The Week Ahead – 11-24-19

Although we have had 3-days of pullback in the indexes, the VIX shows little to no fear, and so far the indexes has suffered no discernible technical damage. According to reports, the likelihood of a completed Phase 1 trade deal before the scheduled December 15th tariff increase has diminished. As we head into the uncertainty of the weekend and the coming holiday, it may be difficult for the bulls to find much inspiration. However, a consolidation at this level would be productive and bullish as we wait for some political clarity.

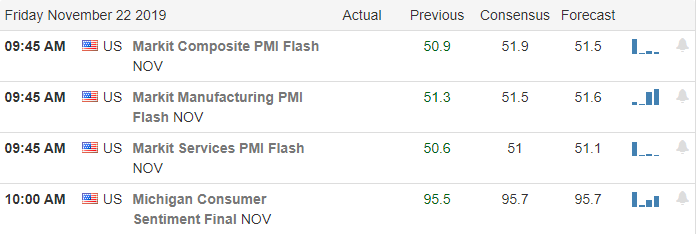

Asian markets closed mixed overnight as trade uncertainty weighed on investor’s minds. Across the pond, European markets are bullish following positive Euro data. US Futures point toward a modestly bullish open ahead of Consumer Sentiment that consensus expects to increase slightly at 10 AM Eastern. Plan your risk carefully as we head into the weekend.

On the last day of trading this week, we have just 15 companies reporting earnings. Notable reports include BKE, FL, HIBB, and SJM.

During the impeachment hearings, the congress could not be bothered to pass a federal budget but did set aside enough time to kick the can down the road with another stopgap spending bill to avoid a government shutdown. It now looks as if there will not be a Phase 1 trade agreement before the scheduled December 15th tariffs increases. China said in a report that they want a trade deal but are not afraid to fight. Impeachment hearings have not progressed into Russian election meddling as the political drama extends.

With a light day of earnings and economic reports the US Futures are trying to put on a brave face and break the 3-day pullback as we head into the weekend. With not many places to find inspiration and trade up in the air it may be difficult for the bulls to gain much traction. However, if they can prevent additional selling and slip the indexes into a consolidation I believe that would be a win keeping the market trends bullish. Although we pulled back there has been on technical damage, and this rest appears to very constructive thus far. According to the VIX, fear of a selloff remains very low as we head into the weekend.

Trade Wisley,

Doug

On Thursday, the bad news was that stocks posted their first 3-day losing streak since July. In the process, they broke their uptrend, which began back in early October. The good news is that this “selloff” has only totaled about one percent…and it was a well-needed rest after a strong six-week rally.

This pullback/pause has seemed to happen over indecision about the outcome of the Trade War with China, etc. Unfortunately, this is likely to continue simply because international trade is such a massive part of GDP around the world, including the US. Therefore, trade is a large driver of earnings and, therefore, stock markets. Moreover, it is likely that finding themselves in this conflict, the Chinese have no reason to rush to an agreement or make concessions, because President Trump faces an election next fall, while President Xi never will. The point is that we traders need to adapt to this new normal.

Perhaps the best news of the day is that Impeachment Hearings are now concluded. Obviously, there will be debate and votes on this case, as well as possibly a Senate trial. However, at least until that trial, these will be limited to being reported in sound bites now that the public hearings are concluded. Beyond that story, Friday’s major economic news includes the Nov. PMI (9:45 am) and Michigan Consumer Sentiment Survey (10 am). The only earnings of note before the bell are FL and SJM.

Overnight, Asian markets were mixed but mostly green. In Europe, all markets are in the green as well at this point. As of 7:30 am, U.S. futures are pointing to a quarter percent gap higher.

Remember that even with the uptrend line broken, we are not far off the highs and we did need a rest. So, be careful about getting too bearish or over-reacting. Yes, Trade War whiplash is likely to continue. However, in a longer-term view, the market is still bullish.

Today is Friday. So don’t forget to take profits in front of the weekend. Continue to lock-in gains, move stops, and trade your plan. Keep in mind that a Trader’s job is to consistently make gains, not to hit home runs every once in a while.

Ed

Sorry, but no Swing Trade Ideas for your watchlist on Friday. However, if you’re in the trading room at 9:10 am Eastern, we will cover some charts. Trade smart, take profits along the way and trade your plan. Also, do not forget to check for upcoming earnings. Stocks we mention and talk about are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

The possible delay of the Phase 1 trade deal and the questions about that means for the December 15th tariff increases brought out the bear yesterday. However, by the end of the day the technicals of the index charts took little to no damage. Even the VIX by the end of the day showed little to no fear growing in the overall market. That being said, the market is obviously quite sensitive to the notion of increased tariffs by the end of year, and it will likely continue to be a driver of market sentiment requiring traders to remain nimble.

Asian markets closed in the red across the board in reaction the possible trade deal delay. This morning European markets are lower across the board as the concern of Hong Kong bill passed by Congress could affect trade relations going forward as it heads to the President’s desk for signature. US Futures are flat to slightly bearish ahead earnings and economic calendar reports.

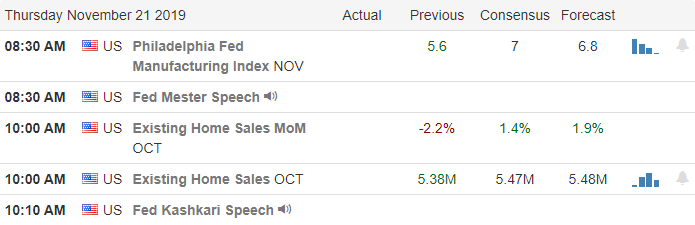

On Thursday’s Economic Calendar, we have 46 companies reporting earnings. Notable reports include JACK, LB, LXB, NTES, and QIWI.

A story suggesting there would not be a Phase 1 deal this year brought out the bears yesterday. The major concern was not the Phase 1 deal; it’s the question as to what happens with the tariffs scheduled to increase December 15? Clearly and increase before the end of the year could have serious impacts on a market that has rallied on the optimism of a partial deal. Though we have a few earnings reports today, it’s unlikely the market will see much impact from their results; instead, the market may focus on the economic calendar news with Jobless Claims, Philly Fed Survey, and Existing Home Sales.

Although yesterday selling was a concern, the technicals of the index charts took very little damage yesterday. Personally, I think the pullback to at this point was good to relieve the relentless bullish pressure. In fact, this pause in the rally could setup new buy opportunities assuming we can get some clarification on the Phase 1 negotiations and December 15th tariffs. Stay on your toes as this political football continues gets kicked about along with market sentiment.

Trade Wisely,

Doug

In spite of LOW and TGT both reporting beats (and guidance raises) before the bell, US Markets all gapped lower Wednesday on trade fears based on China’s anger over the US Senate passing a Hong Kong Democracy Bill. After the Open, we ground sideways the rest of the morning. However, just before 1 pm, word came from White House sources that a phase one of any trade deal is not expected to be completed in 2019. This caused an immediate and dramatic sell-off for the next half hour.

After that early-afternoon selloff, the remainder of the day was spent recovering from this over-reaction. By day end, we closed with indecisive, black candles across the board. The SPY and DIA both finished down about 0.4% and the QQQ down 0.6%. However, all indices remained in their range for the week and we needed a bit of a rest to relieve over-extension anyway. So, the down day was not necessarily a bad thing overall.

Thursday’s major economic news includes Weekly Jobless Claims and Philly Fed Mfg. Index (both at 8:30 am) and Oct. Home Sales (10 am). There are also a couple of Fed speakers, but they should not move markets. The only major earnings before the bell today are for M (which posted a miss on sales and lowered forward guidance). In addition, Impeachment Hearings resume at 9 am.

Overnight, Asian markets were all in the red. In Europe, markets are almost all in the red as well at this point. As of 7:30 am, U.S. futures are just on the red side of flat across the board. However, as is usual lately after the Wed. afternoon bad news about the Trade War, last night the opposite implication comes from China. It is being reported that China has invited the US negotiators to Beijing for another round of talks. (This China Trade War debacle is the very definition of ping-pong diplomacy.)

While Impeachment Hearings continue Thursday, the case has either already been made or was never going to be made (depending on your political point of view). Either way, that circus will wind down soon with an Impeachment vote. However, the China Trade War story is very likely to drag on for some time.

Remember that the bulls remain strong and resilient. So, be careful over-reacting to any temporary shock news. Continue to take profits, move stops, and trade your plan. Keep in mind that a Trader’s job is to consistently work their process to make gains…not to hit home runs every once in a while.

Ed

Swing Trade Ideas for your watchlist and consideration. Long – ADT, PWR, GRMN, AIZ, CAH, FEYE, GE, FITB, NTRS, INFO, STT. Short – MYL, NI, FANG, OXY, CINF, MCD. Trade smart, take profits along the way and trade your plan. Also, do not forget to check for upcoming earnings. Stocks we mention and talk about are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

Some nasty retail earnings and tough talk raise concerns about the so-called Phase 1 trade deal bring a needed pause in the bull run. Even bulls need a little rest from time to time, and this little pullback may prove to be very productive as long as the overall index trends hold. Better earnings results out from TGT and LOW have already recovered some the overnight losses in the futures market now suggesting a modest gap lower at the open.

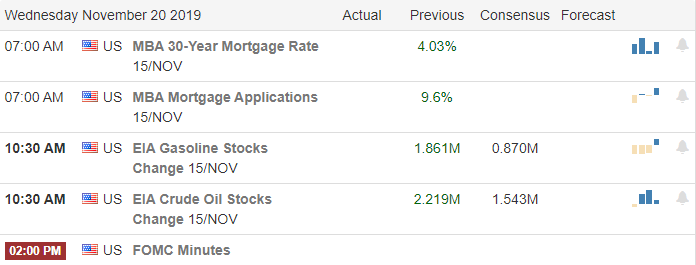

Overnight Asian markets closed the day bearish across the board on growing trade tensions. European markets are also reacting lower this morning, seeing red across the board. US Futures have lifted overnight lows but continue to point to modest declines ahead of more impeachment hearings and the FOMC minutes due out at 2 PM Eastern today.

On the hump day Earnings Calendar, we have more than 50 companies reporting today. Notable reports include LOW, TGT, JACK, LB, LZB, NTES, and QIWI.

Yesterday’s gap up opens eventually turned into a pop and drop pattern with the Dow closing the day with a bearish engulfing candle. However, the SPY and QQQ found enough buyers by the end of the day, and the price action finished the day with just a little rest from breaking daily records. It would seem tensions between the US and China have once again flared with new tariffs threatened as part of the rhetoric. Today the impeachment show continues on the capital hill while the market waits for the FOMC minutes at 2 PM Eastern.

Even with the slight bearishness of yesterday index trends remain intact while the VIX continues to register little to no fear of in the market. Although the futures are under slight pressure this morning, I see this pullback as nothing more than a rest so far. Of course, that could quickly change if the Phase 1 proposal falls apart, but my guess is that’s not likely at least for now. We needed a little rest, and as long as the overall trends hold, this pullback may well prove to be nothing more than a pause in an otherwise very bullish trend. Futures point to modest gap down at the open, but be very careful chasing the open down as many will see this as an opportunity to buy. As always, wait for proof of follow-through!

Trade Wisely,

Doug

Markets gapped higher Tuesday (despite HD and KSS both missing and lowering Q4 forecasts). However, after the gap-up, the selling began immediately and took us to red territory across the board. However, a late-morning rebound rally recovered some of the losses. The rest of the day was a range-bound grind sideways that left the DIA (anchored by HD) printing a Bearish Engulfing candle, the SPY barely red and the QQQ printing a new all-time high close that was also a black-body Hanging Man candle. In addition, the rally may be showing more signs of being stretched as T2122 fell again (meaning we are maintaining all-time highs on fewer participating companies).

It is worth noting that during his Tuesday Cabinet Meeting Photo Op, President Trump again threatened to raise tariffs on China (if they don’t make a deal). That made no impact on markets. This was the first time in a long time, a China Trade headline or rumor had no impact at all on markets. Impeachment Hearings, which dominated news all day, also seemed to have no impact on markets today. However, overnight the Senate passed the Hong Kong Democracy Bill (President Trump is expected to sign), which immediately drew China’s ire and spooked International Markets (on fear this would provoke more escalation in the Trade War).

Wednesday’s major economic news is limited to Oil Inventories (10:30 am) and the release of October FOMC Minutes (2 pm). However, since all Fed votes were made public and most Fed voters have spoken publicly since the FOMC Meeting, this too may be a non-event for markets. Major earnings before the bell today include LOW (which beat earnings, missed on revenue and raised guidance) and TGT (which posted had a huge beat on the top and bottom lines and also raised forecast for Q4.) In addition. Impeachment Hearings resume at 9 am.

Overnight, Asian markets were flat to green. In Europe, markets are mixed, but mostly green at this point. As of 7:30 am, U.S. futures are pointing toward a gap higher of between 0.2% (DIA and SPY) and 0.4% (QQQ). However, HD also reported a sales miss and lowered its full-year guidance this morning. It may also be worth noting that the Hong Kong siege may be winding down with only 100 people still hold-up inside the surrounded University campus.

Once again, we have no scheduled news, all the important earnings already done before the bell, and Impeachment Hearings will likely control the news cycle during the day. However, since we’re in a Trade War, that front always has the potential for news. Nonetheless, it would not be surprising for markets to gap and then drift the remainder of the day. Unexpected news can always surface. Regardless, the bulls remain very resilient, only willing to hear good news for months now. So, don’t get caught over-reacting to a temporary shock. Continue to be cautious, take profits and move stops. Remember that a Trader’s job is to consistently make gains…not to hit the occasional home run.

Ed

Swing Trade Ideas for your watchlist and consideration. Long – DT, ALLE, ARNC, MGM, IPG, FEYE, PKG, GE, FITB, INTC, WFC, GS. Short – MYL, NI, FE, FANG, OXY, MCD, DG, CCEP. Trade smart, take profits along the way and trade your plan. Also, do not forget to check for upcoming earnings. Stocks we mention and talk about are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service

While the bulls seemed to struggle to find inspiration in the morning session, there was a constant and persistent push in the Dow futures, which led the indexes throughout the entire day, ultimately setting new record highs. Oddly, even so-called safe-haven sectors are being swept up in this relentless bull run. A rare thing to see, so enjoy it. How long this can last is anyone’s guess, so don’t get caught up in the emotion of will bullishness stay focused on price action, plan carefully, and remember to take profits along the way!

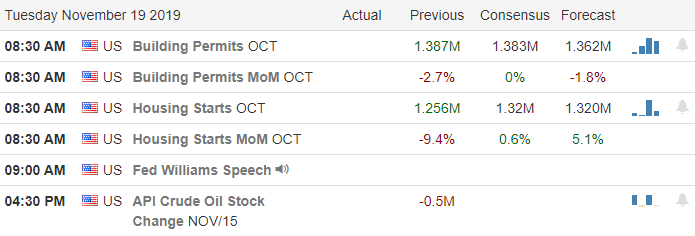

While trouble in Hong Kong continues to get more violent Asian markets managed to close mostly higher though China said yesterday they were pessimistic about a trade deal. European stocks joined the US markets in bullishness setting 4-year highs and are green across the board this morning. US futures pared gains slightly after HD missed on sales expectations but still point to new record highs ahead of the Housing Starts number at 8:30 AM Eastern.

On today’s Earnings Calendar we have just over 60 companies reporting. Notable reports include HD, JKS, KSS, MDT, TJX, and URBN.

Pimco predicts the US and China will sign a Phase 1 trade deal before Christmas causes the futures to leap higher. However, after HD missed on sales expectations, futures have softened but continue to point to another record high open. Impeachment hearings resume this morning, and according to reports, the President is considering the idea of testifying in his own defense. Expect the political drama to attract a good deal of attention, but it’s unclear if the bulls will waver in their march higher even if the news is bad.

Although the markets seemed to lack momentum yesterday, the constant push in the futures market finally broke the log jam setting new record highs for the day. It’s interesting to note value stocks and consumer defensive stocks are moving up in concert with growth and high beta stocks, which is quite odd. Relentless bullishness seems to be the best description of the current market, and it doesn’t seem to matter what their buying just buy something. How long this can last is anyone’s guess, but enjoy it because it’s not often such an event occurs. As always keep your emotions in check, stay focused on price remembering how quickly sentiment can shift.

Trade Wisely,

Doug

The markets waffled and then drifted higher Monday on a lull in news. A late-day push by the bears was unable to stave off another all-time high close on the SPY, DIA, and QQQ…but barely. More troublingly, breadth dwindled again as T2122 fell back into the 50s while we printed those new all-time highs. This means fewer companies are participating in the rally. As we said in the room today, the rubber band is getting pretty stretched.

The only “in day” news Monday was a meeting between President Trump and Fed Chair Powell. While such meetings have happened often in the past, never has a President continually belittled and berated the Fed before and certainly never calling the Fed Chair (he appointed) an “enemy of America.” The White House says the President made a case for negative rates, while Powell explained the current Fed policy. Regardless of the President’s temperament, both sides reported the meeting was cordial. Neither side claimed any changes were decided.

Tuesday’s major economic news is limited to Building Permits (8:30 am). However, there will be a Fed speaker at 9 am. Major earnings include HD (see below), KSS, MDT, TJX, and TDG all before the Open. In addition, Impeachment Hearings resume Tuesday with several people scheduled to testify.

Overnight, Asian markets were flat to green. In Europe, markets are mixed, but mostly green at this point. As of 7:30 am, U.S. futures are pointing toward a gap higher of between 0.2% (DIA and SPY) and 0.4% (QQQ). However, HD also reported a sales miss and lowered its full-year guidance this morning. It may also be worth noting that the Hong Kong siege may be winding down with only 100 people still hold-up inside the surrounded University campus.

With all the important earnings coming before the bell and Impeachment Hearings likely controlling the news cycle during the day, it would not be surprising for markets to gap and drift Tuesday. However, unexpected news (diversion?) from the Trade War with China can always surface. Either way, the bulls have really only wanted to hear good news for months now. So, don’t get caught over-reacting to a temporary shock. Continue to be cautious, take profits and move stops. Remember that a Trader’s job is to consistently make gains…not to hit the occasional home run.

Ed

Swing Trade Ideas for your watchlist and consideration. Long – ALLE, PSX, IFF, IPG, MGM, ITW, PCAR, PKG, LEG, GE, VLO, INTC, APH, NTRS, UTX, WFC, KSU, STI, MS, KR. Short – MCD, FE, CCEP, NI, MYL. Trade smart, take profits along the way and trade your plan. Also, do not forget to check for upcoming earnings. Stocks we mention and talk about are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service