Trump Vows China, Mexico, and Canada Tariffs

Monday saw markets gap higher to start the holiday week. SPY gapped up 0.67%, DIA gapped up 0.78%, and QQQ gapped up 0.82%. From there we saw divergence among the three major index ETFs. SPY and QQQ immediately began to sell off with QQQ recrossing its gap by 12:15 p.m. and SPY doing the same by 12:45 p.m. That was the low for SPY, which bounced a little and traded sideways the rest of the day after 1:30 p.m. Meanwhile, QQQ continued South before reaching its low at 12:50 p.m. and doing its own bounce back to the prior close level and then trading sideways the rest of the day. For its part, after the gap higher, DIA traded sideways, then meandered lower to cross back into the top of the gap. It reached the low at 12:45 p.m. and then rallied back up above the open to trade sideways into the close. This action gave us, gap-up, indecisive candles in all three major index ETFs. DIA was the leader, printing a gap-up, white-bodied, Spinning Top that gave us both a new all-time high and new all-time high close. SPY also gave us a gap-up, Spinning Top, but this one was black-bodied and gave us a new all-time high but not the close. QQQ was the laggard, printing a gap-up, black-bodied, large-body Spinning Top.

On the day, nine of the 10 of the sectors were in the green again as Consumer Cyclical (+1.48%) was well out in front leading the way higher. This time, Energy (-1.68%) was by far the laggard (by 1.75%) and the only sector in the red. Meanwhile, SPY gained 0.34%, DIA gained 0.99%, and QQQ gained 0.16%. VXX dropped another 4.11% to close at 43.88 and T2122 climbed even higher into the top of its overbought territory to close at 96.48. At the same time, 10-Year bond yields dropped sharply to 4.275% while Oil (WTI) dropped 3.03% to close at $69.08 per barrel. So, Monday was all about the morning gap. DIA was able to hold onto the gap gains while the two broader-based index ETFs recrossed their gaps and managed to climb back to stay modestly positive. This all happened on average volume in all three major index ETFs.

There was no major economic news scheduled for Monday.

In Fed news, on Monday, Reuters reported on a San Francisco Fed economic letter that was penned by the Fed’s Economist Emeritus (and top productivity expert) John Fernald, who is no a professor as INSEAD in France. (Fernald has long been very cautious about extrapolating short-term productivity gain trends into broader conclusions.) The new note released Monday, left open the possibility that the recent surge in productivity my not fade and, instead, may be signaling a new breakout in productivity not seen since 1995-2004. The research note said, “This pandemic boom-and-bust in productivity growth was a predictable cyclical response overlaid on a broad continuation of the underlying slow growth pace.” However, it continued, “there are some reasons for optimism, including recent official data revisions that show faster productivity growth since the pandemic than had been previously estimated.” However, the four authors stayed cautious, saying, “Much is still uncertain about the productivity effects of emerging technologies like generative artificial intelligence, which will only be revealed over time, as the economy continues to evolve in the aftermath of the pandemic.”

After the close, A, TBBB. WWD, and Z all reported beats on both the revenue and earnings lines. Meanwhile, CENT and FLNC missed on revenue while beating on earnings. However, SUPV missed (massively) on both the top and bottom lines.

Overnight, Asian markets were mostly in the red. Nine of the 12 exchanges were in negative territory and the ones that were in the green did not make substantial gains. Taiwan (-1.17%), Japan (-0.87%), and Shenzhen (-0.84%) paced the losses. In Europe, with the sole exception of Athens (+0.18%), we see red across the board on Tuesday. The CAC (-0.22%), DAX (-0.31%), and FTSE (-0.29%) lead the region lower in early afternoon trade. In the US, as of 7:15 a.m., Futures point toward a mixed start for the day. The DIA implies a -0.12% open, the SPY is implying a +0.23% open, and the QQQ implies a +0.30% open at this hour. At the same time, 10-Year bond yields are back up a bit to 4.283% and Oil (WTI) is up 1.07% to $69.68 per barrel in early trading.

The major economic news scheduled for Tuesday includes October Building Permits (8 a.m.), November Conference Board Consumer Confidence and October New Home Sales (both at 10 a.m.), November FOMC Meeting Minutes (2 p.m.), and API Weekly Crude Oil Stocks report (4:30 p.m.). The major earnings reports scheduled for before the open are limited to ANF, ADI, BBY, BURL, DKS, HTHT, SJM, KSS, M, and TITN. Then, after the close, ADSK, CRWD, DELL, GES, HPQ, YY, JWN, NTNX, URBN, and WDAY report.

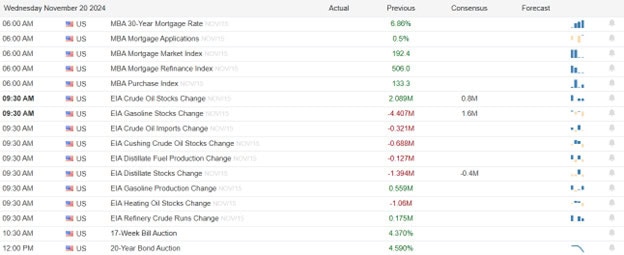

In economic news later this week, on Wednesday, Weekly Initial Jobless Claims, Weekly Continuing Jobless Claims, Preliminary Oct. Core Durable Goods Orders, Preliminary Oct. Durable Goods Orders, Preliminary Q3 GDP, Preliminary Q3 GDP Price Index, Preliminary Oct. Goods Trade Balance, Preliminary Oct. Retail Inventories, October Core PCE Price Index, October PCE Price Index, October Pending Home Sales, October Personal Spending, and Weekly EIA Crude Oil Inventories. On Thursday, markets are closed for the Thanksgiving holiday. Finally, on Friday we get Chicago PMI and markets close early at 1 p.m. for additional holiday time off.

In terms of earnings reports later this week, there are no reports of note Wednesday. Again, Thursday there are no notable reports scheduled. Finally, on Friday, MNSO reports.

So far this morning, ADI, DKS, SJM, and TITN have all reported beats on both the revenue and earnings lines. Meanwhile, BURL missed on revenue while beating on earnings. However, BBY, HTHT, and KSS missed on both the top and bottom lines.

With that background, it looks like the market is of two minds. Coming from all-time highs, DIA started the premarket even higher only to start working on a black-bodied Spinning Top type candle. Meanwhile, SPY and QQQ both started the early session lower, but have since put in large-body, small-wick, white candles in the premarket. All three are above their T-line (8ema). So, the short-term trend is now bullish. Looking further out, the mid-term and longer-term trends also remain bullish with prices sitting at or near all-time highs. In terms of extension, DIA is getting a bit stretched above its T-line, but the other two are not far from their 8ema. However, the T2122 indicator is now back in the top end of overbought territory. So, the Bears may have a more slack to work with today, but there is still room to run higher if the bulls find traction (especially in SPY and QQQ). In terms of the 10 Big Dogs, all 10 are in the green at this point of the early session morning. NVDA (+1.01%) is leading the way higher while MSFT (+0.01%) is the laggard at this point. TSLA (+0.21%) is leading in terms of dollar-volume traded, sitting at 1.5 times as much traded than NVDA, which itself has traded 6.5 times as much as the next premarket volume leader.

As always, be deliberate and disciplined…but don’t be stubborn. If you have a loss, admit you were wrong and take that loss before it gets out of hand. And when the price does move in your direction, always move your stops in your favor and take a little profit off the table. You have to keep the “Legend of the Man in the Green Bathrobe” in mind. In a winning situation, it is NOT HOUSE MONEY you’re betting, it’s YOUR MONEY! There is no reason to keep raising your bet (risk) size just because you’ve had a win. Finally, remember that trading is not a hobby, it’s a job. The gains are real and so is the risk. So, treat it that way. Do the work and follow the process. Stick to your trading rules, trade with the trend, and take those profits when you have them. Do the work!

See you in the trading room.

Ed

🎯 Mike Probst: Rick, Got CTL off the scanner today. Already up 30%. Love it.

🎯 Dick Carp: the scanner paid for the year with HES-thank you

🎯 Arnoldo Bolanos: LTA scanner really works $$, thanks Ed.

🎯 Bob S: LTA is incredible…. I use it … would not trade without it

🎯 Malcolm .: Posted in room 2, @Rick… I used the LTA Scanner to go through hundreds of stocks this weekend and picked out three to trade: PYPL, TGT, and ZS. Quality patterns and with my trading, up 24%, 7% and 12%…. this program is gold.

🎯 Friday 6/21/19 (10:09 am) Aaron B: Today, my account is at +190% since January. Thanks, RWO HRC Flash Malcolm Thomas Steve Ed Bob S Bob C Mike P and everyone that contributes every day. I love our job.

Hit and Run Candlesticks / Road To Wealth Youtube videos

Disclosure: We do not act on all trades we mention, and not all mentions acted on the day of the mention. All trades we mention are for your consideration only.

Free YouTube Education • Subscription Plans • Private 2-Hour Coaching

DISCLAIMER: Investing / Trading involves significant financial risk and is not suitable for everyone. No communication from Hit and Run Candlesticks Inc, its affiliates or representatives is not financial or trading advice. All information provided by Hit and Run Candlesticks Inc, its affiliates and representatives are intended for educational purposes only. You are advised to test any new trading approach before implementing it. Past performance does not guarantee future results. Terms of Service