China Stimulus Let Down as GOOGL in Crosshairs

Tuesday saw a drift higher across the market after the opening bell. SPY gapped up 0.47%, DIA gapped up 0.21%, and QQQ gapped up 0.52%. From there, both SPY and QQQ followed-through with a rally that lasted until 10:50 a.m. Then, those two major index ETFs ground sideways in a small range until 1 p.m. when a new steady rally kicked in. For its part, after the open, DIA immediately recrossed the gap and chopped sideways for the first hour. Then, it drifted slowly higher the rest of the day. This was broker by slight profit-taking the last minutes of the day in all three major index ETFs. This action gave us a large white-bodied candle in the SPY that recrossed above its T-line (8ema) and closed while testing its short-term downtrend line. (SPY also missed another all-time high close by just 65 cents.) At the same time, QQQ printed a large, white-bodied candle that crossed back above its T-line as well as its short-term downtrend line. For its part, DIA was the weakest of the three, giving us a white-body Spinning Top Bull Harami type candle that closed right at a retest of its T-line but did not get up to retest the short-term downtrend line. This happened on below-average volume in the SPY, DIA, and QQQ.

On the day, seven of the 10 sectors were in the green with Technology (+1.31%) far out in front (by 0.68%) of the rest of the group. On the other side, Energy (-2.30%) was by far the biggest mover and biggest loser. Meanwhile, SPY gained 0.95%, DIA gained 0.28%, and QQQ gained 1.49%. VXX fell 4.04% to close at 55.39 and T2122 climbed to the other side of its mid-range at 51.26. At the same time, 10-Year bond yields fell slightly to close at 4.018% while Oil (WTI) plummeted 4.24%, ostensibly on somewhat reduced Middle East war fears, to close at $73.89 per barrel. So, while there was no major driver for the rally Tuesday, Fed members generally leaning toward quarter-point cuts and a “no news is good news” feeling surrounding expansion of the conflicts (i.e. the next Israeli attack on Iran and perhaps Yemen also) led the Bulls to a modest gap up and then a drift higher.

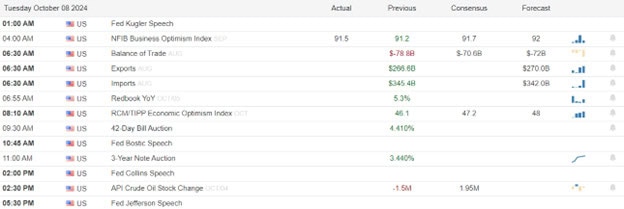

The major economic news scheduled for Tuesday was limited to August Exports, which were up to $271.80 billion (compared to the July value of $266.60 billion). On the opposite side, August Imports were down a bit to $342.20 billion (versus July’s $345.40 billion reading). This resulted in an August Trade Balance of $70.40 billion (compared to a forecasted -$70.10 billion but down from July’s -$78.90 billion). Then, after the close, API Weekly Crude Stocks came in with a much bigger inventory build than anticipated at +10.900 million barrels (versus a forecasted +1.950 million barrels and the previous week’s 1.458-million-barrel drawdown).

In Fed news, on Tuesday, Fed Governor Kugler made a case for more rate cuts. She said she had agreed with the half percent cut in September and feels more should come. Kugler said, “While I believe the focus should remain on continuing to bring inflation to 2%, I support shifting attention to the maximum-employment side of the FOMC’s dual mandate as well.” She continued, “The labor market remains resilient, but I support a balanced approach to the FOMC’s dual mandate so we can continue making progress on inflation while avoiding an undesirable slowdown in employment growth and economic expansion.” Meanwhile, NY Fed President Williams indicated the Fed was “well positioned” and said he supported quarter-point cuts moving forward, saying that the FOMC Dot Plot (which calls for two quarter-point cuts by year end) is a “very good base case.” Later, Atlanta Fed President Bostic said, “The labor market … is certainly slowed down, but is not slow.” However, Bostic also said, “We have to get it back to that 2% target,” … “(Referring to inflation) It’s too high … That’s still quite a ways to go and I want people to understand that I’m still laser-focused on the inflation target.”

At the same time, Boston Fed President Collins indicated there are more cuts to come. She said, “Further adjustments of policy will likely be needed.” She continued, “I will stress that policy is not on a pre-set path and will remain carefully data dependent, adjusting as the economy evolves.” Collins also said, “It will be important to preserve the currently healthy labor market conditions,” noting that it would “require economic activity continuing to grow close to trend, which is my baseline outlook.” Finally, Fed Vice Chair Jefferson told a Davidson College event, “The FOMC has gained greater confidence that inflation is moving sustainably toward our 2% goal.” He continued, “To maintain the strength of the labor market, my FOMC colleagues and I recalibrated our policy stance last month.” In addition, Jefferson said, “Economic activity continues to grow at a solid pace. Inflation has eased substantially. The labor market has cooled from its formerly overheated state.” On inflation, he said, “I expect that we will continue to make progress toward that goal.”

In stock news, on Tuesday, NVDA announce that Taiwanese contract manufacturer Foxconn is building the largest production facility in the world in Mexico to assemble NVDA’s next generation GB200 superchips. At the same time, a regulatory filing shows that BRKB had sold more of its BAC shares, with total proceeds of its reduction now exceeding $10 billion. However, BRKB still owns 10.1% of BAC shares. Later, HON announced it will spin off its advanced materials unit via IPO. BCS values that division at $11 billion. At the same time, IT industry publication The Information reported that OpenAI is moving away from a MSFT datacenter focus in a bid for more independence as a way to get closer to ORCL who has its own datacenter unit. Later, BA announced it had delivered 33 jets in September, down from 40 in August, but up six from August 2023. The company noted the impact of the mid-September strike of 33k Pacific Northwest BA workers. At the same time, AWK announced it had disconnected its computers following a “cybersecurity incident.” The water utility said it had discovered unauthorized activity in its network on October 3.

Elsewhere, LYFT announced it is rolling out a number of improvements aimed at attracting more drivers. Later, Reuters reported that GS has taken derivative positions equal to a 6.7% stake in UNCFF as of September 30. Later, German company FMS said Tuesday it was working with the US FDA and HHS to boost production at its NC plant after direct competitor BAX suffered hurricane damage last week. (Both companies are leaders in the IV solutions business.) At the same time, descendants of the founders of PG lost a shareholder vote to oust company CEO Moeller and members of the board environmental sustainability committee. After the close, S&P placed BA on a rating of “credit watch negative” as the plane maker’s strike drags on. At the same time, Reuters reported BA is weighing options to raise cash by issuing new stock or stock-like securities. Sources told Reuters the company hopes to raise $10 billion to assuage credit agency concerns. Later, Unifor (the Canadian version of UAW) said it had started negotiations with CP. At the same time, WOPEY announce it had completed the $1.2 billion acquisition of TELL.

In stock legal and governmental news, on Tuesday, Reuters reported that the US Dept. of Justice will outline the actions GOOGL could take to restore competition in online search following an August court finding that the company is an illegal monopoly. (This action plan may include the breakup of the company.) At the same time, a Paris-based arbitrator ruled in favor of BP and prohibiting KOS from selling LNG from its Senegal project to other parties. After the close, C filed a motion asking a US District Court to dismiss a suit filed by NY Attorney General James for lax security and failing to reimburse customers who fall victim to online scammers due to company deficiencies. At the same time, the FAA issued a safety alert over BA 737 jet rudder problems, warning that the rudder could become jammed or only operate in a limited manner.

In miscellaneous news, on Tuesday, the EIA Short-Term Energy Outlook said that US electrical power demand will reach a record 4,093 billion kilowatt-hours in 2024 and then another record of 4,163 billion kilowatt-hours in 2025. (For reference, US demand was 4,000 billion kilowatt-hours in 2023.) This breaks down into forecasts of 1,503 billion kWh for residential use, 1,412 billion kWH for commercial use, and 1,033 billion kWh for industrial user. Elsewhere, the ports of Tampa and Sarasota closed Tuesday ahead of Hurricane Milton. Meanwhile, major freight terminals in SC, including the large one at Charleston, began implementing restrictions.

In China news, markets were disappointed late Tuesday when the Chinese National Development and Reform Commission announced $28 billion of additional spending (stimulus) would be pulled forward into Q4 from 2025. Analysts had expected the package to be a staggering $420 billion.

In Middle East news, Israeli PM Netanyahu barred his Defense Minister (Gallant) from making a scheduled trip to the US. This trip was supposed to focus on coordination between Israel and the US related to the retaliatory strike on Iran. Netanyahu has twice tried to fire Gallant in the last year. So, tension between the two is fierce. Still, r, there may be other political angles involved. For example, Reuters reports Netanyahu is demanding a phone call from President Biden prior to sending his defense minister to the US. (Perhaps as a vain show that he is the top dog and must be kowtowed to before actual work gets done.) In addition, Netanyahu is also demanding that the War Cabinet approves his attack plans prior to the trip taking place. (Again, so he gets his way and perhaps to prevent US input into the plan.) There is also significant possibility that Netanyahu has US political motives.

Overnight, Asian markets were mixed with China really pushing to the downside over disappointment about the stimulus details announced Tuesday night. Shenzhen (-8.15%), Shanghai (-6.62%), and Hong Kong (-1.38%) were the big losers. On the other side, New Zealand (+1.75%) and Japan (+0.87%) were the winners. In Europe, the bourses are mixed but lean toward the green side with nine of the 14 exchanges in the green at midday. The CAC (+0.28%), DAX (+0.29%), and FTES (+0.29%) lead the region higher in early afternoon trade. Meanwhile, in the US, the market is just on the red side of flat as of 7:30 a.m. The DIA implies a -0.08% open, the SPY is implying a -0.05% open, and the QQQ implies a -0.09% open at this hour. At the same time, 10-Year bond yields are at 4.02% and Oil (WTI) is off another 0.58% to $73.14 per barrel in early trading.

The major economic news scheduled for Wednesday is limited to Weekly EIA Crude Oil Inventories (10:30 a.m.) and September FOMC Meeting Minutes (2 p.m.). However, we also hear from Fed members Bostic (8 a.m.), Williams (11 a.m.) and Daly 6 p.m.). The no major earnings reports scheduled for before the open are limited to HELE. Then, after the close, there are no major reports scheduled.

In economic news later this week, on Thursday, we get Weekly Initial Jobless Claims, Weekly Continuing Jobless Claims, September Core CPI, September CPI, September Federal Budget Balance, and Fed Balance Sheet. We also hear from Fed member Williams. Finally, on Friday, September Core PPI, September PPI, Michigan Consumer Sentiment, Michigan Consumer Expectations, Michigan 1-Year Inflation Expectations, Michigan 5-Year Inflation Expectations, and the WASDE Ag report are delivered.

In terms of earnings reports later this week, on Thursday, DAL and DPZ report. Finally, on Friday, earnings season kicks off again in earnest as BK, BLK, FAST, JPM, and WFC report.

With that background, markets look nearly flat at this point of the premarket. All three major index ETFs opened the early session lower, but have printed white-bodied candles with tiny upper wicks to recover almost all of the gap at this point. SPY and QQQ remains above their T-line (8ema). However, the DIA has still not quite reached its T-line yet. So, the short-term trend is back to modestly bullish. The mid-term trend remains bullish. In the longer-term we still have a strong Bull trend in all three major index ETFs and they remain not far from their all-time highs. (SPY missed a new all-time high close Tuesday by 0.10%). With regard to extension, none of the major index ETFs are extended from its T-line (8ema). In addition, the T2122 indicator sits in the center of its mid-range. So, markets have room to run either direction, if either the Bulls or Bears can find momentum. With regard to those 10 big dog tickers, they are evenly split this morning with five on each side of break-even. The biggest dog, NVDA (+1.26%) leads that pack higher on both price move and volume. On the other side, GOOGL (-0.96%) is the laggard of the group on that DOJ action plan report. It is worth noting that the biggest dog, NVDA has traded 3.5 times the dollar-volume as next-closest ticker TSLA (-0.09%). This is typical for a bullish day in recent months.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the Man in the Green Bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby, it’s a job. The gains are real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service