After a very exuberant Thursday rally, a US airstrike in retaliation for the embassy attack is sending shock waves through the world markets this morning. What a difference a day makes as uncertainty once again raises its ugly head as we move toward the weekend. As traders face an uncertain weekend, it could easily trigger some profit-taking and increase the overall price action volatility. Watch closely if index price supports can stave off this initial knee-jerk reaction. If they begin to fail, profit-taking could quickly increase.

Asian markets closed the day lower across the board but rather subdued overall. European markets are all in the red this morning in reaction to the Iranian tensions. US Futures point to a sharply lower open this morning with the Dow indicating a gap down of more than 250. Buckle up; it could be a bumpy ride.

On the Calendar

On the Friday Earnings Calendar, we have 18 companies listed as reporting, but just one confirmed report from LW and it happens to be the only one that’s noteworthy on the day.

Action Plan

A day after an exuberant rally that set new records, the market has a very different attitude this morning. During the evening in response to the invasion of the US Embassy in Iran, a strategic killed one of Iran’s top generals sending shock waves throughout the middle east and possibly escalating the conflict. Qasem Soleimani is tied directly to the deaths of over 600 Americans and was a very popular military leader in Iran. What comes next is anyone’s guess, and that uncertainty is evident with a quick look at the futures market.

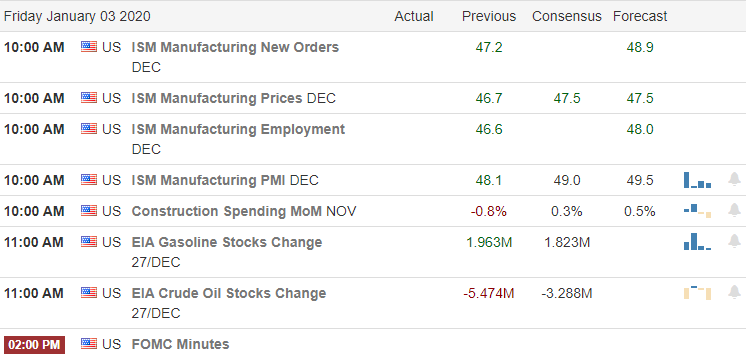

The strong bullish trend over the last three months may still hold after this morning’s knee jerk reaction, but overall, the market hates uncertainty, and we can expect the VIX will respond to show some fear. Keep a close eye on price supports within the index trends. Failure of supports heading into an uncertain weekend could set off a wave of profit-taking. Remember, we have the ISM, Petroleum Status and the FOMC minutes on the economic calendar along with a parade of Fed speakers.

Trade Wisely,

Doug

Comments are closed.