Traders Seem to be Waiting on CPI

Monday saw a gap higher and then a run up and selloff that results in not much move. SPY gapped up 0.79%, DIA gapped up 0.70%, and gapped up 0.92%. After that open, all three major index ETFs rallied until 10:15 a.m. At that point, the resulting pullbacks all lasted about an hour and varied, with DIA not even pulling back to the opening level, SPY pulling back a little less than half way aback across its opening gap, and QQQ pulling back about two-thirds of its opening gap. All three then rallied back to the highs of the day as of shortly after 1 p.m. only to pullback with DIA and SPY staying above their opening level and the more volatile QQQ dipping back into its gap. Then all three made a modest rally the last 75 minutes of the day. This action gave us gap-up, white-bodied, Spinning Top candles in all three major index ETFs. SPY and QQQ were also Bullish Harami candles while DIA closed 5 cents too high to qualify as a Harami. This happened on below-average volume in all three.

On the day, all 10 sectors were in the green with Industrials (+1.35%) and Financial Services (+1.20%) leading the way higher as Energy (+0.23% lagged behind the other sectors. At the same time, SPY gained 1.12%, DIA gained 1.13%, and QQQ gained 1.29%. VXX plummeted 6.52% to close at 52.45% and T2122 climbed out of its oversold area to the bottom part of its mid-range at 34.73. At the same time, 10-Year bond yields fell slightly to close at 3.70% while Oil (WTI) gained 1.49% to close at $68.68 per barrel. So, Monday was a gap-up and then undecided day that stayed on the Bullish side (with all three major index ETFs closing above their gap-up opens). On the Tech front, GOOGL (-1.46%) was the lone loser among the big dogs, but AAPL’s “Glow Day” product announcement did not help it with the stock only closing up 0.04%. However, NVDA (+3.54%) and NVDA (+2.83%) did gain…maybe on the AI focus of AAPL’s new product offerings.

The major economic news scheduled for Monday were limited to August NY Fed 1-Year Consumer Inflation Expectations, which stayed flat at 3.0%, and July Consumer Credit, which showed a massive jump. July Consumer Credit came in at $25.45 billion (compared to a forecast of $12.30 billion and a June reading of 5.23 billion).

After the close, ORCL reported beats on both the revenue and earnings lines.

In stock news, on Monday, prior to AAPL’s big iPhone refresh (this time featuring AI) a key competitor racked up a big win. Chinese phone maker Huawei announced they had received 3 million pre-orders for their own upcoming phone refresh (this one a tri-fold, Z-shape design). This was significant because Huawei is charging $2,800 for the new tri-fold phone and it didn’t even tell consumers when the phones would be available. Huawei just wanted to front-run AAPL by locking in orders. At the same time, KEY announced it had sold $7 billion of low-yield assets for a loss and that they would take about a $700 million hit on the assets in Q3. Later, the CFO of C told an investor conference he expects banking fees from its Investment Banking unit to rise 20% in Q3 compared to Q3 in 2023.

Elsewhere, SIEGY (Siemens) announced it’s spending $60 million on a new US factory (in NY?) to build high-speed trains for the Los Angeles to Las Vegas passenger route. The plant is expected to come online in 2026 with the rail line expected to begin operation in 2028. After the close, GS CEO Soloman told an investor conference that the bank’s trading business is performing weakly (down 10%) in Q3, especially the bond trading unit. Also after the close, the Wall Street Journal reported that the CEO of NSC will step down amidst the internal probe into misconduct (an inappropriate relationship with employee). Finally, as part of its earnings report, ORCL announced it had signed a deal for web services with AMZN.

In stock legal and governmental news, on Monday, BIG filed for Chapter 11 bankruptcy as expected. BIG also announced it had received $707.5 million from Nexus Capital, which will give it the money to operate while it negotiates a sale to private equity as part of the bankruptcy. Later, the SEC announced that seven public companies had agreed to pay a combined fine of $3 million for violating whistleblower regulations. The offending companies were TRU, ACHC, APPF, IEX, LXU, SMFL, and AKA. At the same time, the US State Dept. approved a $133 million sale of RTX air-to-air missiles to Singapore.

Elsewhere, the FTC trial to block the TPR acquisition of CPRI got underway Monday. The FTC presented emails from the CPRI CEO related to several TPR products and urged the judge to block the merger on anti-trust grounds. At the same time, X and Nippon Steel replied to the Committee on Foreign Investment in the US letter sent last week that opposed the acquisition. X and Nippon Steel claim the CFIUS letter did not seriously consider how the merger might positively impact the national security of both countries and ignores a trade agreement that indicates Japanese steel does not present a risk to the US market. (How that relates to whether Japan owns the US competitor is unclear.)

In miscellaneous news, the SEC approved (along party lines, over GOP-appointed board member votes) new accounting standards (actually auditing standards) that were proposed by the US Public Company Accounting Oversight Board (which was created by Congress after Enron and other accounting scandals). The new standards were written by the PCAOB following its study found that 46% of public company audits done in 2023 did not review sufficient or appropriate evidence to provide a valid audit opinion. (The new standards take effect in December. However, if the disgraced GOP candidate wins, they would likely be reversed in 2025 as being too burdensome on businesses.) Elsewhere, the FBI reported Monday that in 2023, Americans lost $5.6 billion to cryptocurrency fraud schemes (mostly crypto investment schemes). This was a 45% increase from the amount lost to the same source in 2022. Finally oil (WTI) prices rebounded Monday as a new tropical storm entered the Gulf of Mexico. The forecast expects it to become a hurricane on Wednesday (named Francine) and oil traders are betting on at least temporary production and refining shutdowns in the US Gulf Coast area.

Overnight, Asian markets were mostly green on modest moves with just four of the 12 exchanges below break-even. Malaysia (+0.54%), Singapore (+0.46%), and India (+0.42%) led the gains while South Korea (-0.49%) was the biggest loser. Meanwhile, in Europe, the opposite picture is taking shape on modest moves at midday. Just four of the 14 bourses are green with the CAC (+0.13%), DAX (-0.44%), and FTSE (-0.54%) pacing the region in early afternoon trade. In the US, as of 7:30 a.m., Futures are pointing toward a start just on the red side of flat. The DIA implies a -0.07% open, the SPY is implying a -0.01% open, and the QQQ implies a -0.13% open at this hour. At the same time, 10-Year bond yields are up to 3.719% and Oil (WTI) is down 1.06% to $67.98 per barrel in early trading.

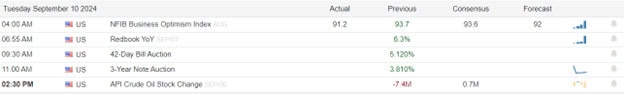

The major economic news scheduled for Tuesday are limited to EIA Short-Term Energy Outlook (noon) and Weekly API Crude Oil Stocks (4:30 p.m.) However, Fed Vice Chair for Supervision Barr does speak at 10 a.m. The major earnings reports scheduled for before the open include ASO and CMA. Then, after the close, PLAY, GME, and WOOF reports.

In economic news later this week, on Wednesday, we get August Core CPI, August CPI, and EIA Crude Oil Inventories. On Thursday, Weekly Initial Jobless Claims, Weekly Continuing Jobless Claims, August Core PPI, August PPI, WASDE Ag report, August Federal Budget Balance, and the Fed Balance Sheet are reported. Finally, on Friday, we get August Export Price Index, August Import Price Index, Michigan Consumer Sentiment, Michigan Consumer Expectations, Michigan 1-Year Inflation Expectations, and Michigan 5-Year Inflation Expectations.

In terms of earnings reports later this week, on Wednesday, DBI, HEPS, and TEN report. On Thursday, we hear from BIG, CAL, KR, SIG, ABDE, and RH. Finally, on Friday, there are no reports scheduled.

In overnight news, the EU’s top court ruled that AAPL must pay $14.4 billion in back taxes in a case the company has dragged out since 2016. (The case stems from AAPL using Ireland to hide revenue (taking advantage of the bribe tax rate Ireland used to lure AAPL and avoid paying taxes throughout the EU). At the same time, the same top EU Court upheld GOOGL’s $2.4 billion fine for abusing its dominant search market position to favor its ads over competitor ad offerings. Meanwhile, GS said it will take a $400 million pretax hit in Q3 as part of the unwinding of its consumer unit (which included the GM-brand credit card business and other loans). Elsewhere, AZN reported disappointing lung cancer drug trial results.

With that background, all three major index ETFs opened slightly higher but have been indecisive since that point. DIA is retesting its T-line (8ema) from below while QQQ pulled back below Monday’s candle body before rebounding back up into a Butterfly Doji and SPU did something similar with a smaller move down. After these machinations, all three major index ETFs remain near the Monday close. So, the short-term trend is bearish. At the same time, the mid-term trend is mixed at best with the QQQ now bearish. In the long-term we still have a Bull trend with DIA and SPY. In terms of extension, the 8ema has caught up and none of the three major index ETFs are too stretched below it. At the same time, the T2122 indicator is back in the lower half of its mid-range. So, the market has room to run either direction if one side or the other can find momentum. However, the Bulls have a bit more slack to play with. Just remember the mantra “follow, don’t lead, but also don’t chase” in mind. With regard to those 10 big dog tickers, 8 of the 10 are in the green this morning, led again by TSLA (+1.33%). However, AAPL (-1.02%) is by far the biggest drag on the group. So, the Bulls have control in the Tech sector again, early this morning.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the Man in the Green Bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby, it’s a job. The gains are real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service