More Fallout From Soleimani Killing

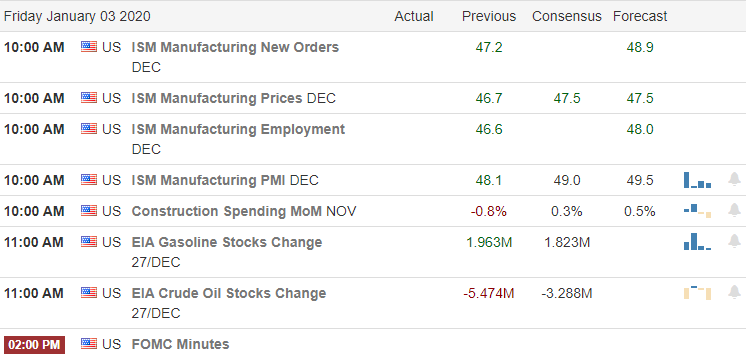

Markets gapped lower Friday on fears and consequences of the US assassination of a top Iranian General (on his way to meet with the Iraqi Prime Minister). However, the major indices recovered a bit over the session. At the end of the day, the SPY was down 0.76%, DIA down 0.80% and QQQ down 0.92%. So, the bulls are not ready to run for cover and we remain near all-time highs. However, the short-term trend is more sideways than bullish as of the end of the week.

It was a busy weekend of reactions from the US drone strike in Iraq. Iran says they are no longer bound by the 2015 nuclear deal and are ramping up uranium enrichment. Rockets were fired into the Green Zone, landing near the US Embassy in Iraq. The Iraqi government has suspended coalition operations against ISIS. In addition, the Iraqi Parliament (at the request of the Iraqi PM) has demanded that US troops leave their country and refrain from using Iraqi land, water or air space. Finally, President Trump is threatening sanctions on Iraq (for kicking us out) and also threatened to strike 52 specific Iranian targets if Iran retaliates…and has deployed thousands more US troops to the area in order to back up that threat.

While market impacts over this still-unfolding story are unsure at this point, it would seem likely that oil markets will be unsettled by the threat of war in the Persian Gulf. (Brent hit $70 today.) Typically, after a middle-eastern crisis, safety plays (Gold and Bonds) tend to fade and stocks gain after an initial reaction. However, oil prices tend to remain elevated for longer periods. An interesting non-US fallout is that the Saudi Aramco stock price fell nearly two percent Sunday over fears of Iranian reprisal attacks against Saudi Arabia.

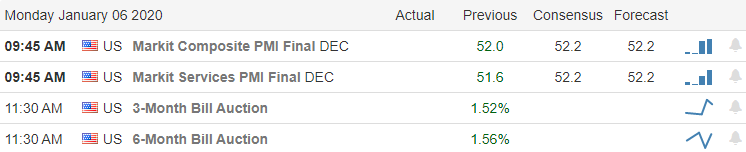

Monday’s major economic news is limited to Dec. Services PMI (9:45 am). The only earnings report of note Monday is STT. However, there may be news out of Congress (either over limiting President’s Trumps War Powers toward Iran or on the Impeachment).

In other business news, BA has found another potential design/wiring flaw in their 737Max. Just like the software flaw that caused the crashes, a December audit found that Boeing knew of this problem, but had not reported it to the FAA.

Overnight, Asian markets were mixed but mostly red on the news out of Iraq. In Europe, markets are also mixed but mostly red at this point. As of 7:30 am, U.S. futures are down sharply (greater than 1%) following Thursday’s stellar start to the year.

The bulls were off to a great start on January 2nd. However, the killing of Iran’s top general has thrown the world into turmoil again. It’s hard to bet against the bulls in the longer-term. However, anything can happen short-term. So, all we can do is be nimble, add hedges or get flat until things settle. Continue to plan your trades, and trade your plans. As always, keep taking profits along the way, move your stops to protect yourself and wait for the trade to come to you.

Ed

Swing Trade Ideas for your consideration and watchlist: CTST, LB, NIO, NUAN, WDAY, TWLO, GE, ROKU, CGC, SHW, XPO. Trade smart, take profits along the way and trade your plan. Also, do not forget to check for upcoming earnings. Stocks we mention and talk about are not recommendations to buy or sell.

✅ SMS text alerts and reminders?👈

✅ Check out our newest YouTube videos👈

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service