Price Below T-Bands

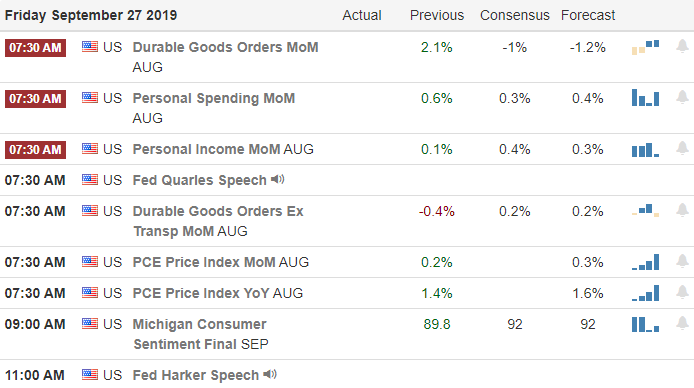

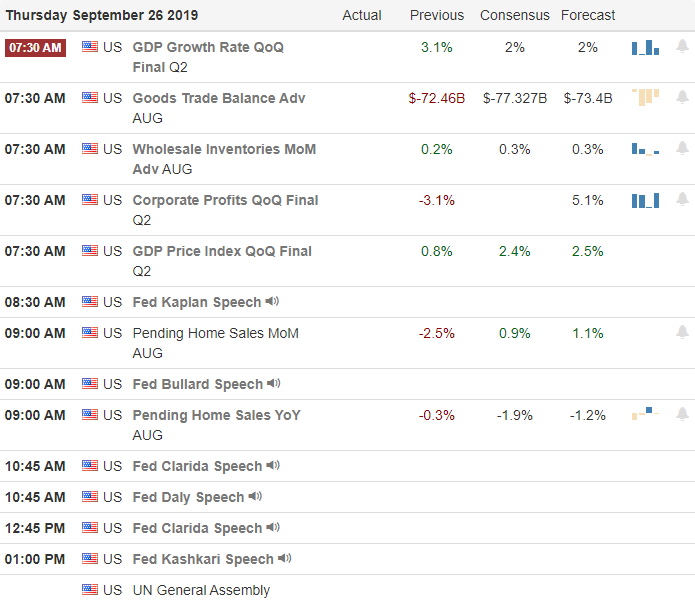

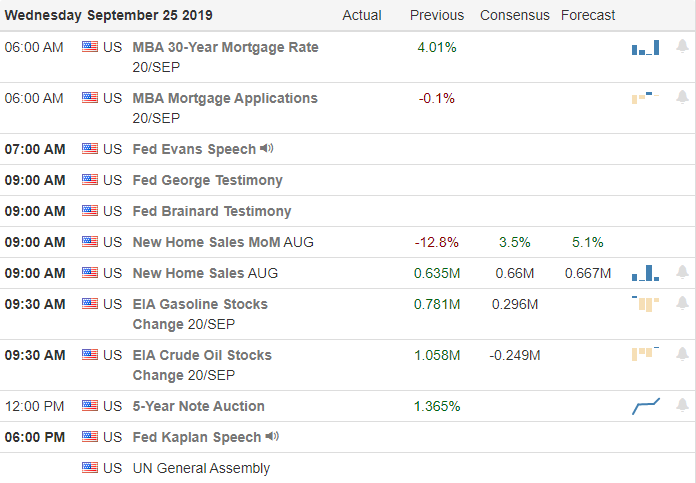

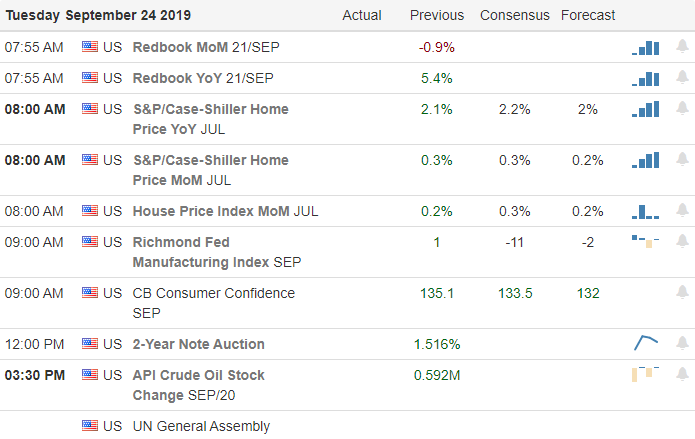

The market (SPY), Yesterday was a Doji / Harami day in the SPY closing below our bullish number of $297.95 and above our bearish number of $293.69. The 34-EMA still is above the 50-SMA, and price action is hovering around both. On the hourly chart, price is in bed with the duces (200-SMA and the Dotted Deuces), the 34-EMA and 50-SMA has kept price pushed down. Price simply needs to be above $297.95

T-Line and T-Line Channels, Price action on the daily chart has fallen below the T-Line and the T-Line Channels. If the Price action gets below the $293.70 line, we should see the T-Line Channels start to lean a little to the downside. The weekly chart has price action between the two upper channels on a bullish pullback; I say bullish because the withdrawal is above the 38% retracement of the August low and September high run and above the 293.70 support line.

The bottom line, Below $297.50 and above $293.70 is just a tug a war between the buyers and sellers, think of it as one significant indecision Doji. The winner will show it’s colors soon. This flat trading can be challenging to navigate; I personally think the key is not to over trade.

Rick

For Your Consideration: Here are a few tickers we will be adding to our swing trade watch-list. HOME, DOCU, WHR, PHM, SSNC, JBL, CLDR, SNX, HIIQ Trade smart, and trade your trade. Stocks we mention and talk about are not recommendations to buy or sell.

✅ SMS text alerts and reminders?👈

✅ Check out our newest YouTube videos👈

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service