Market Fears Inflation as Chart Gets Technical Damage

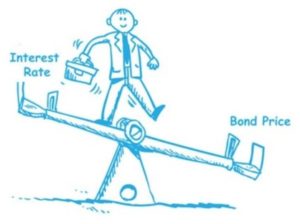

Markets made a small gap-down to open the session Wednesday. However, the bears had the whip in hand all day as inflation fears loomed. Bond yields rose over 8 basis points before settling back. This left us with big, ugly black candles that have either are forming (DIA), have formed (SPY), or have broken out of (QQQ) a Dreaded-h pattern. All 3 major indices closed on the lows. On the day the DIA (buoyed by BA and JOM) lost 0.38%, the SPY lost 1.32%, and the QQQ lost 2.88%. The VXX rose 4.28% and T2122 rose a bit to 39.01, but remains on the lower side of mid-range. 10-year bond yield closed up significantly to 1.469% and Oil (WTI) jumped 2.5% to $61.25/barrel.

After the close, DIS said they are closing 20% of their brick-and-mortar stores in order to shift more focus to e-commerce. President Biden made a concession Wednesday by announcing his support for a reduction in the earnings cap qualification for direct payments. The new number will be $80,000, down from the original $100,000. This would disqualify about 12 million people. This comes as the Senate began debating the bill on Wednesday evening.

AAPL is now facing a new antitrust probe in the UK. This is based on app developer complaints about the Apple app store. Specifically, the 30% fee and long approval process are being challenged. AMZN also made news in the UK, though for better reasons. AMZN opened its first cashier-less retail shop, where customers just pick out their items and leave. The system works on smartphones and an AMZN phone app. An AMZN-backed food delivery service (Deliveroo) also chose London as the location of its first operation.

Related to the virus, US infections have plateaued (after almost 2 months of fall) at a level above the fall level after a month and a half of steep and steady decline in new cases. The totals have risen to 29,456,377 confirmed cases and deaths have now passed half a million at 531,652 deaths. As mentioned, the number of new cases fell just slightly again to an average of 65,322 new cases per day. Deaths, which have always lagged, also fell very slightly to 1,922 per day. President Biden, the CDC, and Dr. Fauci (NIH) all derided states who are lifting restrictions now before the virus and its variants are fully beaten. In the Senate, GOP members are planning “made for TV” testimony sessions that will likely delay a Senate vote until next Wednesday.

Globally, the numbers rose to 115,869,639 confirmed cases and the confirmed deaths are now at 2,573,690 deaths. The trends have been good, but we saw a significant uptick today. The world’s average new cases has up-ticked again to 388,447 per day. Mortality also ticked up again, now at 8,955 new deaths per day. The WHO weighed in to say that after many weeks of falling, the number of cases is ticking up and that variants are to blame. In better news, the UK has now said that like the US, they will fast-track modified versions of vaccines to deal with variants rather than require the full 3-phase trial process. In Germany, the governement finally approved the AZN vaccine for people over 65. And in India, an Indian vaccine (Covaxin) has been found to be 81% effective in trials on almost 26,000 people, based on results from 43 patients. (36 who had gotten the placebo contracted Covid while only 7 who had gotten the real vaccine also contracted Covid).

Overnight, Asian markets were red across the board. Hong Kong (-2.15%), Japan (-2.13%), and Shenzhen (-2.90%) highlighted the losses, but the red was widespread and strong everywhere. In Europe, markets are also in the read all across the continent so far today. Smaller exchanges like Finland (-1.36%) and Belgium (-1.21%) are leading the losses. However, the FTSE (-0.86%), DAX (-0.38%), and CAC (-0.22%) are all headed lower as well at this point in their day. As of 7:30 am, US Futures are pointing to a very modestly red open. The DIA is now implying a -0.14% open, the SPY implying a -0.23% open, and the QQQ implying a -0.23% open.

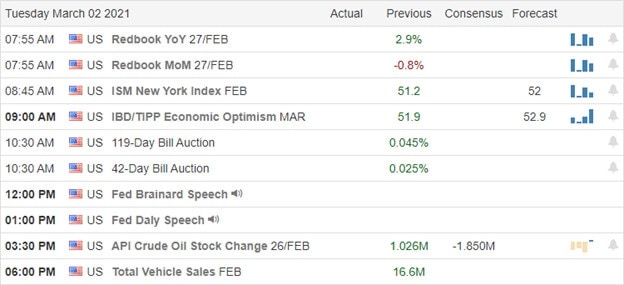

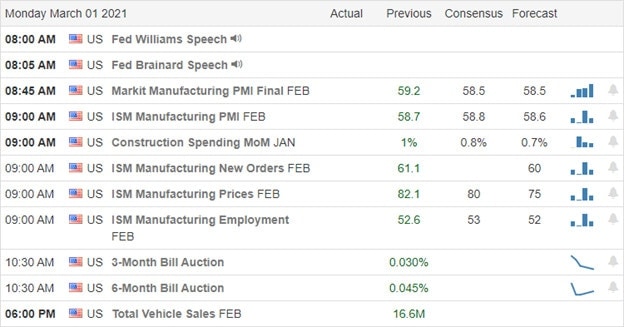

The major economic news for Thursday includes Weekly Initial Jobless Claims, Q4 Productivity, and Q4 Unit Labor Costs (all at 8:30 am), Jan. Factory Orders (10 am), and Fed Chair Powell speaks (noon). Major earnings reports on the day include BJ, BURL, CNQ, CIEN, GMS, KR, MIK, SRLP, and TTC before the open. Then after the close, AVGO, COO, COST, and GPS report.

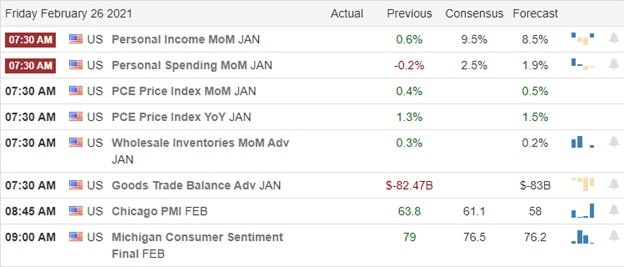

Inflation fear still grips Wall Street. While pre-market futures are just shy of flat, we still have a shot of data coming before the open. Also, with Fed Chair Powell speaking again today (I don’t know if he will be taking questions), markets may be waiting on more reassurance that inflations will be ignored the rest of the year. All we know for sure is that despite a pullback of late, we are still not far from all-time highs and the market is seriously worried about the Fed maybe changing course later this year. So, preparedness is the key here.

Follow the trend, respect support and resistance, and don’t chase those moves that you miss. Another trade will come along any minute. So, forget about predicting reversals or breakouts. Just book your trade goals when you can and stick with your discipline. Achieve your ambitions in the long-run by taking short-term trade gains off the board consistantly as they are met, over and over again.

Ed

Swing Trade Ideas for your consideration and watchlist: SQQQ, BIDU, HON, EMR, KHC, KEYS, PFE, EEM. You can find Rick’s review of tickers on his YouTube Channel here. Trade your plan, take profits along the way, and smart. Also, remember to check for impending earnings reports. Finally, remember that any tickers we mention and talk about in the trading room are not recommendations to buy or sell.

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service