While the bulls seemed to struggle to find inspiration in the morning session, there was a constant and persistent push in the Dow futures, which led the indexes throughout the entire day, ultimately setting new record highs. Oddly, even so-called safe-haven sectors are being swept up in this relentless bull run. A rare thing to see, so enjoy it. How long this can last is anyone’s guess, so don’t get caught up in the emotion of will bullishness stay focused on price action, plan carefully, and remember to take profits along the way!

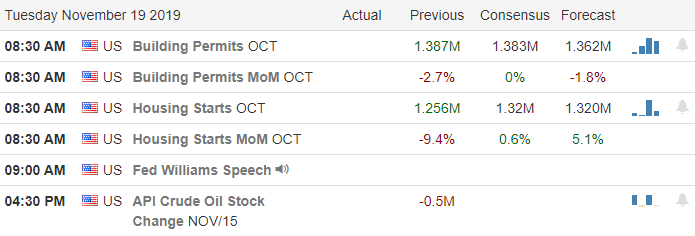

While trouble in Hong Kong continues to get more violent Asian markets managed to close mostly higher though China said yesterday they were pessimistic about a trade deal. European stocks joined the US markets in bullishness setting 4-year highs and are green across the board this morning. US futures pared gains slightly after HD missed on sales expectations but still point to new record highs ahead of the Housing Starts number at 8:30 AM Eastern.

On the Calendar

On today’s Earnings Calendar we have just over 60 companies reporting. Notable reports include HD, JKS, KSS, MDT, TJX, and URBN.

Action Plan

Pimco predicts the US and China will sign a Phase 1 trade deal before Christmas causes the futures to leap higher. However, after HD missed on sales expectations, futures have softened but continue to point to another record high open. Impeachment hearings resume this morning, and according to reports, the President is considering the idea of testifying in his own defense. Expect the political drama to attract a good deal of attention, but it’s unclear if the bulls will waver in their march higher even if the news is bad.

Although the markets seemed to lack momentum yesterday, the constant push in the futures market finally broke the log jam setting new record highs for the day. It’s interesting to note value stocks and consumer defensive stocks are moving up in concert with growth and high beta stocks, which is quite odd. Relentless bullishness seems to be the best description of the current market, and it doesn’t seem to matter what their buying just buy something. How long this can last is anyone’s guess, but enjoy it because it’s not often such an event occurs. As always keep your emotions in check, stay focused on price remembering how quickly sentiment can shift.

Trade Wisely,

Doug

Comments are closed.