PFE to File For Vaccine Use

Stocks ground sideways all morning Thursday. However, an announcement from Senate Democratic Leader Schumer saying that Senate Majority Leader McConnell had agreed to resume stimulus negotiations helped lead to an afternoon rally. All 3 major indices closed near their highs as a result. On the day, DIA was up 0.19%, SPY up 0.42%, and QQQ up 0.78%. The QQQ also managed to print a Bullish Engulfing candle on the day. VXX lost a percent to 18.64 and T2122 fell a tad, but remains in the overbought territory at 84.25. 10-year bond yields fell sharply to 0.836% and Oil (WTI) was flat at $41.82/barrel.

After the close, Treasury Sec. Mnuchin asked the Fed to extend some emergency programs for another 90 days, but to end other programs. The programs he asked the Fed to extend include short-term loans to businesses as well as backstop guarantees for Payroll Protection Program loans. The two main programs he asked the Fed to kill are the purchase of corporate bonds and the direct “Main Street Lending” program targeted toward small and medium-sized businesses. With the killing of a couple of programs, Treasury has asked the Fed to return $455 billion (ostensibly so it can be spent elsewhere). While the impact on markets is as yet unknown, stocks did rally hard at the time the programs were first announced.

The other major overnight news is that as expected, PFE and BTNX will file for an “Emergency Use” Waiver for their vaccine today. The terminology is unclear to me (how can it be an emergency use, if it is a preventative medicine and not a treatment), but approval is expected to be nothing but a formality. The consensus is that MRNA will follow closely behind PFE/BTNX in requesting the same authorized usage next week.

On the virus front itself, infections continue to rage as the US saw another spike to 192,186 cases and 2,065 deaths on Thursday. This surge has raised the US totals to 12,072,560 confirmed cases and 258,354 deaths. The 7-day average of new cases to 169,813 while the average deaths rose to 1,398/day. All 50 states are have reported at least a 10% increase in cases since last week. 33 states have reported at least a 10% increase in covid-19 deaths since last week. New local and statewide restrictions continue to be implemented coast-to-coast mostly including mask mandates, curfews, and stay at home advisories.

Globally, the numbers rose to 57,382,260 confirmed cases and the confirmed deaths are now at 1,368,493 deaths. Overnight a panel of WHO scientists have advised doctors to stop using Remdesivir from GILD to treat covid-19. The panel found in a study that there is no evidence that drug improves survival rates or reduces the need for ventilation. This comes the same night as the US FDA has approved Remdesivir for use in combination with LLY drug Baricitinib to treat covid-19.

Overnight, Asian markets were mixed again, but leaned toward the green side. Thailand (+1.45%) led gainers by a wide margin while India (-0.92%) led the losses (also by a wide margin). All-in-all, most Asian exchanges were modestly positive on the day. However, in Europe, so far today we see green across the board. Smaller exchanges seem to have fared better, but the DAX (+0.47%), FTSE (+0.48%), and CAC (+0.47%) are indicative. As of 7:30 am, US futures are pointing to a mixed, but flat open. The DIA is implying a -0.16% open, the SPY implying a -0.05% open, and the QQQ implying a +0.20% modest gain at the open.

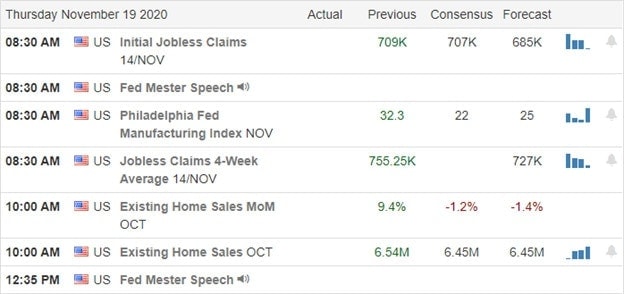

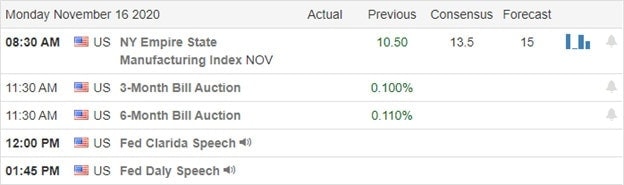

The major economic news for Friday is limited to a single Fed speaker (Kaplan at 8:30 am). Major earnings reports are also very limited with FL reporting before the open.

With more positive vaccine news, not economic or earnings, and the Administration signaling they no longer see as bad of a problem, you might expect a strong rally. However, Thursday was the worst day ever in terms of new cases and the worst day since April in terms of deaths. And it will be several months before vaccines are widely available, let alone administered in two doses per patient (one month apart). So, the realities don’t seem to match. It is unclear which reality Mr. Market will live in today.

Remember that it’s Friday…pay day. So, take some money off the table or at least consider hedging yourself ahead of the weekend. As always, maintain discipline to your trading rules, don’t chase and respect trend, support/resistance, and price action.

Ed

Swing Trade Ideas for your consideration and watchlist: TWLO, WIMI, TUP, ETSY, NBR, TMX, FCX, PSXP. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service