Entry and Exit Signals

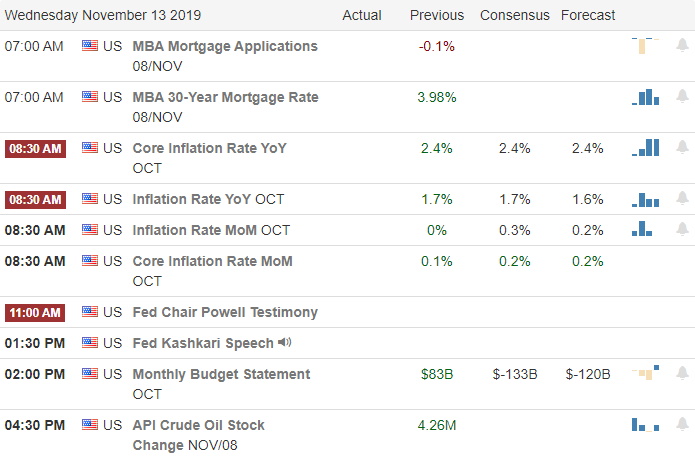

We could have an interesting market day as the events on Capitol Hill unfold. We have the Jerome Powell testifying in Congress as the House begins the Presidential impeachment hearings. We can expect a belly full of political drama and possibly news-driven price action to keep us on our toes. If that’s not enough for the market to digest trade war uncertainty has once again raised its ugly head bring out the bears this morning ahead of the 8:30 AM CPI report.

Asian markets closed in the red across the board as the civil unrest in Hong Kong, and trade uncertainty woke up the bears. European markets are also decidedly bearish this morning, seeing nothing but red across their major indexes. US Futures point a gap down open this morning ahead of earnings reports, CPI, and full-day of Capitol Hill drama. Stay focused on price action and prepare for the possibility of new driven reversals.

On the Earnings Calendar, we have more than 160 companies reporting results. Notable reports include CAE, CSCO, CPA, ENR, FVRR, LK, NTAP, QIWI, SSYS, TNK, TSEM, and VIPS.

Today will be a very busy day on Capitol hill and could spill over into market price action. Chairman Powell will testify before the Joint Economic Committee just a day after the President suggests the US should have negative rates like other countries have. That could set the stage for some interesting conversation and questioning by the committee. Meanwhile, in the house chamber they Nancy Pelosi will begin the presidential impeachment hearings that are not only likely to move the market but also provide Saturday Night Live plenty of comedic inspiration.

Technically speaking, the bulls continue to demonstrate their resiliency in spite of all the political lunacy and uncertainty it faces. This morning it would appear that the bears are trying to reengage as trade war uncertainty once again floats to the surface affecting prices in Asia and Europe during the night. After the morning gap down I would not be surprised to see the price action become light and choppy as we wait for the news-driven events of the day come to light. Remain focused on price action and flexible as market direction could quickly shift in reaction.

Trade Wisely,

Doug

Markets gapped slightly (+0.10%) and then rallied early, maxing out about half a percent above the Monday close. However, the bulls faltered at that level and traded back lower leaving upper wicks. Nonetheless, the SPY, DIA, and QQQ all managed to close the day Tuesday at new all-time high closes…but on candles that were very indecisive.

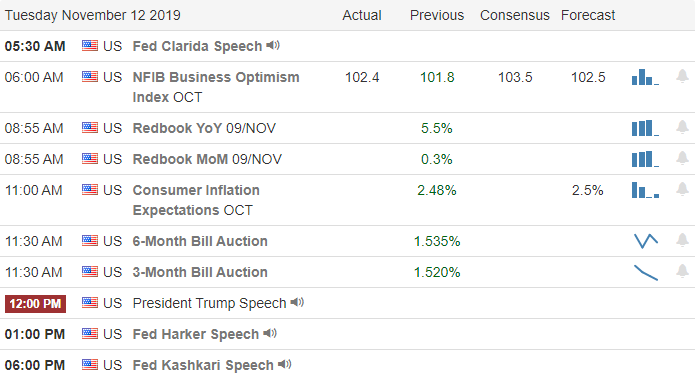

Among the news drivers Tuesday was a mid-day speech by the President. Market Analysts had hoped it would be a positive speech on trade and China negotiation success. Others had expected an announcement of another postponement of European Auto tariffs. (Wed. is the deadline for another postponement, and this being an economic and trade speech the announcement was expected.)

However, instead, President Trump took the opportunity to say the Fed has been holding the US economy back. He also again said China had been cheating the US for decades (and that the prior US Presidents must not have understood trade). And while he said a phase-one deal with China was now “close,” he went on to threaten substantial increases in tariffs if no deal is reached. (Rather than being “a done deal” as he has said in the past, this posturing clearly indicates negotiations are still underway.) Finally, he also failed to mention the postponing of the tariffs on European Automobiles. This was decidedly NOT the kind of speech markets had hoped to hear.

Beyond the speech, the President also threatened the World Trade Organization on Tuesday. (Bloomberg reports say he is threatening to block the WTO budget approval, which requires unanimous consent by member states, unless the WTO falls in-line with his views on trade.) So, all in all, this was a bad day for anyone with any concerns about International Trade.

In addition to the US Market pullback, overnight Asian markets were all in the red. In Europe, markets are also all strongly down at this point. As of 7:30 am, U.S. futures were on track for a 0.3% to 0.4% percent gap lower across the board.

Wednesday’s economic news includes CPI (8:30 am) and Fed Chair Powell testifies before Congress at 11 am. The only major earnings events will take place after the close as CSCO, NTAP, and TCOM all report.

Fed Chairman Powell’s testimony is very likely to be the large market-driver today. However, Impeachment testimony (and off-setting events designed to distract) will also fill the news. Regardless of any shock markets may get, remember the bulls have been extremely resilient in recent months. So, don’t over-react to temporary whiplash. Try to follow the trend. Be cautious and continue to take profits and move stops.

Ed

Swing-Trade Trade ideas for your consideration. Long – CARS, KHC, ARNC, CDW, MAS, K, DOV, PNR, AMD, FBHS, VLO, AMP, UTX, MS, KEY. Short – ETR, SO, CINF, STZ, CTAS, DG, TGT, CPB. Trade smart, take profits along the way and trade your plan. Also, do not forget to check for upcoming earnings. Stocks we mention and talk about are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

News from BA that the 737 may be back in the sky by January inspired the bulls to shake off the trade fears that began the day to close the DIA at a new record high close. Relentlessly the bulls have pushed past bad news to move up and if that bad news eventually finds resolution the surges even higher. This morning there is speculation the President will delay European tariffs by 6-months on Wednesday, lifting futures off of overnight lows. Expect news-driven price action to continue with he Powell speech on Wednesday and the Impeachment hearing also scheduled to begin.

Asian markets recovered from early lows closing in the green despite trade concerns and Hong Kong unrest. European are also green across the board this morning on hope of an auto tariff delay. US Futures continue to fluctuate this morning with more than 300 earnings reports to digest. That said, I expect a modest gap up at the open with the bulls still in control.

On the Earnings Calendar, we have over 300 companies reporting today. Notable reports include DHI, TWOU, ADT, AAP, ACM, CBS, BREW, DF, OSTK, ROK, SWKS, TLRY, TSN, and YY.

The bullishness of this market has been truly remarkable. As issues continue to swirl around trade and Hong Kong, the bulls relentlessly surge forward. Although yesterday’s rally was not broad-based, a new record high closing high in the DIA was inked mostly on the back of BA news. With an upcoming speech by the President on Wednesday with speculation that he is going to dealy European tariffs for 6-months markets this morning a once again surging higher. Jerome Powell is also scheduled to speak on Wednesday.

All the while, the Presidential impeachment hearings will begin, and we can count on a barge of political rhetoric and spin to captivate the public and potentially move the market. News-driven price action can be challenging to trade, but it could also turn out to be a non-event if the bulls remain as relentless as they have been over the last month of trading. No matter what happens, as traders, it’s our job to focus on the price action and follow the clues they present without bias or prediction.

Trade Wisely,

Doug

The indices gapped down about half a percent on Monday (on Hong Kong unrest, the contraction of GDP in the UK and a lack of positive spin to offset Friday’s bad news on the Trade War front). However, the bulls continue to be resilient and they rebounded to cut the losses by more than half, leaving white candles across all major markets.

Among the news that helped were reports that BA will begin deliveries of its 737Max again in December and that KKR has formally asked WBA about purchasing it (in an unknown type of deal). On this news, the DIA even managed to put in a new all-time high close (by a few cents). This leaves us in a tight consolidation in the latest stair-step of the bull run.

There is no US economic news on tap again Tuesday, but there are three Fed speakers during the day. The only earnings of note are DXC.

However, President Trump does make a mid-day speech today on Trade and International Commerce , which will likely touch on his China Trade War. It was also reported after-hours Monday by Politico that he may announce another six-month postponement of tariffs on European Autos. (Those tariffs were already postponed once in May.)

Overnight, Asian markets were mixed. In Europe, markets are also mixed, but mostly green at this point. As of 7:30 am, U.S. futures were pointing to a flat open, barely on the green side of even.

With the vast majority of earnings behind us, fear of global recession, twists in the China Trade War and (Impeachment-related or meant to distract from the Impeachment) political news are likely to drive news cycles and markets again this week. Remember to be cautious and continue to take profits and move stops.

Ed

Swing-Trade Trade ideas for your consideration. Long – CARS, BHC, ARNC, SNA, MAS, DOV, PCAR, AMD, VLO, DD, FBHS, AMP, UTX, MS. Short – EFX, ETR, SO, KO, ATVI, SBUX, STZ. Trade smart, take profits along the way and trade your plan. Also, do not forget to check for upcoming earnings. Stocks we mention and talk about are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Closing at new record highs on Friday, the bears have decided they have something to say this morning trying to claw back a good portion of the move. The good news is with the banks closed in honor of Veterans Day, the bears may find it difficult to find enough energy to create much technical damage. Although it’s always disappointing to see a weekend reverse a strong close of the previous week, the volume is likely to be light and price action choppy due to the holiday.

Asian markets closed the day seeing only red with trade tensions growing over the weekend, and Hong Kong protests flare up once again. European markets are also bearish this morning as they watch trade developments, and the US Futures are following the same path the Dow pointing to a triple point gap down this morning.

There are no events on the Economic Calendar with the banks closed due to Veterans Day.

We have over 140 companies reporting earnings results today. Notable reports include FOLD, FNV, TME, and TERP.

Having taken a few days off, I feel a bit out of the sorts this morning trying to catch up, so this blog post will well be short. Although the DIA, SPY, and QQQ closed at a new record high on Friday it was interesting to note that T2122 slightly declined. That often suggests the rally was not broad-based with just key stocks rising to finish the week strong.

This morning futures are decidedly bearish looking to take back a sizeable portion of Friday’s rally at the open. However, with the banks closed for Veterans Day, this pullback may not create any serious technical damage. In fact, after the morning rush expect price action to become light and choppy.

Trade Wisely,

Doug

More China Trade War news drove markets Friday as pre-market stories indicated that there was “fierce opposition” in the White House to rolling back tariffs as part of any phase one deal. This caused a gap lower in the SPY, QQQ and IWM. However, this gap was quickly faded…until President Trump told reporters he had not agreed to rollback tariffs (as his Senior Economic Advisor Larry Kudlow had told Bloomberg on Thursday was agreed with China).

The President’s comments sparked another mid-morning selloff. However, the rest of the day the bulls slowly regained momentum, driving prices higher right into the close. The day finished with another new all-time high close in the SPY, DIA, and QQQ. Even the IWM closed with a nice white candle back in its recent range.

There is no US economic news on tap for Monday (or Tuesday) due to the Veterans Day holiday. In addition, the only earnings report of note Monday is HPE. However, there is some International news. The UK (5th largest economy in the world), reported a shrinking GDP and Germany (4th largest) is expected to do the same on Thursday. This would put two of the largest economies in the world (and the two largest in Europe) into recession.

Meanwhile, in China, the BABA “Singles Day” sale has sold over $31bil in merchandise (and climbing) in its one-day sale. At the same time, the unrest in Hong Kong has escalated again with Police shooting at least two people, causing a flash mob that shut down downtown traffic. Another man (who apparently opposed the mob) was set on fire and those three are among 60 casualties today.

Overnight, Asian markets were all in the red, on Hong Kong unrest and US-China Trade fears. In Europe, markets are also in the red on the UK recession and Global trade fear. As of 7:30 am, U.S. futures were on-track for a half percent gap lower across the board.

With the vast majority of earnings behind us, fear of global recession, twists in the China Trade War and (Impeachment-related or meant to distract from the Impeachment) political news are likely to drive news cycles and markets again this week. Remember to be cautious and continue to take profits and move stops.

Ed

Swing-Trade Trade ideas for your consideration. Long – KHC, GPC, PSX, K, MAS, PCAR, AMD, VLO, AMP, IR, CE, ROL, UTX, STI, MS, OLLI. Short – EFX, ETR, KO, MLM, HSY, SBUX, DG. Trade smart, take profits along the way and trade your plan. Also, do not forget to check for upcoming earnings. Stocks we mention and talk about are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service