS, and TSN all reported beats on both revenue and earnings. Meanwhile, SAH missed on revenue while beating on earnings. On the other side, CG beat on revenue while missing on earnings. However, KOS missed on both the top and bottom lines.

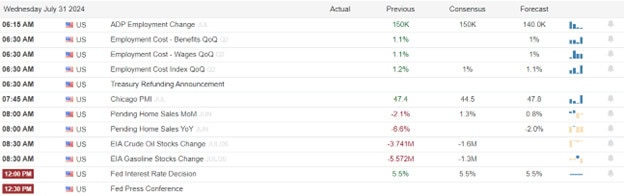

In Fed Rate Cut Expectation news, on Friday, following the July Payrolls and June Factory Orders data, there was a market move in the probabilities of a Fed rate cut in September. In addition, the Fed Fund Futures bets are now expecting a larger cut. One week prior, 88.2% of Fed Funds Rate trades implied a quarter point cut in September, 11.5% were counting on a half percent cut, and a tiny fraction felt rates would remain where they are now. After Friday, 69.0% now expect a half percent rate cut and 31.0% expect a quarter point cut at the September meeting. For their part, major banks also changed their forecasts with BAC, BCS, C, GS, and JPM. All are now calling for a half percent cut in September, with C telling its clients they now expect half percent cuts in both September and November. Back to the Fedwatch tool look into the outlook of Fed Funds traders and looking out to the November meeting, the betting is evenly split between expecting a three-quarters percent reduction by that meeting and a full percent cut.

In miscellaneous news, on Friday, the national average 30-year fixed-rate mortgage plummeted 22 basis points to 6.4%. That was the mortgage’s lowest level since April of 2023. Elsewhere, CMCSA announced Friday that viewership for the 2024 Olympics is up and has blown past the 2021 Tokyo Games. CMCSA’s NBC Sports announced the five-day average viewership was 34 million viewers, up a whopping 79% from 2021. (However, it is worth noting that Tokyo had the lowest-rated summer Olympics viewership of modern games, in part due to pandemic issues.)

With that background, it looks as if the Bears have opened up the over-reaction elevator shaft so far in the premarket. If the market closed where it sits now, it would be the biggest 3-day loss since the lows of the Trump side of the pandemic. All three major index ETFs showed huge gaps down to start the premarket. After that gap, all three have followed through with black-bodied candles that are mostly (or all) body. We are firmly in correction territory here. The short-term trend is now clearly bearish as is the mid-term. However, while the bullish trend line is broken, the longer-term charts are not yet bearish. In terms of extension, all three major index ETFs are now well over-stretched to to downside from their T-line (8ema) and are in need of relief. At the same time, the T2122 indicator closed just into the oversold territory, but unless there is a big rebound it will end closer to the bottom of its range. So, the Bears have used up all their slack and the market is in need of a bounce or pause. However, remember the market can remain oversold or overbought longer than any of us can remain solvent predicting turns too early. With regard to those 10 big dog tickers, all 10 are hugely bearish with the market leader NVDA (-12.69%) absolutely getting destroyed and having traded $2.1 billion worth of stock so far this morning. Buckle up, it’s going to be a massive Bearish and perhaps volatile day. This is where we find out who the weak hands are and just how much guts the “dip buys” have.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the Man in the Green Bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby, it’s a job. The gains are real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service