Pins and Needles

After a big Friday rally and at the cusp of new record highs, the market this morning is tiptoeing on a bed of pin and needles. Will there or won’t there be a Phase 1 trade deal? What will the President decide about the Dec. 15th tariff increase? The market is waiting for answers to these questions and the decision is likely to have substantial impacts on overall market sentiment. Tensions between the countries flared once again with China accusing the US of violations of international law after the House passed a bill citing human rights violations for their use of detention camps.

Overnight, Asian markets closed mixed but mostly higher even after reporting declines in exports for November. European markets are modestly lower across the board this morning and US Futures chop around the flat-line with a slightly bearish lean. With such a big decision pending, plan your risk carefully, and plan for the possibility of substantial moves depending on the answer we receive!

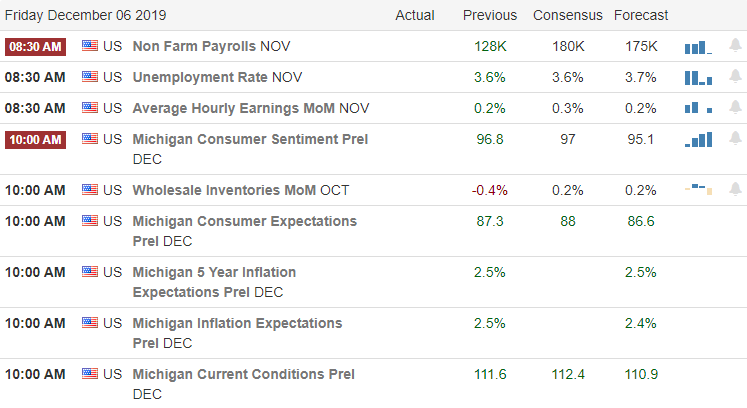

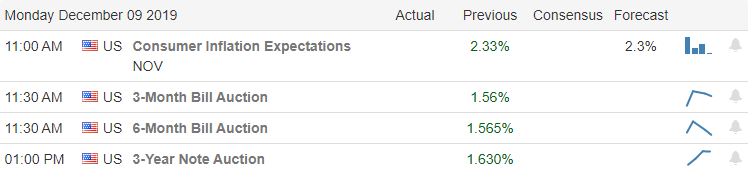

On the Calendar

On the Earnings Calendar, we have 27 companies fessing up to their quarterly results. Among the notable earnings are CASY, CHWY, SFIX, TOL, & MTN.

Action Plan

What, no premarket pump, no 5 AM news citing unnamed sources to start the day? Well, that’s a change that we will have to keep a close eye on as we move toward the December 15th tariff deadline. Though the Director of the National Economic Council Larry Kudlow said on Friday that the Phase 1 trade deal was getting closer to completion, China appears to be very unhappy this morning. Last week the House passed a bill chastising China for its use of detention camps. During the night, China claims the bill violates international law flaring tensions between the two countries once again. The President’s decision could be critical for the market direction this week. Until then, we wait on pins and needles!

Technically speaking, the bullish trend is still in tack, but after a 4-day recovery rally of more than 675 Dow points, perhaps a little rest is just what the doctor ordered. The SPY came very close to breaking to new record highs on Friday’s strong rally. However, close also means that the price resistance above did its job of holding the line as we wait on an important tariff decision. What happens next could be some big moves either up or down, depending on the decision. Remain flexible and plan your risk accordingly.

Trade Wisely,

Doug